What is Copy Trading?

Copy trading is a revolutionary investment strategy that enables individuals, even those with limited financial expertise, to participate in the financial markets effectively. At its core, copy trading involves one participant, known as the copy trader, replicating the trading activities of another, referred to as the signal provider or master trader. This innovative approach leverages the expertise of seasoned professionals, allowing less-experienced investors to automatically mirror their trades.

If you're eager to venture into the world of financial markets but lack the expertise, copy trading can be your gateway to success. In this ultimate guide, we'll explore the ins and outs of copy trading, shedding light on its definition, the key players involved, and the distinctions between copy trading and mirror trading.

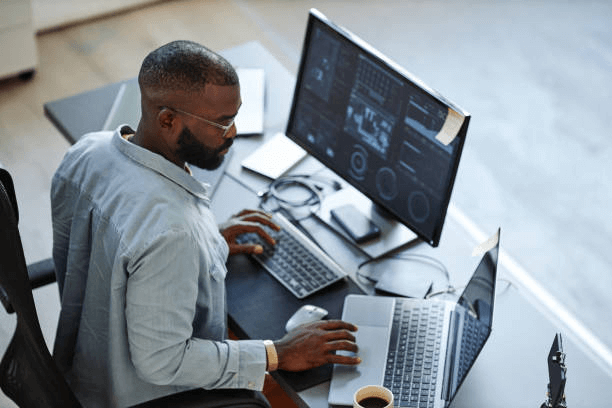

Source: Unsplash

A. Definition of Copy Trading

In a more granular sense, copy trading operates on the principle of real-time synchronization. The actions taken by the signal provider, including opening, modifying, and closing trades, are duplicated in the account of the copy trader. This synchronization is facilitated through sophisticated trading platforms offered by brokers, creating a seamless and automated experience.

The appeal of copy trading lies in its accessibility and democratization of financial markets. Novice investors can benefit from the market insights, strategies, and decision-making skills of experienced traders without having to actively manage their portfolios. It bridges the gap between seasoned professionals and those eager to enter the world of trading, making it a valuable tool for diversified investment approaches.

The copy trading process is user-friendly, making it suitable for individuals with varying levels of market knowledge. Through this method, the financial expertise of successful traders becomes a shared resource, creating a community-driven approach to investing. As the financial landscape continues to evolve, copy trading remains a prominent feature, reshaping the way individuals engage with and navigate the complexities of global markets.

B. Three Parties Involved in Copy Trading

Source: Unsplash

In the dynamic ecosystem of copy trading, three distinct parties play pivotal roles, each contributing to the overall functionality and success of this innovative investment strategy.

1. Provider/Master Trader/Signal Provider

At the heart of copy trading is the provider, also known as the master trader or signal provider. This individual is an experienced and successful trader whose strategies and market insights attract followers. Providers execute trades based on their analysis and expertise, and these actions are automatically mirrored in the accounts of copy traders. The provider's role goes beyond merely executing trades; they become the guiding force for those looking to benefit from their proven track record.

2. Copier/Copy Trader

The copy trader, often an individual with limited trading experience or time constraints, is an integral part of the copy trading triad. This participant chooses a signal provider whose trading activities they wish to replicate in their portfolio. By doing so, copy traders gain exposure to the expertise and decision-making of seasoned professionals without actively managing their investments. The copy trader has the flexibility to diversify their portfolio by selecting multiple providers, and tailoring their strategy to align with personal financial goals and risk tolerance.

3. Broker

Acting as the intermediary facilitating the entire copy trading process is the broker. The broker provides the platform and infrastructure that allows signal providers to broadcast their trades and copy traders to replicate them. This intermediary role involves trade execution, managing synchronization, and ensuring a secure and efficient environment for all participants. Choosing a reputable broker is crucial for the success of copy trading, as it directly influences the reliability of the signals and the overall user experience.

The synergy among these three parties creates a collaborative and dynamic copytrading community. Providers showcase their expertise, copy traders gain access to professional strategies, and brokers facilitate a seamless and secure environment for this financial symbiosis. As the popularity of copy trading continues to rise, these key players remain essential components in reshaping the landscape of modern investing.

C. Copy trading vs. Mirror trading

Source: Unsplash

In the realm of algorithmic trading and automated investment strategies, copy trading and mirror trading are terms often used interchangeably, yet they harbor subtle distinctions that can significantly impact an investor's approach. Understanding these differences is crucial for those navigating the diverse landscape of social trading platforms.

1. Copy Trading

Copy trading involves a comprehensive replication of the entire trading strategy of the signal provider by the copy trader. The emphasis is on mirroring not just individual trades but the broader approach, risk management strategies, and portfolio allocations of the master trader. This form of trading is characterized by a more holistic duplication of the provider's investment decisions. Copy trading is suitable for investors seeking a hands-off approach, relying on the expertise of the signal provider for overall portfolio management.

