Some investors fled from Square stock after the company reported a large annual loss for 2022, and short-seller Hindenburg Research accused the company of fraud. Consequently, SQ stock price has retreated nearly 80% from its peak of about $282 to just about $60 now. In this situation, you may be wondering whether SQ stock is a buy or sell.

While no investment is totally risk-free, the market appears to have punished Square stock excessively. Firstly, the company reported strong Q1 2023 results, a sign that its financial performance is improving and that its profitability may be better this year than in the previous one.

Secondly, Square has offered a credible rebuttable of Hindenburg's fraud allegations. If that is the case, the sharp pullback may be a rare opportunity to buy SQ stock at a steep discount.

This article explores Square's business model, financials, challenges, and growth opportunities to help you decide if investing in SQ stock is right for you. You'll find out how Square makes money, the company's addressable market, and the Square stock forecast. But first, get to know the company.

Block Inc (Square) Overview

Although many continue to refer to it as Square, the company is officially known as Block Inc (NYSE: SQ). As a result, many investors use Square stock and Block stock interchangeably.

Founded in 2009, Square restructured and rebranded to Block in 2021.

If you recall Google's transformation into Alphabet (NASDAQ: GOOGL) or Facebook's transformation to Meta Platforms (NASDAQ: META), it is the same thing that happened to Square. The restructuring created Block as the holding company with Square as one of its units.

Who owns Block Inc

The majority shareholder and CEO of Block Inc is Jack Dorsey, who is best known as the co-founder and former CEO of Twitter. Block's founders are Jack Dorsey and Jim McKelvey. Both of the founders are now billionaires. Dorsey runs the company as the CEO, while McKelvey is a member of the company's board of directors.

Block (NYSE: SQ) listed San Francisco, California, as its corporate headquarters until 2021 when it shifted to the remote work model. Under this model, the company's employees are spread across multiple locations. As a result, Block no longer has an official headquarters location.

With a market cap of more than $35 billion, Block ranks as one of the major fintech providers.

Square's Business Model and Products

Business Model

The company provides technology-driven financial services to consumers and merchants through its various units. To consumers, Block provides a way to send money to others, trade stocks and cryptocurrencies, and pay for purchases with an app or a debit card. To merchants, it processes payments and provides loans.

The company started off selling point-of-sale card readers to small businesses. Square's card readers allowed small businesses such as restaurants and salons to accept credit card payments. Targeted at an underserved market, Square's card readers became a quick hit. The company built on that success to expand its business beyond selling POS hardware to offering an array of services to small businesses.

Although Block still sells POS hardware products, much of its revenue now comes from services. In the services segment, the company mostly makes money from transaction fees and subscription charges.

Main Products and Services

While many only know Block as a fintech provider, the company also runs web hosting and music streaming services. These are Block's major business brands and what they do:

Square: This is Block's flagship unit. Through Square, Block sells POS hardware products, processes card payments for merchants, provides merchant loans, and offers tax preparation services.

Cash App: This is primarily a digital wallet. It is available as an app with an associated debit card. Cash App allows you to send money to your contacts, pay for purchases, withdraw cash at the ATM, and trade crypto and stocks.

Cashapp history: It was launched in 2013 and quickly became popular for its simplicity and lack of fees. Over time, Cash App has expanded its services from peer-to-peer payments to include bitcoin trading, stock trading, direct deposit for paychecks, and a debit card connected to a Cash App balance.

Afterpay: This is Block's buy now pay later (BNPL) brand. Afterpay allows you to buy what you want on credit and get it upfront and then deal with the payment later. With Afterpay, you can pay for a purchase in four installments.

Weebly: This is a web building and hosting platform. Weebly provides small businesses with the tools they need to set up and run online shops. These businesses can then go on and use Square to process payments.

Tidal: This is a music streaming platform that connects artists with their fans. Tidal lets you find and listen to your favorite songs online. It offers millions of songs on a subscription basis.

