If you're looking for the best AI stocks to buy right now, consider Palantir Technologies (NYSE: PLTR). Investors seem so excited about Palantir that PLTR stock has more than doubled this year, crushing the average Wall Street price target.

You'd be hard-pressed to find AI stocks that have exploded more than Palantir stock. Despite its sharp rise, PLTR stock is currently trading at $15, well below its all-time high of $39.

With that in mind, you may be wondering: Should I buy Palantir stock? The question smart investors are asking right now is whether PLTR stock will continue to rise or reverse course and fall to the earth.

Palantir News

The AI Race Is On, and Palantir Is Leading the Way

Palantir CEO Alex Karp recently said that the company is ahead in the race for artificial intelligence (AI) technology. A number of big tech executives, including Tesla CEO Elon Musk, have called for a pause in AI research. According to Karp, those calling for a pause are behind in the AI race and may be trying to buy time to catch up.

Source: Pixabay.com

Palantir Makes Inroads in the Healthcare Industry

Palantir has signed a multi-year partnership with leading healthcare provider Cleveland Clinic. The agreement focuses on improving healthcare performance. The agreement with Cleveland Clinic expands Palantir's presence in the healthcare industry. The company's other major healthcare partners include Cardinal Health and the National Institutes of Health.

Palantir Technologies (NYSE: PLTR) Overview

What is Palantir

Palantir is an American technology company that specializes in big data analytics. The company's clients include governments and private companies in a variety of industries. In the government segment, Palantir is a popular military contractor.

Palantir was founded in 2003 and is headquartered in Denver, Colorado. Palantir co-founder Peter Thiel is a billionaire with a net worth of more than $9 billion, according to Bloomberg.

A master at spotting great investment opportunities, Thiel made huge profits on his early investment in Facebook stock. Thiel owns about 7% of Palantir's stock, making him one of the company's largest individual investors.

Palantir CEO Alex Karp has led the company since its inception. Palantir's stock went public in 2020 through the direct listing method, which Spotify Technology (NYSE: SPOT) also favored in its path to the public market.

Palantir Business Model and Products

What does Palantir do

Palantir provides AI-powered data analytics services. It helps clients make sense of their massive amounts of data so they can make better decisions. Palantir operates as a subscription business, where clients sign contracts to use its products. The contracts typically run for several years and are often worth millions of dollars per client.

Palantir's Key Products and Services

Although Palantir's business is generally big data analytics, the company has several products for its clients. These are Palantir's main product brands:

Palantir Gotham: This is an AI-powered data analytics software. It helps users integrate, manage, and analyze massive amounts of data. Gotham is primarily used by governments for tasks such as counterterrorism and fraud investigations.

Palantir Foundry: This platform helps with data-driven decision making and situational intelligence. Foundry is used primarily by enterprise customers. Palantir Foundry is used by companies such as Airbus and Morgan Stanley.

Palantir Apollo: This is a software development and deployment system. It helps users solve some of the most challenging problems in securely and rapidly delivering software across multiple environments. Apollo helps rapidly deliver configurations and updates to customers using Gotham and Foundry.

Palantir's Financial Performance

You can look at technical charts to inform your trading decisions, but you still need to examine the fundamentals to make sure you're investing in the right thing. With that in mind, let's examine Palantir's financials to see if the company is growing, if it's profitable, and if it has the cash to pay its bills.

Palantir Market Cap

PLTR Earnings

Palantir Revenue

Earnings reports are the biggest force that moves stocks. For a company like Palantir that is disrupting its market, the biggest thing investors are looking for in Palantir earnings reports right now is revenue growth.

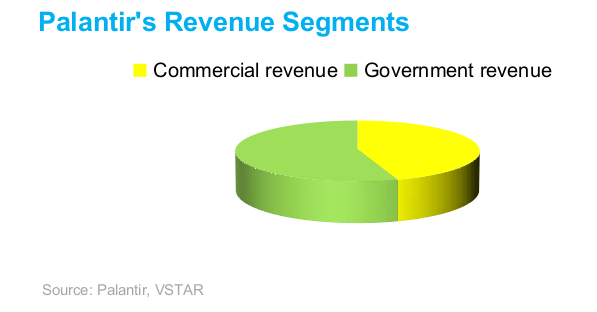

Palantir Technologies (NYSE: PLTR) reported its first-quarter earnings in May. Revenue grew 18% year over year to $525 million, beating Wall Street's expectations of $506 million. Government business accounted for 55% of revenue, with the remaining 45% coming from commercial contracts.

