Impossible Foods, a leading player in the plant-based food industry, has captured the attention of a wide range of investors due to IPO speculation possibilities. The foundation period of the company is 2011, and it is known for its revolutionary, innovative approach to manufacturing meat alternatives, which can serve the purposes of both meat lovers and environmentally conscious consumers as the company has a key focus on delivering alternatives that contain texture, taste, and experience of animal-based products. Impossible Burger, the company's flagship product, has gained significant global traction.

Impossible Foods had a primary plan for going public in 2021. Still, it has yet to be completed due to unfavorable market conditions such as interest rate decisions and economic slowdown for increasing inflation. The company is gradually capturing market access and generating significant investors' attention. Peter McGuinness, the CEO, hints that the company will go public within two to three years, depending on the market conditions. This decision may be influenced by the lesson from Beyond Meat, a competition of Impossible Foods that experienced significant volatility.

However, IPO success for Impossible Foods remains a trend as global demand for plant-based foods increases. The company primarily focuses on innovation, partnership, and sustainability, which drives the company to capitalize on the worldwide demand switch toward alternative protein. The suggestion is to observe the economic conditions and evaluate the company's financials once the potential IPO occurs.

I. What is Impossible Foods

|

Foundation Year |

2011 |

|

Headquarters |

Redwood City, California, USA |

|

Sector |

Consumer Staples |

|

Industry |

Food Technology |

|

Founder |

Dr. Patrick O. Brown |

|

Number of employees |

660+ |

|

Number of investors |

117 |

Impossible Foods is a private company that specializes in providing plant-based food, especially meat alternatives that have the same texture, flavor, and taste to replace traditional meat. Impossible Foods was founded in 2011 and is headquartered in Redwood City, California.

The company's founder is Patrick Brown, a biochemist and former professor at Stanford University. It makes money by selling various products, including beef, meatballs, chicken, sausage, pork, and impossible branded packaged meals, as well as third-party packaged meals with impossible products. These products are available in 40,000 restaurants and 2,000 stores around the globe, including Trader Joe's, Walmart, and Costco.

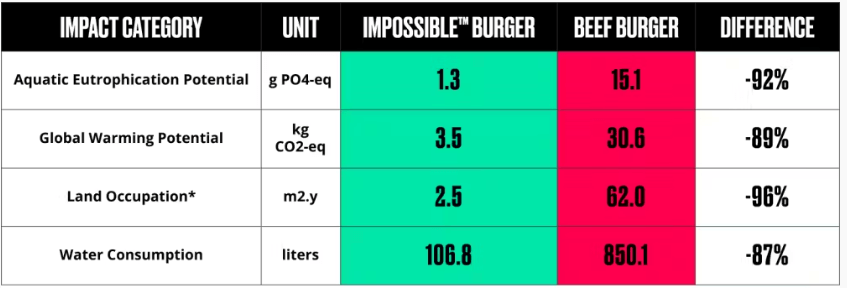

The first grounded beef production took place in 2016 and requires key ingredients, such as coconut oil, soy, sunflower oil, heme, and various binding agents. The company estimates that its beef production significantly reduces its environmental footprint compared to traditional animal meat and claims to consume 92% less water, 96% less land, and 91% less GHG emissions when producing.

