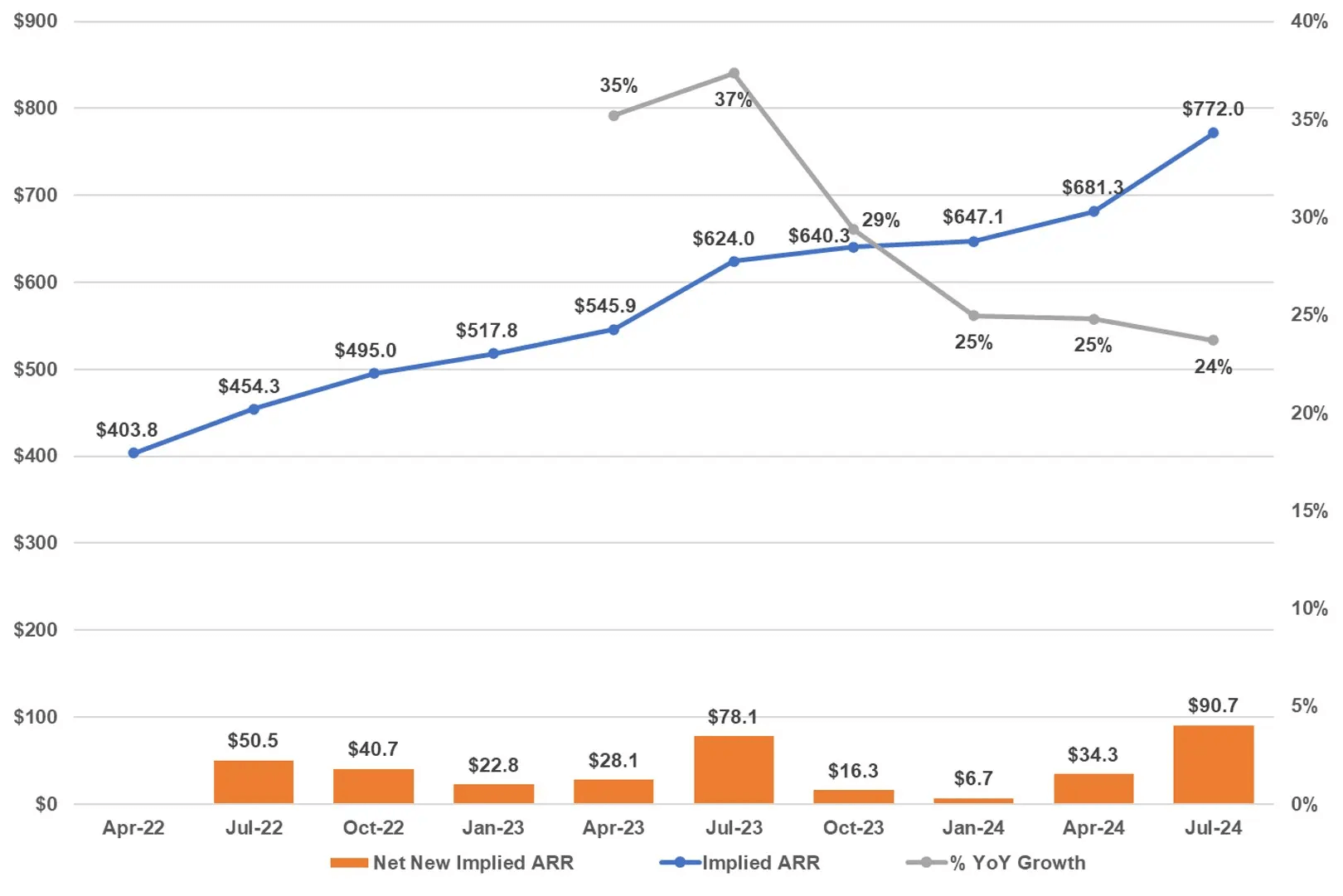

ServiceTitan first proposed its IPO plan in late 2024, seeking to capitalize on its strong market position and significant growth in the trade services software sector. The company aims to raise capital for further expansion, particularly into international markets, and to continue investing in its platform, including new technologies like AI and AR. ServiceTitan's robust financials, including a $772 million ARR and strong customer retention rates exceeding 95%, have attracted substantial interest from investors. The IPO is seen as a key opportunity to tap into the growing demand for cloud-based software in the trades industry, making it a highly anticipated listing.

Source: servicetitan.com

I. What is ServiceTitan

ServiceTitan is a cloud-based software company founded in 2007 and officially launched in 2012, with its headquarters in Glendale, California. It was co-founded by Ara Mahdessian (CEO) and Vahe Kuzoyan (President), who both have personal ties to the trade industry through their parents. The company provides an end-to-end operating system for trade industries such as plumbing, HVAC, roofing, and landscaping. This system encompasses customer relationship management (CRM), field service management (FSM), enterprise resource planning (ERP), human capital management (HCM), and fintech services, including payment processing and financing solutions.

