The finance sector is always buzzing with several worthwhile investment opportunities for traders and investors who know where to look. This time, our focus is on Wells Fargo stock. The current WFC stock forecast suggests that WFC stock is a very good buy, and there are several notable recent Wells Fargo news or developments to back this up.

For example, Wells Fargo & Company recently unveiled their novel Sports & Entertainment Program, an initiative aimed at identifying and supporting financial advisors who cater to clients in the sports and entertainment sectors. This step is likely to enhance the bank's market position, possibly attracting more clients from these sectors who seek advisors that understand their unique financial situations.

Also, In another significant development, Wells Fargo & Company declared that its board of directors has sanctioned a quarterly common stock dividend of $0.35 per share. This dividend for the third quarter reflects an increase of $0.05 per share compared to the previous quarter. The increase in the quarterly common stock dividend signals a favorable financial position for Wells Fargo, indicating strong profitability. This decision will also prove beneficial to the company's image, instilling investor confidence and potentially leading to increased investments.

From all of the above, it's pretty clear that the answers to the questions, "Is WFC stock a good long-term investment?" and "Should I buy WFC stock?" is a strong yes. However, it's also clear that the above news is not enough for you to make an investment decision. So read on to get all the answers you want to the question, "Is now a good time to buy WFC stock?"

Wells Fargo & Company's Overview

Credit: iStock

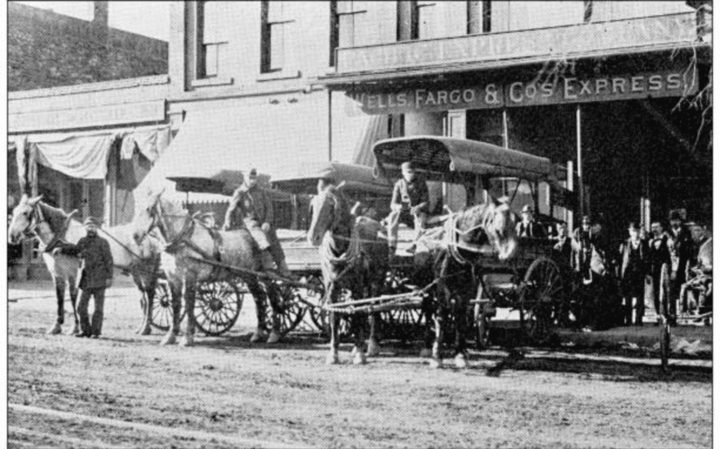

Wells Fargo History

Wells Fargo & Company was established on March 18, 1852, by Henry Wells and William Fargo. The bank is headquartered in San Francisco, California. As of 2023, Wells Fargo operates through four main business segments: Consumer Banking and Lending, Commercial Banking, Wealth and Investment Management, and Corporate and Investment Banking. The bank is currently led by CEO Charles Scharf, a seasoned executive with a rich background in the financial industry, having served previously as the CEO of BNY Mellon and Visa Inc.

Who Owns Wells Fargo

Notable shareholders of Wells Fargo include The Vanguard Group, BlackRock Fund Advisors, and SSgA Funds Management, Inc. among others.

Credit: iStock

Key Milestones: Wells Fargo's history is marked by several important milestones. Some of the most significant ones include the following:

- In 1923, Wells Fargo Nevada and the Union Trust Company joined forces to form the Wells Fargo Bank & Union Trust Company.

- In May 1995, Wells Fargo started offering Internet banking services to its customers, thus becoming the premier financial services firm in the US to do so.

- By 1997, the bank's net income had surged to a substantial $1.35 billion.

- In the inaugural "Green Rankings" by Newsweek Magazine in 2009, Wells Fargo outperformed all banks and insurance companies, securing the first position in these sectors and the 13th position among the country's 500 largest companies.

Wells Fargo & Company's Business Model and Products/Services

Credit: Company Website

Wells Fargo's primary source of revenue comes from interest income and non-interest income.

Interest Income: This is the revenue the company earns from the interest charged on loans it issues, such as mortgages, credit cards, and personal and commercial loans.

Non-Interest Income: Wells Fargo also generates substantial income from non-interest sources, which include fees for services such as account maintenance, ATM transactions, investment management, and advisory services, among others. The bank also earns income from its wealth and investment management services and through commissions and fees for its insurance services.

