Gold / XAUUSD

In the current financial landscape, Gold is exhibiting sensitivity to a multitude of factors, both domestic and international. A focal point of analysis is the US Consumer Price Index (CPI) inflation data, which is poised to play a pivotal role in guiding investor sentiment. The recent performance of key tech giants, namely Apple Inc., Nvidia Corp., and Tesla Inc., has contributed to market caution, as their mixed results have resulted in a somewhat stagnant close on Wall Street.

Source: tradingview.com (Weekly Support and Resistance Levels)

Furthermore, the unexpected hawkish remarks by Bank of Japan Governor have reverberated across markets. Ueda's emphasis on a gradual exit from the ultra-loose monetary policy has triggered a significant surge in the Japanese Yen, leading to a substantial sell-off in the USD/JPY pair. This development has influenced the US Dollar's performance, overshadowing the optimism stemming from the US Treasury bond yields, which point towards a favorable outlook for the US economy.

Gold has experienced a revival from recent lows, capitalizing on the weakening US Dollar. Nevertheless, its potential for further upside remains uncertain due to the concurrent increase in US Treasury bond yields. Additionally, China's economic indicators, such as slowing CPI and factory gate deflation, introduce an element of caution for Gold buyers. China's CPI, although showing a slight uptick in August, still signifies economic challenges.

Looking ahead, the trajectory of Gold prices will be intricately tied to risk sentiment and fluctuations in the US Dollar. The absence of significant economic data at the start of the week and the Federal Reserve's 'blackout period' in anticipation of the upcoming policy meeting will add an air of uncertainty to the market environment. Therefore, Gold investors must monitor these dynamic factors closely to make informed decisions in the coming days.

Silver / XAGUSD

Silver (XAG/USD) is currently navigating a challenging landscape dominated by the strength of the U.S. Dollar. While it recently experienced a brief surge, it is poised for a weekly decline as investors shift their focus to the Federal Reserve's upcoming decisions.

Source: tradingview.com (Weekly Support and Resistance Levels)

The U.S. economy's robust performance is a key driver of the dollar's strength. Positive economic indicators, including a surge in the U.S. services sector and historically low jobless claims, have propelled the dollar to its most significant weekly gain in nearly a decade. In contrast, Germany's industrial production has declined, further emphasizing the U.S.'s position as a sturdy pillar in the global economy.

The Federal Reserve's approach to inflation has been aggressive, resulting in 11 benchmark lending rate increases in the past 18 months, a level unseen in over two decades. Despite this, there has been a recent slowdown in rate hikes, and the sentiment suggests a probable continuation of this pause in September. Dallas Fed President Lorie Logan emphasizes the need for readiness due to persistent inflation threats, while Fed Governor Christopher Waller acknowledges the potential weakening of the job market, hinting at a cautious approach.

Federal Reserve officials have varying viewpoints, with some advocating for a pause in September while others favor a data-driven approach. New York Fed President takes a balanced stance, highlighting the importance of supply and demand equilibrium. On a more positive note, Chicago Fed President Austan Goolsbee believes there is potential for a 'soft landing' without falling into a recession.

In the short term, the outlook for silver is bearish, given the strengthening U.S. dollar and the possibility of further rate hikes, especially when compared to rising yields on Treasury bonds. All eyes are now on the Federal Reserve, whose decisions will continue to shape the dynamics of the silver market. Investors must closely monitor the evolving economic landscape as they navigate this complex financial terrain.

