Are you looking for a way to diversify your investment portfolio and potentially increase your profits? If so, you might want to consider CFD trading. CFD stands for Contracts for Difference, a popular form of trading that allows traders to speculate on the price movements of various financial instruments such as stocks, commodities, and currencies.

In this article, we will provide an overview of CFD trading, discuss its benefits and drawbacks, and explain how different CFD trading strategies work.

Basics of CFD Trading

CFD trading differs from traditional trading in several ways. First, unlike traditional trading, CFD doesn't involve owning the underlying asset. Instead, it is a form of derivatives trading where traders speculate on the underlying asset's price movements. It means traders can take long and short positions to profit from upward and downward price movements.

Like any type of trading, CFD trading has its own benefits and drawbacks. One of the main advantages of CFD trading is the ability to take both long and short positions, potentially allowing traders to profit in any market condition. CFD trading also offers high leverage, which means that traders can make significant profits with a relatively small initial investment. CFD trading is often commission-free, with traders only paying a small spread on the bid-ask price.

However, there are also some drawbacks to CFD trading. One major disadvantage is the potential for high risk, especially when using leverage. Let's overlook CFD trading in this article.

Types of CFD Trading Strategies

There are several popular CFD trading strategies that traders can use to potentially improve their chances of success. These include trend-following strategies, range-bound strategies, and news-based strategies.

Let's take a closer look at each strategy type and its advantages and disadvantages.

Trend-following Strategies

Trend-following strategies are based on the idea that markets tend to move in trends, and traders can profit by following them. This strategy involves identifying the direction of the trend and then buying or selling accordingly.

Some popular trend-following strategies include:

1. Moving Averages: This strategy involves using moving averages to identify the direction of the trend. Traders can use different time frames to identify short-term and long-term trends.

2. Relative Strength Index (RSI): This strategy involves using the RSI indicator to identify overbought and oversold conditions. Traders can use this indicator to identify potential entry and exit points.

3. Moving Average Convergence Divergence (MACD): This strategy involves using the MACD indicator to identify changes in momentum. Traders can use this indicator to identify potential trend reversals.

One advantage of trend-following strategies is that they can be relatively easy to implement, especially for beginners. However, one potential disadvantage is that they can sometimes generate false signals, which can lead to losses if traders don't manage their risk properly.

Now move to some popular trends following strategies:

Golden Cross trading strategy

When the 50 Moving Average crosses above the 200 Moving Average, it is called the Golden cross. The 200 SMA represents long-term investors' sentiment, and if the price is above the 200 SMA, we can consider the long-term outlook bullish.

Let’s see the trading condition in the golden cross strategy:

● The price is above 200 SMA and 50 EMA.

● 50 EMA crosses above the 200 SMA.

● Open a buy order once the price shows a bullish rejection candlestick from the 50 EMA level.

● The aggressive stop loss is below the latest swing low, and the conservative level is below the 200 SMA.

ADX & 20 EMA-based strategy

The Average Directional Index (ADX) shows the overall strength of a trend. If the ADX is above the 20.00 level, we can consider the overall trend strong. On the other hand, the 20 EMA is a dynamic support/resistance level from where a candlestick rejection could offer a trading opportunity.

Let’s see the trading condition in the ADX & 20 EMA-based strategy:

● Identify the long-term market trend to find the broader outlook.

● Find a bullish breakout in ADX above the 20.00 line.

● Wait for a bearish correction in the price chart and open a buy/sell trade after a candlestick rejection from the 20 EMA.

● The stop loss is above or below the latest swing level, and the take profit is based on 1:2 R:R.

Range-bound Strategies

Range-bound trading strategies are designed to take advantage of price movements in assets that are trading within a defined price range. Range-bound strategies involve identifying support and resistance levels and using technical indicators to identify buy and sell signals. Popular range-bound strategies include Bollinger Bands, Stochastic Oscillators, and Average True Range (ATR).