Block's Financial Performance

Block's financial year begins in January and ends in December. The company reports its financial results on a quarterly basis, culminating with an annual report at the end of the year. Here is a look at Block's financial performance:

Revenue Growth

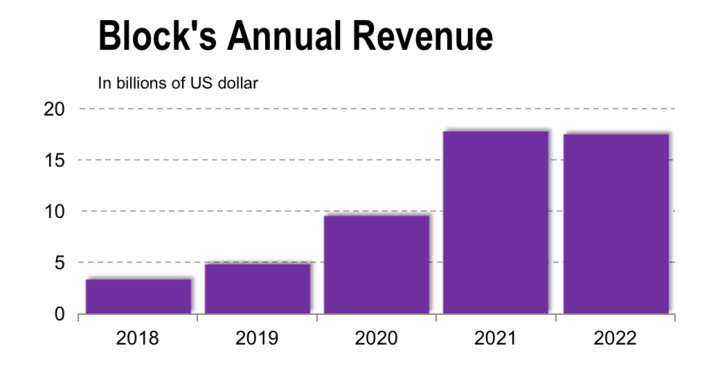

Block (NYSE: SQ) generated revenue of $17.5 billion in 2022, representing a decline of about 1% from the previous year. That marked the first time that the company reported an annual revenue decline since the IPO, which begs the question of what happened in 2022. Block's business has exposure to Bitcoin and the revenue decline in 2022 was mostly attributed to the weakness in Bitcoin price. Excluding the Bitcoin impact, Block's revenue grew 36% in 2022.

Looking back, Block has historically reported strong revenue growth. The company's revenue increased 86% in 2021, following a more than 100% increase in 2020. Block's revenue has increased at a compound annual growth rate of 40% over the past 5 years.

The chart below illustrates Block's annual revenue trend.

The company's revenue is forecast to grow 18% to $20.7 billion in 2023. Indeed, Block is off to a strong start to the year with its revenue increasing 26% year-over-year in the first quarter.

Net Income

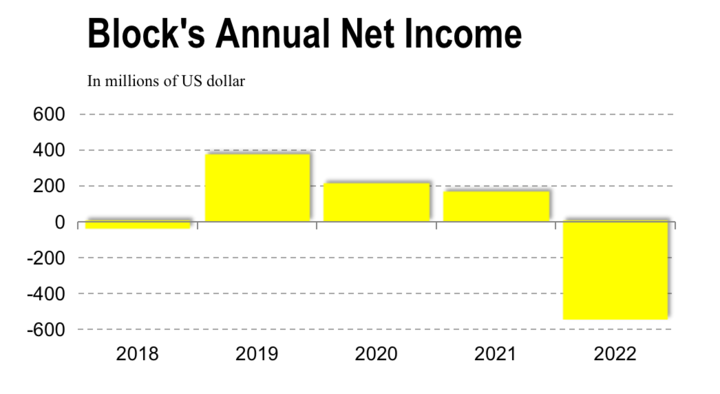

Block (NYSE: SQ) swung to a rare annual loss in 2022. It reported a net loss of $540 million, which was caused by soaring costs. Looking past 2022, the company has had a string of profitable years. It posted a profit of $166 million in 2021, which followed a profit of 213 million in 2020 and a profit of $375 million in 2019.

The chart below illustrates Block's net income trend over the past 5 years.

After the stunning loss in 2022, Block (NYSE: SQ) is setting up to improve its profitability in 2023. The company is counting on revenue growth and cost reductions to improve its bottom line this year. Indeed, there are already promising signs after Block sharply narrowed its first quarter loss to just over $16 million from more than $200 million a year ago.

Profit Margins

Block (NYSE: SQ) has maintained a strong gross profit margin for many years. The company's gross margin was 34% in 2022, improving from 25% in 2021, and 28% in 2020. With such a high gross margin, it becomes clear that the company can be more profitable if it succeeds in reducing its operating expenses as it has set out to do.

Block has identified cost-cutting opportunities in sales and marketing and payroll expenses. For example, the company has decided to slow hiring to lower its payroll costs. It also sees an opportunity in using artificial intelligence technology to bolster its operational efficiency.

