Introduction

Snap Inc. is one of the leading social media companies in the world, with over 300 million daily active users on its flagship app, Snapchat. Snapchat is a platform that allows users to send and receive ephemeral messages, photos, videos, and stories with various filters and effects. Snap also offers other products and services, such as Spectacles, a wearable camera that connects to Snapchat; Bitmoji, a personalized avatar app; and Spotlight, a short-form video platform.

Snap went public in March 2017, raising $3.4 billion in its initial public offering (IPO). Since then, the company has faced many challenges and opportunities in the competitive and rapidly changing social media industry. Snap has invested heavily in innovation, particularly in augmented reality (AR), to differentiate itself from its competitors and attract more users and advertisers.

Snap Inc's Overview

Snap Inc. was founded in 2011 by Evan Spiegel, Bobby Murphy, and Reggie Brown, who were students at Stanford University at the time. The company was originally called Snapchat Inc, but changed its name to Snap Inc. in 2016 to reflect its broader vision beyond Snapchat. The company is headquartered in Santa Monica, California.

Source: Wallstreetjournal

Snap operates as a single segment, providing camera-based products and services for communication, entertainment, and monetization. The company generates revenue primarily from advertising on Snapchat and from the sale of Spectacles and other products.

Who Owns Snapchat

Snap's CEO is Evan Spiegel, who is also a co-founder and the company's largest individual shareholder. Spiegel holds approximately 18% of the voting power of the company's outstanding shares, while Murphy holds approximately 17%. Snap's other major shareholders include Tencent Holdings Ltd, a Chinese Internet giant, which owns about 12% of the voting power; Vanguard Group Inc, a mutual fund company, which owns about 8%; and Fidelity Management & Research Co, an investment firm, which owns about 6%.

Some of the key milestones in Snap's history include:

- In 2022, Snap Inc. announced its fourth quarter and full-year financial results. The company reported that its Daily Active Users increased by 17% year-over-year to 375 million, with full-year revenue of $4.6 billion and fourth-quarter revenue of $1.3 billion.

- In 2023, Snap Inc. announced its first-quarter financial results, reporting that its Daily Active Users increased by 15% year-over-year to 383 million, with first-quarter revenue of $989 million.

- In February 2023, Snap Inc. announced that it had reached the milestone of over 750 million monthly active users.

Snap Inc's Business Model and Products/Services

How Snap makes money

Snap makes money mainly from advertising on Snapchat. The company sells various types of ads on its platform, such as:

- Snap Ads

- Commercials

- Filters and Lenses

- Story Ads

- Spotlight Ads

- Dynamic Ads

- Camera Kit

Main Products and Services

Snap's main products and services include:

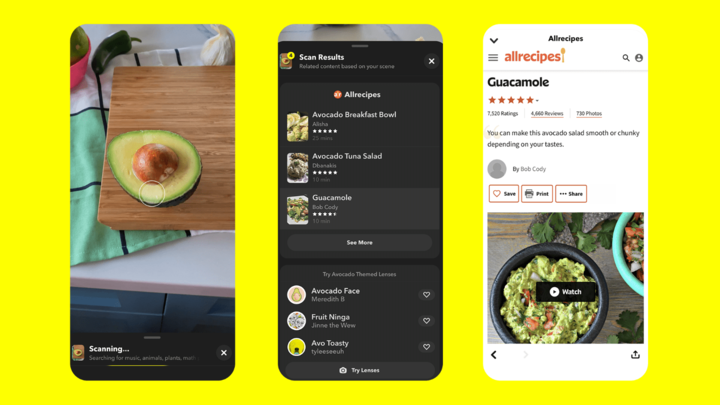

- Snapchat: This is the flagship app that allows users to communicate with their friends through ephemeral messages, photos, videos, and stories. Snapchat also offers various features and content, such as:

- Filters and Lenses

- Discover

- Spotlight

- Snap Map

- Snap Games

- Chat

- Memories

- Spectacles:

- Bitmoji

Source: techcrunch

Snap Financials, Growth, and Valuation Metrics

Review of Snap Inc's financial statements

Market Capitalization

As of July 2023, Snap Inc. has a market capitalization of $21.41 billion. This makes Snap the world's 835th most valuable company by market cap according to our data.

