Reasons Analysis

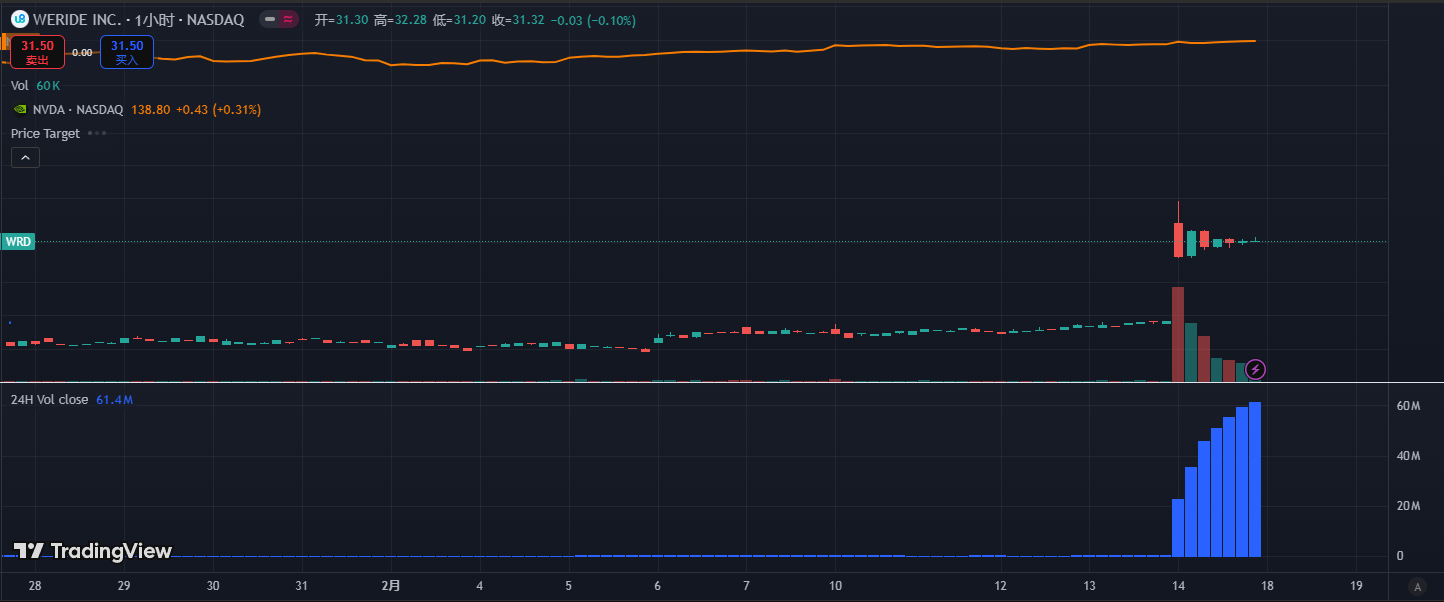

First, the surge in WeRide's stock price directly benefited from its investment from Nvidia. Nvidia held approximately 1.74 million shares of WeRide in the fourth quarter of 2024, with a market value of up to US$24.65 million. This investment has increased WeRide's recognition in the industry. In addition, the broad prospects of the autonomous driving market and policy promotion are also important factors driving the stock price. Autonomous driving technology has attracted much attention, and many large companies have laid out this field, showing that the market has huge room for growth.

However, WeRide's stock price fluctuations may also be affected by market sentiment and investor confidence. Recently, WeRide's stock price has experienced fluctuations, possibly due to market uncertainty about its future development. Despite this, some investors are still optimistic about WeRide's long-term potential, and this optimism has driven the stock price up.

Future Trend Forecast

Market Demand and Policy Support

The rapid development of autonomous driving technology and policy promotion will provide WeRide with more development opportunities and market space. With the advancement of technology and policy support, WeRide's future earnings potential cannot be underestimated.

Investor confidence

The participation of large investment institutions shows their confidence in the company's future profitability. This inflow of funds will boost market sentiment and may attract more retail investors to follow up, forming a virtuous circle.

Global market environment

The introduction of the US reciprocal tariff policy may trigger a chain reaction in the global market. Although the market bullish sentiment remains high in the short term, in the long run, the strengthening of trade barriers may have an impact on the global supply chain and cost structure, which in turn affects the performance of technology companies and consumer demand.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of VSTAR, nor can it be used as investment advice.