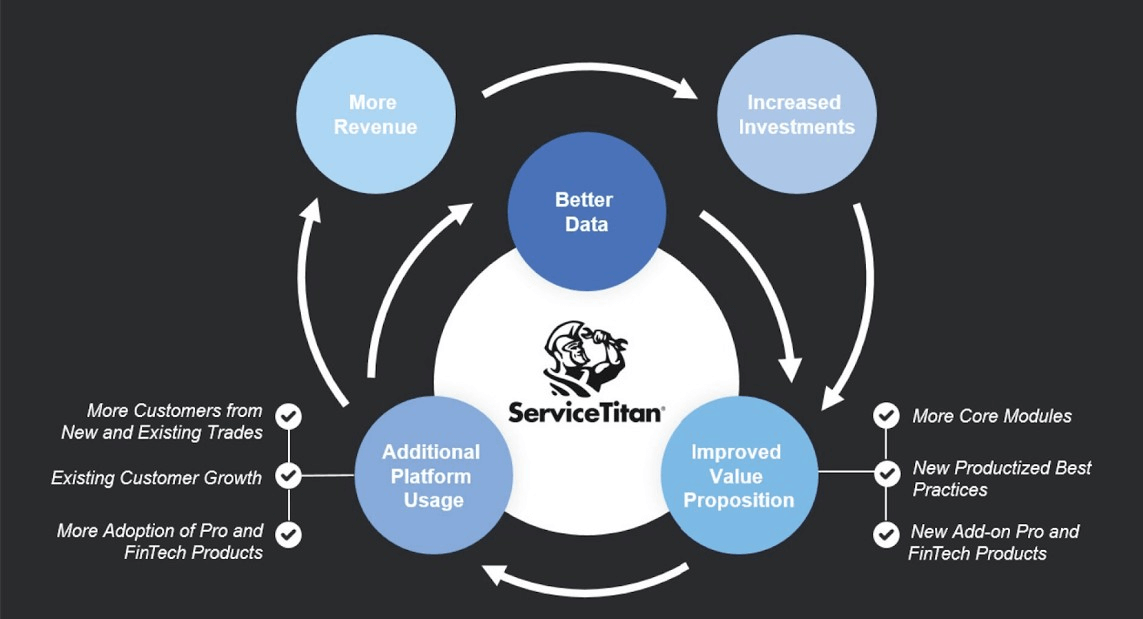

Business model and core services

ServiceTitan's platform is designed to integrate all aspects of a trades business, from lead generation and job scheduling to dispatching teams, collecting payments, and managing back-office functions. The company has attracted nearly 10,000 customers, ranging from small contractors to large franchises with over 500 locations. Active customers, who generate more than $10K in annual billings, contribute an average of $78K annually to ServiceTitan's revenue. The company boasts impressive customer retention metrics, including over 95% gross dollar retention and 110% net dollar retention across the past 10 quarters, highlighting the importance of its product in driving business success for users.