Net Income

In 2022, Snap reported a net loss of $1.43 billion, which was a 192.99% increase from 2021. For the twelve months ended March 31, 2023, Snap reported a net loss of $1.399 billion, which was a 149.46% increase year-over-year.

Revenue Growth

In the first quarter of 2023, Snap generated over $988 million in revenue. This is down from almost $1.3 billion in the fourth quarter of 2022. The final quarter of 2022 saw Snap's highest-ever quarterly revenue.

Profit Margins

As of March 31, 2023, Snap Inc.'s net profit margin was -30.89%.

Return on Equity

Snap's ROE has been negative, as it has reported net losses. However, Snap's ROE has improved over the years, as it has increased its net income relative to its equity. As of March 31, 2023, Snap Inc.'s Return on Equity (ROE) was -48.65%.

Balance Sheet Strength and Implications

As of March 31, 2023, Snap had total assets of $7.89 billion and total liabilities of $5.31 billion. Snap also had cash and cash equivalents of $1.58 billion and marketable securities of $2.52 billion.

In the first quarter of 2023, Snap reported a net loss of $328.67 million. In the fourth quarter of 2022, Snap reported an operating cash flow of $125 million and a free cash flow of $78 million. In 2022, Snap reported a second full year of positive operating cash flow and free cash flow.

Overall, the impact on Snap's balance sheet and cash flow is positive, indicating that the company has sufficient liquidity, solvency, and financial flexibility to support its growth initiatives and withstand potential shocks or downturns.

Key financial ratios and metrics

One way to assess Snap's valuation is to compare its valuation multiples to its peers and the industry average. Valuation multiples are ratios that relate a company's stock price to its earnings, sales, book value, or earnings before interest, taxes, depreciation, and amortization (EBITDA). Some of the commonly used valuation multiples are:

- Price-to-earnings (P/E) ratio

- Price-to-sales (P/S) ratio

- Price-to-book (P/B) ratio

- Enterprise value-to-EBITDA (EV/EBITDA) ratio:

Here is a table comparing the P/E, P/S, P/B, and EV/EBITDA ratios of Snap Inc. and Meta Platforms Inc. as of July 2023:

|

Company |

P/E Ratio |

P/S Ratio |

P/B Ratio |

EV/EBITDA Ratio |

|

Snap Inc. |

-15.4 |

4.64 |

8.17 |

-18.37 |

|

Meta Platforms Inc. |

38.3 |

7.111 |

6.35 |

18.69 |

Source: Yahoo Finance

Based on the table above, we can see that Snap has higher valuation multiples than the industry average. This means that investors are paying a premium for Snap's stock relative to its earnings, sales, book value, or EBITDA.

Therefore, based on the valuation multiples comparison, we can conclude that Snapchat stock is overvalued relative to its peers and the industry average. However, this does not necessarily mean that Snap's stock is a bad investment or that it will decline in the future. It simply means that investors are paying a high price for Snap's stock based on its current earnings, sales, book value, or EBITDA.

SNAP Stock Performance Analysis

Source: tradingview

SNAP Stock trading information

Snap went public on March 2, 2017, on the New York Stock Exchange (NYSE) under the ticker symbol SNAP. The company sold 200 million shares at $17 per share, raising $3.4 billion in its IPO. The IPO valued Snap at $24 billion, making it one of the largest tech IPOs in history. Snap's stock is traded in US dollars (USD).

Snap's stock is traded on the NYSE from Monday to Friday, excluding US public holidays. The regular trading hours are from 9:30 a.m. to 4:00 p.m. Eastern Time (ET). The pre-market trading hours are from 4:00 a.m. to 9:30 a.m. ET. The after-market trading hours are from 4:00 p.m. to 8:00 p.m. ET.

Snap Inc Stock splits

Snap has not conducted any stock splits since its IPO.

Snap Stock Dividends

Snap does not pay any dividends to its shareholders.