Revenue growth was supported by an increase in the number of customers. The company's commercial customers increased to 280 from 260 in the previous quarter.

In addition, the company signed many large deals during the quarter, which likely contributed to the revenue growth. The company signed 64 deals worth at least $1 million, 22 deals worth at least $5 million, and eight deals worth at least $10 million.

For the second quarter, the company expects revenue in the range of $528 million to $532 million.

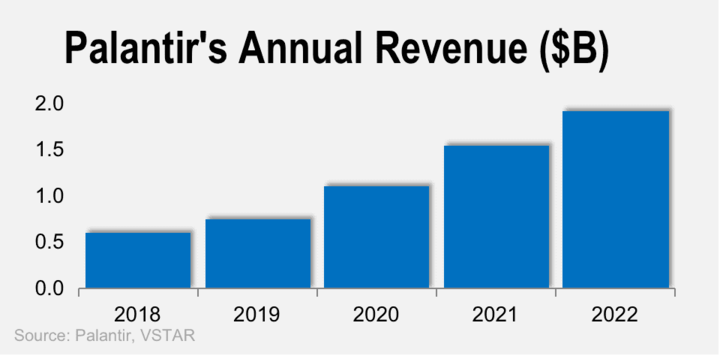

For the full year 2023, the company expects revenue in the range of $2.19 billion to $2.24 billion. The company generated revenue of $1.9 billion in 2022, up from $1.5 billion in the prior year.

The Company has achieved a compound annual revenue growth rate of approximately 30% over the past 5 years. The company believes that it can grow its annual revenue at a rate of 30% over the long term. The chart above illustrates Palantir's annual revenue trend.

Palantir's Net Income

Although much attention is paid to Palantir's revenue growth, the company's bottom line also attracts a lot of interest. The recent excitement surrounding PLTR stock can be attributed to the huge improvement in Palantir's bottom line numbers.

After years of consistent losses on both a quarterly and annual basis, Palantir recently began reporting profits, and investors are excited about the prospects for this AI stock.

The company made a profit of $16.8 million in the first quarter, compared to a loss of $100 million a year ago. This was the second consecutive quarter of profitability for Palantir. The company made its first quarterly profit in the fourth quarter of 2022, reporting a net income of $31 million.

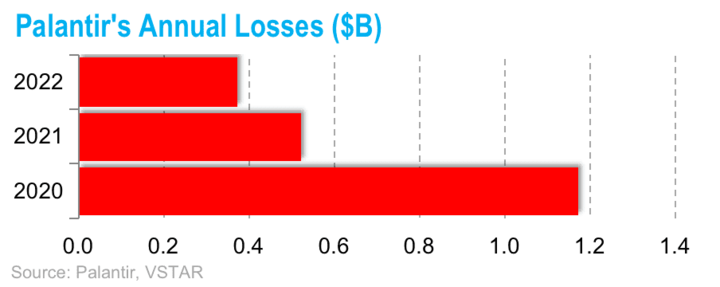

Although Palantir posted a full-year loss in 2022, its annual losses have been shrinking in recent years, as you can see in the chart above. The company is on track to make its first annual profit in 2023.

Palantir's Profit Margins

After years of prioritizing growth, Palantir is also making profitability a central focus. And that brings attention to the company's margins.

Source: Palantir

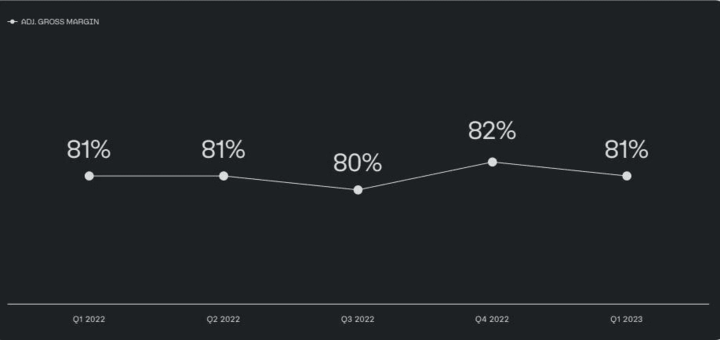

The company achieved a gross profit of 81% in the first quarter. The company has maintained a quarterly gross profit of at least 80% for the past year or so, as you can see in the chart above.

