- U.S. Wheat Outlook: Increased supplies and higher ending stocks foresee downward pressure on prices.

- Global Trends: Varied production shifts impact trade, with Russia's surge counterbalancing reduced exports from major countries.

- Price Projections: Lowered farm price expectations signal a bearish trend for wheat futures and CFDs.

- Supply-Demand Dynamics: Decreased domestic use and global trade contribute to an oversupply scenario, potentially influencing prices negatively.

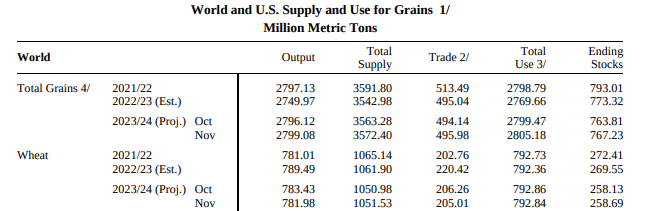

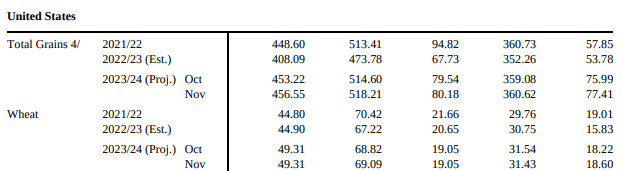

In the realm of commodities, wheat occupies a pivotal position due to its widespread use as a staple food and its significant role in global trade. The dynamics of wheat prices are influenced by a multitude of factors, including supply and demand fundamentals, weather conditions, geopolitical events, and trade policies. Understanding the latest USDA data and its implications on Wheat Futures and Contracts for Difference (CFDs) requires a detailed analysis focusing on both U.S. and global perspectives.

U.S. Wheat Outlook (2023/24)

- Supply Dynamics: The projected increase in supplies stands at 145 million bushels due to a surge in imports. This elevation in supply can exert downward pressure on prices, assuming the demand remains relatively stable. Increased supply often leads to a surplus, resulting in a decline in prices as markets try to balance excess supply.

- Domestic Consumption: The reduction in domestic use by 4 million bushels, specifically in food consumption, following the NASS Flour Milling Products report is indicative of lower domestic demand. A decrease in demand typically correlates with a bearish outlook, potentially impacting futures negatively.

- Ending Stocks: The rise in ending stocks by 14 million bushels to 684 million suggests an accumulation of surplus wheat. Higher ending stocks signal an oversupply situation, which could trigger a bearish sentiment in the market, potentially pressuring prices downward.

- Price Projection: The downward revision of the 2023/24 season-average farm price by $0.10 per bushel to $7.20 signifies an anticipation of lower prices for the remainder of the marketing year. This downward adjustment in price projection signals a bearish outlook for wheat prices, likely influencing futures in a negative direction.

Source: usda.gov

Global Wheat Outlook (2023/24)

- Global Supply Dynamics: Despite a decrease in global production by 1.5 million tons to 782.0 million, the overall increase in supplies to 1,051.5 million tons, driven by higher beginning stocks, could potentially stabilize prices or apply slight downward pressure on CFDs.

- Production Shifts: The reduction in production across various countries, including India, Argentina, Kazakhstan, the United Kingdom, and Brazil, is noteworthy. However, Russia stands out with a notable increase of 5.0 million tons to 90.0 million, primarily based on harvest data. This substantial increase in Russian production could counterbalance negative impacts and potentially stabilize or slightly boost CFD prices.

- Global Trade Scenario: The decrease in the global trade forecast by 1.3 million tons to 205.0 million, largely impacted by reduced exports from major wheat-producing nations like Argentina, India, and Egypt, might adversely affect CFD prices. Reduced trade suggests decreased global demand and can exert downward pressure on prices.

- Ending Stocks on a Global Scale: The rise in projected global ending stocks to 258.7 million tons, supported by larger forecasts for countries like Russia, China, and Argentina, while witnessing declines for India, Ukraine, and Brazil, could impact CFD prices. An increase in ending stocks implies a surplus, potentially pressuring prices downward due to excess supply.

Implications on Wheat Futures and CFDs

U.S. Wheat Futures

- Supply Increase: The surge in supplies due to increased imports might lead to a bearish sentiment, applying downward pressure on futures prices. Elevated supply levels can result in lower prices assuming demand remains constant.

- Reduced Domestic Use: The decline in domestic use, especially in food consumption, may signal decreased demand, which could adversely affect futures prices, projecting a bearish outlook.

- Higher Ending Stocks: An increase in ending stocks points towards a surplus situation, likely generating bearish sentiments in the market and pressuring prices downward.

- Lowered Price Projection: The downward revision in the season-average farm price projection might indicate a bearish outlook, influencing futures negatively and potentially leading to price declines.

Global Wheat CFDs

- Global Supply Increase: Despite a slight decline in production, the overall increase in global supplies due to higher beginning stocks could either stabilize prices or slightly lower CFD prices.

- Decreased Global Trade: The reduction in global trade, primarily due to decreased exports from major producing countries, could have a negative impact on CFD prices by indicating reduced global demand.

- Increased Ending Stocks: The surge in projected ending stocks globally might signal a surplus, potentially impacting CFD prices downward due to an oversupply situation.

- Production Shifts, Especially in Russia: The significant increase in Russian production might counterbalance the negative impacts on CFD prices, potentially stabilizing or slightly boosting prices due to Russia's substantial role in global wheat production.

Wheat Price Technical Take

The prevailing price pattern of Wheat CFDs and Futures presents an opportune moment for daily trading. Despite a short-term downtrend, trading between support and resistance levels for long and short positions appears viable. The neutral RSI suggests potential for executing trades within this range.

Source: tradingview.com

In conclusion, the USDA data points towards a complex interplay of factors affecting both U.S. Wheat Futures and Global Wheat CFDs. U.S. futures might face downward pressure due to increased supplies, reduced domestic use, higher ending stocks, and a lowered price projection. On the other hand, global CFDs could experience varying pressures with a potential stabilization due to increased supplies and production shifts from countries like Russia. However, the negative impacts of reduced trade and increased ending stocks could exert downward pressure on CFD prices.