SNAP Stock Price Performance Since its IPO

Snap's stock price performance since its IPO has been volatile and mixed. The stock reached an all-time high of $83.11 on September 24, 2021, after the company reported strong fourth-quarter results and provided an optimistic outlook for 2021. The stock reached an all-time low of $4.82 on December 21, 2018, after the company faced several challenges and setbacks, including a poorly received app redesign, declining user growth, the loss of key executives, and increased competition from Instagram and TikTok. As of July 14, 2023, Snap's most recent closing share price was $13.15. This represents a 22.6% decline from its IPO price of $17.

According to Yahoo Finance, Snap's beta as of July 14, 2023, was 1.32, indicating that Snap stock is more volatile than the market. This means that Snap's stock tends to rise or fall more than the market in response to various factors, such as earnings reports, news events, analyst ratings, industry trends, etc.

Key Drivers of SNAP Stock Price

Some of the key drivers of Snap stock price include:

- User growth: Snap's daily active users (DAU) reflect its ability to attract and retain users, expand into new markets, and increase engagement.

- Revenue growth: Snap's ability to monetize its user base, improve products, diversify revenue streams, and attract advertisers drove revenue growth.

- Innovation: Snap's investments in augmented reality (AR) and AR products, such as Spectacles and Lens Studio, are differentiating the company, adding value for users and advertisers, increasing competitiveness, and creating new growth opportunities.

SNAP Stock Forecast

SNAP Stock Price Trend Analysis

Snap stock price trend analysis, or the examination of its past and present stock price movements to predict its future direction, can be done using various technical indicators and tools. Technical analysis is based on the assumption that the market price reflects all the available information and that the price movements follow certain patterns or trends that can be identified and exploited. Technical analysis is not an exact science, but rather a subjective art that requires experience and judgment.

One of the most commonly used technical indicators is the moving average (MA), which is the average of the stock price over a certain period. The MA smooths out the price fluctuations and shows the general direction of the trend.

Another commonly used technical indicator is the relative strength index (RSI), which is a momentum indicator that measures the speed and change of price movements.

The chart below shows Snap's stock price with a 50-day MA (blue line) and a 200-day MA (yellow line) as well as an RSI (purple line) as of July 14, 2023:

Source: TradingView

Based on the chart above, we can see that Snap's stock price has been in an uptrend since late 2022, as it has been trading above both the 50-day MA and the 200-day MA. The 50-day MA has also been above the 200-day MA, indicating a bullish crossover. However, Snap stock price has also been experiencing some volatility and corrections along the way, as it has been testing and breaking various support and resistance levels. The RSI has also been fluctuating between overbought and oversold levels, indicating some momentum shifts.

As of July 14, 2023, Snap stock price was $13.15, slightly below its all-time high of $13.59 reached on July 12, 2023. The RSI was at 72.9, indicating a neutral momentum. The 50-day MA was at $12.48, acting as a support level. The 200-day MA was at $10.21, acting as a long-term support level.

Key Resistance & Support Levels of SNAP Stock

Resistance levels are price points where the stock faces selling pressure and may struggle to break through. Support levels are price points where the stock faces buying pressure and may bounce back. Resistance and support levels can be determined by using various methods, such as historical highs and lows, trend lines, Fibonacci retracements, etc.

The chart below shows some of the key resistance and support levels of Snap stock based on historical highs and lows:

Source: TradingView

Based on the chart above, we can see that Snap's stock has been facing resistance at around $13.50-$13.60, which was its all-time high range reached in July 2023. If Snap's stock can break above this level with strong volume and momentum, it may signal a continuation of the uptrend and open up new highs.

On the other hand, Snap's stock has found support at around $8.0. If Snap stock can hold above this level with strong volume and momentum, it may signal a consolidation of the uptrend and a potential rebound.

Snapchat Stock Forecast: Analyst Recommendations and Price Targets

Analyst recommendations and price targets are opinions and estimates from professional analysts who follow and research Snap stock.

According to Yahoo Finance, as of July 14, 2023, there were 42 analysts covering Snap stock with an average rating of Buy and an average price target of $15.47. The consensus analyst view is that Snap stock is undervalued and has a 17.6% upside potential from its current price of $13.15.