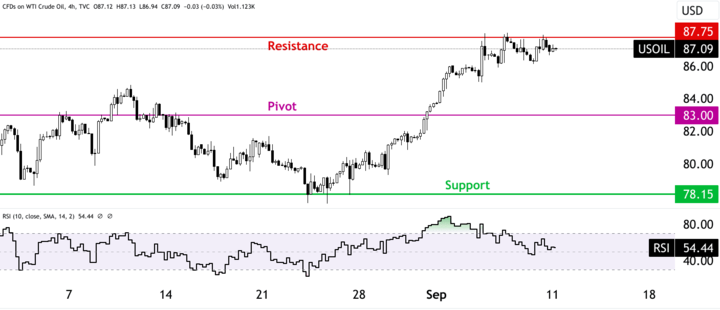

Crude Oil / WTI

The global crude oil market is currently undergoing significant shifts, primarily driven by production cuts within the OPEC+ alliance. These production cuts, initially announced in early June, have had a cascading effect on the prices of specific types of crude oil.

Source: tradingview.com (Weekly Support and Resistance Levels)

Saudi Arabia's decision to extend its voluntary production cuts and reduce production by an additional 1 million barrels per day (b/d) for July, which was later extended through the end of 2023, has impacted the market dynamics. Most of Saudi Arabia's crude oil falls into the sour category, containing more than 1% sulfur, making them more expensive to refine. This has caused an unusual trend where sour crude oils are now trading at premiums compared to their sweet counterparts, contrary to the typical price relationships. Even light, sweet crude benchmarks like Brent and West Texas Intermediate (WTI) have experienced upward price pressure due to global crude oil inventory draws.

One significant indicator of this trend is the narrowing spread between the price of medium, sour Mars crude oil and the light, sweet Magellan East Houston (MEH) crude. This spread declined in late 2022 and briefly saw Mars sold at a premium in July. However, after Saudi Arabia's announcement to extend production cuts in September, the spread narrowed again.

Globally, sour crude oil prices, such as Dubai Fateh, have also surged compared to sweet benchmark crude oils like Dated Brent. Dubai Fateh recently traded at a price premium to Dated Brent, reversing the usual trend. This price dynamic has been further supported by global inventory draws, driven by consumption growth and OPEC+ production cuts, particularly those led by Saudi Arabia.

Saudi Arabia's crude oil exports have also decreased as a result of these production cuts, which, when combined with increased official selling prices (OSPs) for Arab Light crude oil to Asia and Europe, has contributed to the rising prices of sour crude oil worldwide.

The future trajectory of these market dynamics remains uncertain. OPEC+ and Saudi Arabia's production decisions, as well as OSP adjustments, will continue to play a pivotal role in shaping sour crude oil prices. Furthermore, demand for sour crude oil may increase with the commissioning of new Middle East refineries, such as Oman's Duqm refinery and Kuwait's Al Zour refinery. Additionally, the Trans Mountain Pipeline's potential operation in early 2024 could shift the landscape by moving heavy sour Western Canada Select (WCS) crude oil away from U.S. refining centers, potentially affecting the competition for sour barrels in the United States.

NG

The U.S. natural gas futures market is currently experiencing a 1% increase, reaching a one-week high due to several significant factors. Forecasts predict hotter than usual weather conditions extending into late September, which has spurred higher demand for natural gas in the energy sector. Additionally, concerns about a potential strike at Chevron's LNG export projects in Australia have driven global gas prices upwards, influencing the U.S. natural gas market.

Source: tradingview.com (Weekly Support and Resistance Levels)

Front-month gas futures for October delivery settled at $2.605 per million British thermal units (mmBtu), marking their highest close since September 1. However, it's important to note that this week, the U.S. contract experienced a 6% decline after a 9% increase the previous week, highlighting the market's volatility.

In Europe, gas futures surged by 13% to approximately $11 per mmBtu at the Dutch Title Transfer Facility benchmark, triggered by a strike at Chevron's LNG facilities in Australia, which accounts for over 5% of global supply. This labor dispute in Australia has international repercussions in the LNG market.

Texas is currently grappling with a severe heatwave, leading to increased electricity demand for air conditioning. The Electric Reliability Council of Texas (ERCOT) successfully managed to avoid power outages but had to increase supply and reduce demand, causing real-time electricity prices to spike to over $4,000 per megawatt hour (MWh) for an extended period. This compares starkly with an average price of $101 so far this year, underlining the market's susceptibility to extreme weather conditions.