Impossible Foods Business Model

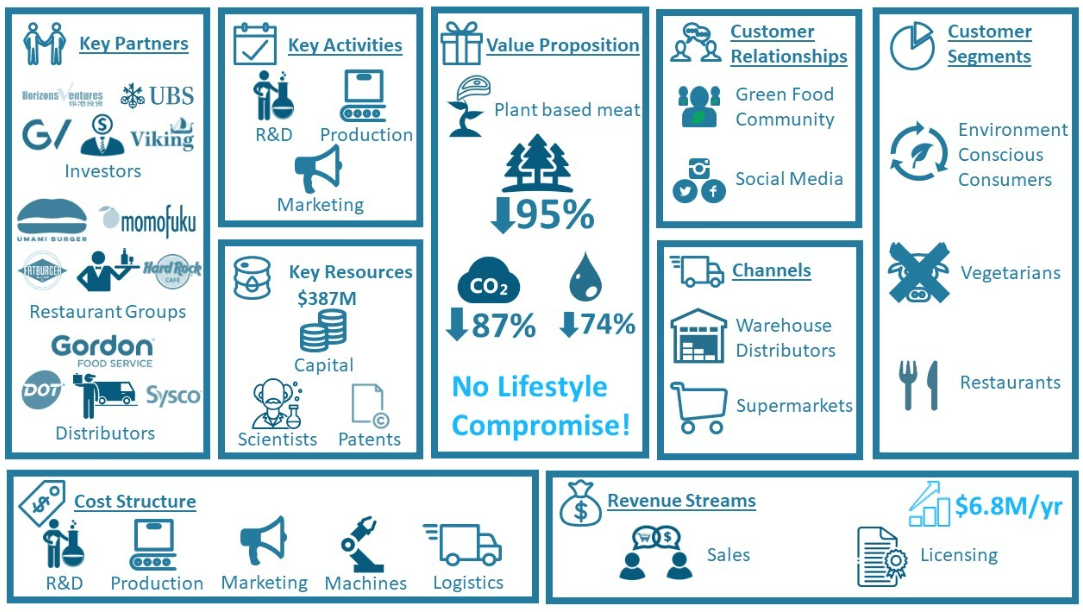

A Forbes report reveals that the sale of Impossible Foods products surged by 85% in 2021 compared to the previous year, 2020. The core product, Impossible Burger, was only founded in 150 stores then, whereas now it is available in thousands of stores. The company's business model focuses on developing, researching, and commercializing plant-based foods that serve purposes for both meat-eaters and vegetarians seeking alternatives.

The flagship product of Impossible Foods, Impossible Burger, has gained significant traction from consumers around the globe due to its plant ingredients that deliver textures of meat-like qualities. The distribution occurs through different channels besides direct store sales, such as partnerships with food service providers and restaurants.

Impossible Foods's Key Activities

- Research & Development: Scientific research and development are key factors for this company. There is a team of chefs, researchers, and scientists from whom any innovation can be a generating factor.

- Revenue Generating System: The company offers its products to grocery stores and supermarkets in several countries. Partnerships with other food service providers could enrich profitability.

Customer Segments For Impossible Foods

- Plant-based & vegetarian: There is an ongoing concern regarding plant-based food enthusiasts, creating a solid customer base. Impossible Foods Plant-based segment could be in line with people's expectations.

- Fitness & Wellness Seekers: People are eager to exercise, and people who want to maintain good health should be extra concerned about food. Targeting this person is a revenue-generating factor for Impossible Foods.

The company's strong position in retail and supermarkets and collaborations with other food chains signal a positive outlook.

Who Owns Impossible Foods

Significant investment firms, including Khosla Ventures, Coatue Management, Horizons Ventures, Temasek, and Mirae Asset, privately own the company as having significant portions. Some celebrities also invested in Impossible Foods, including film director Peter Jackson, musician Jay-Z, Microsoft co-founder Bill Gates, and athlete Serena Williams.

Impossible Foods's Key Partners

- Plant-based ingredient suppliers

- Grocery stores

- Major food distributors

- Packaging companies

- Restaurant chains

- Government regulatory bodies

- Sustainability-focused organizations

- Marketing agencies

- Food scientists and researchers

- Environmental NGOs

II. Impossible Foods Financials

Revenue Growth

In recent years, impossible Foods has become a prominent innovator and supplier of plant-based products, highlighting significant growth and market capitalization. The company reported revenue growth of $137M in 2021, which was 70% up from 2020. Although the company faced challenges in 2022, it achieved a record sales increase in the retail sector, boosting 50% compared to the previous year, 2021. The progress continued in 2023 as the sale reached approximately $460 million, which was again nearly a 50% surge from 2022. Combining all these, the company has already posted attractive revenue growth to attract significant investors to the potential IPO program. Currently, the company has a revenue estimation of $276.4M per year. Annual revenue for Impossible Foods reached $750M as of November 2024.

Profitability and Margins

Impossible Foods products are currently available in 80,000 retail locations and 40,000 restaurants worldwide, indicating robust market expansions and an increasing consumer base within a short period. Impossible Foods has remained a privately owned company, so inside information like margin remains disclosed, but profitability seems attractive enough to gain significant investors' attention.

