Even though Walmart Inc (NYSE: WMT) stock is only up a modest 10% as of July, this is one retail stock that could actually make you rich.

Walmart's sales continue to grow, and the company is consistently profitable. As a result, the retailer returns billions of dollars to investors each year through generous dividends and share buybacks.

The company continues to seek additional growth opportunities with new products and services. Walmart's management sees more of its future revenue coming from service businesses, which grow faster and have higher profit margins.

If you're wondering whether Walmart stock is a good long-term investment, read on to find out why some of the world's elite investors have named Walmart their favorite retail stock.

Walmart News

Source: Pixabay

Walmart Business Gets Associated App

In an effort to become the preferred retailer for small businesses and nonprofits, Walmart has launched a companion app for its Walmart Business platform. The platform is designed to save small businesses money, time, and hassle when shopping with Walmart. The companion app provides additional features to make the platform even more useful for small business customers.

Singing Machine expands product line at Walmart

Singing Machine is bringing more products to Walmart stores. The maker of karaoke products plans to introduce a new line of party accessories to nearly 1,000 stores across the U.S. For Walmart, this could help attract more customers to its stores, resulting in more sales for the retailer.

Walmart to offer electric vehicle charging at its stores

Walmart plans to build its own electric vehicle charging network in the U.S. by 2030. The company plans to place chargers at its Walmart and Sam's Club branded stores across the country. In addition to the potential direct revenue from offering EV charging services, the charging network could also bring more shoppers into Walmart stores and reward the retailer with valuable consumer spending data.

Walmart Inc Overview

Source: Pixabay

Walmart is an American multinational retailer that sells everything from groceries to clothing to home improvement products. With a market capitalization of more than $410 billion, it is the world's largest retailer. Walmart operates nearly 11,000 stores worldwide. It also sells online.

The retailer has a presence in more than 20 countries and serves nearly 240 million customers each week. Walmart is a mass-market discount retailer. It strives to offer the best prices on a wide range of products.

Walmart has a large stake in China's leading e-commerce company, JD.Com (NASDAQ: JD).

With annual revenue of more than $600 billion, Walmart is the world's largest company by revenue. It employs more than 2 million people worldwide, making it the world's largest private employer.

Founded in 1962 by brothers Sam Walton and James Walton, Walmart is headquartered in Bentonville, Arkansas.

The Walmart symbol WMT is recognized around the world as one of the most valuable brands in retailing. Walmart's distinctive logo and trademark blue star within a yellow sparkle form part of its corporate identity.

Walmart's Top Shareholders

|

Walmart shareholders |

Stake |

|

Walton Enterprises |

37% |

|

Walton Family |

8% |

|

Vanguard Group |

5% |

Key Milestones in Walmart's History

From its humble beginnings to becoming the world's largest retailer of almost everything, Walmart has achieved many milestones in its many decades of existence. These are some of the key milestones and events in the history of the giant retailer.

|

Year |

Milestone |

|

1962 |

The First Walmart store opens in Rodgers, Arkansas. |

|

1970 |

Walmart stock goes public. |

|

1975 |

First Walmart stock split. |

|

1978 |

First Walmart pharmacy opens in health care venture. |

|

1980 |

Walmart reaches $1 billion in annual sales. |

|

1983 |

First Sam's Club opens. |

|

1991 |

Walmart goes global with the Mexico store. |

|

1997 |

Walmart reaches $100 billion in annual sales. |

|

2007 |

Walmart launches Walmart.com e-commerce platform. |

|

2018 |

Walmart acquires Flipkart to expand in India. |

Walmart's Business Model

While many people only know Walmart as a retailer, the company offers a range of services in addition to selling things. These range from financial services to car services to health services to advertising.

How Walmart Makes Money

The retailer's main source of revenue is the sale of products. It buys goods from suppliers and sells them at a higher price than it paid for them, making a profit. Walmart also makes money from fees and commissions tied to the services it provides.

Walmart's Main Business Divisions

While Walmart is generally a retailer, the company has organized its operations into several divisions: These are Walmart's main business units and what they do:

- Walmart U.S.: This is the retailer's flagship division. It focuses on the U.S. retail market, sells a broad assortment of products, and provides a wide range of services. Walmart U.S. accounts for the majority of the retailer's sales.

- Walmart International: This is the unit that houses the retailer's international operations. Walmart operates under various banners in international markets. In Mexico, for example, it operates under the Walmex brand. In India, it operates under the Flipkart brand.