2. Mirror Trading

While mirror trading shares similarities with copy trading, it typically involves replicating specific trading signals rather than the entire strategy. In mirror trading, investors have the flexibility to select specific signals or trading actions they wish to mirror in their own portfolios. This approach allows for a more granular level of control, as investors can tailor their strategy by choosing signals based on their risk preferences or asset preferences. Mirror trading is suitable for those who desire a more hands-on approach to managing their investment decisions.

Key Distinctions

- Scope of Replication: Copy trading duplicates the entirety of the master trader's strategy, while mirror trading focuses on specific signals or actions.

- Level of Control: Copy trading is more hands-off, relying on the holistic expertise of the signal provider, whereas mirror trading offers investors a more selective and customizable approach.

- Ease of Use: Copy trading is often more straightforward for beginners, as it requires minimal decision-making, while mirror trading may demand a deeper understanding of specific signals and their implications.

Choosing between copy trading and mirror trading depends on an investor's preferences, risk tolerance, and desired level of involvement. Both approaches harness the power of social trading, enabling individuals to benefit from the expertise of others, yet the nuanced differences cater to a diverse range of investment styles and objectives. As the landscape of algorithmic trading continues to evolve, traders can leverage these options to tailor their strategies and participate in the financial markets with greater precision.

Why Copy Trading?

Copy trading is not just a method; it's a transformative approach that empowers you to navigate financial markets successfully, even without extensive experience. It's a journey where you can leverage expertise, earn passive income, and become an active participant in a supportive community.

If you've ever felt overwhelmed by the complexities of financial markets or lacked the time to delve into trading intricacies, copy trading emerges as a transformative solution that aligns with the diverse needs of today's traders. Let's explore five compelling reasons why copy trading might be the game-changer you've been seeking.

A. Leverage the skills of experienced traders

Copy trading allows you to harness the skills and insights of seasoned professionals in the financial realm. By selecting reputable signal providers, you can automatically replicate the trading strategies of expert traders. This unique feature positions you to benefit from their market acumen and potentially achieve favorable returns without having to become a market expert yourself.

B. No trading experience is required to get started

For those new to the world of trading, copy trading provides an accessible entry point. You can initiate your investment journey without the need for extensive market knowledge or trading experience. The intuitive platforms offered by copy trading providers make the onboarding process seamless, enabling you to participate in the financial markets confidently from the start.

C. Potential for passive income from other traders copying

As a signal provider, you can not only benefit from copying successful traders, but also open the door to earning passive income. When other traders choose to copy your strategies, you receive a percentage of their profits. This dual-sided advantage creates a collaborative and mutually beneficial environment within the copytrading community.

D. Diversify trading portfolio across multiple assets

Copy trading allows you to effortlessly diversify your trading portfolio across various assets. Whether it's stocks, forex, commodities, or cryptocurrencies, you have the flexibility to choose signal providers specializing in different markets. This diversification mitigates risk and enhances the potential for stable, long-term returns.

E. Social trading community provides trading ideas

Engaging in copy trading means being part of a vibrant social trading community. This community not only fosters collaboration but also provides a constant stream of trading ideas. By staying connected with fellow traders, you can gain insights, discuss market trends, and refine your strategies based on collective wisdom.

How Does Copy Trading Work?

Source: Unsplash

The process of copy trading is designed to be straightforward and accessible, making it an ideal option for both novice and experienced investors. By choosing a reliable platform, selecting a suitable trader, and allocating capital judiciously, you can leverage the expertise of seasoned professionals to enhance your own investment journey. Start your copy trading adventure today, and witness the power of automated investing working for you.

If you're intrigued by the concept of copy trading and eager to kickstart your journey into the world of automated investing, understanding the step-by-step process is essential. Let's delve into the mechanics of how copy trading operates, empowering you to make informed decisions and maximize the benefits.

A. Choose a reliable copy trading platform

The first step is crucial: selecting a reliable copy trading platform. Today, numerous platforms offer copy trading services, each with its unique features and strengths. Look for platforms with a user-friendly interface, a diverse pool of experienced traders, and a robust track record of security and reliability.

B. Select a trader to copy trade

Once on the platform, you'll be presented with a diverse array of experienced traders, each with their own strategies and performance metrics. Take your time to explore and analyze these traders, considering factors such as historical performance, risk tolerance, and trading style. Choose a trader whose approach aligns with your investment goals.

C. Allocate capital in copy trading

With your selected trader in mind, the next step involves allocating capital to copy their trades. This is a crucial decision that impacts the size of your positions and overall exposure to the market. Consider your risk tolerance and the trader's historical drawdowns when determining the amount of capital to allocate.

