Money Manager Account

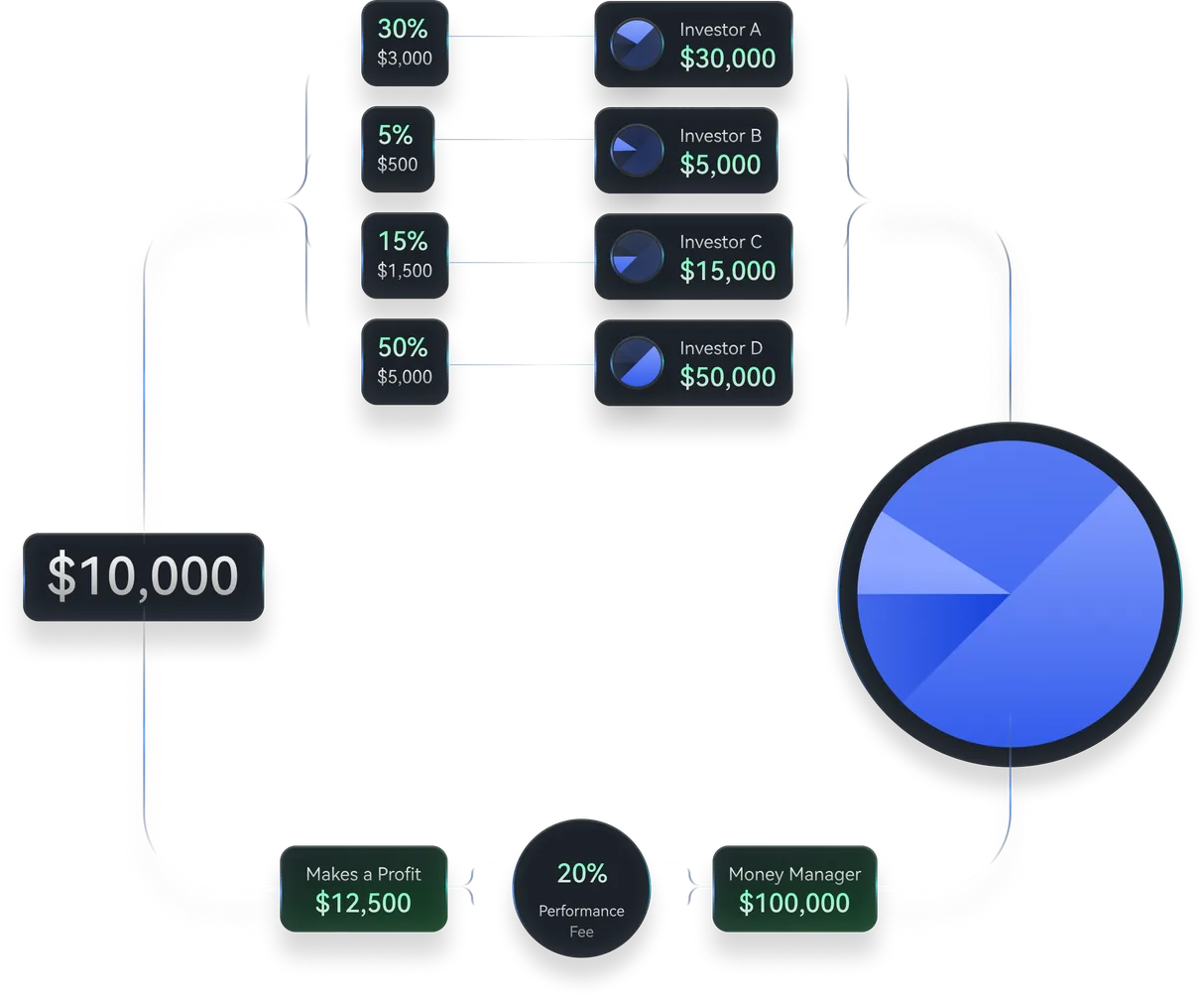

PAMM (Percentage Allocation Management Module)

Flexible Trade Distribution

Aggregate Value of Sub-Accounts

Automated Trade Replication

Risk and Profit Sharing

MAM (Multi-Account Manager)

Customizable Risk Profiles

The MAM account operates on a similar percentage system as the PAMM account, allowing for the distribution of trades among multiple sub-accounts based on allocated percentages. However, the MAM account offers enhanced flexibility in managing risk.

Trade Diversification

Unlike the PAMM account, the MAM account allows the account manager to diversify trades and adjust the risk profile for each sub-account individually. This means that the manager can vary the lot sizes traded in each sub-account according to the risk tolerance and investment goals of the investors.

Fixed Lot Trading

In a MAM account, the account manager can set the number of lots traded for each sub-account on a fixed basis. This provides a level of control and precision in executing trades, ensuring that each sub-account's risk exposure aligns with the investor's preferences.

Adaptation to Market Conditions

The ability to adjust lot sizes in the MAM account allows for agile responses to changing market conditions. The account manager can increase or decrease trading volumes in specific sub-accounts as needed, optimizing performance based on market trends.

Money Manager Technology

Whether you're into scalping, hedging, scaling, or other strategies, you have the power to personalize client portfolios within the advanced trading environment of tailored to your professional requirements.

Extensive Reporting Functions

High Level of End-User Control

Transparent Trading Environment

Multiple Allocation Methods

Lightning-Fast Order Execution

Customizable Trading Conditions

Automated Commission Calculation

Access to Top-Tier PAMM& MAM Technology

Smooth Addition/Removal of Funds

EA & Manual Traders Solutions

Dynamic Leverage up to 1:1000

Trade over 100+ CFD instruments

Get Started with you MAM Account

Engage with a trusted regulated trading platform and succeed together! Your dedicated manager will be at your side.