ERCOT expects power usage to peak at 85,521 megawatts, breaking its all-time high of 85,435 MW, as high temperatures continue to scorch the state.

The combination of extreme heat and increased demand has led to higher gas consumption for electricity generation, with gas-fired plants providing around 49% of Texas's power in 2022.

Looking forward, natural gas output in the lower 48 U.S. states is showing a slight decrease from the previous month, and preliminary data suggests a 12-week low. Meteorologists predict hotter temperatures through at least September 23, which could further strain supply and increase demand.

Copper

London copper prices are showing signs of recovery, increasing by 0.8% to $8,305 per metric ton following a 3% loss the previous week. This uptick is primarily attributed to a positive outlook on demand from China, the world's largest consumer of copper, as the country's economy stabilizes. The most-traded October copper contract on the Shanghai Futures Exchange, however, experienced a slight dip of 0.1%, settling at 68,780 yuan ($9,402.34) per ton.

Source: tradingview.com (Weekly Support and Resistance Levels)

China's central bank has taken steps to strengthen the yuan by setting a daily midpoint guidance rate with a significant bias, reversing its depreciation trend. This move is crucial as the yuan's weakness had been putting downward pressure on copper prices. A weaker yuan results in increased costs for importing dollar-priced metals like copper.

Positive economic indicators from China further support the optimism in the copper market. Recent data indicates that China's consumer prices turned positive in August, and the decline in factory-gate prices has slowed down. Additionally, trade data for August showed narrowing declines in both exports and imports, suggesting a potential stabilization of the Chinese economy.

However, there are concerns about sluggish copper demand in the first week of September, which typically sees a rebound in demand. This has led to higher inventories of refined copper products, with copper stocks on the Shanghai Futures Exchange increasing for the third consecutive week to 54,955 tons.

Investor attention is also focused on U.S. inflation data set to be released later in the week, as it may provide insight into the likelihood of future interest rate hikes. This information could impact copper prices and market sentiment moving forward.

EURUSD

Fundamental Perspective

The Euro (EUR) initially gained ground against the US Dollar (USD) during the first hour of the Wall Street opening, pushing the exchange rate towards its daily peak at 1.0743. However, the currency pair later reversed its course, and the EUR/USD is currently trading at 1.0698, recording marginal gains of 0.03%. The week is expected to conclude with a 0.69% loss.

Limited economic data releases from both the Eurozone (EU) and the United States (US) left the EUR/USD pair searching for direction. It fluctuates within a 40-pip range before settling at its current level. In the EU, Germany reported its Harmonised Consumer Price Index (HICP) for August, in line with expectations at 6.1% year-on-year, while core HICP also reached 6.1%.

Despite the pause in inflation, a Reuters poll suggests that analysts anticipate the European Central Bank (ECB) will maintain unchanged interest rates at its upcoming meeting on September 14.

Meanwhile, Timo Wollmershaeuser, the IFO head of forecasts, expressed the view that Germany's economy is poised to contract by 0.2% in Q3, potentially triggering a technical recession. He emphasized that they do not anticipate a severe downturn.

In the United States, the services sector showed signs of improvement in business activity, although the labor market remained tight, as indicated by Initial Jobless claims. Several Federal Reserve officials adopted a more cautious stance, moderating their previously hawkish tone, as the US central bank treads carefully to avoid over-tightening monetary policy, which could push the US economy into a recession.

Technical Perspective

Source: tradingview.com

EURUSD is currently trading around the 1.0698 price area and trying to continue lower. After an impulsive bearish momentum, the price may find support around the 1.0668 - 1.0635 psychological event area. So, if the price finds support around the 1.0668 - 1.0635 psychological event area, EURUSD may retrace higher towards the 1.0900 - 1.0945 area in the coming days.