Source: SEC S-1/A

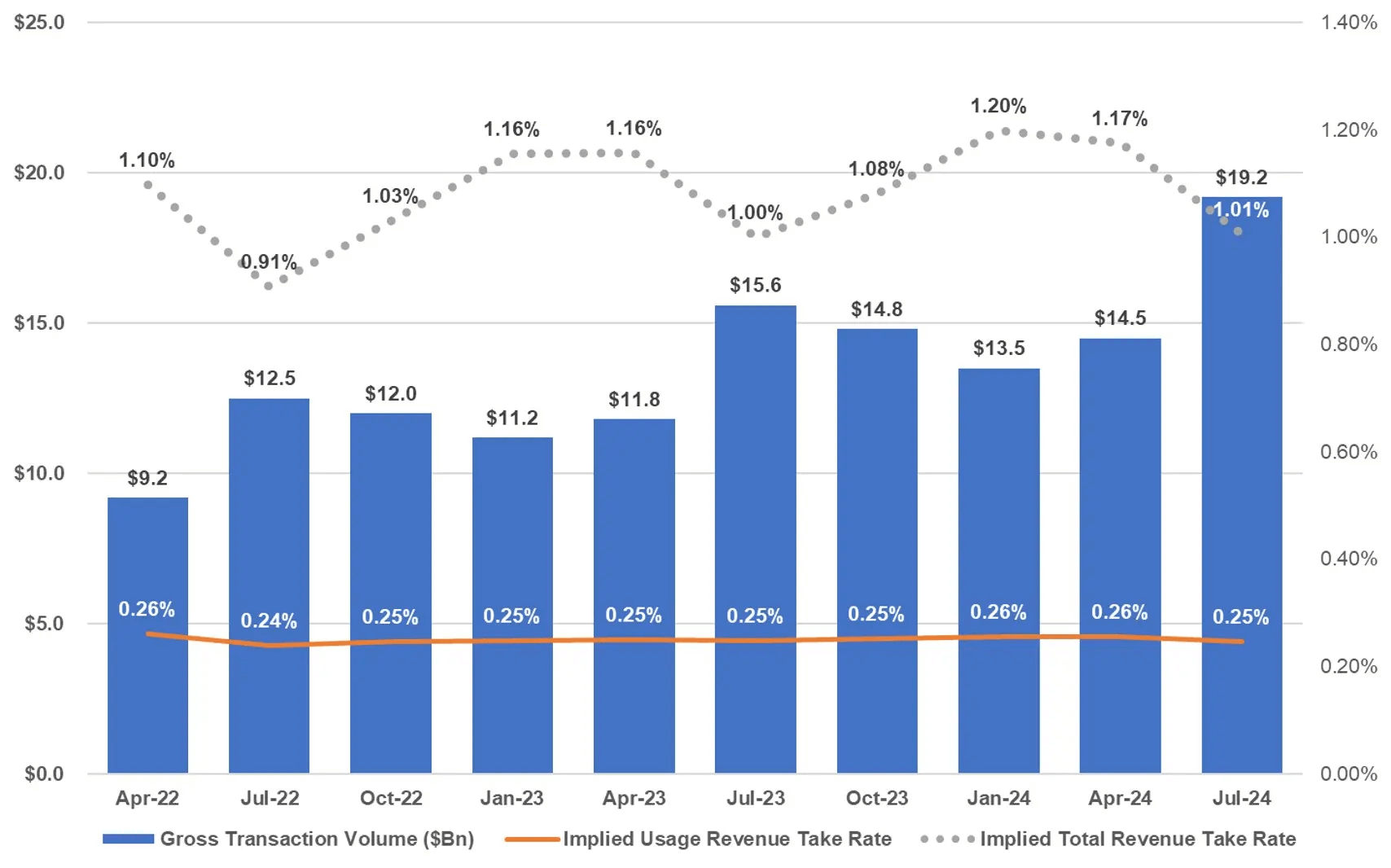

ServiceTitan's revenue model is divided into two categories: platform revenue, which comprises 95% of total income, and professional services, accounting for 5%. The platform revenue comes from subscription fees for its software solutions, as well as usage-based fees related to transaction processing through its fintech services. Most customers are billed on a monthly basis, with contracts typically ranging from 12 to 36 months. However, unlike many SaaS companies, ServiceTitan does not receive upfront annual payments, which can impact its free cash flow margins.