Cash Position and Balance Sheet Condition

Block (NYSE: SQ) stands on solid financial grounds. The company ended Q1 2023 with cash and cash equivalents of $7 billion. It also has access to $600 million in a revolving credit facility. The management has said that the available liquidity is sufficient to meet the company's financial requirements.

On top of the strong liquidity, Block has a solid balance sheet with more than $31 billion in assets and only $13 billion in liabilities.

Block's debt-to-equity ratio of 0.32 is better than PayPal's (NASDAQ:PYPL) 0.53 and Affirm's (NASDAQ:AFRM) 1.90.

SQ Stock Performance

Square Symbol: Block stock trades on the NASDAQ exchange under the ticker symbol "SQ".

Block, then trading as Square, went public in November 2015 at an IPO price of $9 per share in a deal that valued it at $2.9 billion. It was a strong debut as SQ stock price popped up 45% on its first day of trading to close above $13, achieving a market cap of $4.4 billion.

Square stock price went on to hit an all-time high of about $282 in August 2021. Notably, the stock reached that peak price soon after Square announced that it would acquire BNPL provider Afterpay in an expansion of its business. Although SQ stock has since retreated sharply from its peak, it still boasts a hefty return of 570% over its IPO price.

Why Square Stock Is Down

SQ stock price fell 6% in February after Block reported a surprise annual loss for 2022. The stock again dropped 10% in March after short-seller Hindenburg alleged that Block was misleading investors about the growth of its Cash App platform.

A turbulent global economy characterized by high inflation and rising interest rate has also put pressure on fintech stocks across the board. Consequently, Square stock price has retreated about 30% over the past year. That compares to PayPal stock's 25% decline and Affirm stock's nearly 50% pullback over the same period.

SQ Stock Forecast

Considering Square's steep decline, you might be debating whether to buy the dip or stay away from this fintech stock. According to Wall Street analysts, SQ stock is a buy. And Block stock price predictions suggest that further downside is limited after the stock's recent fall.

Wall Street's average 12-month SQ price target of about $90 implies over 50% upside. The peak Block stock forecast of $130 suggests as much as 120% upside. And the stock's lowest price target of $63 shows limited downside potential.

These are some of the key drivers of SQ stock price:

Financial performance: Investors pay close attention to Block's financial results. Square stock tends to rise whenever Block reports improvements in revenue and profitability.

Bitcoin price: Block's business has substantial exposure to Bitcoin. As a result, SQ stock can rise when Bitcoin price goes up and decline when Bitcoin price falls.

Economic condition: Block's business flourishes during economic growth and struggles during recessions. As a result, investors tend to be more bullish on SQ stock in a strong economy.

Company news: Block's stock price tends to move on announcements such as acquisitions, product launches, and partnerships.

Square's Challenges and Opportunities

Succeeding in a business requires navigating challenges while taking advantage of opportunities. Let's take a look at the challenges facing Block (NYSE: SQ) and the opportunities lying ahead for the company.

Square's Risks and Challenges

Regulation: Block's brands Square, Cash App, and Afterpay operate in heavily regulated markets. Heightened regulatory measures can slow down the company's growth or increase its compliance costs.

Crypto exposure: Block (NYSE: SQ) has substantial exposure to Bitcoin. The volatility of Bitcoin price can have an adverse impact on Block's financial results.

Competition: Block's biggest challenge is competition. Here are Block's major competitors and the threat they pose to the company:

|

Square competitors |

Threat |

|

PayPal |

Through its namesake platform, PayPal competes with Block's Square unit for merchant payments processing business. Additionally, PayPal's Venmo app competes with Block's Cash App platform. |

|

Affirm |

Block's Afterpay unit faces intense competition from Affirm in the BNPL market. Block's other BNPL competitors are PayPal, Zip, and Klarna. |

|

SoFi |

Cash App faces competition from SoFi in offering cryptocurrency and stock trading services. |

|

Spotify |

Spotify competes with Tidal for online music streaming subscribers. Tidal's other competitors are Amazon, Pandora, Google, and Amazon. |