GBPJPY

Fundamental Perspective

Global risk sentiment remains a vital driver for GBP/JPY. Geopolitical events, trade tensions, and broader market dynamics can sway investor sentiment, impacting risk-on versus risk-off sentiment and affecting the pair accordingly.

Brexit-related developments continue to exert influence over the Pound. Any updates on trade negotiations, regulatory changes, or political developments between the UK and the European Union should be closely watched.

Lastly, central bank actions, particularly any statements or decisions from the Bank of England and the Bank of Japan regarding interest rates or monetary policy, could have a direct and immediate impact on GBP/JPY. The GBP/JPY currency pair is likely to experience volatility in the upcoming week, driven by a combination of economic data releases, central bank actions, global risk sentiment, and geopolitical events. Traders should stay informed, exercise risk management strategies, and adapt their trading plans based on evolving market conditions.

Technical Perspective

Source: tradingview.com

GBPJPY is currently residing around the 184.14 price area and trying to retrace upward. After an impulsive bullish momentum, the price found resistance around the 186.00 - 186.70 key resistance area. As the per current price action context, the price may continue lower toward the 181.00 - 180.40 support area in the days ahead. Also, we can see that the MACD indicator has created a bearish divergence, which also indicates that the bears may continue further lower in the coming days.

NAS100

Fundamental Perspective

The NAS100 is likely to experience a dynamic week influenced by economic data releases, central bank actions, global trade developments, technology sector news, geopolitical events, and overall market sentiment. Traders should stay updated on these factors and exercise prudent risk management strategies to navigate potential volatility in the coming week.

The NAS100 index, which tracks the performance of the top 100 non-financial companies listed on the NASDAQ stock exchange, faces several significant factors that could impact its direction in the upcoming week.

Investors will be closely monitoring key economic data releases during the week. This includes U.S. inflation data (CPI) and retail sales figures, as well as any updates on the labor market, such as jobless claims and employment reports. Strong economic data could boost confidence in the U.S. economy, potentially supporting NAS100. The stance of the U.S. Federal Reserve remains pivotal. Any hints or announcements regarding changes in monetary policy, including interest rates and asset purchases, can significantly influence market sentiment and the NAS100 index.

Technical Perspective

Source: tradingview.com

NAS100 is currently trading around $15302.0 price area and trying to push higher. After retracing towards the $15630.0 resistance area, the bears regain momentum and push the price downside below the $15385.0 area again. So, if the price can have an impulsive daily bearish candle close below the dynamic level of 20 EMA, the bearish may push the price down towards the $14712.0 support area again in the coming days.

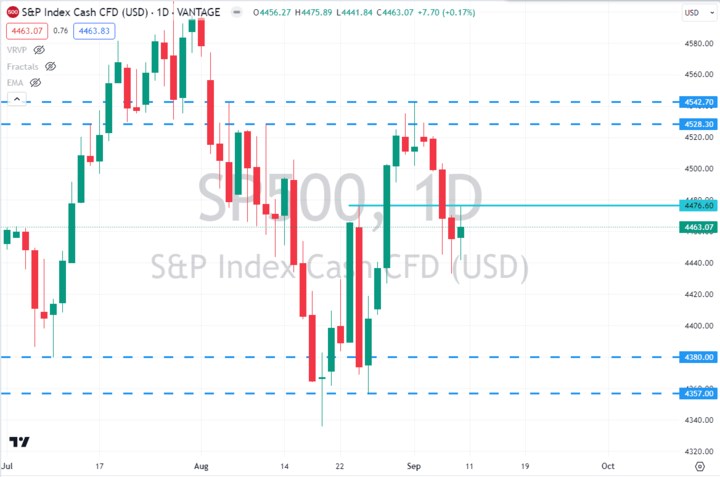

SP500 / SPX500

Fundamental Perspective

The S&P 500 is gearing up for a week that promises to be influenced by an array of key factors, shaping the index's potential movements in the upcoming trading sessions.