Main Products and Services

Wells Fargo provides a broad range of financial products and services to its customers. Some of the main ones include the following:

- Banking Products: This includes a range of retail banking services such as checking and savings accounts, CDs, debit and credit cards, and mobile banking.

- Loans and Credit: The bank provides various types of loans, including home mortgages, car loans, and personal lines of credit

- Investment Services: Wells Fargo offers wealth and investment management services, retirement services, and brokerage services.

- Insurance Services: The company also provides different types of insurance, such as auto, homeowners, life, and disability insurance.

- Commercial Banking Services: For businesses, Wells Fargo provides services, including commercial loans, treasury management, and investment banking.

Through this diversified portfolio of products and services, Wells Fargo can cater to a wide range of customer needs, contributing to its expansive client base and revenue streams.

Wells Fargo & Company's Financials, Growth, and Valuation Metrics

Credit: iStock

Wells Fargo Market Cap

WFC stock currently has a market capitalization of $166.81 billion.

WFC Earnings

For the quarter that ended on June 30, 2023, Wells Fargo reported a net income of $4.659 billion, marking a significant rise of 64.11% from the same period in the previous year. However, the bank's net income for the twelve months ending on June 30, 2023, stood at $15.091 billion, reflecting a drop of 9.12% from the previous year.

WFC stock revenue for the quarter ending on June 30, 2023, reached $28.200 billion, a substantial increase of 53.38% year-over-year. Over the past five years, Wells Fargo's revenue witnessed a decline, dropping from $101,060 million in 2018 to $82,407 million in 2021. Nevertheless, the revenue showed a slight rebound to $82,859 million in 2022.

The Price-to-Earnings (PE) ratio of Wells Fargo, as of July 25, 2023, is 10.43. The Return on Equity (ROE) for the WFC stock as of June 30, 2023, is 8.32%, a rise from the 7.34% noted on March 31, 2023.

The figures above signal an improved performance, potentially indicating successful business strategies or cost reduction efforts. WFC stock's PE ratio of 10.43 may suggest that it is priced relatively low compared to its earnings, indicating that the stock is undervalued, assuming the earnings are sustainable. The increase in ROE also signifies that Wells Fargo has become more effective at generating profits from its equity capital.

Key financial ratios and metrics

Credit: iStock

As mentioned earlier, WFC stock has a P/E value of 10.43. However, major competitors like JPMorgan Chase (JPM) and Bank of America (BAC) have P/E values of 10.42 and 9.38, respectively. Also, WFC stock currently has a P/S value of 1.78. JPMorgan Chase (JPM) has a P/S value of 2.57, while Bank of America (BAC) has a P/S value of 1.76.

The fundamental worth of a single share of Wells Fargo & Co, based on a baseline scenario, is $71.71. When compared to the current market price of $45.48, it's clear that Wells Fargo & Co's stock is 37% below its intrinsic value.

WFC Stock Performance Analysis

Credit: Company Website

Now let's take a closer look at the WFC stock analysis, but before that, here is some general WFC stock trading information you should know:

WFC Stock trading information

Wells Fargo & Company, though founded in 1852, went public much later on Oct 6, 1978. Today, its shares trade on the New York Stock Exchange (NYSE) under the ticker symbol "WFC". The company operates in the United States and trades in US dollars. Standard NYSE trading hours are from 9:30 a.m. to 4:00 p.m. Eastern Time (ET) on weekdays, excluding market holidays.

WFC Premarket trading on the NYSE typically occurs between 4:00 a.m. and 9:30 a.m. ET, while after-market trading occurs from 4:00 p.m. to 8:00 p.m. ET. This gives investors the opportunity to react to news events and earnings reports released outside of regular market hours.

WFC Stock Splits: WFC stock has currently undergone six splits, with the most recent one occurring on the 14th of August, 2006.

WFC Dividend: As of July 25, 2023, the trailing twelve-month (TTM) dividend disbursement for Wells Fargo (WFC) stands at $1.20. Also, the current dividend yield of Wells Fargo is recorded at 2.59%.

WFC Stock Price Performance since its IPO

Credit: TradingView

Since its IPO, WFC stock steadily increased in price till it reached a high of 44.69. The price then suffered a massive and sharp dip to the 7.80 level before continuing on a massive bull run that eventually led to the creation of the current all-time WFC stock price high of 66.31. This move encompassed a previous high (58.77) that was eventually broken after a brief dip to the 43.55 level.