- Sam's Club: This is the members-only retail arm of Walmart. Sam's Club sells everything you would expect from a retailer but is more popular with bulk shoppers. In order to shop at Sam's Club, you must purchase a membership plan, which costs between $50 and $110 per year.

Walmart's Financial Performance and Balance Sheet Condition

Looking at Walmart's financial results and balance sheet can help you decide if this is the best retail stock to buy. Let's examine Walmart's financials to see how the company has performed in recent years and what the future might hold for it.

To avoid confusion, Walmart's fiscal year begins in February and ends in January. As a result, the retailer is currently in its fiscal year 2024. Its most recent annual report is for fiscal 2023, which ended on January 31.

Walmart Earnings

Walmart's Revenue

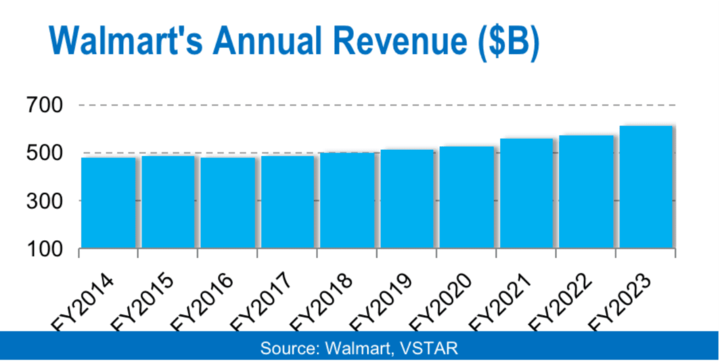

Revenue grew about 7% to $611 billion in fiscal 2023. For fiscal 2024, Walmart's revenue is expected to grow nearly 5% to $634 billion. As you can see in the chart below, Walmart has consistently grown its annual revenue over the years, even through economic downturns.

Walmart's Net Income

While its profit can fluctuate from year to year, as you can see in the chart above, the retailer has been consistently profitable. In fiscal 2023, it made a profit of $11.7 billion. In fiscal 2022, the profit was $13.7 billion, up from $13.5 billion in fiscal 2021.

Over the past 5 years, the retailer has generated more than $60 billion in cumulative profits.

Walmart's Profit Margin

The retailer posted an operating profit margin of 3.34% and a net profit margin of 1.91% in fiscal 2023. These were the company's lowest profit margins in four years, which can be attributed to the high cost of doing business due to inflation.

As Walmart takes steps to control costs and expand its higher-margin service businesses, there is room for the retailer's profit margins to improve in the future.

Walmart's Cash Position and Balance Sheet Strength

The retailer generated more than $29 billion in cash from operations and $12 billion in free cash flow in fiscal 2023. As of April, Walmart had more than $10 billion in cash on hand.

The company's balance sheet shows $245 billion in assets against total debt of just $50 billion.

Walmart has a practice of sharing its excess cash with its investors. It does this through dividend payments and share repurchases. The retailer launched a $20 billion buyback program in November 2022.

Walmart Stock Analysis

Walmart Valuation

WMT stock currently trades at a forward P/E ratio of 37.34 and a forward P/S ratio of 0.65. In comparison, Amazon.com, Inc. (NASDAQ: AMZN) stock trades at a forward P/E ratio of 73.92 and a forward P/S ratio of 2.33. Costco Wholesale Corporation (NASDAQ: COST) stock trades at a forward P/E ratio of 36.34 and a forward P/S ratio of 0.97.

As you can see, WMT stock is more cheaply valued than AMZN stock and is roughly comparable in valuation to Costco stock.

Walmart (WMT) Stock Trading Information

Walmart stock is listed on the NYSE, where it trades under the ticker symbol "WMT".

You can trade Walmart stock as early as 4 a.m. ET and as late as 8 p.m. ET using extended trading hours. However, the regular trading session begins at 9:30 a.m. and ends at 4:00 p.m. On average, nearly 6 million shares of Walmart stock change hands in a single day.

Walmart stock price history

Walmart has come a long way since first listing on the New York Stock Exchange in 1972, with an adjusted IPO price of less than $0.50 per share. While initially slow to gain traction, Walmart's stock price accelerated rapidly during the 1980s and 1990s in tandem with its meteoric store and revenue growth, leading to several stock splits. Buoyed by its dominant position in discount retail and resilience during recessions, Walmart stock broke $100 per share in early 2015. Despite increased competition from e-commerce players, Walmart has held its own with strategic acquisitions and strengthening of its online footprint. Today, Walmart trades around $162 per share with a market cap of over $430 billion, attesting to its long record as a stalwart in the retail universe.