The table below shows the breakdown of the analyst ratings and price targets for Snap stock as of July 14, 2023:

|

Rating |

Number of Analysts |

Percentage |

Price Target Range |

Price Target Average |

|

Buy |

29 |

69% |

$14-$18 |

$15.86 |

|

Hold |

11 |

26% |

$12-$15 |

$13.64 |

|

Sell |

2 |

5% |

$10-$11 |

$10.50 |

|

Total |

42 |

100% |

$10-$18 |

$15.47 |

Source: Yahoo Finance

Based on the table above, we can see that most analysts were bullish on Snap stock, as they gave buy ratings and high price targets. The highest price target was $18, implying a 37% upside potential from the current price. The lowest price target was $10, implying a 24% downside potential from the current price.

Some of the reasons why analysts were optimistic about Snap stock include:

- Snap's strong user growth and engagement in the highly coveted 13-to-34 demographic.

- Snap's innovative and differentiated product offerings, especially in AR and short-form video.

- Snap's improving monetization and profitability, driven by its direct-response advertising business and its diversified revenue streams.

- Snap's positive outlook and guidance for 2023, despite the headwinds from the COVID-19 pandemic and the iOS 14 privacy changes.

Challenges and Opportunities

Competitive Risks

One of the main risks that Snap faces is the intense competition from other social media platforms, such as Instagram, TikTok, Facebook, YouTube, etc. These platforms offer similar or superior features and content to Snapchat, such as stories, filters, lenses, short-form videos, etc. These platforms also have larger and more diverse user bases, more established and diversified revenue streams, and more resources and capabilities to invest in innovation and expansion.

Some examples of how Snap's competitors pose threats to its business include:

- Instagram: Instagram is one of Snap's biggest rivals, as it has copied and improved on many of Snapchat's features, such as stories, filters, lenses, etc. Instagram also has a larger and more global user base, with over 309billion daily active users (DAU) as of 2022, compared to Snap's 375 million DAU as of 2023.

- TikTok: TikTok is another major rival of Snap, as it has emerged as the leading platform for short-form video content, which is one of Snap's core offerings. TikTok also has a massive and fast-growing user base, with over 061 billion DAU as of 2023, compared to Snap's 375 million DAU as of 2023.

However, despite these competitive risks, Snap has several competitive advantages that can help it differentiate itself from its rivals and continue to grow its business. Some of these advantages include its unique software that allows self-deleting of messages, its robust mobile phone interface that is more user-friendly than its competitors, its amazing face filters that are matchless, and its ability to target millennials and the Z-Generation with Lenses.

Other Risks

Source: techcrunch

Some of the other risks that Snap faces include:

- Regulatory risks: Snap is subject to various laws and regulations in different countries and regions that govern its privacy, data protection, content moderation, taxation, antitrust, etc.

- Operational risks: Snap relies on various third-party providers and partners for its infrastructure, cloud services, content distribution, payment processing, etc. These providers and partners may experience disruptions, failures, breaches, or conflicts that may affect Snap's operations and performance.

- Financial risks: Snap is still operating at a loss and burn cash from its operations. Snap may need to raise more capital from debt or equity offerings to fund its growth initiatives and meet its obligations.

Growth Opportunities

Some of the growth opportunities and drivers that Snap can leverage include:

- User growth potential: Snap still has room to grow its user base in both existing and new markets. Snap can attract more users by improving its product quality, expanding its content offerings, launching localized versions, partnering with local influencers and media, and investing in marketing and user acquisition. Snap can also retain more users by increasing its engagement and retention features, such as games, chat, maps, etc.

- AR innovation: Snap is a leader in the AR market, which is expected to grow rapidly in the coming years. Snap can capitalize on its AR innovation by creating more immersive and interactive experiences for its users and advertisers, such as lenses, filters, spectacles, etc.

- Diversified revenue streams: Snap can diversify its revenue streams by exploring new or underutilized revenue streams, such as e-commerce, subscriptions, tipping, licensing, etc.