Square's Competitive Advantages

Although it faces competition from multiple fronts, Block (NYSE: SQ) has a chance to fight and win in its various market segments. Here are some of Block's competitive advantages:

|

Competitive Advantages |

Details |

|

Solid financial position |

With about $7 billion in cash, Block boasts substantial liquidity and financial flexibility to defend its turf and pursue growth. |

|

Strong brand |

Square is one of the most recognized brands in the fintech space. Moreover, Square and Cash App are highly trusted brands among consumers and merchants. |

|

Bank license |

Block operates an industrial bank through its Square unit. With an in-house bank, Block has a tight grip on transaction costs because it doesn't rely much on outside intermediaries. |

|

Diversified business |

Block's diversified operation that spans payments processing, cash transfer, and music streaming help the company to spread its risks. |

|

Stable leadership |

Block is run by its co-founder Jack Dorsey. After quitting as CEO of Twitter, Dorsey has put all his attention on growing Block. |

Square's Growth and Expansion Opportunities

Block (NYSE: SQ) has plenty of room for growth across its business segments. These are some of the company's growth and expansion opportunities:

International expansion: Block's Square and Cash App currently have limited international presence. For example, Square's payments processing service is available in only 8 countries and Cash App is available in only two countries. In contrast, PayPal is available in more than 200 countries. Block can significantly grow its revenue by entering more international markets.

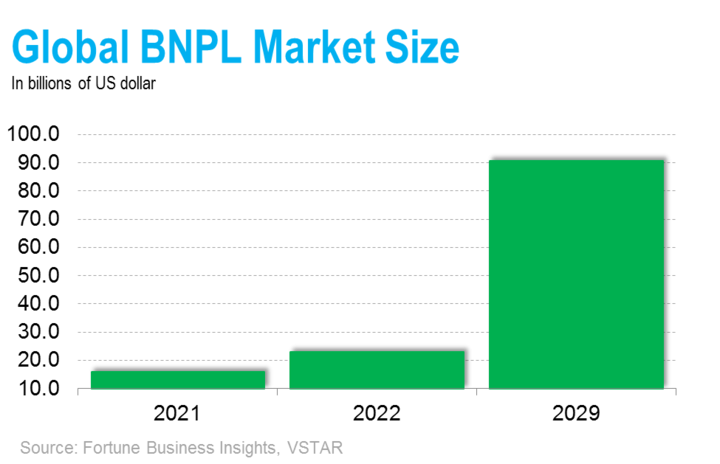

BNPL lending: Block's Afterpay business has a significant revenue opportunity in the buy now pay later market. The global BNPL market size is forecast to grow to over $90.5 billion by 2029, from about $23 billion in 2022. Capturing even 5% of the BNPL market could bring substantial incremental revenue for Block.

Cash App monetization: Cash App's user base is expanding steadily. At the end of March, the platform had 53 million monthly active users. Interestingly, only a tiny fraction of Cash App activities currently make money for Block. Cash App's monetization rate was only 1.41% in Q1 2023. Therefore, Block still has a large untapped revenue opportunity on this platform.

Music streaming: An increasing number of people are turning to listening to music online. As a result, online music streaming market is expanding rapidly. Considering the massive gains that Spotify and Apple are making in streaming music business, this is another area where Block has a large untapped revenue opportunity with its Tidal unit.

Square's Addressable Market

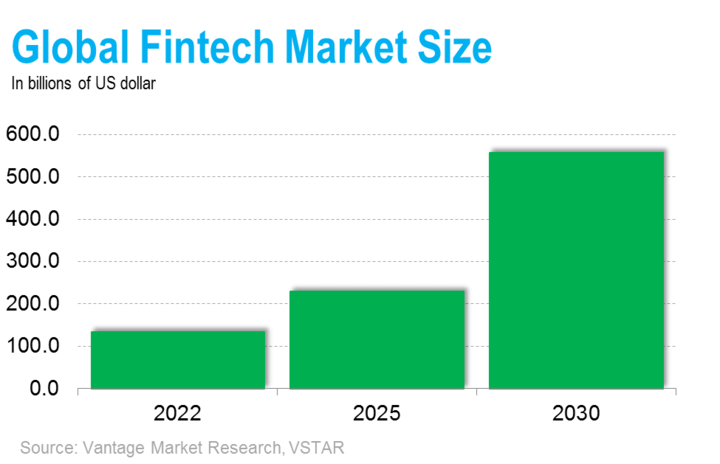

Although Block (NYSE: SQ) operates in various industries, fintech is its primary focus market. Square's addressable market size in the fintech space is on track to surpass $556 billion by 2030, up from $133 billion in 2022.

