The upcoming FOMC meeting holds specific and numerical implications for the silver market

Historically, silver prices have been inversely correlated with interest rates. The Fed's decision to hold interest rates steady or raise them will directly impact silver. If the Fed raises rates, it can lead to higher yields on other assets like bonds, potentially diverting investments away from silver, which does not yield interest. Conversely, if rates remain unchanged, silver may become more attractive to investors seeking alternative assets.

Notably, silver has been considered a hedge against inflation. If the Fed decides to raise rates to combat inflation, it might initially suppress silver prices as higher interest rates could strengthen the US dollar, making commodities like silver more expensive for international buyers. Conversely, if the Fed maintains a dovish stance due to concerns over inflation, it could support silver prices.

Updated Economic Projections of The Fed

Further, the Fed's updated economic projections may provide numerical guidance on key economic indicators such as GDP growth, unemployment rates, and inflation expectations. These projections can directly impact silver prices as they shape investor sentiment and risk appetite. Strong economic projections may boost confidence in silver as an industrial metal, driving demand from sectors like electronics and solar panels.

Correlation between silver price and US dollar

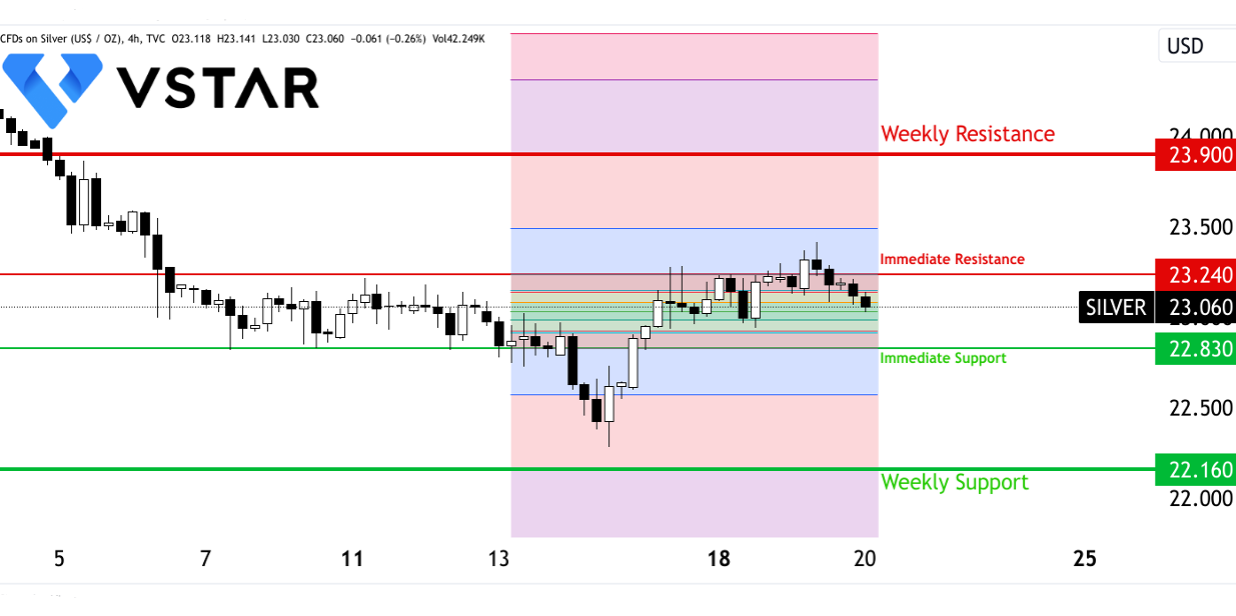

While the correlation between silver and the US dollar is not always perfect, it remains a crucial factor. A stronger US dollar, often associated with higher interest rates, can exert downward pressure on silver prices as it becomes more expensive for foreign buyers. Conversely, a weaker dollar can support silver prices. The FOMC meeting and its outcome can introduce short-term volatility to financial markets. Silver, as a precious and industrial metal, can experience amplified price swings during times of market uncertainty. The specific numerical values for silver's price movements will depend on the extent of market volatility.

Moreover, the Fed's decision can indirectly influence silver's supply and demand dynamics. For instance, if the Fed's policy stances impact economic growth and industrial production, it can affect the demand for silver in various industries, including electronics, automotive, and healthcare. Silver's historical trading range will serve as a numerical reference point. If silver is trading closer to the lower end of its range, it may indicate favorable buying opportunities, as there is likely demand at that level. Conversely, if silver is near the upper end of its range, it may suggest overvaluation.

Finally, the following technical perspective may be better for navigating during the ongoing week.

Data source: tradingview.com