The Fed rate hikes spill over into global FX market

Since March 2022, the Federal Reserve has made 11 rounds of interest rate hikes, with the federal funds rate rising from an all-time low of 0.25% to 5.25%. The currencies of several countries around the world have depreciated significantly against the US dollar, including the Japanese yen.

There are two main reasons why the Fed's rate hikes cause other countries' currencies to depreciate: interest rate differentials and capital flows.

- Interest rate differentials: When the Federal Reserve raises interest rates, interest rates in the U.S. rise, which can lead to a higher return on U.S. dollar investments. Investors tend to seek higher returns, so they may move their funds to the United States to seek more attractive returns. This shift in liquidity increases the supply of other countries' currencies relative to the dollar, which could cause those currencies to depreciate. Lower interest rate differentials could reduce the demand for other countries' currencies, negatively affecting the value of those currencies.

- Capital flows: The Fed rate hike could trigger international capital flows. Investors may move funds from other countries to the United States in search of higher returns. Such capital outflows can lead to an increase in the supply of other countries' currencies, which could cause them to depreciate.

- Of course, this currency depreciation is not a direct result, but rather results from a complex set of market forces with varying socioeconomic effects.

Impact of yen depreciation on Japan's GDP

Normally, currency depreciation has a more negative impact, but the Japanese government, business community and economists are not overly concerned about the state of the yen because Japan's GDP growth continues to perform very well, even exceeding expectations.

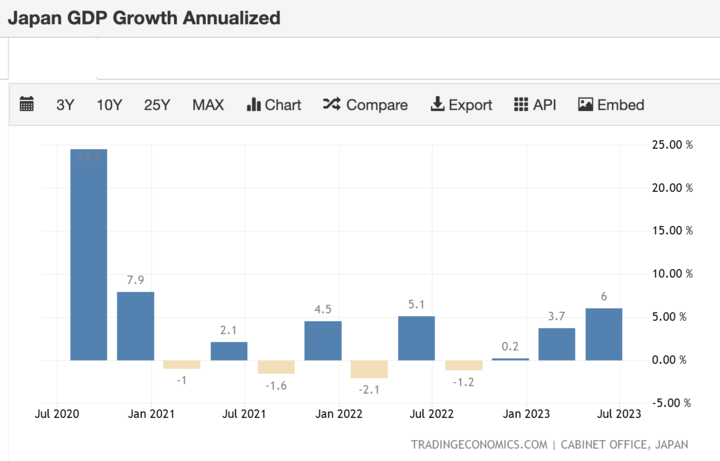

Chart: Japan's GDP grew by 2.7% in the first quarter and even more by 6% in the second quarter

Source: tradingeconomics

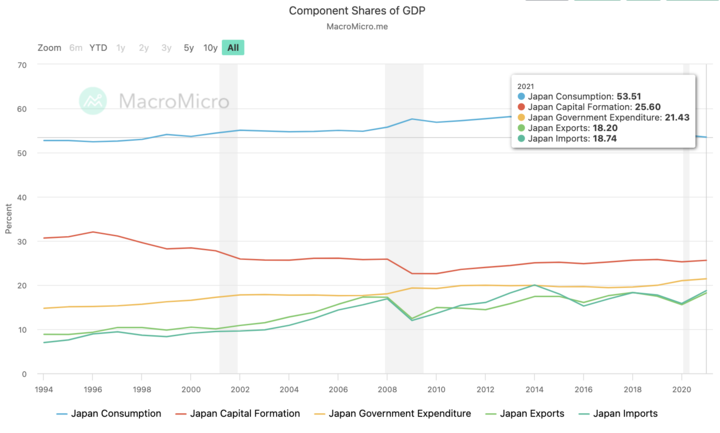

According to the latest GDP composition of Japan in 2021, consumption is the largest at 53.51%, capital formation is 25.6%, government expenditure is 21.43%, exports is 18.2%, and imports is 18.74%.

For Japanese export-oriented firms, when the yen depreciates, Japanese exports become more competitive in the international market because it means that the same amount of foreign currency can be used to buy more Japanese products, which in turn makes consumers in other countries prefer to buy Japanese goods and services. As a result, the depreciation of the yen has a more positive impact on the profit and revenue growth of Japanese export-oriented companies.

- Increased profits: The depreciation of the yen can increase the overseas sales of Japanese companies' export products, thereby increasing their operating income. Especially if the company's production costs are relatively stable, the increase in export revenue will directly translate into higher profits. According to statistics, a one-unit (1 yen) daily depreciation of the yen against the U.S. dollar increases Toyota's profits by 4.8 billion yen, Honda's by 1 billion yen, and Uniqlo's by 120 million yen.

- Improved performance: The depreciation of the yen is likely to have a positive impact on the financial performance of companies, leading to improved results, which in turn will increase shareholder value and boost stock prices. According to estimates by Daiwa Securities of Japan, a one-unit daily depreciation of the yen against the U.S. dollar would increase the total profits of all companies listed on the Tokyo Stock Exchange by about 198 billion yen. As a result, employees of multinational companies will be able to receive higher bonuses and shareholders will be able to share in more dividends, thus reaping the benefits of the yen's depreciation.

Japan's stock market is booming

Since the beginning of this year, the Nikkei 225 Index has reached its highest level since 1990, thanks to the continued influx of foreign capital.

In most countries, there tends to be a positive correlation between the stock market and the exchange rate because, from a flow-of-funds perspective, when foreign capital floods into a country's stock market, it not only boosts that country's stock market, but it can also put pressure on the local currency to appreciate in the foreign exchange market (when foreign investors buy the country's stocks, they need to convert foreign currency into the local currency to complete transactions. This leads to an increase in demand for the domestic currency, which can lead to appreciation pressure on the domestic currency). Thus, the stock markets of most countries can be seen as a "barometer" of the economy, while the exchange rate, over the long term, reflects the relative strength of the fundamentals of the two countries.

