Introduction

Pinduoduo (NASDAQ: PDD) is one of the most popular and innovative e-commerce platforms in China. It has been growing rapidly since its inception in 2015, challenging the dominance of Alibaba and JD.com in the online retail market. Pinduoduo’s stock price has also soared in the past year, making it one of the best-performing Chinese stocks in 2021. But what makes Pinduoduo so successful and attractive to investors? How does it make money and generate profits? What are the risks and opportunities facing its social e-commerce model? And what type of stock is Pinduoduo—growth or speculative? In this article, you will get the answers to these questions and more, as we explore the fundamentals and prospects of Pinduoduo.

Pinduoduo’s Overview

Pinduoduo, founded in 2015 by Colin Huang, a former Google engineer, aims to create an exciting and social shopping experience for Chinese consumers. Headquartered in Shanghai, China, it operates as a mobile-only platform connecting buyers and sellers across a wide range of products, from groceries and electronics to clothing and cosmetics.

One of Pinduoduo's standout features is its group-buying option. It allows users to team up with their friends, family, or online buddies to buy the same item at a discounted price. The more people that join the team, the lower the price drops. It's a win-win situation that fosters engagement, boosts traffic, and drives sales.

Since its launch, Pinduoduo has experienced remarkable growth. The company reported that it had 1.31 billion active buyers as of March 31, 2023, a 30% increase from a year ago. This means that Pinduoduo has surpassed Alibaba as the most popular e-commerce platform in China by user base. Pinduoduo also achieved impressive results in terms of sales and revenue. The company’s annual gross merchandise value (GMV), which measures the total value of goods sold on its platform, reached 2.19 trillion yuan ($330 billion) in 2022, up 55% year-over-year. Revenue for the full year 2022 was 140.8 billion yuan ($21 billion), up 52% year-over-year. Pinduoduo’s market capitalization as of March 31, 2023 was $160 billion, making it the third-largest e-commerce company in China, behind Alibaba and JD.com.

The current CEO, Lei Chen, took the helm in July 2020, succeeding Colin Huang. Chen, who holds a Ph.D. in computer science from the University of Wisconsin Madison, joined Pinduoduo back in 2017 as its chief technology officer. With over 20 years of experience in internet technology, he has been leading the company's research and development efforts, steering Pinduoduo towards even greater heights.

Pinduoduo’s Business Model and Products/Services

How does Pinduoduo make money?

Pinduoduo’s main sources of revenue are online marketing services and transaction services. Online marketing services include advertising fees paid by merchants who want to promote their products on Pinduoduo’s platform. Transaction services include commissions and platform fees charged to merchants who sell their products on Pinduoduo’s platform.

Pinduoduo’s revenue in the first quarter of 2023 was mainly derived from two sources: online marketing services and transaction services. Online marketing services, which include advertising and promotional fees paid by merchants, accounted for 60% of the company’s revenue, while transaction services, which include commissions and payment processing fees, accounted for 40%. The company’s online marketing revenue increased by 50% year-over-year to 27.2 billion yuan ($3.97 billion), as more merchants joined the platform and spent more on advertising. The company’s transaction revenue increased by 86% year-over-year to 10.4 billion yuan ($1.51 billion), as the value and volume of transactions on the platform grew and the company charged higher fees.

Pinduoduo’s business model differs from that of Alibaba and JD.com in several ways. First, Pinduoduo focuses on lower-tier cities and rural areas in China, where consumers are more price-sensitive and less brand-conscious than those in higher-tier cities. Second, Pinduoduo relies more on social networking and word-of-mouth marketing than on search engines and paid advertising. Third, Pinduoduo offers more diverse and dynamic products and services than its rivals, such as fresh produce, live-streaming, and mini-games.

Main Products/Services

Pinduoduo offers four main product and service segments: Pinduoduo Mall, Duo Duo Grocery, Duo Duo Live, and Duo Duo Maicai.

● Pinduoduo Mall: The core segment where users can explore and purchase a wide range of products across categories like apparel, electronics, home appliances, health and beauty, and more. Users can enjoy group-buying deals, flash sales, and promotional events for discounts and rewards.

● Duo Duo Grocery: Focuses on selling fresh produce and groceries. Users can order fruits, vegetables, meat, seafood, dairy products, and daily necessities from local farmers and merchants, with delivery within 24 hours. Community group-buying programs allow users to team up with neighbors to save money by purchasing groceries in bulk.

● Duo Duo Live: Utilizes live-streaming technology to enhance the shopping experience. Users can watch live broadcasts of merchants, celebrities, influencers, or other users showcasing and selling products. Interactions through comments, likes, gifts, and purchases are encouraged.

● Duo Duo Maicai: Offers a one-stop solution for home cooking. Users can order ready-to-cook ingredients, recipes, kitchenware, and related products, with delivery within an hour. Live videos of chefs and users demonstrating various dishes are also available.

Pinduoduo’s Financials, Growth, and Valuation Metrics

Review of Pinduoduo’s financial statements

Pinduoduo’s financial statements show that the company has been growing rapidly in terms of revenue, GMV, and user base. However, the company has also been losing money consistently due to its high operating expenses, especially in sales and marketing.

Pinduoduo’s market capitalization as of June 30, 2023 was $201 billion. The company’s net income for the first quarter of 2023 was -1.0 billion yuan (-$146 million), compared to -1.2 billion yuan (-$187 million) in the same period of 2022. The company’s revenue for the first quarter of 2023 was 37.6 billion yuan ($5.5 billion), up 63% year-over-year. The company’s revenue growth over the past five years has been impressive, increasing from 1.4 billion yuan ($218 million) in 2017 to 159.5 billion yuan ($23.2 billion) in 2022.

