I. Research and monitor the market

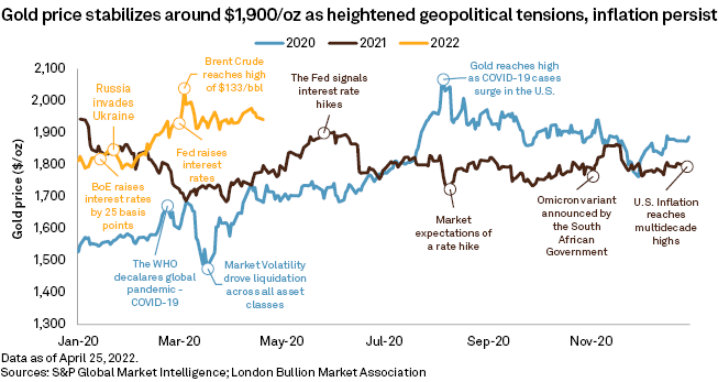

Successful gold trading requires a comprehensive approach that includes researching and monitoring the market. Traders need to stay up-to-date with economic data, geopolitical events, and market trends to gauge the potential impact on gold prices. Additionally, employing technical analysis techniques can assist in identifying key support and resistance levels, helping traders make informed decisions about entry and exit points.

Stay up-to-date with current events that could impact the price of gold, such as economic data, geopolitical events, and market trends.

Gold trading requires careful research and monitoring of the market in order to make informed decisions and maximize profits. Expert traders emphasize the importance of staying up-to-date with current events that could potentially impact the price of gold. Economic data, geopolitical events, and market trends all play a significant role in influencing the value of this precious metal.

To begin with, economic data releases can have a substantial impact on the price of gold. For example, if there is a positive jobs report indicating a strong economy, it might lead to increased investor confidence in other assets, causing a decrease in the demand for gold as a safe-haven asset. On the other hand, if there is negative economic data suggesting a downturn, investors may flock to gold as a hedge against market volatility, leading to an increase in its price. By staying informed about such economic indicators, traders can anticipate market movements and make well-timed trades.

Geopolitical events also have the potential to significantly impact the price of gold. Instances such as political unrest, trade disputes, or major international crises can create uncertainty and drive investors towards gold as a safe haven. For instance, if there is political instability in a region, investors may seek the stability and security of gold, resulting in an increase in its demand and price. By closely monitoring geopolitical developments, traders can anticipate shifts in market sentiment and adjust their trading strategies accordingly.

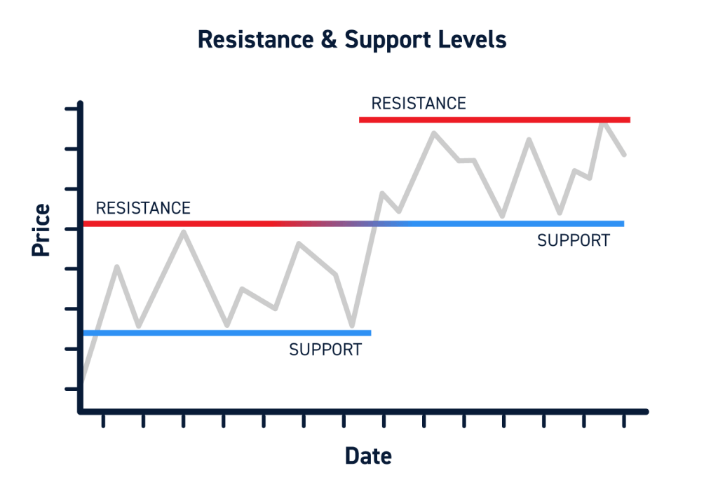

Use technical analysis to identify key support and resistance levels as well as potential entry and exit points.

Moreover, expert traders rely on technical analysis to identify key support and resistance levels in the gold market. Support levels represent price levels at which the demand for gold is expected to be strong, preventing it from falling further. Resistance levels, on the other hand, indicate price levels at which selling pressure increases, making it difficult for gold to rise above that level. By identifying these levels, traders can determine potential entry and exit points for their trades.