It achieved an annual gross profit of 79% in 2022, which is an improvement from 78% in 2021 and 68% in 2020. The company aims to maintain an annual gross margin above 85% and an operating margin above 35% over the long term.

Palantir's Liquidity and Balance Sheet Position

Palantir Technologies (NYSE: PLTR) generated $187 million in cash flow from operations and $182 million in free cash flow in the first quarter. The company ended the quarter with $2.9 billion in cash. Money isn't a problem for this company, as it has access to $950 million in credit facilities in addition to its substantial cash balance.

The company's balance sheet is also in great shape, with nearly $4 billion in assets and less than $0.1 billion in liabilities. The current ratio of 5.41 is impressive, and the debt-to-equity ratio of 0.10 is great for a fast-growing company like Palantir.

Palantir Technologies Stock Analysis

PLTR Stock Trading Information

Palantir stock trades on the NYSE under the ticker symbol "Palantir". The company went public in 2020. Although the stock was directly listed at a reference price of $7.25, it made its market debut at a price of $10.

Palantir is one of the most heavily traded AI stocks. An average of 100 million shares of Palantir stock change hands on a typical trading day.

Regular trading in PLTR stock begins at 9:30 a.m. ET on weekdays and runs until 4:00 p.m. Traders who want to spend more time in the market can take advantage of premarket and post-market trading hours.

Pre-market trading in PLTR stock begins at 6:30 a.m. and runs until the opening bell of the regular session. Post-market trading in PLTR stock begins immediately after the closing bell and continues until 8:00 p.m.

Palantir (PLTR) Stock Split: Palantir has not split its stock since going public, and management has not discussed any plans to split PLTR stock.

Palantir (PLTR) Dividend Yield: Although Palantir has started to turn a profit, the company doesn't pay a dividend yet, and there don't appear to be any dividend plans for the foreseeable future.

Palantir Stock Performance

After entering the market at $10 in September 2020, PLTR stock more than doubled in just a few months. As you can see in the chart above, PLTR stock continued to sprint to an all-time high of $39 in January 2021.

But in 2022, as you can see in the chart above, the stock began a steady decline, at one point falling as much as 90% from its all-time high. The decline in PLTR stock came as investors began to weigh the impact of rising interest rates amid growing signs of a looming recession.

Many technology stocks, not just Palantir, pulled back sharply during this period as investors turned conservative in the face of economic uncertainty.

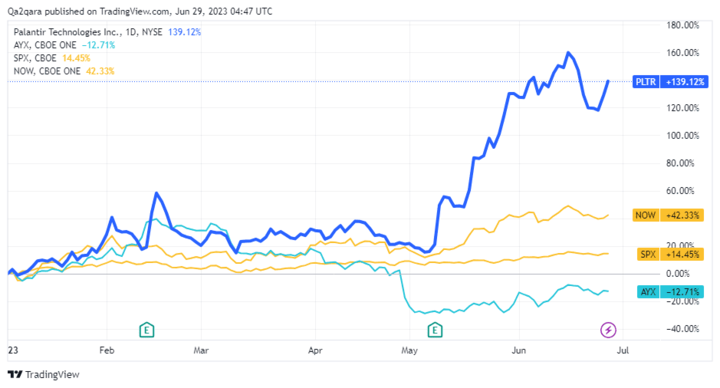

But PLTR stock is making a strong comeback in 2023, as you can see in the chart above. It's up more than 130% since the beginning of the year, outperforming many AI and data analytics stocks, as well as the S&P 500 Index.

Why is Palantir share price soaring?

Several factors are contributing to the meteoric rise of Palantir stock price this year. Here are some of the reasons investors are lining up to buy PLTR stock:

Huge upside potential: While PLTR stock is nearing its 52-week high of $18, investors still see a long runway for the stock as it retraces its path to the all-time high of $39. The stock is still about 60% below its all-time high.

The upside is here: PLTR stock looks more attractive now that Palantir has started to report profits. Although Palantir is still targeting an annual profit, investors are betting that the stock will continue to rise as Palantir's profits become more consistent.