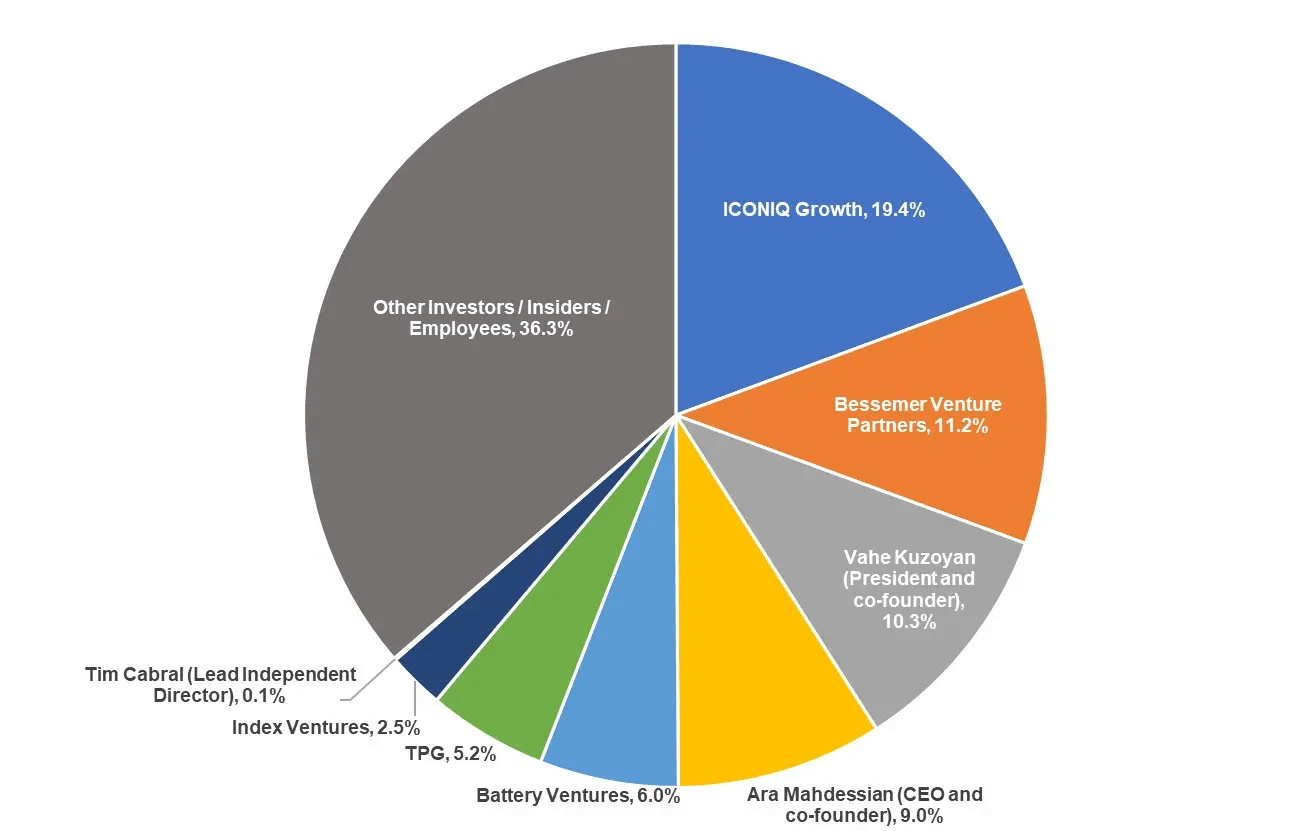

Who Owns ServiceTitan

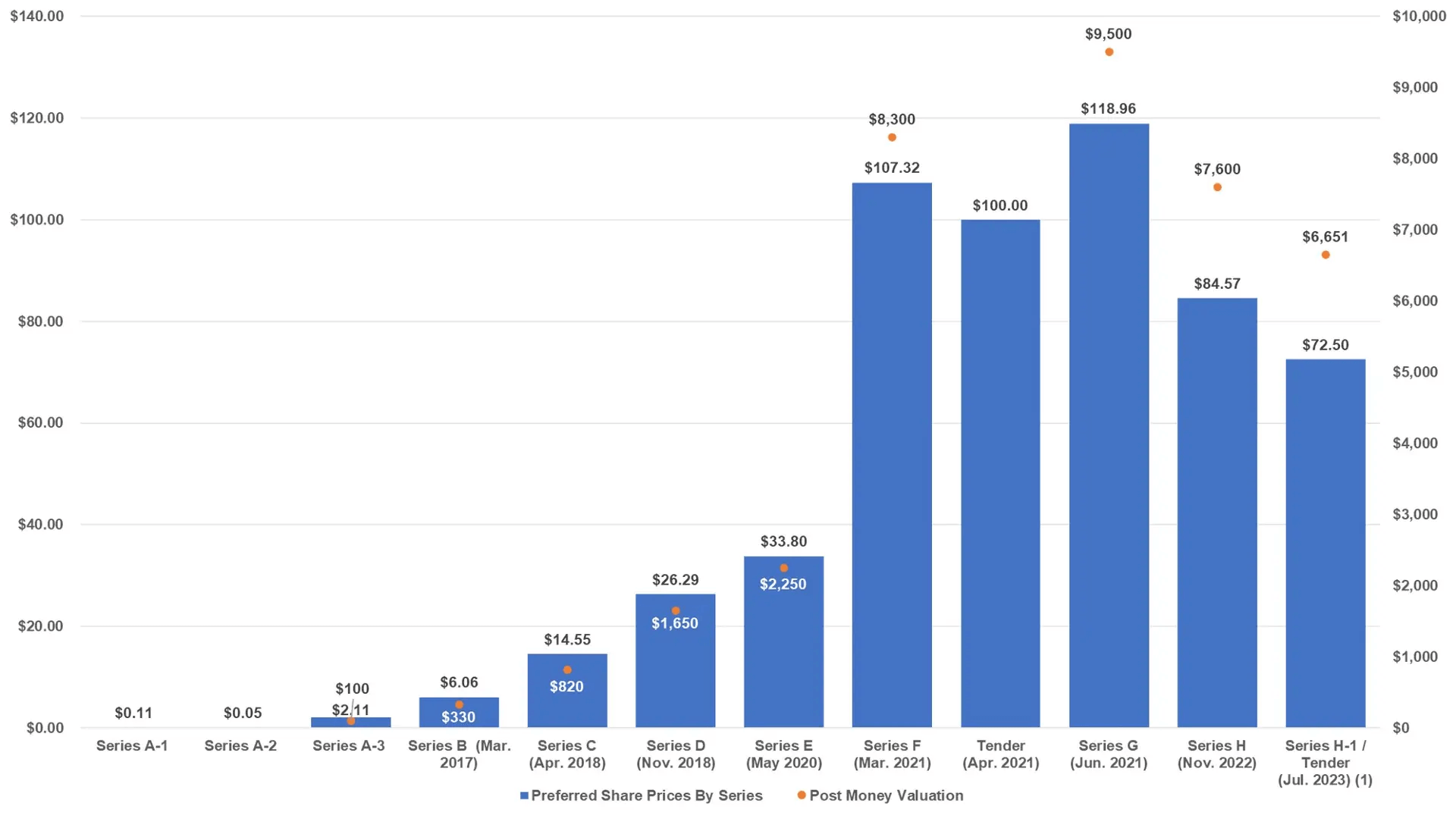

The company has raised approximately $1.4B in venture funding, with its most recent funding round being a $365M Series H in November 2022, bringing its post-money valuation to $7.6B. It plans to go public under the ticker “TTAN” on the Nasdaq, with Goldman Sachs acting as the lead banker for the IPO. Notable investors include ICONIQ (19.4%), Bessemer (11.2%), and Battery (6.0%), while the co-founders retain significant stakes in the company.