For instance, if the price of gold approaches a well-established support level, it may present a buying opportunity for traders who believe that the price will rebound. Conversely, if the price approaches a strong resistance level, it might be a suitable time to sell or take profits. Technical indicators, such as moving averages, trend lines, and oscillators, can provide additional insights into market trends and potential turning points.

Source: centerpointsecurities.com

II. Choose your trading instrument carefully. Gold futures or gold CFDs

Study the difference between gold futures and CFDs.

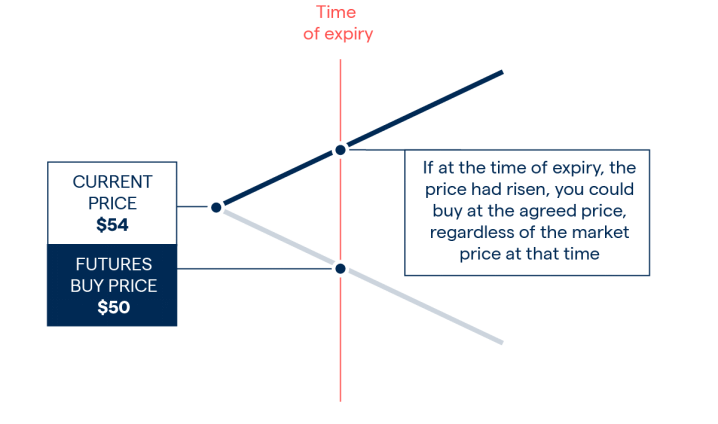

When it comes to gold trading, selecting the appropriate trading instrument is crucial for achieving success. Expert traders suggest considering two common options: gold futures and gold contracts for difference (CFDs). However, it is essential to carefully study the differences between these instruments and identify which one aligns with your trading goals, risk tolerance, and financial capabilities.

Gold futures are standardized contracts that oblige the buyer to purchase a specific quantity of gold at a predetermined price and date in the future. These contracts are traded on regulated exchanges, such as the Chicago Mercantile Exchange (CME), and require a significant amount of capital to participate. Gold futures have specific contract sizes, such as 100 troy ounces, which means traders need to have substantial financial resources to meet margin requirements.

Source: ig.com

One advantage of trading gold futures is the transparency and liquidity of the market. The regulated exchange ensures fair trading conditions and efficient execution of orders. Additionally, futures contracts provide a clear timeline for delivery or settlement, which can be advantageous for traders with longer-term strategies. However, trading gold futures carries risks, such as price volatility and potential margin calls if the market moves against the trader.

On the other hand, gold CFDs are derivative instruments that allow traders to speculate on the price movements of gold without owning the underlying asset. CFDs are typically offered by online brokers and provide traders with leverage, enabling them to control larger positions with a smaller amount of capital. This feature makes CFDs more accessible to retail traders with limited financial resources.

Source: ig.com

One advantage of trading gold CFDs is the flexibility they offer. Traders can enter and exit positions more easily as there are no specific contract sizes or delivery obligations. CFD trading also provides the opportunity to profit from both rising and falling gold prices through long (buy) or short (sell) positions. However, it is important to note that trading CFDs involves higher leverage and carries the risk of potential losses exceeding the initial investment.

Identify which instrument aligns with your trading goals, risk tolerance, and financial capabilities.

Choosing between gold futures and gold CFDs requires careful consideration of one's trading goals, risk tolerance, and financial capabilities. If a trader has a substantial amount of capital, is comfortable with the strict regulations of a futures exchange, and seeks a longer-term investment or hedging strategy, gold futures may be a suitable choice.

On the other hand, if a trader has limited capital, prefers more flexibility in position sizing and time horizons, and is comfortable with the risks associated with leverage, gold CFDs may be more appropriate. CFDs are also advantageous for traders who wish to participate in gold trading through online brokers that provide access to various other financial instruments.

Ultimately, the choice between gold futures and gold CFDs should be based on a trader's individual circumstances and preferences.

