If you are looking to benefit from economic momentum, or lack of, in the European Union, quite often the first stop will be the DAX 40. As it is the biggest index on the continent, it is a highly liquid market that continues to gain popularity.

Overview of the DAX

The performance of the 40 most significant and busiest firms listed on the Frankfurt Stock Exchange in Germany is reflected in the DAX 40, a stock market index. It was introduced in September 2021 to replace the DAX 30 index and consists of businesses from various industries, including healthcare, technology, automotive, and finance.

The index is based on the total return performance of the companies included; therefore, it accounts for both capital gains and dividends that the companies have distributed. The DAX 40 is a crucial indication of the performance of European stocks and is closely watched by investors and traders in Germany and around the world as a gauge of the German economy.

The DAX 40 index includes businesses including Volkswagen, Deutsche Bank, Siemens, and BASF. Each company's weight in the index is determined by its market capitalization and free-float market capitalization. The largest businesses have the most significant influence on the index's overall performance.

The DAX 40 Index accounts for roughly 80% of the Frankfurt Stock Exchange market capitalization. This is one of the most common benchmarks to measure the strength or weakness of the German economy.

Trading the DAX 40

The DAX 40 index can be traded in several ways:

ETFs: Exchange-traded funds are a well-liked and convenient investment option in the DAX 40. They are investment funds that mirror the performance of the DAX 40 index and trade on stock markets like individual stocks. Investors can purchase and sell these ETF shares on stock exchanges during trading hours.

The most common ETFs include the iShares and Lyxor DAX ETFs.

Futures and options: Several derivatives markets worldwide offer futures and options contracts on the DAX 40 index. These financial products allow traders to predict the index’s future course and protect themselves from losses. They are riskier and more complicated than investing in ETFs, however. It should also be noted that the margin costs associated with trading futures can be a barrier to most retail traders.

Contracts for Difference (CFDs): Financial derivatives known as contracts for difference (CFDs) enable traders to bet on the price changes of the DAX 40 index without owning the underlying asset. Using CFDs, traders can go long or short on the index and profit from both price increases and decreases. However, compared to ETFs, CFDs have higher risks and costs, assuming you take on all available leverage.

Factors impacting the DAX 40

If you are going to try to trade the DAX 40, you need to understand some of the major factors that can influence the DAX and its price.

Major companies

BMW, Siemens, and Bayer are all major companies listed on the DAX 40 index, and their performance can significantly impact the index’s overall performance. The performance of BMW, Siemens, and Bayer on the DAX 40 index is primarily tied to their respective industries and global market demand for their products. Their strong brand recognition, innovative products, and global reach make them key players in the German economy and the DAX 40 index. The major companies in Germany are tied to the overall health of Germany itself.

Health of the German economy

The health of the German economy, the largest in the European Union and the fourth largest in the world, significantly impacts the performance of the DAX 40 index. Here is a summary of some significant German economic indicators:

GDP: One of the most significant indicators of Germany's economic health is its gross domestic product (GDP). Germany's GDP has been increasing significantly in recent years and is expected to reach $4.2 trillion in 2021, according to the International Monetary Fund (IMF). The COVID-19 pandemic, however, significantly impacted the German economy in 2020, resulting in a 4.9% decline.

Inflation: Another crucial economic indicator, inflation tracks how quickly prices for goods and services are increasing. In 2021, the inflation rate in Germany is expected to be approximately 2%, which is lower than in recent years. This results from the nation's robust economic growth and dedication to stability and fiscal restraint.

Interest rates: Central banks use interest rates as a critical tool to curb inflation and promote economic expansion. The European Central Bank (ECB) in Germany determines interest rates for the entire eurozone, which includes Germany. In recent years, the ECB has maintained a low-interest rate policy to stimulate regional economic growth.

Employment: Since it indicates the number of people who can engage in and contribute to the economy, employment is a crucial indicator of economic health. According to the IMF, the unemployment rate in Germany will be 4.2% in 2021, which is reasonably low compared to recent years.

Global risk sentiment

Like other stock market indices, the DAX 40 index is highly influenced by the overall risk climate. Investors tend to be more upbeat about the future of the world economy when there is a positive global risk sentiment, which can raise demand for stocks, particularly those listed on the DAX 40. As a result of investors purchasing more shares of the companies listed on the index, their prices may climb, raising the index's value.

In contrast, investors tend to be more pessimistic about the future of the global economy when there is a negative feeling toward risk, which can result in a decline in demand for stocks, particularly those traded on the DAX 40. As a result, the index may decline if investors sell their shares of its constituent companies.