Source: SEC S-1/A

II. ServiceTitan Financials

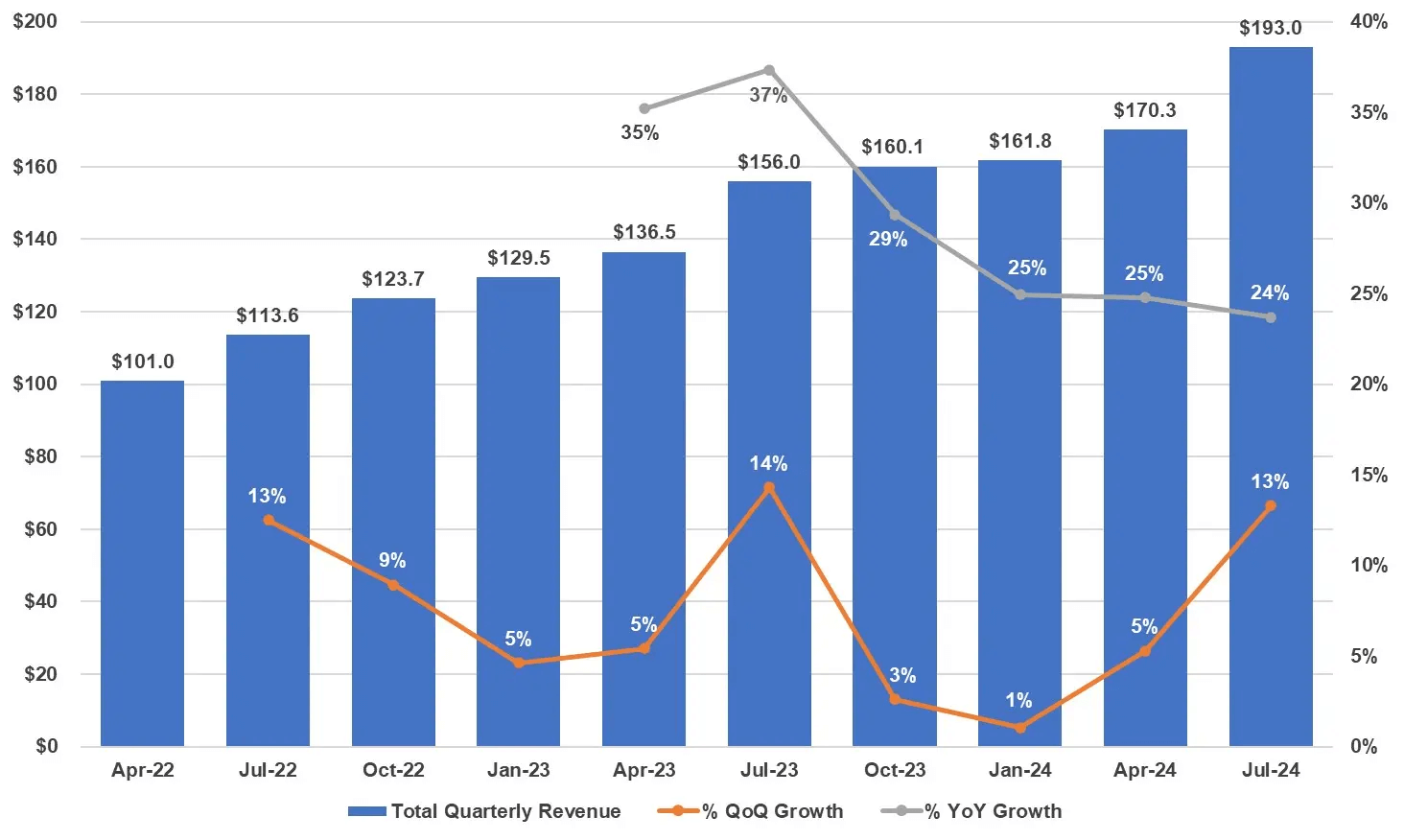

ServiceTitan's financial performance reveals strong revenue growth, though its profitability and margins remain below industry averages. For fiscal 2024, the company reported $614.3 million in total revenue, marking a solid 31% YoY increase from $467.7 million in 2023. The platform revenue, which makes up the bulk of this figure, rose by 31%, driven primarily by a 33% increase in subscription revenue ($109.3 million). Usage-based revenue from FinTech products also grew by 26%, contributing an additional $28.9 million. This shift to more subscription-based and usage-driven revenue highlights ServiceTitan's successful expansion of its core product offerings, including its Core, Pro, and FinTech products.

Despite impressive top-line growth, profitability metrics tell a different story. Non-GAAP gross margin for the last twelve months (LTM) stood at 70%, which is considerably below the median of 78% seen in the Meritech Software index. The company's focus on lower-margin areas, like payments revenue and professional services, accounts for this underperformance. Professional services alone saw a marginal decline, dropping by 8% YoY for the six months ending July 2024, mostly due to the divestment of certain marketing solutions.

ServiceTitan's operating margins also fall short, with a non-GAAP operating margin of just 2% for LTM, far from the 15% industry median. This is a direct consequence of the company's ongoing investments aimed at scaling its operations. Although these investments may support future growth, the company is currently burning cash. LTM free cash flow margins were negative at -2%, a stark contrast to the 15% median.

Source: SEC S-1/A

Key Financial Metrics

The company's customer metrics paint a positive picture, with $772 million in implied annual recurring revenue (ARR) growing at 24% YoY. ServiceTitan added $91 million in net new ARR in Q2, bolstered by strong customer retention (gross retention >95%) and a dollar-based net retention above 110%. However, this retention has dropped by seven percentage points over the last ten quarters, suggesting normalization as the customer base matures. Active customers paying over $10K in annualized billings grew by 18% YoY, now representing 96% of total billings. Furthermore, customers with annualized billings exceeding $100K now represent over 50% of total billings, a sign of the company's success in landing larger clients.

On the operational side, ServiceTitan's ARR per full-time employee (FTE) was $269K, lower than the SaaS industry median of $356K. This points to potential inefficiencies in scaling the workforce relative to revenue growth. The company also has considerable debt, with $176 million in liabilities, though it holds $128 million in cash and cash equivalents.

Source: SEC S-1/A

III. ServiceTitan IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

ServiceTitan IPO offers significant growth potential, bolstered by its position in the underserved trades industry, but also faces challenges from both competition and market risks.

