Solana has exhibited selling pressure in the previous week after recovery from levels not seen in several years. When its primary supporter FTX, encountered setbacks, the token came under pressure. Notwithstanding this, the ecosystem endured, resulting in a significant resurgence over an extended period.

Improvement in the Solana Ecosystem

The Solana network is experiencing development, as indicated by a report by Coingecko. It came as the network's successful recovery in the cryptocurrency market and a succession of favorable developments.

The renewed vitality has garnered the interest of investors and developers, leading to a surge in the implementation of pre-existing initiatives within the ecosystem. According to Coingecko's analysis, specific initiatives emerge as pivotal contributors to the trajectory of DeFi and NFTs on Solana.

Key Players Under Solana Ecosystem

Within the ecosystem of Solana, decentralized exchanges (DEXs) such as Jupiter, Orca, and Drift are at the forefront of innovation. With its limit-order decentralized exchange services and DEX aggregator, Jupiter is transforming the industry by ensuring that users obtain optimal price offers.

Whirlpools, a concentrated liquidity feature on Orca, another DEX, increases returns for liquidity providers and decreases slippage for traders. In the future months, new users are anticipated to be drawn to Orca's community-driven governance model, which has an estimated total value of $185 million.

Drift, a decentralized perpetual trading platform, incorporates numerous features, including a money market for decentralized lending, which provides traders with additional opportunities to generate passive income via staking and market maker rewards and up to 20x leverage.

Projects such as Jito and Marinade Finance have been identified as potential beneficiaries of Solana's sustained expansion. With an excess of $1 billion in assets, Marinade Finance maximizes returns via liquid staking and immediate unstaking options. Jito, which increases staking returns through MEV rewards, currently has an estimated 6.7 million SOL staked on its platform.

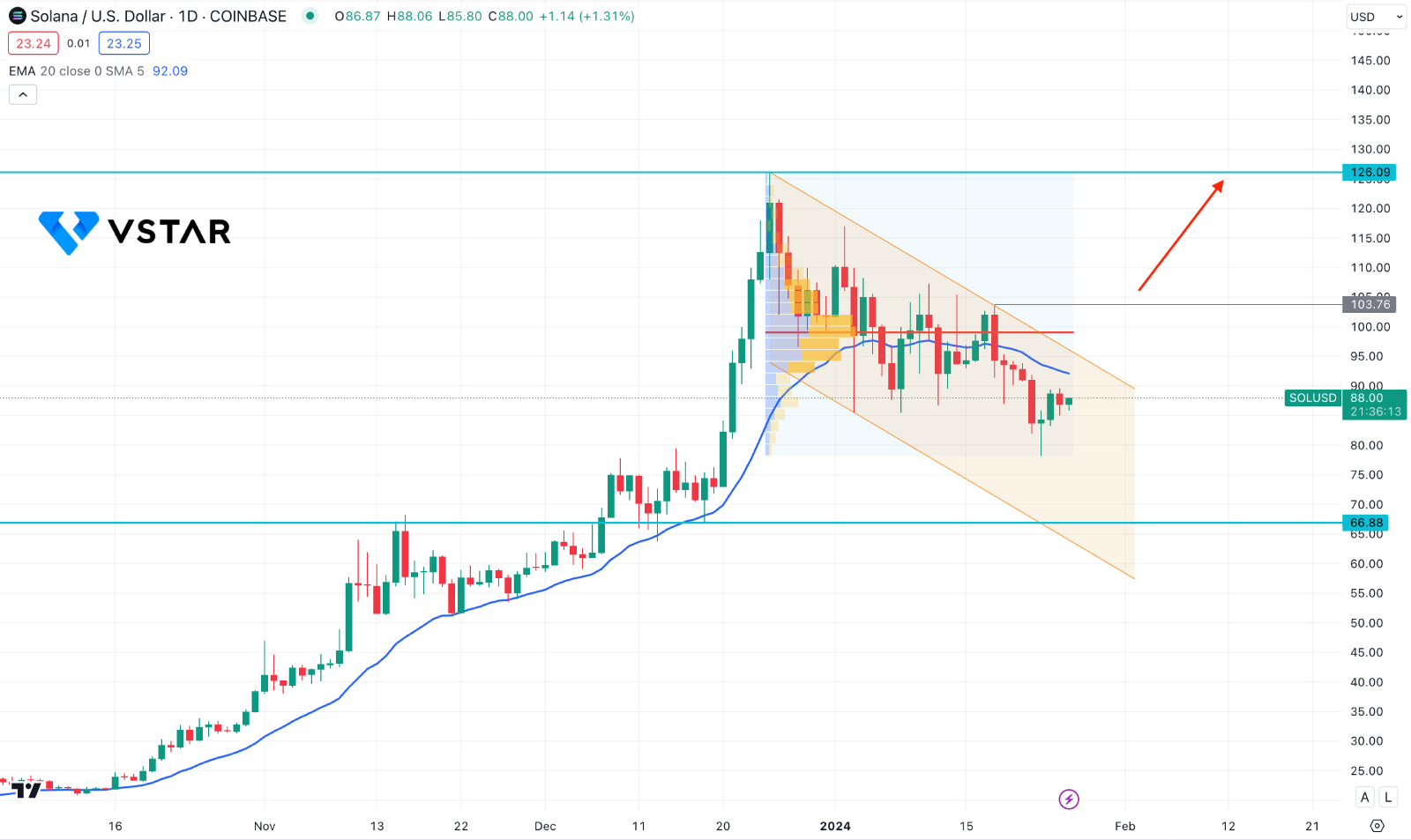

SOLUSD Technical Analysis

Solana price fell below the $80 level but recovered swiftly from near-term support levels. It indicates that bulls are intent on maintaining this upward trend. If effective, it might put an end to the ongoing downside correction that was initiated in late December.

The increase in buy volume over the previous two days explains the recent price movement and the rebound. However, a bullish break from the critical 99.00 level is still pending.

Despite SOL price reaching a lower low, the daily MACD histogram indicates higher lows, indicating bullish divergence. At this time, the bias towards SOL is neutral but a descending channel breakout with a daily candle above the 99.00 level could resume the existing bullish trend, targeting the 140.00 area.