PLTR Stock Forecast

After seeing Palantir's sharp rise, you may be wondering where Palantir stock forecast stands.

PLTR price target

Palantir has already cleared the average analyst price target of $11 and is about to break through Wall Street's top price target of $18.

As you can see on the chart above, PLTR stock broke through the longstanding resistance level of $10 in May. After a long uptrend, the stock has run into resistance at $17, but it has also established solid support at $15.

With PLTR stock rising faster than Wall Street expected, you can expect analysts to start revising their Palantir stock forecasts.

Palantir's Risks and Opportunities

Business success requires overcoming challenges and capitalizing on opportunities. Let's explore Palantir's risks and opportunities:

Palantir's Risks and Challenges

1. High Revenue Concentration

Palantir relies on its top 20 clients for two-thirds of its revenue. This is a concern because the loss of a single large customer can cause a significant drop in revenue. However, this risk is diminishing as the company's customer base expands.

2. Political interference

Government contracts currently account for the majority of Palantir's revenue. But you know that elections can bring major changes in governments that can affect the company's contracts.

3. Competition for the Data Analytics Business

Palantir is a software company in a class by itself. Rather than citing other companies as their biggest threat, Palantir executives have repeatedly said that their only concern is that customers will develop internal solutions and cut Palantir out of their budgets. But this is a low risk given Palantir's advanced technology.

Still, Palantir's analytics services overlap to some extent with those of companies such as Alteryx Inc (NYSE: AYX), Splunk Inc (NASDAQ: SPLK), and ServiceNow Inc (NYSE: NOW).

Palantir's Competitive Advantages

Strong financial position: With $2.9 billion in cash, nearly $1 billion in credit facilities, and minimal debt, Palantir is in a much better financial position than many of its competitors.

Trusted brand: In its 20 years in business, Palantir has successfully completed many high-profile and complex projects. As a result, Palantir is highly trusted and respected by its clients.

Leading edge AI technology: Before AI capabilities hit the public scene and got everyone talking, Palantir had already made AI the foundation of its products. The company recently launched a new AI platform that is making waves in the market.

Stable management: Palantir is still run by its founders. These founders not only have a deep financial stake in the company, but are also passionate about Palantir's role in solving complex problems.

Palantir's Opportunities

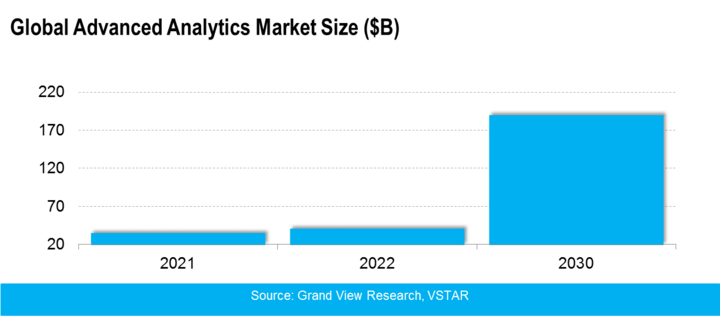

The company estimates its addressable market opportunity at $120 billion. While huge, note that the company's estimate is lower than third-party estimates. The global advanced analytics market is expected to grow from $35 billion in 2021 to $190 billion by 2030, with a compound annual growth rate of 21%.

As you can see, Palantir's market size estimate is actually conservative. As a result, the company has much more room to grow than many investors have realized.

In the commercial segment, Palantir estimates that 6,000 of the world's largest companies could use its products. This estimate does not include companies in China and Russia. With 280 commercial customers in the first quarter, the company has penetrated less than 5% of this market segment.

The growth opportunity in the government segment is also huge as the company wins over foreign government agencies. Rising global tensions and geopolitical instability are driving demand for Palantir's products.

The company is forging strategic partnerships to reach new customers and diversify its customer base across geographies and industries. It has partnered with major defense contractor Lockheed Martin (NYSE: LMT) on some of its Apollo software programs.

In addition, Palantir has partnered with major cloud providers Amazon, Microsoft, and Google, giving it access to thousands of potential commercial customers across multiple industries.