III. Impossible Foods IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

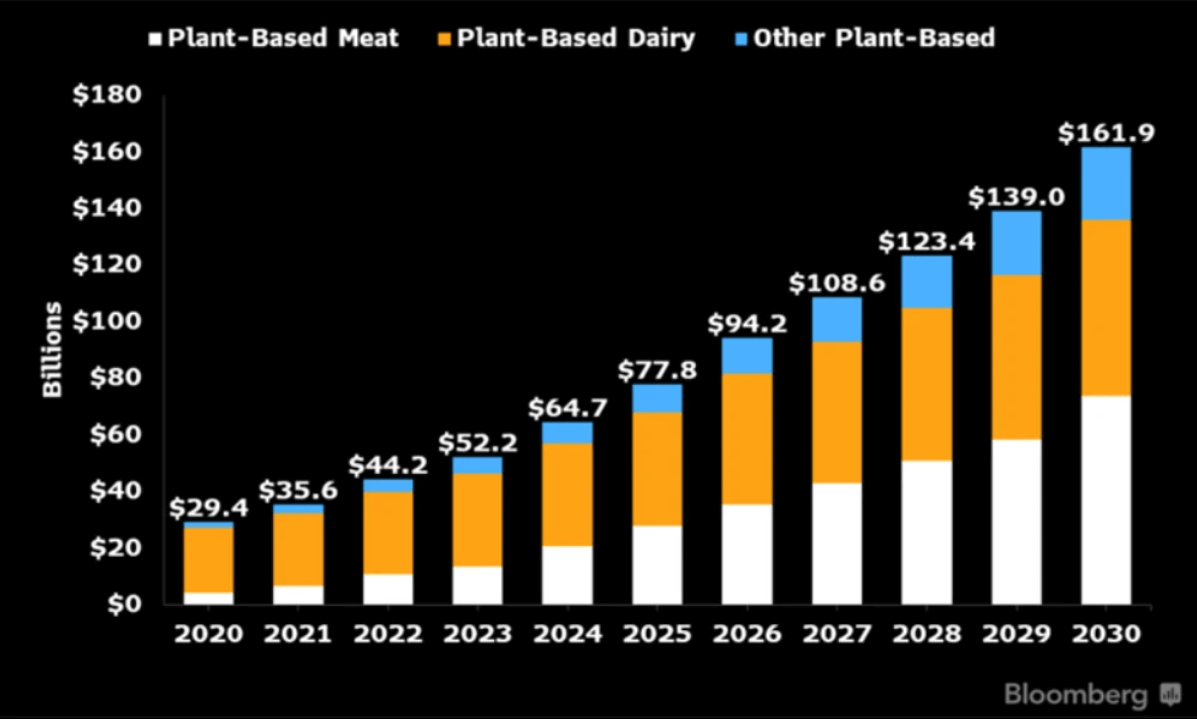

Impossible Foods operates in a rapidly expanding market with billion-dollar values. Recent Bloomberg data confirms that plant-based foods can capture 7.7% of the global protein supply by the end of 2030. By then, the total market value reached $162B, a significant increase from $29.4B in 2020.

The key utilization of heme and aroma to produce meat alternatives with the texture, smell, and taste of traditional meats gives Impossible Foods a competitive edge. A potential demand surge in the food supply can positively impact Impossible Foods' future growth in revenue and production.

The company is expanding rapidly in different regions and strategic partnerships with significant food services and chain restaurants indicate future potentiality. Constant development and research for plant-based foods enable the company to enhance production efficiency and product quality to capitalize on the market demand.

Impossible Foods competes with various giants in the sector, including Aleph Farms, Climax Foods, Chunk Foods, Hungry Planet, BlueNalu, THIS, Sovos Brands, Perfect Day, etc, which reflects both increasing demand and future potentiality of the company.

B. Weaknesses & Risks

Impossible Foods needs to achieve sustained profitability besides revenue growth. Production cost increases, particularly related to research and development, can negatively impact the company's growth.

The company competes with giants like Oatly, Beyond Meat, and Nestlé, and it is also challenging to gain an advantage over traditional meat suppliers. These can increase the pressure on Impossible Foods to maintain its market share.

Impossible Foods depends on specialized ingredients for production. Any disruption in the supply of raw materials can negatively impact supply management and scale production costs for the company.

Some other challenges the company has to overcome include regulatory risks, economic uncertainty, and dependency on consumer adoption of plant-based alternatives.

IV. Impossible Foods IPO Details

A. Impossible Foods IPO Date

Impossible Foods has no specific IPO date or official release marking a date as of writing. The company hinted at an IPO in 2021 as it may go public in the next twelve months, which have been long passed. The IPO delay may have occurred from the scenario of Beyond Meat, a key competitor in the sector. Beyond Meat experienced a price surge after the IPO but declined by 90%, giving a valid reason to wait until a favorable environment.