The growth prospects for ServiceTitan are strong, primarily driven by its ability to capitalize on the $1.5 trillion spent annually on trade services in the U.S. and Canada. The company currently addresses around $650 billion of this market, which is fragmented across residential and commercial services, as well as construction and maintenance. ServiceTitan's core market today is the $180 billion residential service market, with substantial expansion into the commercial and construction sectors, where its gross transaction volume (GTV) has grown 2x YoY to $5 billion. ServiceTitan estimates its total addressable market (TAM) in these segments could generate $13 billion in revenue if it achieves full product penetration and doubles its "take rate" from 1% to 2%. Given its <10% penetration of the $650 billion serviceable spend, the company's growth potential remains vast, especially with continued expansion into new verticals.

ServiceTitan's competitive advantages stem from its comprehensive cloud-based platform tailored for trades, a market historically underserved by technology. Its products are designed to streamline business operations across various workflows, from scheduling to marketing. This gives the company an edge over traditional, less integrated solutions. Major competitors like HouseCall Pro, Jobber, and ServiceM8, along with larger incumbents such as Salesforce and SAP, are all vying for market share, but ServiceTitan's specialized focus on trades and its strong brand recognition from its roots in the plumbing industry give it a distinct edge.

The company's move into AI and augmented reality (AR) for new product offerings further strengthens its growth prospects, enabling ServiceTitan to enhance its platform and provide cutting-edge solutions to customers. These advancements, coupled with potential international expansion, provide additional avenues for scaling beyond the U.S. and Canadian markets.

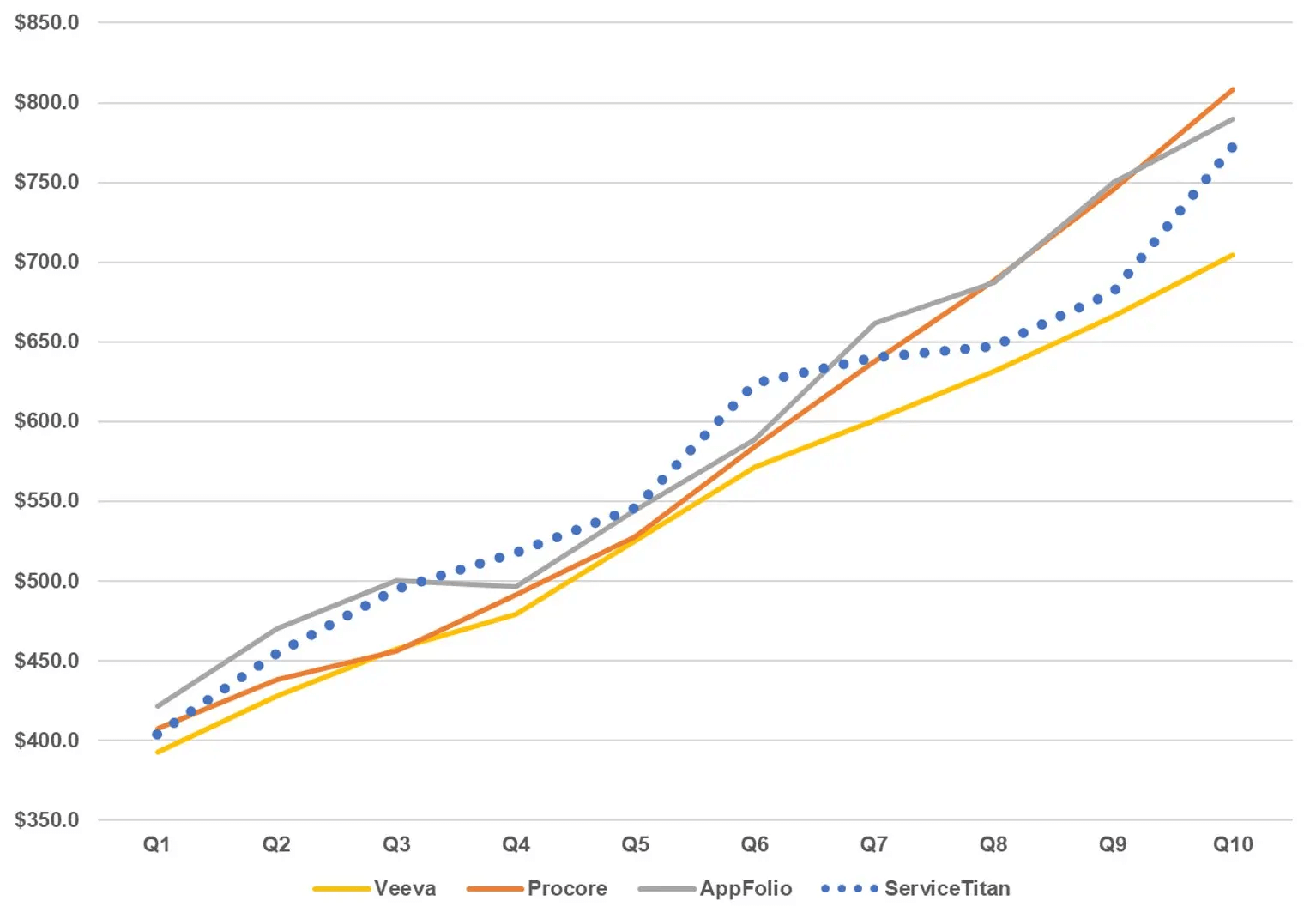

Source: SEC S-1/A [ARR of ServiceTitan growing in line with other successful public vertical SaaS companies.]