III. Use leverage wisely

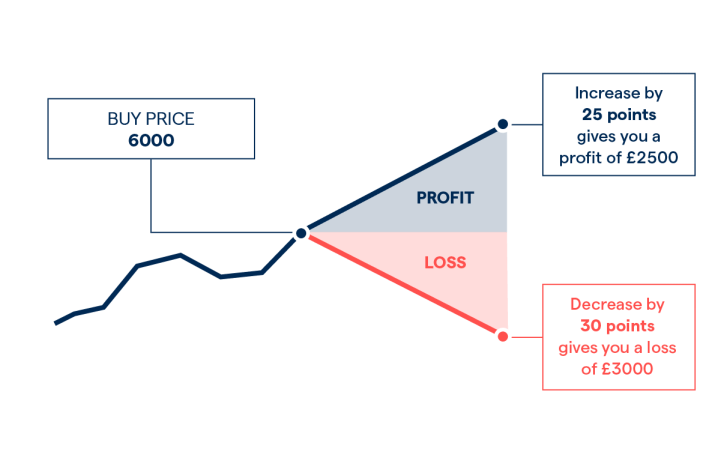

Leveraging can offer opportunities for increased profits in gold trading, but it should be approached with caution. Traders must fully understand the risks associated with leverage and have a well-defined trading plan in place. Implementing risk management techniques, such as setting stop-loss orders, is crucial to limiting potential losses and protecting trading capital. By using leverage wisely and employing effective risk management strategies, traders can enhance their chances of success in gold trading.

Only use leverage if you fully understand the risks and have a solid trading plan in place.

Leverage can be a powerful tool in gold trading, but it should be used wisely and with caution. Expert traders emphasize the importance of fully understanding the risks associated with leverage and having a solid trading plan in place before utilizing it. Additionally, implementing risk management techniques like stop-loss orders can help limit potential losses.

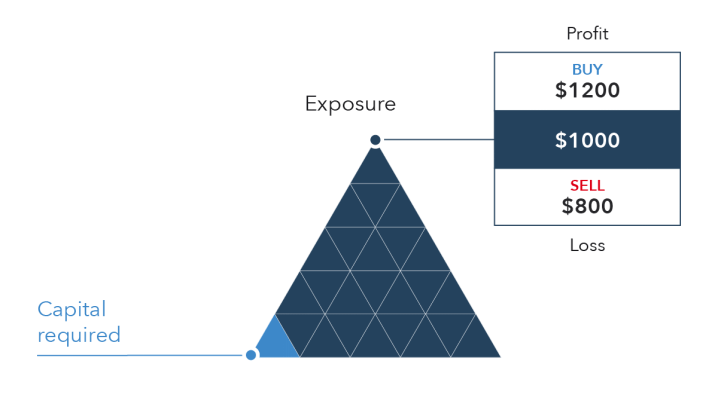

Leverage allows traders to control a larger position in the market with a smaller amount of capital. For example, if a broker offers a leverage ratio of 1:10, a trader can control a position worth $10,000 with just $1,000 of their own capital. This amplifies both potential profits and losses. While leverage can magnify gains, it also increases the risk of significant losses if the trade goes against the trader's expectations.

Source: ig.com

Before utilizing leverage, it is crucial to have a thorough understanding of how it works and the potential risks involved. Traders should educate themselves about margin requirements, margin calls, and the impact of leverage on their trading capital. Without proper knowledge, traders may find themselves in situations where they are unable to meet margin requirements or face substantial losses due to the amplified effect of leverage.

Furthermore, having a solid trading plan is essential when using leverage. A trading plan outlines the trader's goals, risk tolerance, entry and exit strategies, and overall approach to trading. By having a plan in place, traders can better manage their positions and make informed decisions based on their pre-defined rules. This includes determining the appropriate leverage level based on their risk tolerance and the specific market conditions.

