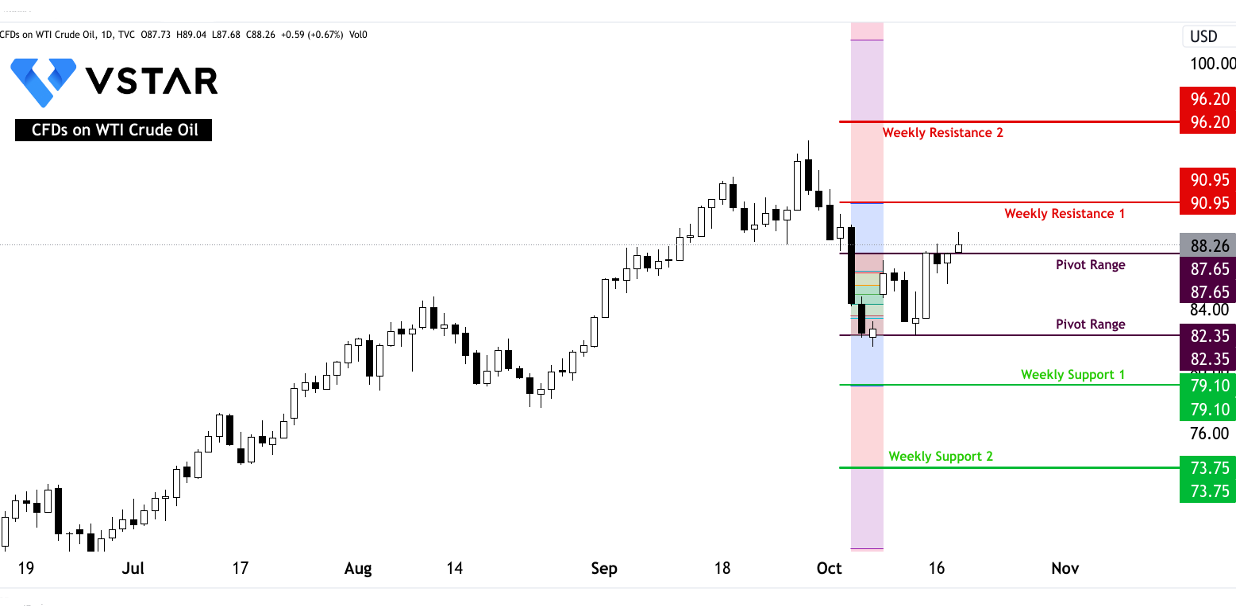

Nuclear Outages

A return to 2021 levels in U.S. summer nuclear outages in 2023

The nuclear generating capacity outages averaged 3.1 gigawatts (GW) per day during the summer of 2023, a notable increase from the previous summer, exceeding summer 2022 outages by over 25%. The peak capacity outages occurred in June, with an average of 6.1 GW per day and a peak of 8.3 GW.

Source: eia.gov

Nuclear power plants undergo both planned and unplanned outages, impacting electricity supply and, indirectly, energy markets like crude oil. Let's delve into the specifics and potential implications:

Planned Nuclear Outages

Planned nuclear generation outages are typically scheduled to coincide with reactor refueling cycles, occurring every 18 to 24 months. These outages are mostly planned during fall and spring when electricity demand is lower. During refueling outages, plants often conduct facility upgrades, repairs, and maintenance work.

In 2023, U.S. nuclear plant refueling outages averaged 35 days, slightly shorter than the 38 days in 2022. Some reactors were offline for more extended periods, such as Millstone Nuclear Plant in Waterford, Connecticut, which was offline for 89 days, and the Columbia Generating Station in Richland, Washington, which had a 44-day outage extending into June.

The shorter average length of planned nuclear outages in 2023 could lead to improved electricity generation capacity. Shorter outages mean that nuclear power plants can return to generating electricity faster, potentially reducing the demand for alternative energy sources like natural gas, which is often used during peak electricity demand. This could impact crude oil indirectly by affecting the demand for energy sources in the power generation sector.

Unplanned Nuclear Outages

Unplanned or forced nuclear generation outages can result from equipment failure, operational errors, or external circumstances such as severe weather. In 2023, there were 31 unplanned nuclear outages, a slight reduction from the 35 in 2022. These reductions in unplanned outages contribute to the stability of electricity supply.

Specific cases, such as the Fermi Nuclear Generating Station's shutdown due to a coolant leak and Vogtle Unit 3's unplanned maintenance outage, highlight that unexpected disruptions can still occur. The impact of these specific outages on energy markets depends on their capacity and regional significance.

Reducing unplanned outages in the nuclear power sector can help maintain a stable and reliable electricity supply. A stable electricity supply can influence the energy market, including crude oil, as it impacts the need for backup energy sources in case of power shortages. Lower occurrences of unplanned outages can reduce the reliance on alternative energy sources like natural gas and crude oil for electricity generation.

Crude Oil Market

Now, let's shift our focus to the state of the crude oil market as of October 12, 2023.

Crude Oil Refinery Inputs

The US crude oil refinery inputs averaged 15.2 million barrels per day, with a slight decrease of 399 thousand barrels per day from the previous week. Refineries operated at 85.7% of their operable capacity. This suggests a decrease in crude oil processing, which may be due to factors like maintenance or decreased demand.

A decline in refinery inputs can impact crude oil demand. When refineries process less crude oil, it can result in an oversupply of crude oil in the market, potentially leading to lower crude oil prices.

Crude Oil Imports

Crude oil imports averaged 6.3 million barrels per day, with an increase of 115 thousand barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 6.6 million barrels per day, indicating a 3.5% increase compared to the same period in the previous year.