B. Weaknesses & Risks

However, the IPO also carries risks. ServiceTitan's financials reflect a high burn rate, with consistent losses from operations ($182.9 million in 2024) and negative free cash flow margins of -2%. Moreover, its competitive landscape includes a mix of traditional players and nimble startups, meaning the company must continuously innovate to maintain its market leader position. While growth is strong, the path to profitability remains uncertain in the near term. Additionally, scaling its product offerings internationally and expanding into new markets presents both execution and operational challenges.

IV. ServiceTitan IPO Details

A. ServiceTitan IPO Date

The ServiceTitan IPO date is December 12, 2024. This IPO marks a crucial step in the company's journey to the public market, with the company targeting a valuation range between $5.16 billion and $5.2 billion. The IPO is set to raise up to $502 million by offering 8.8 million shares, priced between $52 and $57 each. The company plans to trade under the ticker "TTAN" on the Nasdaq. This marks a pivotal moment for ServiceTitan, especially given the IPO ratchet structure tied to its Series H round in November 2022. The ratchet provides downside protection for investors if the company's IPO price falls below $84.57, which could trigger dilution of up to 2% depending on the final IPO price.

B. ServiceTitan Valuation

In terms of valuation, ServiceTitan has undergone several rounds of funding, raising nearly $1.4 billion in equity capital from venture and crossover investors. Notably, during the 2021 fundraising boom, ServiceTitan raised $200 million at a $9.5 billion post-money valuation, its peak. The most recent round, a Series H in November 2022, raised $365 million at a $7.6 billion post-money valuation, signaling a slight decline in valuation compared to 2021. Additionally, in July 2023, the company completed a $34 million Series H-1, combined with a $136 million employee tender, at a blended share price of $72.50, indicating a $6.7 billion valuation at that time.