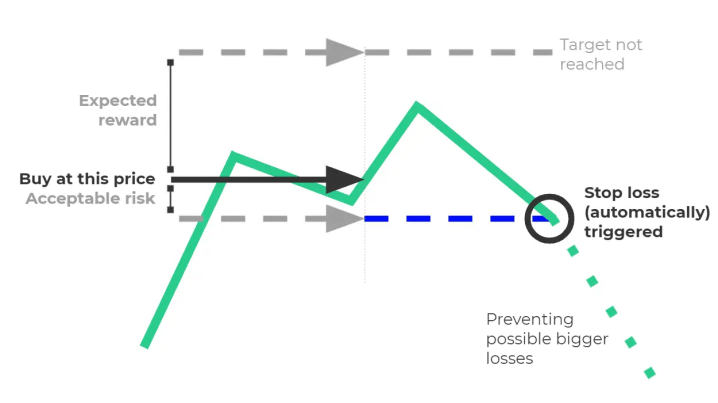

Consider using stop-loss orders to limit potential losses

Risk management is a critical aspect of successful gold trading. One risk management technique that traders can employ when using leverage is the use of stop-loss orders. A stop-loss order is a predetermined price level at which the trader's position is automatically closed to limit potential losses. By setting a stop-loss order, traders can protect themselves from significant drawdowns in the event that the market moves against their position.

Source: patternswizard.com

For example, if a trader enters a long position on gold with a leverage ratio of 1:100 and sets a stop-loss order at 2% below their entry price, their position will automatically be closed if the market moves 2% against them. This helps to control risk and prevent losses from escalating beyond a certain threshold.

It is worth noting that while stop-loss orders are an effective risk management tool, they are not foolproof. In highly volatile market conditions or during news events with significant price gaps, the execution of stop-loss orders may differ from the intended level. Traders should be aware of this possibility and consider implementing additional risk management strategies, such as trailing stop-loss orders or diversifying their positions.

IV. Diversify your portfolio

Invest in a variety of assets to spread out risk and reduce exposure to any one asset or currency

Diversifying one's portfolio is a key strategy recommended by expert traders for successful gold trading. By investing in a variety of assets, traders can spread out their risk and reduce their exposure to any single asset or currency. In addition to gold, considering investments in other precious metals, commodities, or currencies can further enhance portfolio diversification.

When traders diversify their portfolio, they allocate their capital across different asset classes or instruments. This is based on the understanding that different assets have varying performance patterns and may respond differently to economic conditions or market events. By diversifying, traders aim to reduce the impact of any one asset's poor performance on the overall portfolio and increase the chances of achieving consistent returns.

Consider investing in other precious metals, commodities, or currencies to diversify your portfolio

In the context of gold trading, diversification can involve allocating a portion of the portfolio to other assets that exhibit different characteristics from gold. For example, traders may consider investing in other precious metals such as silver, platinum, or palladium. These metals often have their own supply and demand dynamics and may respond differently to market forces compared to gold. By including other precious metals in the portfolio, traders can potentially benefit from their individual price movements and reduce their reliance solely on gold.

Furthermore, diversification can extend beyond precious metals to include other commodities. Commodities like oil, natural gas, agricultural products, and industrial metals have their own market drivers and can provide additional diversification benefits. For instance, during periods of economic growth, industrial metals like copper or aluminum may perform well due to increased demand in construction and infrastructure projects. By diversifying into different commodities, traders can capture opportunities across various sectors and reduce their exposure to any single commodity's price volatility.

Additionally, traders can consider diversifying their portfolio by including investments in different currencies. The value of gold is often influenced by currency fluctuations, as it is denominated in a particular currency (typically the US dollar). By investing in other currencies, traders can hedge against currency risk and potentially benefit from currency movements. For example, if a trader expects the value of the US dollar to weaken, they may allocate a portion of their portfolio to currencies such as the Euro, British Pound, or Japanese Yen.

It is important to note that diversification does not guarantee profits or protect against losses. However, it can be an effective risk management strategy by reducing concentration risk and enhancing the potential for consistent returns over the long term.

To implement diversification effectively, traders should carefully assess their risk tolerance, investment goals, and market conditions. They should consider factors such as correlation between assets, market trends, and their own knowledge and expertise. Additionally, it is recommended to seek professional advice or conduct thorough research when diversifying into new asset classes or instruments.