How to Make Money With SQ Stock

You can make money with SQ stock in three ways: Holding Square shares, trading Square stock options, and trading Square stock CFD. The best way to make money with Square stock depends on your investment timeline, amount of capital, and risk tolerance. Let's look at how these investment methods entail:

|

Investment method |

How it works |

Benefits |

|

Holding shares |

-You buy shares of Square stock and hold them in your brokerage account for months or years. -You count on the stock price appreciating during your holding to make a profit. -Requires a large initial capital to purchase a reasonable number of shares. |

-You get shareholder voting rights. -Best for long-term investment timeline. |

|

Trading options |

-You purchase a call option contract if you expect Square stock price to appreciate. This allows you to buy SQ stock at a discount price at a future date. -You purchase a put option contract if you expect the stock to fall. This allows you to sell SQ stock at a premium price at a future date. -Requires putting down a non-refundable deposit that you can lose if you fail to exercise your option. |

-You can lock in favorable prices for your future trades. -It simplifies going long or short on stocks. |

|

Trading CFD |

-You speculate on SQ stock price movements. -If you expect Square stock to rise, you make a CFD trade that pays you the price increase. -If you expect the stock to decline, you make a CFD trade that pays you the price decrease. |

-You can make money both when the stock goes up as well as when it goes down. -You can start investing with a small amount of capital and use leverage. -Best for capturing short-term profits from stock price fluctuations. |

Why Trade SQ Stock CFD With VSTAR

If you prefer trading Square stock CFD to holding Square shares or trading SQ stock options, consider using VSTAR CFD trading platform. Here're a few reasons why VSTAR is popular with CFD traders:

● Low trading costs: VSTAR offers tight spreads and low trading fees to maximize your profits.

● Low starting capital: VSTAR allows you to start trading stock CFDs with as little as $50.

● High-speed trading: VSTAR offers ultra-fast trade order execution.

● Leverage: If you have little initial capital, VSTAR offers generous leverage to boost your trade.

● Human support: VSTAR also offers 24/7 real human support.

● Fully regulated: VSTAR is a fully registered and regulated CFD trading platform, giving you peace of mind when trading.

How to Trade SQ Stock CFD With VSTAR

It only takes a few steps to start trading stock CFD on VSTAR.

Open VSTAR CFD trading account – You only need an email address or phone number.

Fund the account – VSTAR accepts more than 50 deposit methods, including bank transfer, credit cards, and digital wallets.

Start trading – You can start trading SQ stock CFD once your account is approved and funded.

If you're new to CFD trading, VSTAR offers a demo account with up to $100,000 in free virtual cash for your practice.

Final Thoughts

Square is a major force in the fintech space. The company is diversifying into other businesses in pursuit of growth opportunities. With a solid financial position, strong brand, and expanding addressable market, Block (NYSE: SQ) seems to have bright prospects.

FAQs

1. Is Square a buy or sell?

Most analysts currently rate it as a buy or strong buy, believing it is undervalued.

2. Who owns the most SQ stock?

The majority shareholder and largest individual owner of Block (SQ) stock is CEO Jack Dorsey, who owns approximately 18% of the total shares outstanding.

3. What is the SQ stock forecast?

The consensus analyst price target for Block (SQ) stock is approximately $100 in the next 12 months.

4. Where will Square stock be in 5 years?

Given Block's strong history of growth and innovation, as well as bullish projections in areas like digital payments and bitcoin, analysts estimate that Block stock could reach $200+ within 5 years.