PayPal Holdings Inc (NASDAQ: PYPL) stock price has been falling for quite a while. PYPL stock has declined from its all-time high of about $308 reached in July 2021 to just over $60 now. That represents a more than 80% pullback from the peak.

PayPal shares soared in August 2022 after activist investor Elliott Management disclosed a $2 billion-stake in the company. Looking back, PayPal stock price has retreated 40% since Elliott’s stake came to be known publicly.

As its profit margins come under pressure, PayPal is taking a hard look at its costs. Apart from cutting some jobs, the company has signaled that it may lean on artificial intelligence technology to bolster its efficiency. And PayPal may also offload its little-known money transfer business called Xoom in an apparent cost-cutting measure.

With all this in mind, you might be wondering whether PayPal stock is a buy or sell now. This article answers your questions about investing in PayPal. If you’re wondering how PayPal makes money, the article explores PayPal’s business model and financial results.

You’ll also learn about PayPal’s stock performance, challenges, and growth opportunities. In the end, you’ll find out how to make money with PayPal stock both when the stock is rising and when the stock is falling.

PayPal (NASDAQ: PYPL) Stock Overview

PayPal Holdings (NASDAQ: PYPL) provides online financial services ranging from payments processing, money transfer, and credit solutions. Therefore, PayPal operates in the financial technology (fintech) services industry. The company has footprints in more than 200 countries.

Founded in 1998, PayPal is headquartered in California, the U.S. PayPal founders include Peter Thiel and Elon Musk of Tesla (NASDAQ:TSLA). The company is currently led by CEO Dan Schulman, supported by chief technology officer Sri Shivananda and chief product officer John Kim.

PayPal is regarded as an online payments pioneer. Although it started as an independent company, PayPal became a subsidiary of eBay (NASDAQ:EBAY) in 2002. PayPal’s market cap of about $70 billion makes it one of the world’s largest fintech providers.

Paypal’s Business Model and Products

Paypal’s Business Model

PayPal operates platforms that process payments for consumers and merchants. For consumers, PayPal enables them to pay for purchases conveniently from their smartphone or laptop. On the other hand, PayPal’s merchant services include processing online payments and offering credit solutions.

Therefore, PayPal operates a two-sided network that allows it to make money from both consumer and merchant activities on its platforms. How does PayPal make money? The company’s primary revenue source is the fee charged on transactions.

While processing payments is PayPal’s primary business, the company also provides loans that earn it interest. For example, the company offers the so-called Buy Now Pay Later (BNPL) short-term credit line that enables shoppers to get what they want now and pay for it through installments over time. Moreover, the company offers money transfer and crypto trading services.

Paypal’s Main Products and Services

The company serves its consumers and merchants through a portfolio of platforms that bear various brand names. These are PayPal’s main products brands:

● PayPal: This is PayPal’s namesake and flagship platform. It mainly processes payments for shoppers and merchants. The PayPal platform also supports sending money to contacts and trading cryptocurrencies. It makes money from charging transaction fees.

● Venmo: This is a digital wallet that supports peer-to-peer money transfer. It is popular with young people who use it to split bills. The Venmo app also supports buying and selling of cryptocurrencies. Although Venmo is largely free to use, select features in the app attract a fee.

● Xoom: This is PayPal’s international money transfer platform. Xoom can be used to send money from the U.S. to dozens of countries. Xoom also supports remittances from Canada and the UK. The service makes money by charging a remittance fee.

● Zettle: PayPal acquired Zettle to expand its merchant solutions. Zettle offers point-of-sale devices and funding to small businesses. With Zettle card readers, small merchants can accept credit card payments. Zettle has a fee model for its services.