Bollinger Bands range bound strategy

Bollinger Bands are a popular technical analysis tool that uses a moving average and standard deviations to identify support and resistance levels. In this range-bound strategy, we will look to sell trades from Upper Bollinger Bands and buy trades from Lower Bollinger Bands.

The stochastic Oscillator is another popular technical analysis tool that measures the momentum of price movements to identify overbought or oversold conditions. When the Stochastic is at the 80.00 level, we can consider the market is overbought. Therefore, we will look to sell trades on 80.00 Stochastic and buy trades on 20.00 Stochastic.

ATR based range bound strategy

The Average True Range (ATR) measures the volatility of a price. If the ATR is above the 20.00 line, we can consider the overall market volatile, leading to a reversal opportunity. Therefore, if the price approaches a resistance, we can open a sell trade, considering the ATR level.

News-based Strategies

News-based trading strategies involve trading based on market-moving news events such as economic indicators, major policy announcements from central banks, and geopolitical news. News-based strategies involve identifying news events that are likely to impact the markets and taking a position before or after the news is released.

Trading economic indicators such as employment data, GDP, and inflation can provide valuable insights into the health of an economy and the likely direction of interest rates. Trading major policy announcements from central banks, such as interest rate decisions and quantitative easing programs, can also significantly impact financial markets.

Geopolitical events such as wars, natural disasters, and political upheavals can also significantly impact financial markets. News-based strategies require careful research and analysis to identify the likely impact of news events and the best time to enter and exit positions.

The above image represents the economic calendar from where you can observe new economic events with results.

News trading Method with Fibonacci Retracement

After releasing high-impact news like Non-farm payroll, interest rate and CPI, we can use this method to open a long/short entry.

After releasing the news, a primary wave will come with sharp impulsive pressure. If the price moves toward the news sentiment, we will wait for the 50% to 61.8% Fibonacci retracement level from the primary wave.

Now, move to a 5-minute chart and wait for a valid candlestick rejection toward the primary wave. Open a short/long trade once the rejection is done. The stop loss will be above or below the pre-news price, and the take profit is a minimum 1:2 R:R.

Implementation of CFD Trading Strategies

If you are interested in trading contracts for difference (CFD), you must have a trading strategy to succeed. CFD trading strategies are used to help traders identify trends and market conditions and make informed decisions about when to enter and exit positions. This section will discuss the importance of selecting the right strategy for your individual goals and risk tolerance and provide tips for implementing CFD trading strategies.

Selecting the Right Strategy for Your Goals and Risk Tolerance

Before you can start implementing a CFD trading strategy, it's important to select the right strategy for your individual goals and risk tolerance. Various CFD trading strategies are available, each with unique advantages and disadvantages. Some traders prefer short-term strategies focusing on quick profits, while others prefer long-term strategies focusing on building a solid portfolio over time.

When selecting a CFD trading strategy, it's important to consider your own goals and risk tolerance. For example, if you are more risk-averse, you may prefer a strategy focusing on minimizing losses rather than maximizing profits. On the other hand, if you are more comfortable taking on risks, you may prefer a strategy that aims for higher returns.

Tips for Implementing CFD Trading Strategies

Once you have selected a CFD trading strategy that aligns with your goals and risk tolerance, it's time to implement it.

Here are some tips to help you get started:

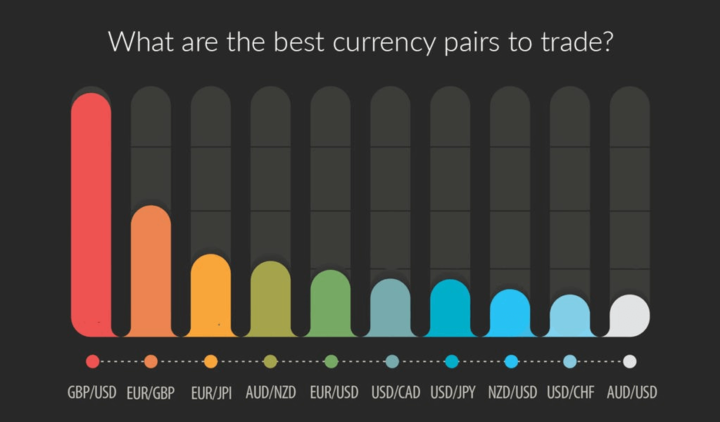

1. Choose the right currency pairs to trade: The first step in implementing a CFD trading strategy is choosing the right currency pairs. Major currency pairs like EURUSD, GBPUSD, etc, are famous in the industry as they are highly liquid with a lower spread. Also, there are other factors like fundamental analysis, policy factors, and market sentiment that a trader should consider while choosing the right pair.