In April 2024, CEO Peter McGuinness quoted the IPO remains on the table that can occur in the next two-three years.

B. Impossible Foods Valuation

Impossible Foods added $500M from the latest round of funding that occurred in November 2021 at around a valuation of $7B. The company accumulated around $2B from venture funding. In April 2021, the company had an estimated valuation of around $10B as it had a plan for going public through SPAC or IPO.

Major Funding Rounds & Total Funding

Impossible Foods raised approximately $2.01B over 13 funding rounds.

|

Funding Date |

Funding Round |

Funding Amount |

Investors |

|

Nov 17, 2021 |

Series H |

$500M |

Mirae Asset, Future Asset Global Investments |

|

Aug 12, 2020 |

Series G |

$200M |

Coatue, Mirae Asset, Temasek |

|

Mar 09, 2020 |

Series F |

$500M |

Mirae Asset Global Investments, Serena Ventures, Khosla Ventures, Horizons Ventures, Temasek, Jay-Z, Serena Williams, Katy Perry |

|

Jun 10, 2019 |

Series E |

$37.3M |

- |

|

May 08, 2019 |

Series E |

$300M |

Temasek, Horizons Ventures, Khosla Ventures, Bill Gates, Google Ventures, UBS, Viking Global Investors, Open Philanthropy, Jay Brown, Kirk Cousins, Jay-Z, Paul George, Trevor Noah, Alexis Ohanian S, Kal Penn, Ruby Rose, Jaden Smith, Phil Rosenthal, Zedd, will. i.am, Katy Perry, Sailing Capital, Serena Williams |

|

Mar 21, 2018 |

Series E |

$114M |

Temasek, Open Philanthropy, Google Ventures, UBS, Viking Global Investors, Horizons Ventures, Bill Gates, Sailing Capital |

|

Jul 28, 2017 |

Series D |

$75M |

Temasek, Open Philanthropy, Bill Gates, Khosla Ventures, Horizons Ventures, Trinity Capital |

|

Nov 10, 2016 |

Series D |

$100M |

Trinity Capital |

|

Aug 14, 2015 |

Series D |

$108M |

UBS, Viking Global Investors, Khosla Ventures, Bill Gates, Horizons Ventures, Li Ka-Shing, Innovative funding |

|

Jun 27, 2014 |

Series C |

$40M |

- |

|

Jul 17, 2013 |

Series B |

$25M |

- |

|

Feb 07, 2013 |

Series A |

$3M |

- |

|

Sep 11, 2011 |

Series A |

$6.2M |

- |

C. Share Structure & Analyst Opinions

No details are currently available for the share structure or official announcement on the share price or number of shares. The company has prominent investment firms and individuals behind it, including Mirae Asset, Future Asset Global Investments, Serena Ventures, Khosla Ventures, UBS, Viking Global Investors, etc. As of now, the share price and issued share number would be equivalent to $10B by the IPO period from various sources.

As of writing, an official analysis report has yet to be published on the Impossible Foods IPO. Meanwhile, many professional investors reckon it might be a potential investment opportunity following the performance and growth perspective.

V. How to Invest in Impossible Foods IPO & Impossible Foods Stock

Where to Buy Impossible Foods IPO Shares

When considering investing in Impossible Foods IPO, investors primarily have to check on official announcements for preferred platforms that the company chooses. When the declaration comes, first have to open an account on that supported platform. In most cases, it would be a broker, bank, or other financial institution. After signing up, the account must be validated by providing user information to access full features.

Trading Strategies for Impossible Foods IPO

Once Impossible Foods goes public, investors can adopt strategies to maximize returns:

- Momentum Trading: Leverage early market excitement around Impossible Foods' leadership in plant-based food by tracking initial price swings for short-term gains.

- Short-Term Trading: Day or swing traders can capitalize on price volatility during the IPO's early trading days before the stock stabilizes.

- Long-Term Investment: Impossible Foods' strong market position, innovation, and global expansion potential make it a promising long-term investment as demand for sustainable food grows.

Alternative Trading Methods:

- ETFs: Diversify exposure through funds focused on sustainable or plant-based sectors.

- Options Trading: Hedge risks or secure favorable entry points by taking advantage of IPO-driven price swings.

- CFD Trading: Platforms like VSTAR allow speculative positions on Impossible Foods stock price movement without ownership, offering flexibility amid market shifts.

Align strategies with risk tolerance and financial goals while staying updated on Impossible Foods' performance and broader industry trends to navigate opportunities effectively.