Walmart (WMT) Stock Split History

The retailer has split its stock nine times since its IPO. The first Walmart stock split was a two-for-one stock split in August 1975. The most recent Walmart stock split was a 2-for-1 in April 1999. Because of the splits, an original position of 1,000 shares of Walmart has grown to 512,000 shares.

Walmart Dividend

Walmart is a popular dividend stock in the retail sector. It pays its dividends on a quarterly basis, resulting in four payouts per year.

Walmart Dividend History

Walmart established its dividend track record in March 1974 and has steadily increased its payout ever since, cementing its status as a Dividend Aristocrat. For 48 consecutive years, Walmart has increased its annual dividend, from an initial $0.05 per share in 1974 to a quarterly rate of $0.56 per share beginning in 2022. This remarkable dividend growth through recessions, expansion years, and retail disruption speaks to Walmart's resilience.

Walmart Stock Dividend

With a current WMT stock dividend yield of nearly 1.5%, Walmart offers income investors a relatively attractive payout supported by its strong cash flows. As one of the top dividend payers in the S&P 500, Walmart's dividend heritage plays a key role in its reputation as a stalwart for investor portfolios in all market environments.

Walmart (WMT) Stock Performance

Walmart's stock debuted on the public market at an IPO price of $16.50. The stock reached an all-time high of $160 in 2022. At the current price of about $155, WMT stock has gained more than 10,800% since the IPO. The stock is up about 10% so far this year.

Over the past year, WMT stock has traded between $120 and $159.

Walmart Stock Forecast

With Walmart stock now trading near its all-time high, you might be wondering if it has more room to run.

WMT Stock Forecast

About 30 analysts cover Walmart stock with price targets ranging from $157 to $186.

The average Walmart stock price target of $169 implies an upside of almost 10%. The highest WMT stock price target of $186 implies a 20% upside. These are 12-month price forecasts for Walmart stock, so the stock could go higher in the short term. Analysts have a consensus buy rating on WMT stock.

About 25 analysts have a Buy rating on Walmart stock and four have a Hold rating. Therefore, the consensus analyst rating for WMT stock is a Buy.

Walmart (WMT) Stock Technical Analysis

Walmart stock has broken through several resistance levels in 2023. If you look at the chart above, you'll see that every time the stock breaks through a long-established resistance level, it becomes a new strong support level.

And when the stock breaks below a long-established support level, traders see it as an opportunity to buy the dip and the stock. This causes the stock to soar, turning the previous resistance into a new support level.

As of July 2023, Walmart stock has established a strong support level at $153, while $159 is the resistance level.

Walmart's Challenges and Opportunities

To succeed in business, a company must seize opportunities and overcome challenges. Walmart has its share of challenges and opportunities. Let's explore them:

Walmart's Risks and Challenges

- Dependence on the U.S. market: Walmart is highly dependent on the U.S. market, which accounts for approximately 70% of its sales. As a result, an economic downturn in the U.S. could have a material adverse effect on Walmart's financial performance.

- Foreign exchange effects on international sales: Walmart's international operations make it vulnerable to adverse changes in foreign currency exchange rates. The company reports its results in U.S. dollars. A stronger dollar can reduce reported international sales.

- Regulatory pressures: As a leading retailer, Walmart is on the radar of many antitrust regulators. The company's safety and worker compensation practices are also under close scrutiny. Increased regulatory scrutiny can disrupt the company's plans and increase its compliance costs.

- Fierce competition: Walmart faces many competitors in its retail and other businesses. These are some of Walmart's main competitors and the risks they pose.

|

Competitor |

Threat |

|

Amazon |

Amazon is Walmart's biggest competitor in the e-commerce industry. Amazon is currently the leader in e-commerce. Walmart and Amazon are also fierce competitors in the advertising market. |

|

Costco |

Costco is a major competitor of Walmart in the grocery retail industry. Both retailers try to attract customers with lower prices and a wide selection of products. |

|

Kroger |

Kroger is primarily a grocery retailer. Like Walmart, it focuses on offering lower prices. In addition to groceries, Kroger competes with Walmart in the sale of health and beauty products and electronics. |

|

Home Depot |

Home Depot competes with Walmart in selling home improvement products, such as building materials and tools. Both have a large physical retail presence and an online presence. |

Walmart's Competitive Advantages

1. Strong financial position

Walmart is far more financially stable than most of its competitors. As a result, the retailer is well-positioned to continue to invest in driving growth. It can also weather economic downturns or take advantage of growth opportunities better than its competitors.