Future Outlook and Expansion

Snap has a positive future outlook and expansion plan for 2023 and beyond. Some of the examples of Snap's future goals and strategies include:

- Achieving profitability and positive cash flow: Snap aims to achieve profitability and positive cash flow by 2023 or earlier. This involves growing revenues faster than expenses, improving operating efficiency, optimizing investments, and managing cash flow effectively.

- Expanding into new markets and segments: Snap plans to enter high-growth markets and segments by launching tailored products and features. Examples include Spotlight in India, Snap Minis in Indonesia, and exploring opportunities in education, health, gaming, and other industries.

- Strengthening competitiveness and differentiation: Snap will invest more in innovation, particularly in AR and AI. This includes developing cutting-edge products like Spectacles 4 with AR capabilities, and enhancing features like Snap Map with live location sharing.

Why Traders Should Consider SNAP Stock

Traders are investors who buy and sell stocks frequently to take advantage of short-term price movements and trends. Traders should consider SNAP stock for the following reasons:

- SNAP stock has high volatility: SNAP stock has high volatility, which means that it has large and frequent price fluctuations. This creates more opportunities for traders to profit from the price swings and momentum. SNAP stock's beta, which measures its volatility relative to the market, is 1.32, indicating that it is more volatile than the market. SNAP stock's average daily price range, which measures the difference between its high and low prices in a day, is $0.87, or 6.6% of its current price of $13.15.

- SNAP stock has high liquidity: SNAP stock has high liquidity, which means that it has a large and active market with many buyers and sellers. This makes it easier for traders to enter and exit positions quickly and at favorable prices.

- SNAP stock has strong fundamentals: SNAP stock has strong fundamentals, which means that it has a solid business model, financial performance, growth prospects, and competitive advantages. This supports its long-term value and attractiveness to investors.

Trading Strategies for SNAP Stock

Some of the trading strategies that traders can use for SNAP stock include:

- Day trading: Day trading is a trading strategy that involves buying and selling Snap stock within the same day. Day traders typically try to profit from small price changes, and they often use technical analysis to make trading decisions. Day trading can be time-consuming and stressful for Snap stock, but it can also be profitable if done correctly.

- Swing trading: Swing trading is a trading strategy that involves buying and selling Snap stock over a period of days or weeks. Swing traders typically look for larger price movements, and they often use technical analysis to make trading decisions. Swing trading can be less time-consuming and stressful than day trading for Snap stock, but it can also be more difficult to time the market.

- CFD Trading: CFD trading, or contract for difference trading, is a type of derivative trading that allows traders to speculate on the price movements of an underlying asset without owning or delivering it. CFD trading has several advantages for Snap stock, such as:

- Leverage

- Short selling

- Hedging

- Swing Trading

Trade SNAP Stock CFD with VSTAR

VSTAR is a platform that allows you to trade CFDs on Forex, Stocks, Indices, Gold, Oil, Crypto, and 1000 other popular instruments. You can register and download the VSTAR app to start trading.

Conclusion

SNAP stock is an attractive option for traders who are looking for high volatility, high liquidity, and strong fundamentals. SNAP stock has been in an uptrend since late 2022, as it has been growing its user base, revenue, and innovation. SNAP stock also has high growth potential and opportunities in the AR and short-form video markets. However, SNAP stock also faces some risks and challenges from competition, regulation, operation, and finance. Traders should consider SNAP stock for CFD trading, swing trading, or day trading, depending on their preferences and goals. Traders should also use technical analysis, risk management, and trading strategies to optimize their performance and returns.

FAQs

1. Is Snap a Hold or a Sell?

Hold - Many analysts still see long-term potential and upside for Snap stock.

2. What is Snap's target price?

The average analyst price target for Snap is around $13-$15 per share.

3. What will Snap stock be worth in 2025?

Snap stock could potentially be worth $15-$25 per share by 2025 based on projected revenue growth and other assumptions.

4. What will Snap stock be worth in 2030?

If Snap executes on its augmented reality and advertising plans, estimates indicate that its stock could potentially trade between $25-$50 per share by 2030.