Japan, however, is a special case. Since the signing of the Plaza Accord in 1988, government intervention has led to a gradual appreciation of the yen. For most of the next 35 years, the yen exchange rate was negatively correlated with the Japanese stock market index.

According to the findings of the IFC Securities Research Institute, the main reason for the negative correlation between the Japanese stock market and the exchange rate is the disconnect between interest rates and economic fundamentals due to Japan's long-term implementation of ultra-loose monetary policy. Since the first implementation of the "zero interest rate" policy in 1999, Japan has continued to implement an ultra-loose policy, with the policy interest rate target always below 0.5%. This led to the decoupling of Japanese 10-year government bond rates and economic fundamentals, which no longer dominate the Japanese stock market trend. Instead, the U.S.-Japan spread has become one of the keys to market pricing.

The U.S.-Japan spread is the difference between U.S. interest rates and Japanese interest rates. Specifically, it is the difference between the U.S. dollar and Japanese yen deposit or borrowing rates. The spread is typically measured in basis points (bps), where a basis point is one-hundredth of a percentage point.

The U.S.-Japan spread plays an important role in the foreign exchange market because it can influence the attractiveness of the U.S. dollar or the Japanese yen for investors and traders. A higher U.S.-Japan spread means that interest rates in the U.S. are relatively high, which may attract investors to buy U.S. dollars, causing the Japanese yen to depreciate on a relative basis. Conversely, a lower U.S.-Japan spread may lead to a relative appreciation of the Yen.

The interest rate differential between the United States and Japan may also affect the direction of investors' capital flows. If interest rates in the United States were to rise, this could induce international investors to shift their capital to the United States, leading to capital outflows from other countries, such as Japan. Such capital flows can affect exchange rates and asset prices.

If the U.S.-Japan interest rate differential widens, arbitrage funds will flow into the high-yielding currency (currently the U.S. dollar), leading to a depreciation of the yen against the U.S. dollar. In addition, rising U.S. bond yields also depress U.S. risk assets, and some funds flow out of the U.S. stock market and into the Japanese stock market. As a result, the higher the U.S.-Japan spread, the stronger the Japanese stock market becomes relative to the U.S. stock market.

Japanese Real Estate, Industrial Supply Chain and Tourism

As a result of the depreciation of the yen, Japanese dollar-denominated assets (e.g., land, real estate) and labor costs are relatively lower, creating favorable conditions for Japan to attract foreign investment and encouraging overseas companies to relocate their factories back to the country. According to data, the return on investment in the Japanese real estate market has increased by 10% since the depreciation of the yen, which has increased the attractiveness of Japan to foreign investors.

In the semiconductor industry, the global semiconductor value chain is being reorganized under the leadership of the United States. Against this backdrop, both the Japanese government and industry are actively exploring ways to revitalize the once-glorious semiconductor industry. At the same time, the depreciation of the yen has provided strong support for attracting overseas semiconductor companies to set up factories and expand their business in Japan.

Since Abe became Prime Minister of Japan for the second time in 2013, he has identified tourism as a key industry to drive Japan's economic growth. Under Abe's leadership, the number of overseas visitors has increased from 8 million in 2012 to 30 million in 2019, a figure that demonstrates significant growth in tourism. However, due to the outbreak of the Shinkansen epidemic, Japan's overseas visitors have dwindled to almost zero. This year marks the first year that the outbreak has been completely eliminated in Japan, while the sharp depreciation of the yen against the dollar has further contributed to foreign tourists feeling that traveling to Japan is more cost-effective. This has given a huge boost to the recovery of Japan's tourism industry. From January to June this year, more than 10 million foreign tourists came to Japan, indicating that the tourism industry is gradually recovering.

Fiscal solutions in the face of imported inflation

It is worth noting that while the depreciation of the yen may bring certain benefits to Japan's export-oriented industries and foreign investment, the devaluation of the currency may lead to increased inflation, which obviously has a negative impact on domestic consumers in Japan, which needs to import large quantities of raw materials such as oil, natural gas, and coal. Gasoline prices in Japan have risen from ¥130 to ¥170 per liter, and electricity costs have increased by 20 percent.

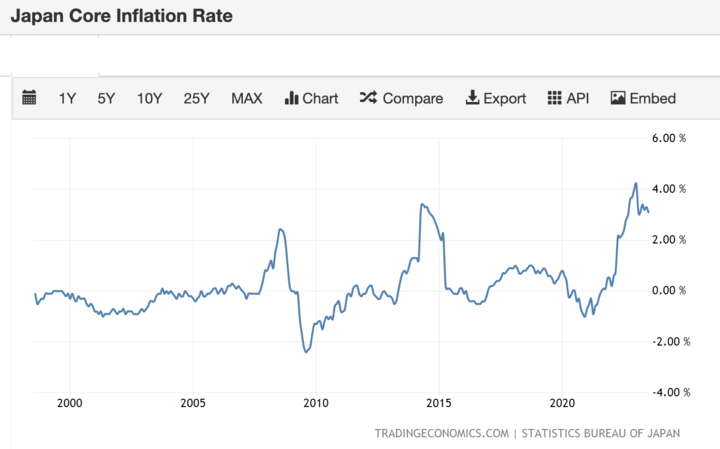

Chart: Japan's core inflation has climbed to its highest level since the 1990s

Source: tradingeconomics

In response, the Japanese government has used fiscal policy to hedge against the negative impact of zero interest rate monetary policy on the economy, for example by subsidizing gasoline and household electricity bills.

Therefore, in the face of currency depreciation, the government needs to strike a balance between various economic factors in order to achieve long-term economic stability and sustainable development.