PayPal’s Financial Performance

Revenue Growth

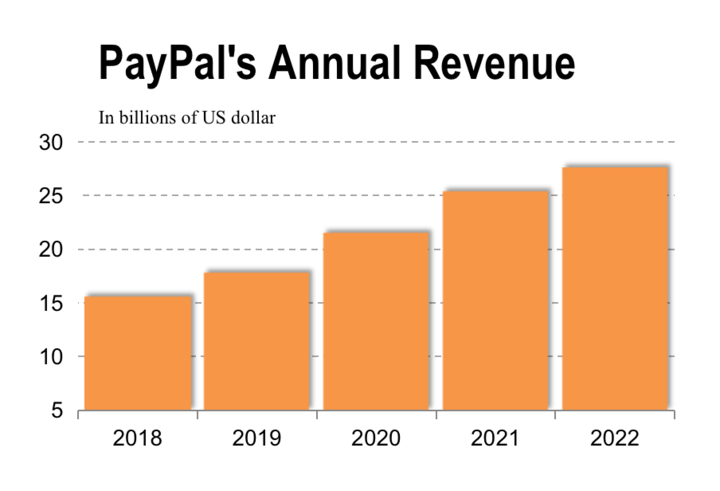

PayPal’s revenue rose 8.5% to $27.5 billion in 2022. Although the company’s topline continues to grow, the growth rate has sharply decelerated in recent years. For example, the 8.5% revenue growth in 2022 slowed down from 18% in 2021 and 20% in 2020.

Nevertheless, PayPal’s annual revenue has increased at a compound annual growth rate of 12% over the past 5 years. The chart below illustrates PayPal’s annual revenue trend.

PayPal has had a strong start to 2023, with revenue growing nearly 9% in the first quarter. The company expects its topline to keep expanding, forecasting about 7% revenue growth for the second quarter. Wall Street expects PayPal’s 2023 annual revenue to grow 7.5% to $29.6 billion.

Net Income

The digital payments giant earned a net income of $2.4 billion in 2022, working out to $4.13 in adjusted earnings per share (EPS). That was down from the adjusted EPS of $4.60 in 2021. The company anticipates EPS growth of 20% to $4.95 in 2023.

In addition to revenue growth, PayPal’s forecast EPS improvement in 2023 is expected to benefit from the share repurchase program. The company plans to spend about $4 billion on share repurchases this year.

Profit Margins

PayPal appears to be struggling to control its costs. The company’s gross profit margin narrowed to 42% in 2022, from about 47% in 2021. The operating profit margin dipped to 13.9% in 2022, from 16.8% in 2021. And PayPal’s net profit margin of 8.79% in 2022 was not only down sharply from 16.4% in 2021, but also stood out as the company’s lowest in more than 5 years.

The chart below illustrates PayPal’s net profit margin trends.

Cash Position and Balance Sheet Condition

Despite weakening profitability in recent periods, PayPal maintains high liquidity and a strong balance sheet. In Q1 2023, the company generated more than $1 billion in free cash flow, bringing its cash balance to $15.3 billion. The company also has a solid balance sheet with more than $77 billion in assets and only $10.9 billion in total debt.

PayPal (NASDAQ: PYPL) Stock Performance

PayPal initially went public in 2002 at an IPO price of $13 per share. But the debut was only brief as eBay came in and acquired PayPal just six months into the IPO. After more than a decade under eBay’s armpit, PayPal separated and staged its second IPO in 2015.

PayPal shares trade on the NASDAQ exchange under the “PYPL” stock ticker symbol. The company doesn’t pay dividends and hasn’t had stock splits since the IPO.

PayPal stock price has dropped about 17% year-to-date, representing a steeper decline than the 5% drop for Square parent Block Inc (SQ). But PayPal’s decline is better than that of its rival Payoneer (NASDAQ:PAYO), which has dropped nearly 20% year-to-date.

PayPal shares have retreated more than 20% over the past year, compared to the nearly 30% decline for Block shares.

PYPL Stock Forecast

Wall Street has a 12-month price target of about $98 on PYPL stock, which suggests over 50% upside potential. The peak PayPal stock price prediction of $160 implies over 150% upside.

PYPL stock trades at 2023 forward PE of 12.75, compared to 35.50 for Square parent Block, and 37.17 for Payoneer. Therefore, PayPal stock comes out as undervalued on the forward PE measure.

Earning results, interest rates, competitor actions, and fintech industry trends are some of the factors that impact PayPal stock price.

PayPal’s Risk and Opportunities

The broadening adoption of digital financial services is expanding the market opportunity for PayPal. But the company faces several challenges in its efforts to grow its revenue and improve its profitability.

Challenges Facing PayPal

High Competition

PayPal is facing increasing competition in the fintech industry. The intensifying competitive pressure can clearly be seen in the company’s slowing growth. PayPal’s revenue growth has slowed sharply in recent years, casting doubts on its hopes of achieving $50 billion in annual revenue and reaching 750 million active accounts in 2025. PayPal finished Q1 2023 with 433 million active accounts.