Eurozone political risks

19 European nations that share the euro as their common currency make up the Eurozone. Events like political instability, changes in governmental policy, disputes between member states, and prospective withdrawals from the Eurozone or threats of exit from the Eurozone are examples of political risks in the Eurozone.

A couple of factors can affect how these political risks affect the DAX 40:

Economic uncertainty: Political instability and uncertainty can result in a lack of clarity on laws and regulations, resulting in financial volatility and uncertainty. This may result in a decline in investor confidence and a corresponding reduction in interest in equities listed on the DAX 40.

Trade and investment flow: Political risks may also impact international commerce and investment, which may affect the performance of the DAX 40. For instance, disputes or trade obstacles between Germany and other Eurozone nations may affect the demand for the products made by DAX 40 companies, which may affect their earnings.

Overall, the DAX 40 can be significantly impacted by political uncertainties in the Eurozone, especially in the short term. Investors should monitor political changes in the Eurozone and consider how they can affect the DAX 40 when making investing decisions.

The DAX 40 benefits from a strong euro:

Companies having international operations might benefit from a strong euro by seeing an increase in the value of their earnings when expressed in euros. This may favor the profits and revenue of DAX 40 companies with significant global exposure.

Increases consumer purchasing power: A strong euro can increase consumer purchasing power in Germany and the Eurozone, benefiting businesses that rely on domestic sales. This can result in a rise in demand for products and services made by DAX 40 companies.

Negative effects of a strong euro on the DAX 40:

Companies with significant export exposure may see a decline in earnings due to the strong euro because it increases the cost of their products to international consumers. This might result in less market for their goods, meaning lesser sales and earnings.

If the euro is strong, companies listed on the DAX 40 may find it harder to compete with those in other nations with weaker currencies. Lower market share, revenue, and profitability may result from this.

Trading Strategies for the DAX 40

There are a lot of ways that people will try to benefit from the DAX 40, including some of these strategies:

Buy and Hold

Regardless of short-term market swings or volatility, the buy-and-hold strategy is a long-term investing strategy that entails purchasing stocks or other financial assets and hanging onto them for a considerable amount of time.

Investing in an index fund or exchange-traded fund (ETF) that monitors the index's performance can enable the buy-and-hold technique to invest in the DAX 40 index. Investors can use this to expose themselves to the long-term performance of Germany's biggest and most traded corporations.

One of the purchase-and-hold strategy's key advantages is the ability to profit from the potential long-term development of the DAX 40 index. Historically, despite short-term market swings and economic uncertainty, stock market indices like the DAX 40 have continuously grown over extended periods.

The buy-and-hold approach has the additional benefit of minimizing the transaction fees and taxes linked to the frequent purchasing and selling stocks or other financial assets. Investors can avoid transaction costs and short-term capital gains taxes by keeping their investments for the long term rather than selling them.

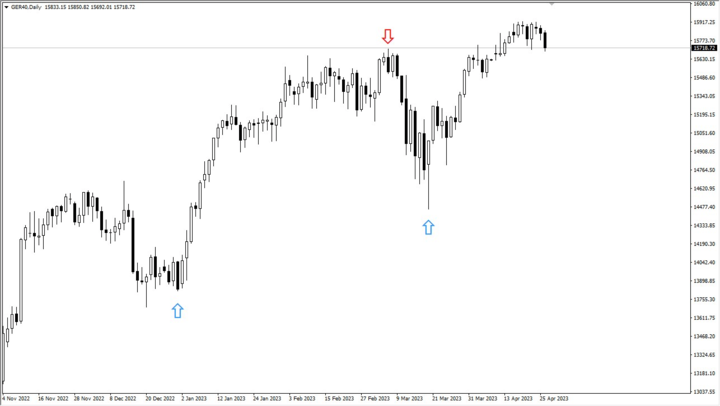

Swing trading

A short to medium-term trading strategy known as swing trading is purchasing and holding stocks or other financial assets for a few days or weeks to profit from swift changes in price.

Trading derivatives like CFDs, futures, or options on the DAX 40 index allows the swing trading method to be used. These financial instruments let traders profit from transient price changes in the DAX 40 index without holding the underlying assets.

Using technical analysis, swing traders look for probable price swings or trends in the DAX 40 index. To do this, historical price and volume data must be analyzed to find patterns and trends that can be used to forecast future price changes.

Swing traders can take a position in the DAX 40 index by purchasing or selling derivatives such as CFDs, futures, or options once prospective price swings or trends have been detected. The aim is to profit from the transient price changes that occur inside the specified swing or trend.