Traders will closely monitor a slate of crucial economic data releases during the week. This includes the U.S. Consumer Price Index (CPI) and retail sales data, offering insights into inflation and consumer spending trends. Strong numbers could boost confidence in the U.S. economy and support the S&P 500. The Federal Reserve's stance on monetary policy remains central. Any hints or declarations regarding interest rates, asset purchase tapering, or the central bank's economic outlook will significantly impact market sentiment and the S&P 500's trajectory.

Technical Perspective

Source: tradingview.com

SP500 is currently trading inside the range of $4542.70 - $4357.00 price area. After rejecting the $4542.70 - $4528.30 resistance area the bears pushed the price down and had a weekly close below the $4476.60 event level. So, if the price can have an impulsive bearish candle close below the $4476.60 event area in the coming days, SP500 may continue further toward the $4380.00 - $4357.00 support area.

HK50

Fundamental Perspective

Recent economic data indicates that Hong Kong's economy is gradually recovering from the global pandemic and political unrest challenges. A key driver of this recovery has been the resurgence in mainland Chinese tourism and increased cross-border trade. However, ongoing concerns about global supply chain disruptions, rising inflation, and the potential for further regulatory changes in the financial sector continue to weigh on investor sentiment.

On the global stage, the Federal Reserve's monetary policy decisions and any signs of tapering asset purchases could impact global equity markets, including HK50. Geopolitical tensions, particularly those involving China and its relationships with other major economies, remain a source of uncertainty.

Technical Perspective

Source: tradingview.com

HK50 has been trading inside the bearish channel for an extended period. After bouncing from the $17600.0 support area, the bulls pushed the price upward but failed to continue above the $18800.0 psychological area. As per the current price action, the price may retrace towards the $17600.0 support area again. So, if the price comes to $17600.0 support level again, and has an impulsive daily bullish candle close above it, the bulls may regain momentum and push the price higher towards the bearish channel resistance in the days ahead.

Bitcoin / BTCUSD

Fundamental Perspective

Recent data indicates a resurgence of interest in cryptocurrencies, driven in part by growing adoption in traditional finance and a continued influx of institutional investors. The total cryptocurrency market capitalization is approaching record levels, with Bitcoin maintaining its position as the dominant digital asset.

However, regulatory developments remain a key concern. Governments worldwide are actively exploring or implementing regulations for the cryptocurrency space, which could impact BTC's trading environment. Investors should closely monitor any regulatory announcements, especially from major economies like the United States, China, and the European Union.

Market sentiment, which can be influenced by macroeconomic factors, is another crucial element. Factors like inflation, central bank policies, and geopolitical tensions can sway investor sentiment in either direction.

Technical Perspective

Source: tradingview.com

Bitcoin is currently trading around the $25841 price area. After breaking over the key resistance level $28150 on 20th June, the price retraced back again to the demand zone around the $25730 - $24800 area. So, if the price can have an impulsive daily bullish candle close above the demand zone, the bulls may regain momentum and push the price upwards toward the $28150 event area in the days ahead.

Ethereum / ETHUSD

Fundamental Perspective

Ethereum's recent performance has been marked by a strong rally, with the London Hard Fork and the transition to a proof-of-stake (PoS) network via Ethereum 2.0 upgrades garnering significant attention. This has led to increased investor confidence and a surge in decentralized finance (DeFi) projects on the platform.

However, the cryptocurrency market remains highly sensitive to external factors. Regulatory developments, particularly in major crypto markets like the United States, can influence sentiment and trading patterns. Investors should closely monitor any regulatory announcements during this period. Market sentiment is also likely to be influenced by macroeconomic factors such as inflation, interest rates, and geopolitical events, which could impact the broader financial markets and subsequently affect Ethereum.

Technical Perspective

Source: tradingview.com

ETH is currently trading around $1624.0 price area. After an impulsive bearish momentum, the price found support around the $1582.0 - $1610.0 price area. As per the current price action context, if the price can break above the $1670.0 neckline area in the days ahead, the bulls may regain momentum and continue higher towards the $1800.0 price area.