D. Trades are automatically copied in proportion to allocated capital

The beauty of copy trading lies in its automation. Once you've allocated capital, the platform takes care of the rest. Trades executed by your chosen trader are automatically replicated in your account, proportionate to the capital you've allocated. This seamless process ensures that you mirror the trader's actions without the need for constant monitoring or manual intervention.

E. Traders being copied earn commissions on the profits of copiers

Importantly, copy trading creates a symbiotic relationship between copiers and the traders being copied. While copiers benefit from successful trades, the traders being copied earn a commission based on the profits generated for their followers. This aligns interests and fosters a collaborative environment within the copy trading community.

Who to Copy Trade?

Source: Unsplash

The key to successful copy trading lies in meticulous research and strategic decision-making. By leveraging social trading features, analyzing performance metrics, assessing risk management strategies, and diversifying across multiple traders, you empower yourself to make informed choices and optimize your copy trading experience.

Starting on your copy trading journey involves strategic decisions in selecting traders to replicate. To optimize your experience and enhance your chances of success, consider the following steps in identifying and evaluating traders on social trading platforms:

A. Utilizing Social Trading Features to Identify Top Traders

Take advantage of the social features offered by copy trading platforms. Explore rankings, user reviews, and community discussions to identify top-performing traders. These platforms often provide valuable insights into a trader's historical performance, risk tolerance, and overall reputation. Engage with the community to gather diverse perspectives on potential traders.

When researching and evaluating potential traders to copy, delve into their profiles. Verify the trader's identity, analyze their trading history, and assess their risk management strategies. Look for traders who transparently share their insights and communicate effectively with their followers.

B. Analyzing Performance Metrics and Statistics

Evaluate a trader's performance metrics to make informed decisions. Look for consistent returns over multiple years, indicating stability and reliability. Pay attention to risk metrics such as maximum drawdown, which provides insights into a trader's ability to manage risk during challenging market conditions. Analyzing these statistics ensures a thorough understanding of a trader's track record.

C. Assessing Risk Management Strategies

A critical aspect of successful copy trading is aligning with traders whose risk management strategies match your own risk appetite. Evaluate how traders handle risk, including position sizing, stop-loss mechanisms, and overall risk exposure. Choosing traders who share a similar risk profile enhances the likelihood of a harmonious and profitable copy trading experience.

D. Diversify Across Multiple Copied Traders

To further mitigate risk, consider diversifying your copy trading portfolio across multiple traders. This approach spreads risk exposure and reduces dependency on the performance of a single trader. Diversification provides a more resilient portfolio, enhancing your ability to weather market fluctuations.

How to Copy Trade?

Source: Unsplash

Onsetting your copy trading journey is a straightforward process that can open the door to lucrative opportunities in the financial markets. Here's a step-by-step guide on how to copy trade, with a focus on the user-friendly VSTAR platform.

Copy trading with VSTAR offers a fast, efficient, and user-friendly experience. By following some simple steps, you can leverage the power of copy trading today to achieve your financial goals right now. Let's dive into the world of copy trading with VSTAR and unlock a simplified path to potential profits.

A. Sign up for a Copy Trading Platform like VSTAR

To get started, sign up for a reputable copy trading platform like VSTAR. Why VSTAR? It stands out for its user-friendly interface, a diverse pool of top-performing traders, and advanced features that enhance the copy trading experience. Registering with VSTAR positions you at the forefront of seamless and reliable copy trading.

B. Deposit Funds into Your Account

After successfully signing up, the next step involves depositing funds into your account. VSTAR provides a secure and efficient deposit process, allowing you to fund your copy trading endeavors swiftly. The platform typically supports various payment methods to cater to your convenience.

C. Find Traders to Copy

Utilize VSTAR's advanced search and filtering tools to find traders aligning with your preferences. Evaluate their performance metrics, risk management strategies, and trading styles. VSTAR's platform offers transparent and comprehensive profiles, facilitating informed decisions when selecting traders to copy.

D. Click "Copy" on a Trader's Profile to Open a Copy Position

Once you've identified a trader you want to follow, click "Copy" on their profile to initiate a copy position. VSTAR's intuitive platform ensures a seamless and quick copying process, allowing you to mirror the chosen trader's activities in real-time.

E. Monitor the Overall Performance of Your Copied Traders

Stay engaged by regularly monitoring the overall performance of your copied traders. VSTAR provides real-time updates and performance analytics, enabling you to make timely adjustments or diversify your portfolio further if needed.

F. Mix Copying with Your Own Manual Trading for Diversification

Enhance your investment strategy by combining copy trading with your own manual trades. This diversification approach helps you strike a balance between automated copying and personal decision-making, optimizing your overall trading portfolio.

G. Withdraw Profits When You Reach Your Goals

Celebrate your success by withdrawing profits when you reach your financial goals. VSTAR ensures a seamless withdrawal process, allowing you to enjoy the fruits of your copy trading endeavors promptly.