V. Choose a reliable broker

Choosing a reliable broker is a crucial aspect of successful gold trading. Expert traders emphasize the importance of selecting a broker that is regulated and has a strong reputation in the industry. Additionally, traders should carefully review the broker's fees and trading conditions to ensure they align with their trading style and financial goals.

Select a broker that is regulated and has a strong reputation in the industry

Regulation is a fundamental factor to consider when choosing a broker. Regulated brokers are subject to oversight by financial authorities, which helps ensure they operate in a fair and transparent manner. Regulatory bodies impose certain standards and requirements on brokers to protect the interests of traders and maintain the integrity of the financial markets. By selecting a regulated broker, traders can have confidence in the broker's compliance with industry regulations and the security of their funds.

A strong reputation in the industry is another important criterion for choosing a broker. Traders should research and consider brokers with a track record of providing reliable and efficient services. They can seek feedback from other traders, read reviews and testimonials, and assess the broker's overall reputation within the trading community. A broker with a solid reputation is more likely to provide a trustworthy trading environment and reliable customer support.

Review the broker's fees and trading conditions to ensure they align with your trading style and financial goals

In addition to regulation and reputation, traders should carefully evaluate the broker's fees and trading conditions. Different brokers may have varying fee structures, such as commissions, spreads, or overnight financing charges. Traders should compare these costs among different brokers to ensure they align with their trading style and financial goals. For instance, if a trader frequently engages in short-term trading, a broker with low spreads and commissions may be more cost-effective.

Source: avatrade

Furthermore, traders should consider the trading conditions offered by the broker. This includes factors such as available trading platforms, order execution speed, liquidity, and the range of financial instruments offered. The trading platform should be user-friendly and stable and provide the necessary tools and features for effective gold trading. Efficient order execution and access to liquidity are essential for executing trades in a timely manner. Traders should also assess whether the broker offers a variety of gold-related instruments, such as spot contracts, futures, or CFDs, to suit their preferred trading approach.

It is also worth considering the broker's customer support and educational resources. A reliable broker should provide responsive and helpful customer support to assist traders with their queries or technical issues. Educational resources, such as tutorials or market analysis, can be valuable for traders seeking to enhance their knowledge and skills in gold trading.

VI. Have a solid trading plan

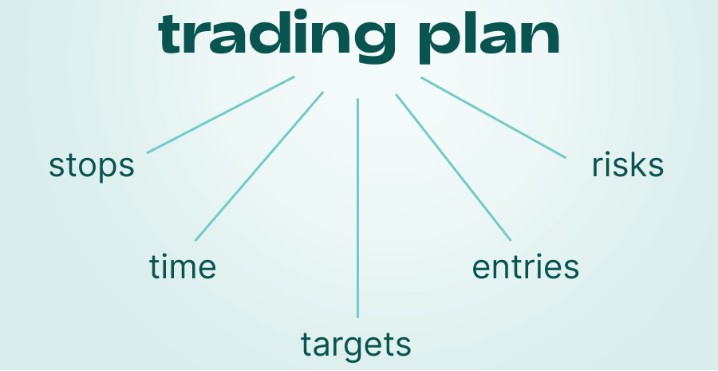

Having a solid trading plan is a fundamental element of successful gold trading. Expert traders emphasize the importance of establishing clear entry and exit points, setting realistic profit targets, and implementing effective risk management strategies. Furthermore, continuously reviewing and adjusting the trading plan based on market conditions is crucial for adapting to changing dynamics.

A trading plan serves as a roadmap for traders, guiding their decision-making process and providing structure to their trading activities. It outlines the trader's goals, preferred trading style, risk tolerance, and specific rules for entering and exiting trades. By having a well-defined plan, traders can approach the market with discipline and consistency, reducing the influence of emotions on their trading decisions.

Establish clear entry and exit points before entering a trade

One key aspect of a trading plan is establishing clear entry and exit points. Traders should determine the criteria that need to be met before entering a trade, such as technical indicators, chart patterns, or fundamental analysis. This helps to filter out potential trades that do not meet the predetermined criteria, reducing the likelihood of impulsive or emotional trading decisions.