After this, however, WFC stock price dipped massively again, all the way to the 20.76 level before rebounding as high as 60.30. Currently, WFC stock price is around the 45.48 level, and it looks to be gaining momentum. If WFC stock price can break the nearest high of 60.30, there's a real chance that it will go on to break its all-time high of 66.31.

Key Drivers of WFC Stock Price

Credit: iStock

There are several factors that can influence Wells Fargo stock price. Some of these include the following:

- Interest Rates: Wells Fargo, like other banks, profits from the spread between interest earned on loans and paid on deposits. Therefore, changes in the Federal Reserve's policy rates can impact its net interest income, driving WFC stock price. For instance, if the Federal Reserve raises rates, Wells Fargo could potentially earn more from loans, positively affecting WFC stock price.

- Regulatory Environment: Regulatory fines or issues can negatively impact the bank's profitability. For example, the fake accounts scandal of 2016 damaged Wells Fargo's reputation and resulted in billions in fines, causing a drop in WFC stock price.

- Market Sentiment: Investor attitudes towards the banking sector or overall market can also influence the stock. For example, positive news about the banking sector's growth could lead to increased investor interest in Wells Fargo, pushing up WFC stock price.

Wells Fargo Stock Forecast

The consensus analyst recommendation for WFC stock is a buy. A 24 analysts 12-month price prediction for WFC stock places the median target at 51.00, the highest estimate at 65.00, and the lowest at 42.00. This median figure signifies a prospective rise of +12.11% from WFC stock's recent trading price of 45.48.

Challenges and Opportunities

Credit: iStock

Wells Fargo (WFC) operates in a highly competitive industry that includes financial institutions such as JPMorgan Chase (JPM), Bank of America (BAC), and Citigroup (C), among others. All of these competitors could pose significant risks to WFC's stock performance.

For example, JPMorgan Chase, with its strong global presence and comprehensive range of financial services, often sets industry benchmarks that Wells Fargo has to match or exceed. Bank of America, on the other hand, poses a threat with its extensive domestic network and customer base.

However, Wells Fargo does have its competitive advantages. The bank has a substantial footprint, and it has made significant strides in digital banking. Wells Fargo's wide range of services allows it to cross-sell and build long-term customer relationships, which could potentially strengthen the WFC stock.

Other risks that could potentially affect WFC stock include regulatory risks and reputational risks. Wells Fargo has faced significant regulatory scrutiny and fines in the past, such as the well-publicized unauthorized accounts scandal. These actions can significantly damage the bank's reputation and customer trust, which can negatively impact the stock price.

Growth Opportunities

- Digital Banking: With the increasing adoption of technology in banking services, Wells Fargo has a significant opportunity to enhance its digital platforms. This can include improving online and mobile banking interfaces and incorporating advanced features like AI-powered financial advice. This digital transformation could drive customer engagement and result in higher revenues, thereby positively influencing WFC stock.

- Expanding Wealth Management Services: Wells Fargo also has an opportunity to grow its Wealth and Investment Management segment. Given the increase in high-net-worth individuals and the rising interest in personalized wealth management services, Wells Fargo could expand its offerings in this segment to increase its market share and revenues, thus potentially strengthening WFC stock.

Future Outlook and Expansion for WFC Stock

Credit: Company Website

- Geographic Expansion: Wells Fargo could explore growth opportunities in emerging markets, which are witnessing rapid economic development and increasing demand for financial services. For instance, expanding into Asian markets, where there is a growing middle-class population with unmet banking needs, could present significant growth opportunities. Thus positively impacting WF stock.

- Sustainable Finance: There is a growing emphasis on environmental, social, and governance (ESG) factors in investment decisions. This opens a new avenue for Wells Fargo since the bank can develop and promote sustainable finance products that are aligned with ESG criteria. For example, Wells Fargo could offer more ESG-focused funds, which could attract environmentally conscious investors and potentially enhance the value of WFC stock.