The company’s headache comes from existing rivals doubling down on their campaigns to increase their market share and new rivals entering the scene. While Stripe, Wise, and Payoneer are trying to erode the flagship PayPal platform’s market dominance, Block’s CashApp, SoFi, and banks-sponsored Zelle are putting great pressure on Venmo. Xoom also continues to struggle with intense competition from traditional money remittance providers Western Union and MoneyGram.

Additionally, PayPal is grappling with increasing competition from digital wallets offered by the likes Apple and Google.

Fake Accounts

As PayPal competitors intensify their onslaught, the company dreams up various strategies to fight back. But as PayPal has learned, some strategies to fight back rivals can backfire. When the company offered a $10 account opening reward to entice new users, it discovered that people were opening fake accounts just to collect the free money. In the end, PayPal counted as many as 4.5 million bogus accounts.

The fake accounts issue raises several problems for PayPal. For example, it discourages the company from using incentive programs to try to win over users. Yet incentives can be effective marketing tools to drive growth in a competitive market.

Another issue with fake accounts is that they can cause serious reputational damage to the company, shaking confidence in its performance metrics. Moreover, fake accounts can attract heightened regulatory scrutiny of the company’s activities that can increase compliance costs.

High Interest Rates

As it seeks additional growth opportunities, PayPal has done deeper into the credit business. The company provides loans to merchants and credit lines to shoppers at the point of purchase. The adoption of its buy now, pay later (BNPL) credit service is particularly growing rapidly. The trouble is that high interest rates can increase loan defaults that can expose PayPal to heavy losses with an expanded credit business.

Longtime CEO Departing

PayPal’s longtime CEO Dan Schulman is set to retire at the end of 2023. The company has begun the search for Schulman’s successor. But executive transitions can come with many uncertainties as there is no guarantee that the coming executive would be as effective as Schulman.

PayPal’s Competitive Advantages

Although PayPal faces many challenges, it also enjoys many competitive advantages in the battle for the control of the lucrative fintech market. These are some of PayPal’s strengths as it fights to repel competitors from eroding its market share.

Solid Financial Position

With its massive cash balance and solid balance sheet, PayPal is in a great position to weather tough economic times better than many of its competitors. Moreover, the company can easily outspend many of its rivals when it comes to financing aggressive marketing campaigns and innovation efforts.

Two-Sided Network Effect

PayPal has built a system that serves both shoppers and merchants in a complementary manner. The company can use its consumer information to boost sales for its merchants. That makes existing merchants loyal to PayPal and encourages new merchants to join the platform. And more merchants on the platform draw more consumers to the platform, which in turn expands PayPal’s revenue opportunity.

Strong Brand Recognition

PayPal has built a strong brand in the digital payments space. Shoppers and merchants associate the PayPal brand with integrity, security, and excellence. With increasing fintech frauds, PayPal’s trusted brand can help it win over customers concerned about the safety and security of their online funds and transactions.

China Footprint

China is a large fintech market that is largely walled off for foreign providers, but PayPal is an exception. PayPal used an acquisition to establish a footprint in China, giving it a head start over its Western rivals in a lucrative international market.

AI Technology For Efficiency

Spiraling costs have weighed on PayPal’s profitability in recent years. The company has attempted to reduce its headcount to control costs, but it may need to do more. PayPal now sees an efficiency opportunity in artificial intelligence (AI) technology. The company says AI can help it operate more efficiently. Perhaps the company is looking at replacing human workers with AI to cut costs. Additionally, PayPal can apply AI technology to unlock additional revenue opportunities across its two-sided network.

PayPal’s Future Growth and Expansion Opportunities

Although competition is intensifying in the fintech industry, many growth and expansion opportunities exist for PayPal. Let’s take a look at the opportunity lying ahead for PayPal in the expanding fintech addressable market.