2. Economies of scale

Walmart operates more than 10,000 stores in dozens of countries. It also has an extensive supply and logistics network. The retailer's massive scale allows it to control operating costs better than its competitors. As a result, it can source products cheaply and sell them at competitive prices. This helps Walmart attract and retain customers.

3. Large, loyal customer base

Approximately 240 million people shop at Walmart stores each week. By offering various membership programs, the retailer has also built a loyal customer base. With a large and loyal customer base, Walmart can easily introduce new products and secure key partnerships.

4. Strong brand recognition

Walmart is a widely recognized and respected retail brand. Shoppers associate Walmart with low prices, broad product selection, and high quality. Because of its strong brand position, Walmart has an easier time attracting new customers. In addition, the high level of trust in the Walmart brand makes it easier for the retailer to secure key partnerships.

5. Diversified business

Although Walmart is primarily a retailer, it has a highly diversified business. For example, it sells through physical stores and e-commerce platforms. Its stores include grocery stores, department stores, and neighborhood markets. The retailer is also geographically diversified with domestic and international locations. The company's diversified business allows it to take advantage of opportunities in different markets and minimize the risk of economic downturns in certain segments of the market.

Walmart's Growth Opportunities

1. International expansion

While Walmart already operates in about two dozen countries, it still has tremendous room to grow internationally. In addition to entering additional international markets, the retailer can expand its existing footprint with more stores and additional products and services.

In Mexico and Central America, where it operates under the Walmex brand, Walmart plans to invest about $1.5 billion in 2023 to grow its business in the region. The investment will be used to open new stores and upgrade existing ones. Walmart has set a goal to double its international sales to $200 billion in 5 years.

2. Online Retail Business

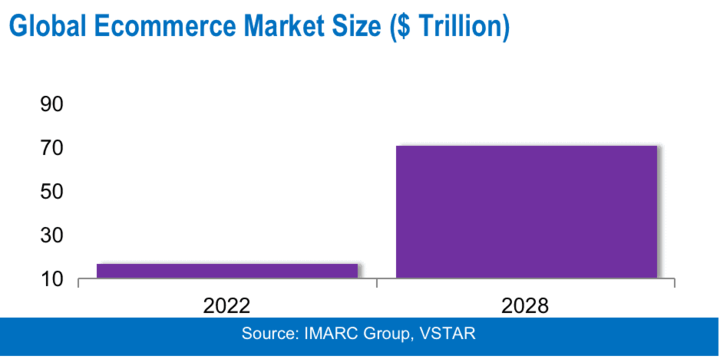

Walmart already sells products online, but e-commerce remains a tiny part of its business. Despite Amazon's dominance in online retail, Walmart still has a huge growth opportunity in the e-commerce industry as more households turn to online shopping.

Walmart can leverage its strong brand recognition and reputation to grow faster than most of its competitors in areas such as online grocery and apparel. The global e-commerce market is expected to grow from $16.6 trillion in 2022 to $70 billion by 2028, according to IMARC Group.

3. Advertising Services

Walmart provides advertising services to other merchants and brands. The advertising business is growing at a high double-digit rate, according to the retailer's financial reports. Walmart's advertising revenue grew 30% to $2.7 billion in fiscal 2023 (ended January 31).

The advertising business represents a huge growth opportunity for Walmart, both in-store and online.

Services like advertising are among Walmart's faster-growing, higher-margin businesses. The retailer expects more of its future revenue to come from advertising sales and other services it offers, including delivery services.

4. Financial Services

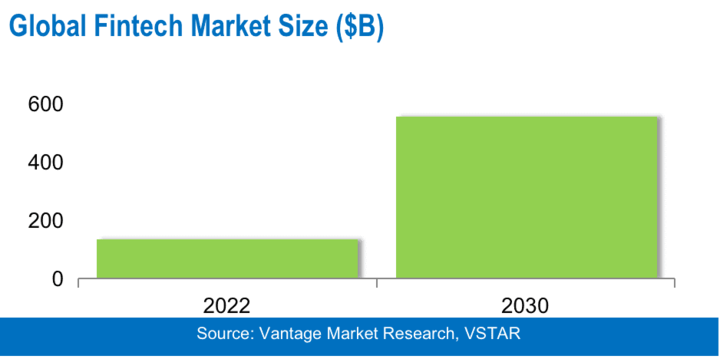

Walmart offers a range of financial services to its customers, including money transfers, check cashing, prepaid cards, and bill payments. The company plans to expand its financial services business with additional services. The buy-now-pay-later market is a promising opportunity for Walmart.