Increasing crude oil imports suggest a higher reliance on foreign oil sources to meet domestic demand. This can have implications for the crude oil market, as it reflects the dynamics of global oil trade and influences supply and demand in the U.S.

Crude Oil Inventories

U.S. commercial crude oil inventories increased by 10.2 million barrels from the previous week, reaching a total of 424.2 million barrels. Importantly, this inventory level is about 3% below the five-year average for this time of year.

Growing crude oil inventories, while below the five-year average, indicate an accumulation of crude oil stocks. An increase in crude oil inventories can suggest an oversupply in the market, which, if sustained, can exert downward pressure on crude oil prices.

Petroleum Inventories

The total commercial petroleum inventories increased by 6.3 million barrels in the last week. This includes various petroleum products, not just crude oil. This rise in inventories, once again, signifies increased supply or reduced demand for petroleum products, affecting the broader energy market.

Crude Oil Prices

The West Texas Intermediate (WTI) crude oil price was $82.83 per barrel on October 6, 2023. This price is $7.94 lower than the previous week and $10.24 less than the price a year ago. The spot price for conventional gasoline at New York Harbor and No. 2 heating oil also decreased significantly.

The substantial drop in crude oil prices over the past week and year can be attributed to the combination of increased crude oil inventories and reduced demand, which can lead to price depreciation.

Gasoline and Diesel Prices

The national average retail price for regular gasoline was $3.684 per gallon on October 9, 2023, which is $0.114 less than the previous week and $0.228 lower than the price at the same time last year. The national average retail price for diesel fuel also decreased.

The decline in gasoline and diesel prices indicates a benefit for consumers who experience lower transportation costs. This can potentially lead to increased consumer spending and stimulate economic activity.

Implications

The reduction in planned nuclear outages and fewer unplanned outages indicates a more stable electricity supply. A stable supply of electricity can reduce the need for alternative energy sources like natural gas and crude oil, impacting the energy market.

The decrease in crude oil refinery inputs and increasing crude oil inventories suggests a potential oversupply in the crude oil market. Oversupply typically exerts downward pressure on crude oil prices. Crude Oil CFDs' valuations may reflect this downward trend.

Lower gasoline and diesel prices can reduce transportation costs for consumers, potentially increasing discretionary income and stimulating economic activity. This can indirectly influence the demand for crude oil and its derivatives.

It's crucial to remember that the energy market is influenced by various factors, including geopolitical events, international oil production, and demand trends.

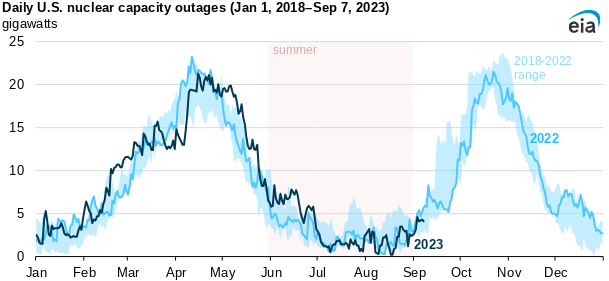

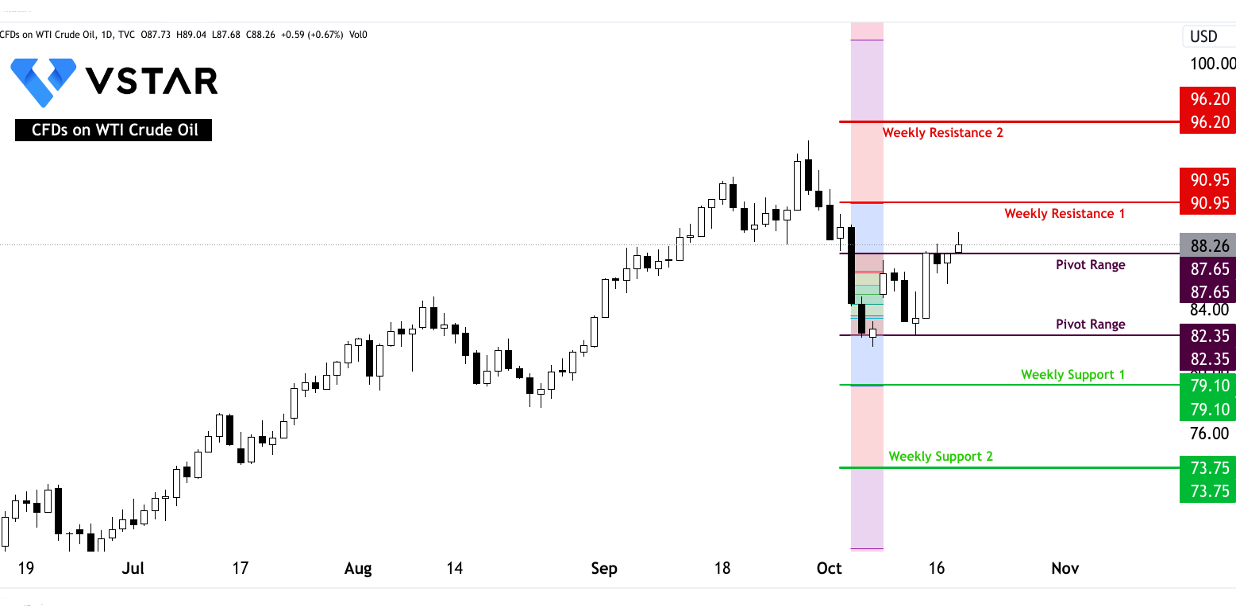

The technical perspective on the weekly price moves of CFDs on WTI Crude Oil can be comprehended as follows:

Source: tradingview.com