Bitcoin's trajectory in 2024 is poised for examination against a backdrop of significant market evolution, regulatory changes, expert projections, and macroeconomic influences. The year 2023 marked a turning point for the crypto market, witnessing transformations in market leadership, increased institutional participation, and the impending arrival of a spot Bitcoin ETF, among other critical developments.

Source: tradingview.com

The emergence of regulatory mechanisms and the potential launch of a spot Bitcoin ETF in Q1 2024 are pivotal narratives steering expectations. This regulatory evolution is anticipated to attract institutional investors by introducing a regulated avenue for Bitcoin exposure. Consequently, industry experts and institutions have formulated a spectrum of predictions regarding Bitcoin's price performance for 2024, each rooted in varying assessments of market dynamics and external factors.

Regulatory Shifts and Institutional Participation

2023 heralded a transformation in market dynamics, characterized by changes in exchange leadership and a growing emphasis on compliance and regulation. Notably, the imminent launch of a spot Bitcoin ETF in 2024 is expected to provide a regulatory bridge, potentially captivating institutional investors and broadening market participation.

Expert Projections and Forecasts

A myriad of predictions has been put forth by experts and institutions regarding Bitcoin's price range in 2024, spanning from conservative estimations to remarkably bullish forecasts:

Mark Mobius, Youwei Yang, CoinShares, Nexo, Standard Chartered, Carol Alexander, and Matrixport: Forecasts span $60,000 to $125,000. Their predictions largely hinge on the prospects of Bitcoin ETF approval, the impending halving event, and broader macroeconomic conditions favoring Bitcoin's growth.

CoinFund: Among the most bullish forecasts, CoinFund anticipates a potential range of $250,000 to $500,000. Their analysis revolves around Bitcoin's inverse correlation with the dollar, expected inflows post-BTC ETF launch, and regulatory normalization.

Evaluation of Key Influencing Factors

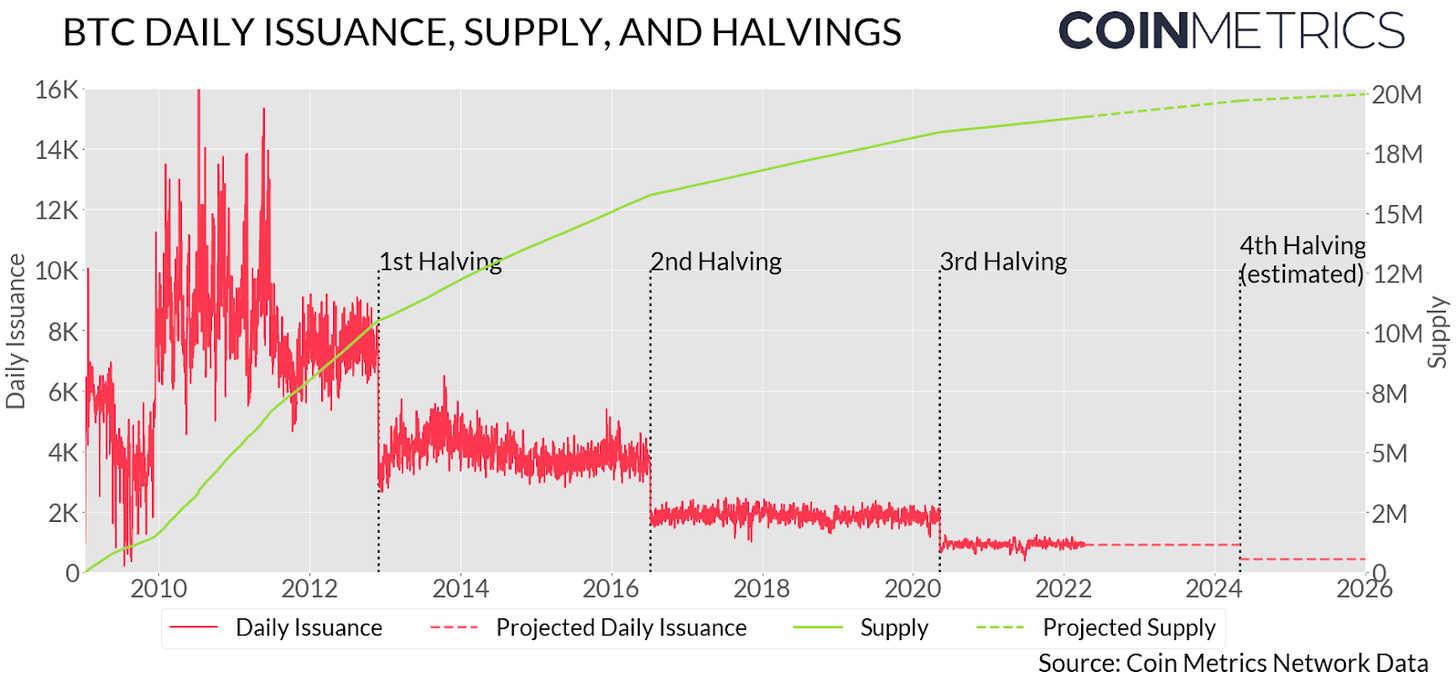

- Bitcoin Halving: Historically, Bitcoin halving events have preceded price surges. The reduction in mining rewards constraints supply, potentially fostering increased demand and consequent price appreciation.