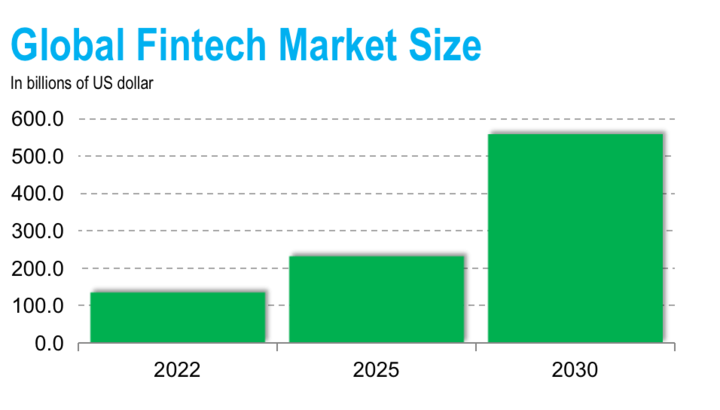

The broader fintech market continues to expand, largely driven by the shift to online shopping and mobile money services. The global fintech market is forecast to generate more than $556 billion in revenue for providers by 2030, from about $133 billion in 2022. PayPal’s widening product portfolio and expanding global footprint position it well to capture this revenue opportunity.

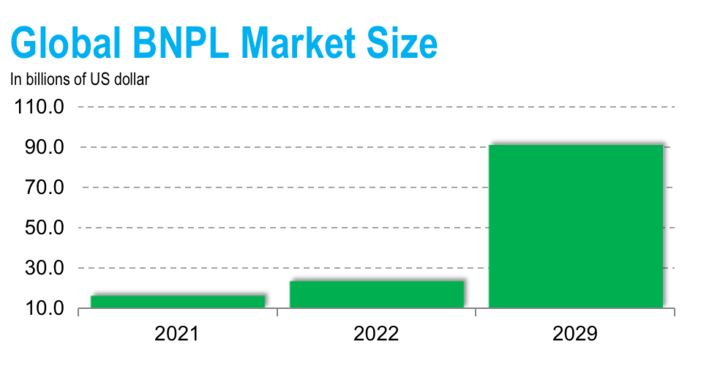

The buy now pay later market is a particular bright spot for PayPal in the fintech industry considering the company’s low penetration in this space.

PayPal saw an exciting opportunity in the BNPL market and quickly jumped in to it. Despite coming from behind competitors like Affirm, PayPal has grown rapidly in this space to rank among the leading BNPL providers. The BNPL service complements PayPal’s two-sided platform as it is encouraging consumers to spend more and generating more sales for merchants.

At the end of Q1 2023, about 32 million PayPal consumers had used the BNPL service at nearly 3 million merchants. The PayPal platform hosts more than 400 million consumer accounts and about 35 million merchant accounts. With only a small fraction of PayPal users having adopted the BNPL service, there is more room for growth within the company’s existing user base.

The global BNPL market is on track to surpass $90 billion by 2029, from $15.9 billion in 2021. PayPal has a great chance to capture a huge chunk of this market.

These are some of the steps PayPal is taking or considering to grow its business in the lucrative but highly competitive fintech industry:

Strategic Partnerships

PayPal is a master of strategic partnerships. Despite competing business interests with Visa and Mastercard, PayPal has found ways to work with these card networks for its benefit. Additionally, PayPal has forged strategic ties with Facebook parent Meta Platforms, Google, Apple, and Shopify. These arrangements not only enable PayPal to win over new users, but also enhance its two-sided network effect.

Venmo For Teens

PayPal has introduced the Venmo teen account to further extend the reach of its popular money app. The Venmo teen account comes with an accompanying debit card. Bringing teens on board to Venmo expands PayPal’s revenue opportunity on the app.

First is the opportunity to make money from the new teen transactions on the app. Moreover, opening Venmo to teens can help draw more adults to the app. Venmo has been more popular with young adults than older adults. With the addition of the teen account with parental controls, there is an incentive for older adults to become part of the Venmo network.

Cryptocurrency Services

PayPal’s cryptocurrency services are available on the namesake PayPal platform and Venmo app. It allows users to buy, sell, save, or spend their crypto funds. There is still plenty of room for PayPal to grow its crypto business. For example, the company currently offers only a handful of cryptocurrencies. Additionally, PayPal’s crypto service has only rolled out in a few markets. PayPal can make more money from the crypto service by expanding the number of cryptocurrencies it supports and launching the service in more markets.