Palantir Stock Investing Strategies

Depending on the amount of money you have to invest and how quickly you want to see a return, there are two main ways to make money with Palantir stock. Let's examine these PLTR stock investment methods in detail, along with their pros and cons.

1. Buy and Hold Palantir Stock

This method involves buying and holding Palantir stock for an extended period, usually several years. It is popular with people with long investment horizons, such as those saving for retirement or a down payment on a home.

You can buy any number of Palantir shares to start, but some brokers have minimum share purchase requirements.

Pros:

● You get shareholder voting rights.

● You may receive dividends in the future.

● Your share count may increase in the event of a PLTR stock split.

Cons:

● You can only profit if the price of PLTR stock goes up.

● You need a large initial capital.

● You may have to wait a long time before you see the returns you want.

2. Trade Palantir Stock CFD

This method gives you easy exposure to PLTR stock. Instead of holding Palantir stock in your portfolio, you simply need to predict which way PLTR stock will move. Your profit is calculated by multiplying the increase or decrease in price over the trading period by the number of contracts purchased.

Let's say you bet that Palantir stock will go up and you buy 100 contracts. If the price goes up $5, your profit would be $500. You would also make a profit if you bet that the stock would go down and it did.

Pros:

● You can profit whether PLTR stock goes up or down.

● You need minimal initial capital compared to holding shares.

● You can make profits over short-term PLTR stock price fluctuations, such as over an hour, a day, or weeks.

Cons:

● You don't get shareholder voting rights.

● You're not eligible for potential dividends.

Palantir Stock CFD Trading Tips

● Follow the 1% asset allocation rule to prevent a losing trade from closing your account.

● Buy PLTR stock near support if you are betting the stock will go up, and buy near resistance if you are betting the stock will go down.

● Use risk management techniques such as stopping loss and taking profit orders.

Trade PLTR Stock CFDs With VSTAR

The first thing you want to do after finding the best AI stock to buy is to choose the best CFD broker. Trading Palantir stock CFDs allows you to make money in both bull and bear markets.

The best CFD broker can both maximize your profits with low trading costs and improve your trading skills over time. VSTAR is a fully licensed and regulated CFD trading platform.

Designed for both professional and beginner traders, VSTAR is ideal for fast and frequent CFD trading at a lower cost. The platform offers tight spreads and has no commissions on standard accounts.

You can start trading Palantir CFDs on VSTAR with as little as $50 and take advantage of generous leverage to increase your position. The platform offers effective risk management tools and prompt customer support, which are some of the reasons it has received highly positive reviews on Trustpilot.

VSTAR offers a demo account with up to $100,000 for new traders to practice their strategies and gain confidence before they start investing real money. Open a VSTAR account today and start trading with Palantir CFDs. It is free and all you need is an email address or phone number to get started.

Final Thoughts

With a plethora of options out there, the hardest part for many investors is finding the best AI stocks to buy now. Whether you're investing for the long term or trading CFDs for short-term gains, few AI stocks out there look more promising than Palantir (NYSE: PLTR) stock.

FAQs

1. Is Palantir a good company?

Palantir provides data analytics software and services and has government and commercial clients. It's considered innovative, but some criticize its government work. Overall, a decent company.

2. Who owns the most Palantir stock?

Co-founder and CEO Alex Karp owns the most Palantir stock. Major institutional investors include Morgan Stanley and BlackRock.

3. Is Palantir a Buy, Sell, or Hold?

Analyst opinions on PLTR are currently mixed. Recent price targets range from $10 to $20 per share, with a consensus of $15. So it could be a hold or a buy depending on your outlook.

4. What is the 5-year forecast for PLTR stock?

Many analysts expect steady but modest growth for PLTR over the next 5 years. Revenue could double, but profits could remain small in the near term.

5. What is the target price for PLTR in 2023?

Current price targets for 2023 range from $10 to $16. The average target is around $13.

6. What will Palantir stock be worth in 2025?

For Palantir stock price forecast 2025, most analyst price targets for Palantir range from $15 to $25 per share. Based on their projected growth and profitability, a stock price between $20 and $25 in 2025 seems reasonable if they execute well.

7. What will Palantir stock be worth in 2030?

The PLTR stock forecast for 2030 is more speculative, but if Palantir can continue growing revenue at around 30% annually and expand margins, then price targets around $30+ in 2030 are feasible.