Source: SEC S-1/A

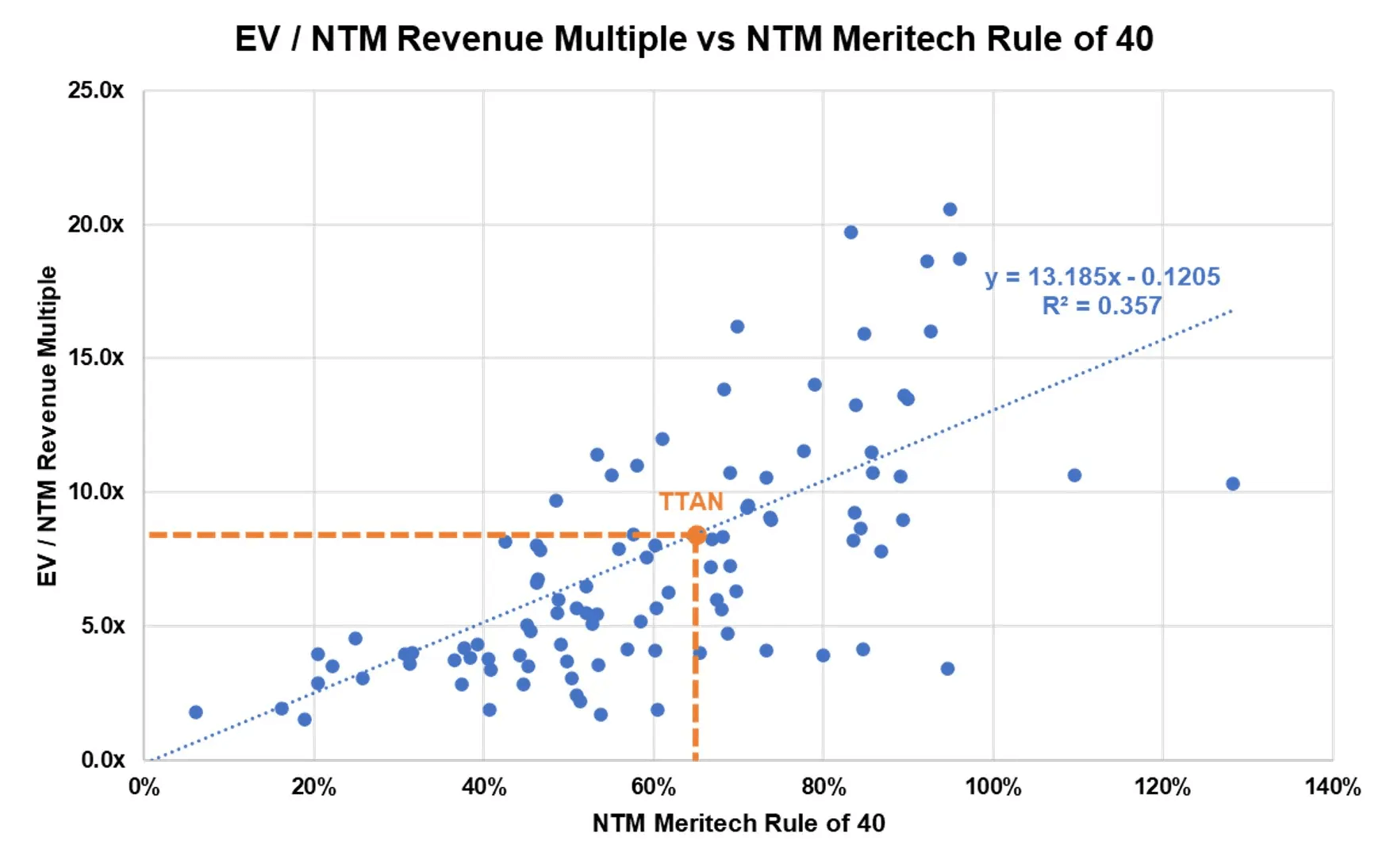

C. Share Structure & Analyst Opinions

The ServiceTitan IPO also comes with an additional layer of complexity due to the company's share structure. ServiceTitan has three classes of stock: Class A shares with one vote, Class B shares with 10 votes, and Class C shares with no votes. The co-founders hold all Class B shares, giving them control over the company's decisions post-offering. Analysts are projecting ServiceTitan to trade at approximately 10x its annual sales for 2024, which is in line with other recent IPOs in the SaaS sector, though not at the premium multiples enjoyed by the top decile of public SaaS companies. Overall, ServiceTitan IPO will serve as a key benchmark for the broader tech IPO market, providing a potential signal for other startups planning to go public.

Source: meritechcapital.com

V. How to Invest in ServiceTitan IPO & ServiceTitan Stock

Where to Buy ServiceTitan IPO Shares

To invest in ServiceTitan IPO, you'll need to open a brokerage account with a firm that offers access to IPO shares. Leading brokers such as Goldman Sachs, Morgan Stanley, or TD Ameritrade typically facilitate IPO participation for eligible clients. Once your account is set up, you can place an order during the IPO pricing process, which is expected to be between $52 and $57 per share.

Source: SEC S-1/A

ServiceTitan IPO Trading Strategies

For trading ServiceTitan stock post-IPO, investors can explore several strategies. Day trading, where investors buy and sell shares within the same trading day, could be a viable option if you're aiming to capitalize on short-term price fluctuations. However, be cautious with IPOs, as they often experience volatility in the first few days of trading. Another strategy is to hold the stock for longer-term growth, given ServiceTitan's solid retention rates and growth in the SaaS sector.

Ways to Trade ServiceTitan Stock

Additionally, investors can trade ServiceTitan stock through ETFs that focus on SaaS, cloud computing, or home services. Top ETFs may include ServiceTitan as a component in their portfolios, offering indirect exposure, given the company's growth trajectory and industry positioning. This allows investors to participate in the company's potential upside without directly purchasing shares.

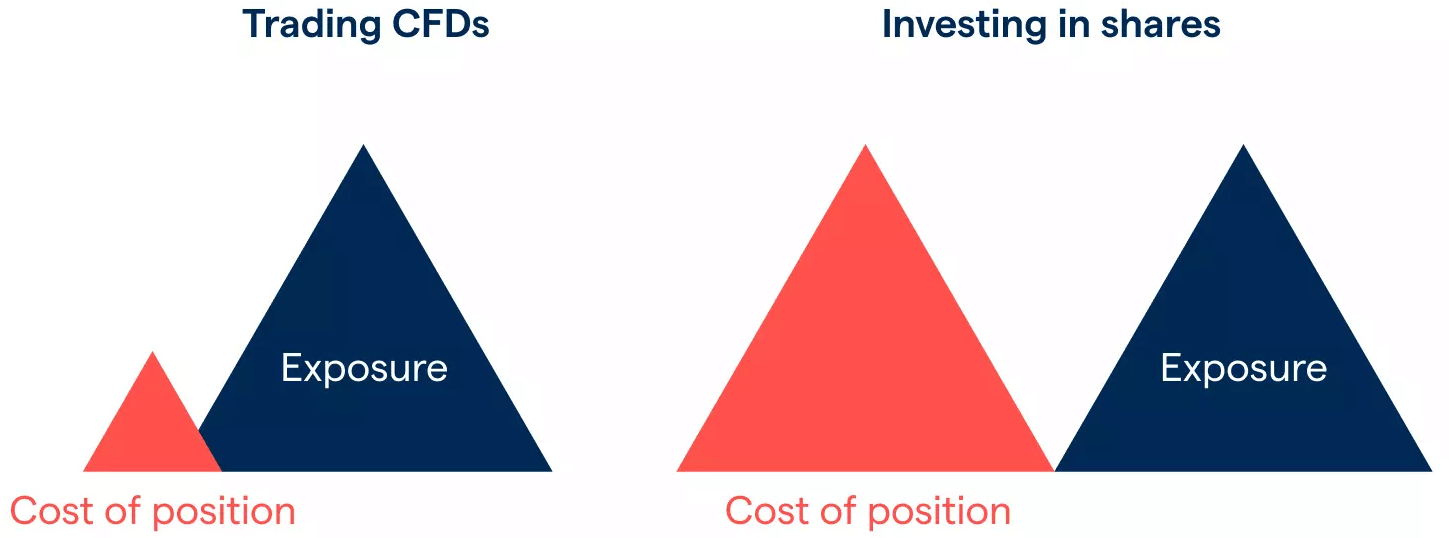

Options trading is another route, where you can buy calls or puts based on your market outlook. CFDs (Contracts for Difference) also provide a way to speculate on ServiceTitan stock price movements without owning the shares outright. For those interested in gaining exposure through well-managed CFD brokers, VSTAR could potentially be a good idea once they include ServiceTitan as part of its diversified tradable stocks.

Source: IG.com