Swing traders often employ take-profit orders to lock in profits and stop-loss orders to reduce potential losses. This enables them to control risk, capitalize on potential benefits, and mitigate potential losses.

Day trading

Day trading is a short-term technique that involves purchasing and selling stocks or other financial assets during the same trading day to take advantage of modest price movements or fluctuations.

The day trading method can be used with the DAX 40 index by trading derivatives like CFDs, futures, or options. These financial instruments let traders profit from transient price changes in the DAX 40 index without holding the underlying assets.

During day trading, traders use technical analysis to look for possible price changes or patterns in the DAX 40 index. To do this, historical price and volume data must be analyzed to find patterns and trends that can be used to forecast future price changes.

Day traders can enter into a position in the DAX 40 index by purchasing or selling derivatives such as CFDs, futures, or options once possible price moves or patterns have been spotted. Profiting from short-term price changes that take place throughout the same trading day is the objective.

Day traders often employ take-profit orders to lock in profits and stop-loss orders to reduce possible losses. This enables them to control risk, capitalize on potential benefits, and mitigate potential losses.

Spread betting

Spread betting is a type of financial trading that enables investors to predict changes in the DAX 40 index price without owning the underlying assets. Spread betting is a form of derivative trading, allowing investors to speculate on the DAX 40's price changes without owning the index.

Investors who participate in spread betting wager on whether they believe the price of the DAX 40 index will increase or decrease. The spread, determined by the spread betting company, distinguishes between the index's purchasing and selling prices. If the DAX 40's price moves in the direction they forecast, the investor will profit; otherwise, they will lose money.

Spread betting on the DAX 40 allows investors to speculate on short-term price swings without buying or selling the underlying assets, which is one of its key benefits. This can be advantageous in tumultuous market conditions where conventional trading tactics might not be as successful.

Spread betting has the additional benefit of enabling investors to use leverage, which allows them to place larger bets with less money. Investors must be mindful of the dangers of using leverage because it can magnify any losses.

Stop-loss orders are another tool investors can employ to control possible losses and manage risk while safeguarding their wealth.

Options strategies

Financial contracts, known as options, grant the buyer the right, but not the duty, to buy or sell an underlying asset at a specific price and time. The DAX 40 index is suitable for several options strategies.

Call option strategy: The buyer of a call option can purchase the underlying asset at a specific price (referred to as the "strike price") within a predetermined time frame. One might employ a call option strategy by purchasing call options on the DAX 40 index, hoping the index's price would increase. As a result, the investor can benefit from the rise in the index's price without purchasing the underlying assets. However, the investor will forfeit their option premium if the index's price declines.

Put option strategy: A put option offers the buyer the right to sell the underlying asset at a fixed price (the strike price) within a predetermined time frame. One might employ a put option strategy by purchasing put options on the DAX 40 index, anticipating that the index's price will decline. As a result, the investor can benefit from the index's price decline without disposing of the underlying assets. However, the investor will forfeit their option premium if the index price increases.

Straddle option strategy: A straddle option strategy is purchasing call and put options with the same strike price and expiration date on the same underlying asset. This method can be applied to the DAX 40 index if high market volatility is anticipated. The investor can make money on the related option while limiting potential losses on the other option if the index price changes sufficiently in either direction.

Butterfly option strategy: In a butterfly options strategy, two call options are purchased at various strike prices, and two calls are sold at a middle strike price. When market volatility is anticipated to be minimal, this method can be applied to the DAX 40 index. The investor can profit from the intermediate option while limiting potential losses on the other options if the index price remains within a specific range.

Overall, investors who recognize short-term market changes and successfully manage risk can benefit from using options techniques in the DAX 40 index. Options trading is a high risk, so investors should do extensive research and risk analysis before engaging. They should also adopt the right risk management strategies to reduce potential losses.

Conclusion

In conclusion, the DAX 40 index is actively watched by investors and traders worldwide and plays a significant role in reflecting the health of the German economy. The index can be traded using a variety of instruments, including spread betting, CFDs, futures, options, and ETFs. The DAX 40 can be heavily impacted by the success of large corporations like BMW, Siemens, and Bayer, as well as economic indices like GDP, inflation, interest rates, and employment. Moreover, the index may be impacted by political concerns, the perception of global risks, and the euro’s value. Finally, investors can invest in the DAX 40 index while minimizing risk using various trading methods such as buy-and-hold, swing trading, day trading, and options strategies.

By trading CFDs at VSTAR, you can have negative balance protection and over 1000 markets. Traders can trade DAX 40 CFD markets and gain exposure to stocks, commodities, and indices through CFD offerings. Educational products are also available, and VSTAR is fully regulated in several markets and has ample liquidity.