2. Use technical indicators: Technical analysis tools such as moving averages, relative strength index (RSI), and Bollinger Bands can be used to identify trends and market conditions. Using a combination of tools is important to get a more accurate picture of market conditions.

3. Apply risk management techniques: Risk management techniques such as stop-loss orders and position sizing can be used to manage overall portfolio risk. It's important to have a clear risk management plan in place to minimize potential losses.

If you want to consider trading as a tool to make 200X or 500X gains per month, you are on the wrong track. The ideal risk management approach is not to take more than 1% risk per trade. It would be satisfactory if you could gain 5% to 20% a month.

Backtesting and Results

A sound trading strategy is essential if you are looking to trade CFDs (Contracts for Difference). But how can you know if your strategy will work in the real world? The answer lies in backtesting.

Backtesting involves applying your trading strategy to historical market data to see how it would have performed in the past. This is important because it allows you to identify the strengths and weaknesses of your strategy and refine it accordingly.

Backtesting is a vital component of successful trading because it enables you to assess the effectiveness of your strategy and identify any potential flaws. Without backtesting, you would be trading blindly, without knowing how your strategy would perform in different market conditions.

To backtest your CFD trading strategy, you should follow these guidelines:

● Identify the market conditions in which you want to test your strategy, such as a trending or range-bound market.

● Choose a time frame for your backtesting, such as a year or two years.

● Use reliable historical market data,to stimulate your trades.

● Use a spreadsheet or a trading platform with a backtesting function to record and analyze your trades.

● Evaluate your results and make adjustments to your strategy as needed.

By following these guidelines, you can ensure that your backtesting is thorough and accurate and that you can make informed decisions based on your results.

When backtesting popular CFD trading strategies, it is essential to evaluate the results critically. While some strategies may perform well in certain market conditions, they may not be effective in others. Additionally, past performance does not guarantee future results, so it is crucial to be cautious when interpreting backtesting results.

How to Get Success from Your CFD Trading Strategy

Once you have backtested your CFD trading strategy, it is time to optimize and refine it to improve its performance.

Here are some tips to help you do so:

1. First, you have to learn a profitable trading strategy with a good risk management system.

2. Monitor your strategy's performance regularly, and adjust it to changing market conditions.

3. Implement risk management techniques, such as stop-loss orders and position sizing, to minimize losses.

4. Stay disciplined and stick to your trading plan, even during periods of market volatility.

5. Keep a trading journal to track your results and refine your strategy over time.

By following these tips, you can increase your chances of success with your CFD trading strategy. Successful trading requires discipline, patience, and adapting to changing market conditions.

Once your strategy is ready, you are ready to test it in the demo account before proceeding with the real money. Opening a demo account in VSTAR is easy, as you can do it by following simple steps. Make sure to track your demo trading performance in a trading journal so that you can identify where to improve.

Conclusion

Having a sound CFD trading strategy is essential for success in the markets. Backtesting is a critical component of developing and refining your strategy, and it allows you to assess the effectiveness of your approach before risking real money.

When backtesting, following guidelines for accuracy and evaluating results critically is important. Additionally, optimizing and refining your strategy through risk management, discipline, and monitoring is crucial to improving its performance and increasing the chances of success.

Finally, keeping a trading journal can provide valuable insights into your trading behavior and progress over time. By following these principles, you can develop a winning CFD trading strategy and achieve your financial goals.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of VSTAR, nor can it be used as investment advice.