Source: cryptoslate.com

- Regulatory Advancements: The anticipated approval of a Bitcoin ETF is poised to unlock substantial institutional investment, rendering Bitcoin more accessible to a broader investor base.

- Macroeconomic Landscape: Factors such as potential interest rate adjustments and geopolitical tensions hold sway over Bitcoin's perceived value as a hedge against inflation and global uncertainties.

- Market Sentiment and Volatility: Sentiment-driven market fluctuations, fear, greed, and regulatory clarity are pivotal factors influencing price movements.

Risks and Challenges Ahead

- Regulatory Uncertainty: The volatile nature of the crypto market remains subject to regulatory actions. Any delays or adverse regulatory decisions regarding ETF approvals could impede market growth.

- Volatility and Market Sentiment: Despite optimistic forecasts, cryptocurrency markets remain susceptible to rapid price swings influenced by market sentiment, regulatory changes, and unexpected events.

- Geopolitical and Macro Events: Unforeseen geopolitical shifts or macroeconomic developments may disrupt market stability, impacting Bitcoin's price trajectory unpredictably.

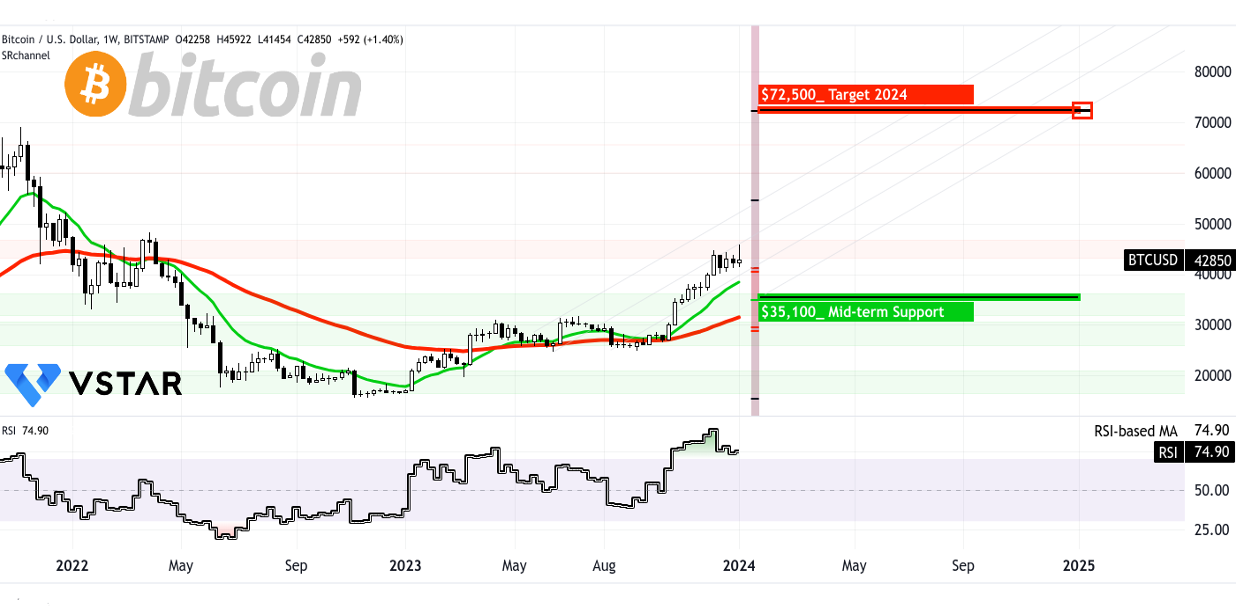

BTCUSD: Technical Take

The price of Bitcoin may hit $72,500 by 2024 (highly probable).

The bitcoin price has experienced solid bullish momentum since mid-2023. However, the price is experiencing resistance at the current level ($43,500–$45,000).

Looking at the Relative Strength Index (RSI), it indicates an overbought condition for the cryptocurrency. Therefore, a correction can be expected. A price in the range of $36,000–$35,100 serves as an ideal price to accumulate more bitcoins.

Looking forward, the 13-week and 52-week exponential moving averages (EMA) are on a bullish trajectory. Here, the 13-week EMA serves as a vital navigator for the trend, and the 52-week EMA may serve as a dynamic support for the trend.

Lastly, projecting the current momentum forward leads to a 2024 target of $72,500, even with pessimistic measures. On the way to hitting the target, $54,800, $60,000, and $65,800 may serve as minor resistances. Meanwhile, after closing above $47,000, the level may become the critical pivot for 2024.

Source: tradingview.com

In conclusion, Bitcoin's projected price in 2024 encompasses both optimism and caution, reflecting the dynamic interplay between regulatory advancements, macroeconomic conditions, investor sentiments, and unforeseen events. While factors like the Bitcoin halving and ETF approvals stand as potential catalysts for price growth, the inherent risks associated with regulatory ambiguity, market sentiment, and unforeseen events necessitate a balanced and cautious investment approach.

Bitcoin's trajectory in 2024 will pivot on a delicate interplay of regulatory dynamics, macroeconomic factors, market sentiment, and unforeseen events. Prudent investors must exercise caution, balancing bullish and bearish scenarios while navigating the volatile cryptocurrency ecosystem.