The revenue opportunity for Walmart in the financial services industry is enormous. The global fintech market is expected to reach $556.6 billion by 2030, up from $133 billion in 2022, according to Vantage Market Research.

In addition to generating direct revenue from fees and commissions, Walmart's financial services can help the retailer drive sales in other areas and increase customer loyalty.

5. Health and Wellness

Walmart is a major player in the healthcare space, operating clinics, and pharmacies. The company plans to double its clinic footprint by the end of 2024. There is plenty of room for Walmart to grow in this space with additional products and entry into new segments. For example, the company recently partnered with Pawp to offer pet telemedicine to its members.

The retailer has also partnered with UnitedHealth (NYSE: UNH) to enter the Medicare Advantage business.

The global health and wellness market is expected to grow from $5.2 trillion in 2022 to $8.9 trillion by 2032, according to Precedence Research. Capturing even a modest piece of this market could mean significant incremental sales for Walmart.

6. Operations Automation

Walmart is investing heavily in automation technology as it seeks to improve its operational efficiency. This has led the retailer to take a large stake in automation robotics provider Symbotic (NASDAQ: SYM). Walmart uses robots to speed up order fulfillment in its warehouse. It wants to use self-driving vehicles to deliver orders.

In addition, the company is automating store operations and aims to have 65% of its stores automated in some way by 2026. There is also an opportunity for the retailer to use AI technology to improve its efficiency and reduce costs. Automation provides a great opportunity for the retailer to reduce costs by cutting jobs, thereby improving its profitability.

Trading Strategies for WMT Stock

Source: Pixabay

Walmart is an industry with strong competitive advantages and many exciting growth opportunities. WMT stock has more upside potential, as evidenced by analysts' Walmart share price targets. The pursuit of dividends and the buyback program could push WMT stock higher than many currently expect.

There are several ways to make money with Walmart stock. These are the popular ways:

- Long-term investment strategy: You buy Walmart stock and hold it in your portfolio for years. This method of investing makes you eligible for dividends but requires a large upfront investment and a long wait for returns.

- Short-term investment strategy: You buy and sell Walmart shares over short periods of time, such as an hour, a day, or a week. Trading Walmart CFDs is a flexible and potentially more rewarding short-term investment strategy. CFD trading requires little upfront capital and you can make money in both bull and bear markets.

Trade Walmart Stock CFD with VSTAR

VSTAR is a fully licensed and regulated CFD broker with an excellent Trustpilot review rating. Designed for CFD traders of all levels, VSTAR offers industry-leading tight spreads and low trading costs.

You can start trading Walmart CFDs with VSTAR with as little as $50 of your own funds and use leverage to increase your position. The VSTAR CFD trading platform also offers highly effective risk management tools, and trades are backed by prompt customer support.

Consider opening your free VSTAR account today and start trading Walmart stock CFD. The platform offers new traders up to $100,000 of free virtual money in a demo account to practice trading.

Final Thoughts

Walmart (WMT) is in great financial shape, has many competitive advantages, and has exciting growth opportunities. WMT stock has proven to be the best retail stock for many elite investors.

You can buy and hold WMT stock for long-term returns and trade Walmart stock CFD for short-term profit opportunities.

FAQs

1. Is Walmart a good stock to buy?

Yes, Walmart is considered a good, long-term buy by many analysts due to its steady growth, reasonable valuation, and strong dividend history.

2. Is Walmart a buy or a sell?

Most analysts rate WMT stock as a buy or strong buy stock currently. Its low P/E ratio and dividend yield make it attractive for value and income investors.

3. Is Walmart a dividend stock?

Yes, Walmart is known as a dividend aristocrat, having increased its dividend annually for over 45 straight years. The current WMT stock dividend yield is around 1.5%.

4. When did WMT split?

The last time WMT stock split was a 2-for-1 split that took effect in April 1999 at a split-adjusted price of around $25.

5. Where will Walmart stock be in 5 years?

Based on historical growth and analyst estimates, WMT stock could be over $250 in 5 years. Continued e-commerce and international expansion are growth drivers.

6. What does the future hold for Walmart stock?

The future continues to look bright for Walmart stock, with both its brick-and-mortar and online segments poised for steady growth globally, although Amazon remains a fierce competitor. Its mature business and dividend should attract investors.

7. What will Walmart stock be in 10 years?

In 10 years, Walmart stock could potentially more than double from its current level of around $162 per share to over $350 per share based on expected consistent revenue and earnings growth of 5-8% annually over the next decade. However, competition poses a risk to achieving this estimated stock price.