Xoom Divestiture

PayPal may sell Xoom, its international money transfer unit. A sale of Xoom may allow PayPal to narrow its focus to businesses that have better prospects. Selling Xoom may also open an opportunity for PayPal to drop some costs. The company has been trying to control its costs, including through job cuts. Additionally, selling Xoom may generate massive cash for PayPal to invest in areas such as acquisitions, product development, and share repurchases.

BNPL Loan Portfolio Sale

PayPal has figured out how to reduce risk in its buy now pay later loan business. The company is looking to offload much of its BNPL loan portfolio. It wants to focus on originating BNPL loans rather than holding the loans in its books.

The BNPL loans that PayPal offers are uncollateralized, so there is a high risk of default and loss. For example, there is little PayPal can do to recover its money if its borrowers can’t pay back their loans.

Therefore, selling the BNPL loan portfolio would both reduce PayPal’s risk in the business and free up cash for other purposes.

How to Make Money With PayPal (PYPL) Stock

You can apply various methods to make money with PayPal stock. Let’s look at the three common ways of making money with PYPL stock:

Buying and Holding PayPal Shares

This method requires the most amount of capital to get started. It also requires a long wait for returns. But it works best for those seeking long-term returns and ability to influence PayPal’s decisions through shareholder votes. This is how it works:

You purchase 100 PayPal shares at $60 apiece, investing $6,000 in the stock. Let’s say after one year the stock is at $70. If you close your position at this time, you would make a profit of $1,000 [100 shares x ($70 – $60)].

Trading PayPal Stock Options

Options trading allow you to lock in favorable prices if you want to go long or short on a stock. This is how it works:

Let’s say PYPL stock price is $60 in May and expect it to be higher by July. In that case, you would purchase a call option that allows you to buy PayPal shares at $60 in July even if the price would have gone up to $80 or higher at that time. As you can see, this arrangement allows you to buy PayPal stock at a discount in the future.

On the other hand, let’s say you plan to sell PayPal shares in July but expect the price to have declined at that time from the current $60. In that case, you would purchase a put option that allows you to sell your PayPal shares at $60 in July even if the price would have dropped to $50 at that time. As you can see, this arrangement allows you to sell your PayPal shares at a premium in the future.

A major downside with options trading is that it requires a non-refundable deposit called a premium. You lose the premium deposit if the market moves against you and you decide to skip exercising your option.

Trading PYPL Stock CFD

With CFD trading, you bet on a stock’s price movements without actually owning the stock. CFD trading offers the simplest way to get exposure to a stock if you have little capital to start with and look to capture short-term profits. This is how it works:

If you expect PYPL stock price to rise, you enter a CFD trade that pays you the price increase. But if you expect the stock to decline, you enter a CFD trade that pays you the price decrease. Let's say you bought 100 PYPL stock CFD contracts and the stock price increased by $10 in a day. In that case, you would make a profit of $1,000.

Because only price movements matter in CFD trading, you can profit both when PayPal stock price is rising and also when it is falling.

Why Trade PYPL Stock CFD With VSTAR

If CFD trading feels like your favorite method to make money with PayPal stock, consider using VSTAR. This fully registered and regulated CFD trading platform is known for its low-cost and high-speed trades. VSTAR also provides leverage opportunities to help you maximize your profit.

For those new to CFD trading, VSTAR offers a demo practice account with up to $100,000 in free virtual money. VSTAR also offers 24/7 real human support.

How to Trade PYPL Stock CFD With VSTAR

It is easy to get started with CFD trading on VSTAR. This is all you have to do to trade PayPal CFD with VSTAR:

● Open a VSTAR account – You only need your email address or phone number.

● Fund your account – VSTAR supports more than 50 deposit methods, including cards, bank transfer, and online payments. VSTAR offers generous deposit bonuses.

● Start trading – Once your account is approved and funded, you can start trading PYPL CFD with VSTAR.

Final Thoughts

PayPal stock price has dropped steeply from its peak, but the downside potential now looks limited as its cheap valuation begins to attract investors. In addition to the improving fundamentals, PayPal’s generous share repurchase program could also accelerate the stock’s rebound.

If you’re taking a long position on PYPL stock, you bet on the stock going up. But if you’re trading PayPal CFD, you can profit both from the stock’s rise and fall.