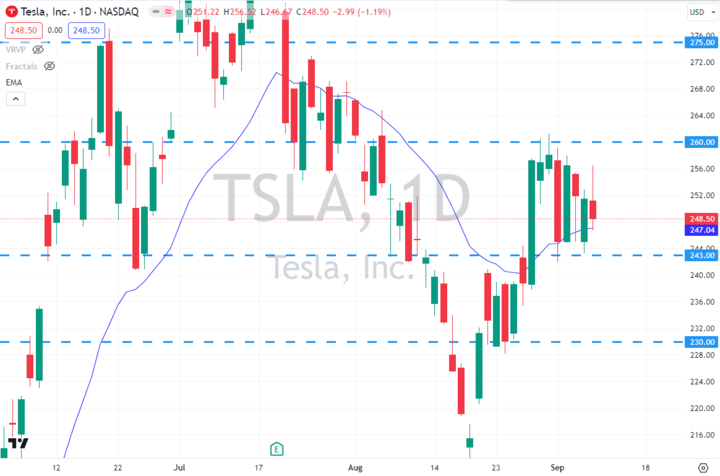

Tesla / TSLA

Fundamental Perspective

Tesla's performance in the upcoming week will be closely tied to developments in the EV and clean energy sectors, as well as macroeconomic factors and regulatory changes. Tesla has been a focal point of the electric vehicle (EV) revolution and the broader clean energy sector. Recent data indicates strong delivery numbers and continued expansion into global markets. Elon Musk's vision for Tesla's role in sustainable energy solutions and advancements in autonomous driving technology continues to attract investors.

However, TSLA remains sensitive to various external factors. Fluctuations in global energy prices, particularly in relation to lithium and other raw materials for EV batteries, can impact production costs and profitability. Additionally, regulatory changes and safety concerns in the EV industry are potential risk factors.

Technical Perspective

Source: tradingview.com

The TSLA price is currently in the $243.00 - $260.00 price area. So, if the price can have an impulsive bullish candle close above the $260.00 resistance level, the bulls may continue higher toward the $275.00 price area. On the contrary, if the price breaks below the $243.00 support area with a daily bearish candle, the bears may push the price down toward the $230.00 price level in the coming days.

Amazon / AMZN

Fundamental Perspective

Amazon's recent performance has been marked by strong e-commerce sales, growth in its cloud computing division (Amazon Web Services), and expansion into various sectors, including healthcare and entertainment. The company's Prime membership program remains a significant driver of customer loyalty and revenue.

However, AMZN faces several challenges, including regulatory scrutiny, labor issues, and competition in the e-commerce space. Recent labor disputes and increasing calls for antitrust action may impact the company's operations and reputation. Macroeconomic factors, such as consumer sentiment, inflation, and interest rates, can also influence Amazon's performance, given its reliance on consumer spending.

Technical Perspective

Source: tradingview.com

AMZN is currently trading around $138.23 in the price area and trying to push higher. So, if the price continues further higher and rejects from the $140.00 resistance level with a daily bearish candle close, the bears may regain momentum and push the price down towards the $130.00 price area in the days ahead.

Netflix / NFLX

Fundamental Perspective

With a vast content library and a global subscriber base, Netflix has long been a dominant force in the streaming space. Recent data suggests steady subscriber growth and increased investment in original content. However, competition in the streaming sector has intensified, with the entry of new players and existing rivals like Disney+ and Amazon Prime Video.

NFLX's performance is also influenced by content production costs, which can impact profitability. Additionally, macroeconomic factors such as interest rates and consumer spending can affect subscriber retention and acquisition.

Technical Perspective

Source: tradingview.com

NFLX is currently residing around the $442.80 price area after rejecting the $450.00 resistance level. As per the current price action context, if the price can have an impulsive daily bearish candle close below the $444.00 price area, the bears may regain momentum and push the price down toward the $415.00 support level in the coming days.