Set realistic profit targets and risk management strategies

Similarly, defining exit points is crucial for managing risk and capturing profits. Traders should set realistic profit targets based on their analysis and market conditions. This can involve identifying key levels of resistance or support where price reversals or consolidations are likely to occur. Having predefined exit points helps traders secure profits and limit losses, as they are less likely to hold on to positions in hopes of unrealistically large gains or tolerate excessive losses.

Implementing effective risk management strategies is another critical component of a trading plan. Traders should determine the maximum amount of capital they are willing to risk on any single trade or in a given period. This can be expressed as a percentage of the trading account balance or in monetary terms. Additionally, using tools such as stop-loss orders, trailing stops, or position sizing techniques can help control risk and protect capital.

Review and adjust your plan as necessary based on market conditions

Moreover, continuously reviewing and adjusting the trading plan is essential for adapting to market conditions. The financial markets are dynamic, and factors influencing gold prices can change rapidly. Traders should regularly assess their trading plan to ensure it remains aligned with current market dynamics and their own evolving strategies. This may involve incorporating new indicators or adjusting profit targets and risk management strategies based on ongoing analysis and market trends.

An example of adjusting a trading plan based on market conditions could be during periods of increased volatility or economic events with significant impact. In such situations, traders may choose to tighten their profit targets or widen their stop-loss levels to account for heightened price fluctuations. Similarly, if market conditions indicate a significant shift in the trend or a change in the underlying factors affecting gold prices, traders may consider adjusting their entry and exit strategies accordingly.

VII. Consider using technical indicators

The use of technical indicators is a common strategy shared by expert traders for successful gold trading. Technical indicators, such as moving averages, MACD (moving average convergence divergence), and RSI (relative strength index), can assist traders in identifying potential trends and determining entry and exit points. Combining technical analysis with fundamental analysis provides traders with a more comprehensive approach to understanding and interpreting market dynamics.

Technical indicators are mathematical calculations based on historical price and volume data. They help traders analyze and interpret price patterns, trends, and market sentiment. By incorporating these indicators into their analysis, traders aim to make informed trading decisions based on the signals generated.

Use technical indicators such as Moving Averages, MACD, and RSI to help identify potential trends and entry and exit points

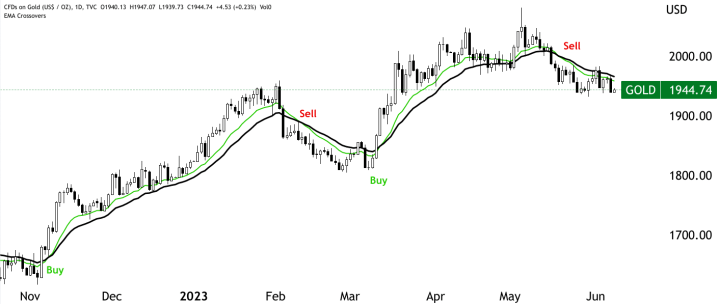

Moving averages are widely used technical indicators in gold trading. They smooth out price fluctuations and help identify the direction and strength of a trend. The most commonly used moving averages are the simple moving average (SMA) and the exponential moving average (EMA). Traders often use the crossover of different moving averages or the price's relationship to the moving average as a signal for potential entry or exit points.

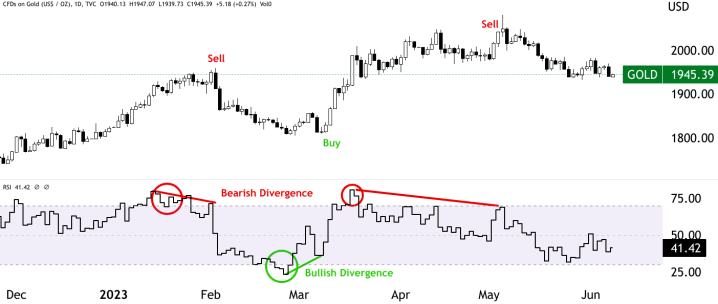

The MACD is another popular technical indicator that combines moving averages to identify potential trend reversals, momentum shifts, and market divergences. It consists of a MACD line, a signal line, and a histogram. Traders look for crossovers between the MACD line and the signal line, as well as divergences between the MACD and price, to generate trading signals.