Potential Risks of Copy Trading

Source: Unsplash

While copy trading provides a simplified entry into the world of trading, it also comes with inherent challenges that traders should be aware of. Hence, it's crucial to approach it with a well-informed perspective.

By acknowledging and understanding the potential risks associated with market dynamics, technical issues, emotional aspects, fees, and regulatory changes, you empower yourself to navigate these challenges successfully. Today, take the necessary steps to mitigate risks, ensuring a more secure and rewarding copy trading journey.

A. Market Volatility and Unexpected Events

The ever-changing nature of financial markets introduces inherent risks, particularly with market volatility and unexpected events. Sudden price fluctuations or geopolitical developments can impact even the most meticulously crafted trading strategies, affecting both the master trader and those copying their trades.

B. Technical Issues and Platform Limitations

Copy trading is not immune to technical challenges and platform limitations. Execution risks, such as slippage, rejected orders, or platform outages, can disrupt the seamless replication of trades. Staying informed about the reliability of your chosen copy trading platform is crucial to mitigating these technical risks.

C. Emotional and Psychological Aspects of Trading

While copy trading automates the execution of trades, it doesn't eliminate the emotional and psychological aspects of trading. There's a risk of over-reliance on copying others without understanding the underlying strategies. It's essential to maintain a balanced approach and be aware of the emotional impact of market fluctuations.

D. Additional Fees and Commissions on Copied Trades

While many copy trading platforms offer user-friendly interfaces, it's vital to be aware of the associated costs. Additional fees and commissions on copied trades can impact overall returns. Understanding the fee structure and choosing cost-effective platforms contribute to a more transparent and financially viable copy trading experience.

E. Regulatory Changes and Compliance

The financial industry is subject to regulatory changes, and compliance requirements may evolve. Copy traders need to stay informed about these changes, as they can influence the operational framework of copy trading platforms and impact the overall trading environment.

Tips for Success with Copy Trading

Source: Unsplash

Being successful in copy trading stems from a thoughtful and disciplined approach. By starting with small positions, having a clear plan, avoiding excessive copying, implementing risk management tools, monitoring and adjusting trades, and leveraging additional tools, you position yourself for a more informed and successful copy trading experience.

Going on a copy trading journey certainly offers a shortcut to potential financial success, but it's crucial to keep in mind that success requires strategic decision-making and a disciplined approach. Here are essential tips to enhance your chances of success in the dynamic world of copy trading.

A. Start with Small Position Sizes

When initiating your copy trading venture, consider starting with small position sizes. This cautious approach allows you to test the waters without exposing yourself to significant risks. As you gain confidence and experience, you can gradually increase your position sizes.

B. Have a Plan and Investment Goals

Successful copy trading involves more than randomly selecting traders to follow. Develop a clear plan and set investment goals. Define your risk tolerance, desired returns, and the time horizon for your investments. Having a well-thought-out strategy provides a roadmap for your copy trading endeavors.

C. Avoid Excessive Copying and Blindly Following Trades

Resist the temptation to excessively copy multiple traders without a clear rationale. Blindly following trades can lead to an unmanageable and chaotic portfolio. Instead, focus on a select few traders whose strategies align with your goals, enabling a more concentrated and purposeful approach.

D. Implement Stop-Loss Orders and Risk Management Tools

Mitigate potential losses by implementing stop-loss orders and leveraging risk management tools provided by the copy trading platform. These tools act as safeguards, automatically closing positions if predefined loss thresholds are reached. By proactively managing risk, you protect your capital and promote a more sustainable trading approach.

E. Monitor and Adjust Your Copied Trades

Regularly monitor the performance of your copied trades. Stay informed about market trends and be prepared to adjust your portfolio if needed. Markets are dynamic, and a proactive approach ensures that your copy trading strategy remains aligned with current conditions.

F. Leverage Additional Tools and Indicators

Enhance your decision-making process by leveraging additional tools and indicators. Many copy trading platforms offer a range of analytical tools and indicators that can provide valuable insights. Stay informed about market sentiment, technical analysis, and other relevant factors to refine your copy trading strategy.

Conclusion

As we look ahead to the future of copy trading, the landscape promises continued evolution. The rise of social trading communities and ongoing regulatory developments will shape the way individuals engage with financial markets. The fusion of innovative technologies and robust regulatory frameworks ensures that copy trading remains a dynamic and accessible avenue for both novice and experienced traders alike.

For those ready to embark on their copy trading journey, VSTAR stands as a beacon of reliability and user-friendly features. Encouraging you to start copy trading with confidence, VSTAR provides a seamless platform, empowering you to mirror the strategies of top-performing traders. Today, embrace the potential of copy trading, right now, and step into a world of fast, efficient, and simplified financial opportunities with VSTAR.