Why Traders Should Consider WFC Stock

Credit: Company Website

Not sure if WFC stock is the right one for you? Here are some reasons why you should consider WFC stock as a trader and an investor:

- Strong Fundamentals: Wells Fargo has a strong balance sheet and has consistently reported robust financial results, including improved net income figures. The company's strong financial health, combined with its historical track record of paying dividends, may provide a level of certainty for investors looking for steady income streams. Thus making WFC stock an attractive option

- Digitalization and Innovation:Wells Fargo is actively embracing digital transformation and innovation in its operations. The bank is investing in enhancing its online and mobile banking platforms and services. This adaptation to changing consumer behavior and technological advancements can potentially drive future growth for the bank, thereby providing upside potential for WFC stock.

- Exposure to Economic Recovery: As a major bank with a wide range of services, Wells Fargo is well-positioned to benefit from an economic recovery. As the economy strengthens, loan demand increases, unemployment rates drop, and interest rates may rise, all of which can improve the bank's profit margins. Therefore, investing in WFC stock could allow you to gain from the economic rebound.

Trading Strategies for WFC Stock

Credit: iStock

Looking to trade WFC but not sure where to start? Here are some trading strategies for WFC stock that you should definitely consider:

- Relative Strength Index (RSI):The RSI is a momentum oscillator that you can use to look for oversold or overbought conditions. For example, from the chart below, we see that when the RSI falls below 30, WFC stock is considered oversold, indicating a potential price rebound. Conversely, an RSI above 70 suggests that WFC stock is overbought, thus triggering the future price drop that followed.

Credit: TradingView

- Moving Average Convergence Divergence (MACD):The MACD is a trend-following momentum indicator. A bullish signal for WFC stock could be when the MACD line crosses above the signal line, and a bearish scenario is the opposite. For example, we see from the chart below that when the MACD line crosses above the signal line, a bullish move follows. Conversely, when the MACD line crosses below the signal line, it indicates a bearish movement.

Credit: TradingView

Double Bottom Pattern: The Double Bottom is a bullish reversal pattern. If WFC stock forms this pattern, it could indicate a potential downtrend reversal. The pattern is confirmed when the price breaks through the resistance level (the high point between the two lows), suggesting that it may be an excellent time to buy the stock. Conversely, if the stock fails to break the resistance level, it might continue its downtrend. A typical example is shown below:

Credit: TradingView

CFD Trading

There are several ways to trade WFC stock, but it should be said that CFD trading offers the most advantages. Some of the advantages of trading WFC stock CFDs include:

- Leverage: When trading CFDs, you can potentially benefit from leverage. This means that you can control a large position while only committing a small amount of your capital, potentially leading to significant profits. However, it's important to remember that leverage can also amplify losses.

- Trading on Margin:CFDs allow for margin trading, meaning you can deposit a small percentage of the total trade value to open a position. This can enhance the potential return on investment.

- Short Selling: With CFD trading, you can take a short position on WFC stock, which allows you to potentially profit from price drops. Traditional stock trading typically only allows investors to profit when prices increase.

- No Ownership:When trading CFDs, you don't own the underlying asset (in this case, WFC stock). This means you don't have to worry about responsibilities tied to ownership, such as voting rights or dividends.

Trade WFC Stock CFD with VSTAR

To trade WFC stock CFDs, you'll need to have an account with a CFD provider. Don't know which one? Not to worry, VSTAR is the perfect WFC stock CFD trading platform. Here are some reasons why you should definitely choose VSTAR:

- Super Low Trading Cost: VSTAR offers highly competitive trading fees, allowing traders to maximize their profits. The lower transaction costs can help improve your overall return on investment when trading WFC stock CFDs.

- Deep Liquidity: VSTAR's deep liquidity ensures that you can buy or sell your WFC stock CFDs at your desired price levels without significant price slippage. This allows for more efficient trading and helps minimize potential losses due to illiquidity.

- 50+ Deposit Methods: VSTAR offers over 50 deposit methods, making it easy for traders across the globe to fund their trading accounts and get started with trading WFC stock CFDs with VSTAR.

- Lightning-fast order execution: VSTAR also offers rapid order execution, ensuring that you get the prices you want when trading WFC stock CFDs. This speed can be critical for short-term trading strategies, where even a minor delay can impact profitability.

Conclusion

From all that has been said so far and the WFC stock forecast 2023, there's a strong likelihood that Wells Fargo can indeed regain its dominance as one of the leading companies in the finance industry. According to analysts' ratings, WFC stock is currently undervalued, so download VSTAR today and position yourself for the bull move that is to come!