The RSI is a momentum oscillator that measures the speed and change of price movements. It helps traders assess whether an asset is overbought or oversold and can indicate potential trend reversals (with the use of divergence). The RSI ranges from 0 to 100, and readings above 70 suggest overbought conditions, while readings below 30 indicate oversold conditions.

Source: tradingview.com

Combine technical analysis with fundamental analysis for a more comprehensive approach

While technical indicators can provide valuable insights, they have limitations and are not foolproof. Market conditions can sometimes render technical indicators less reliable, especially during periods of high volatility or when unexpected news events occur. Therefore, it is essential to use technical indicators in conjunction with other forms of analysis, such as fundamental analysis.

Fundamental analysis involves examining economic, geopolitical, and other relevant factors that can influence gold prices. It focuses on factors such as interest rates, inflation, central bank policies, geopolitical tensions, and economic data releases. By considering fundamental factors alongside technical indicators, traders can gain a more comprehensive understanding of market dynamics and make more informed trading decisions.

For example, suppose technical indicators signal a potential bullish trend in gold based on moving average crossovers and RSI readings. Traders can then examine fundamental factors such as geopolitical tensions or a weakening global economy that may support the bullish outlook. Conversely, if technical indicators indicate a bearish trend, traders can look for fundamental factors such as a strong U.S. dollar or positive economic data that may confirm the bearish sentiment.

By combining technical and fundamental analysis, traders can improve their ability to anticipate market movements and increase their confidence in their trading decisions. However, it is important to note that no analysis method can guarantee accurate predictions or eliminate all risks. The markets are complex and influenced by various factors, and prices can deviate from the expectations generated by technical indicators and fundamental analysis.

Source: YahooFinance

VIII. Be patient and disciplined

Being patient and disciplined is a key aspect of successful gold trading, as emphasized by expert traders. It involves avoiding impulsive decisions based on emotions or short-term market fluctuations and adhering to a well-defined trading plan. By maintaining patience and discipline, traders can improve their decision-making process and increase their chances of long-term success.

Avoid making impulsive decisions based on emotions or short-term market fluctuations

One of the common pitfalls in trading is succumbing to emotions such as fear or greed, which can lead to impulsive decision-making. For example, during periods of market volatility, it is natural for emotions to run high, and traders may feel compelled to make quick decisions in response to rapid price movements. However, acting on impulse can often result in poor trading outcomes.

By practicing patience, traders can avoid acting on short-term market fluctuations and instead focus on the bigger picture. It is important to remember that gold prices can experience significant daily fluctuations, but the long-term trend is often more reliable and meaningful. Making decisions based on short-term price movements can lead to overtrading, chasing trends, or exiting positions prematurely.

Stick to your trading plan and remain disciplined in your approach to trading

Discipline is closely linked to patience and involves sticking to a well-defined trading plan. A trading plan outlines specific rules and strategies for entering and exiting trades, managing risk, and determining position sizes. It helps traders maintain a structured approach to their trading activities and minimizes the influence of emotions.

For example, if a trader's plan dictates that a certain technical indicator or a specific price level must be reached before entering a trade, discipline requires waiting for those conditions to be met rather than entering prematurely based on impatience or FOMO (fear of missing out). Similarly, discipline means adhering to predetermined risk management strategies, such as using stop-loss orders to limit potential losses.

Source: fbs.com

By being patient and disciplined, traders can avoid the detrimental effects of impulsive decision-making and increase their chances of making rational and well-informed trading choices. Patience allows traders to wait for high-probability setups that align with their trading plan, while discipline ensures that they follow through with their plan without deviating based on emotional impulses.

Furthermore, patience and discipline contribute to the overall consistency of a trader's approach. Consistency is key in trading because it allows traders to evaluate their strategies and make necessary adjustments over time. By consistently following their trading plan, traders can gather valuable data and feedback on the effectiveness of their strategies and make informed decisions regarding their trading approach.