Furthermore, their profit margins have been negative since its inception. The company’s operating margin for the first quarter of 2023 was -3%, compared to -5% in the same period of 2022. The company’s net margin for the first quarter of 2023 was -3%, compared to -5% in the same period of 2022.

But here’s the kicker, Pinduoduo’s cash from operations (CFFO) for the first quarter of 2023 was 6.8 billion yuan ($991 million), compared to 4.8 billion yuan ($748 million) in the same period of 2022. The company’s CFFO for the full year of 2022 was 12 billion yuan ($1.7 billion), compared to -2 billion yuan (-$313 million) in 2020.

Moreover, Pinduoduo’s balance sheet strength is moderate. The company’s total assets as of March 31, 2023 were 186 billion yuan ($27.1 billion), while its total liabilities were 84 billion yuan ($12.2 billion). The company’s current ratio (current assets divided by current liabilities) was 2.2 as of March 31, 2023, indicating that it has enough liquidity to meet its short-term obligations. The company’s debt-to-equity ratio (total debt divided by total equity) was 0.3 as of March 31, 2023, indicating that it has a low level of leverage.

Key financial ratios and metrics

Pinduoduo’s key financial ratios and metrics show that the company is growing faster than its peers in terms of revenue and earnings growth, but also trading at a higher valuation than its peers based on the forward price-to-earnings (P/E) ratio.

Pinduoduo is still outperforming its rivals in terms of revenue growth, despite facing fierce competition in the e-commerce market. The company’s revenue grew by 58% in the past year, as of March 31, 2023, beating Alibaba’s 30% and JD.com’s 40%. Pinduoduo is also narrowing its losses, as its earnings improved by 20% in the same period. The company’s forward P/E ratio for the next fiscal year is 12.37, which is lower than Alibaba’s 15.25 and JD.com’s 17.70.

These ratios and metrics suggest that Pinduoduo is growing faster than its peers in terms of revenue, but also facing more challenges in terms of profitability. Pinduoduo is also trading at a higher valuation than its peers based on forward earnings, but this may reflect its higher growth potential and market expectations.

PDD Stock Performance

PDD Stock trading information

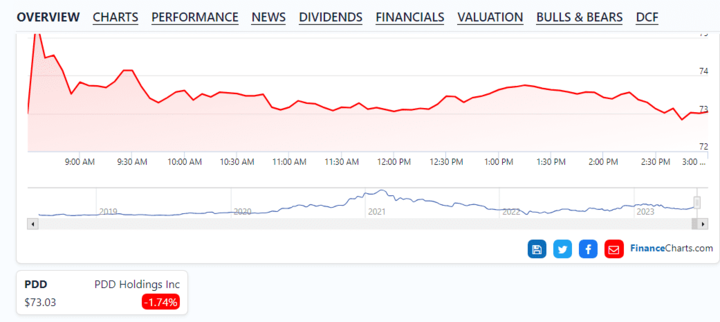

Pinduoduo’s stock is listed on the Nasdaq Stock Market under the ticker symbol PDD. The stock was first traded on July 26, 2018, at an initial public offering (IPO) price of $19 per share. The stock has since split twice, once in a 3-for-1 ratio on April 20, 2020, and once in a 5-for-1 ratio on July 17, 2020. As of June, 2023, the stock’s closing price is $73.03 per share.

Pinduoduo’s stock trades in US dollars and follows the US market hours. The regular trading hours are from 9:30 a.m. to 4:00 p.m. Eastern Time (ET) on weekdays, except for US public holidays. The pre-market trading hours are from 4:00 a.m. to 9:30 a.m. ET and the after-market trading hours are from 4:00 p.m. to 8:00 p.m. ET.

Pinduoduo does not pay dividends to its shareholders, as it reinvests its earnings into its business growth and expansion. The company has not announced any plans to initiate a dividend policy in the near future.

Overview of PDD Stock Performance

Pinduoduo’s stock performance has been impressive since its IPO, especially in 2020, when it more than quadrupled in value amid the COVID-19 pandemic and the surge in online shopping demand. The stock reached its all-time high of $212.60 per share on February 16, 2021, representing a staggering increase of over 1,000% from its IPO price.

However, since then, the stock has been under pressure due to several factors, such as increased competition from Alibaba and JD.com, regulatory uncertainties, slowing economic growth and consumer spending in China, and rising inflation and interest rates in the US.

Pinduoduo’s stock price has suffered a steep drop since its all-time high in late 2020, amid regulatory uncertainties and competitive pressures. The stock has plunged by 69.2% from $193.00 on October 29, 2020, to $73.03 on June 22, 2023, significantly underperforming the Nasdaq Composite Index, which has risen by 18.1% in the same period. The stock has also fallen behind its rivals, as Alibaba’s stock has dipped by 33.9%, and JD.com’s stock has climbed by 9.2%.

Pinduoduo’s stock performance reflects its strong growth potential as well as its high volatility and risk. The company has been able to gain market share and user loyalty by offering a unique and engaging shopping experience, especially for lower-income and rural consumers who are underserved by traditional e-commerce platforms. The company has also been investing heavily in new initiatives, such as grocery delivery, live-streaming, and cloud computing, to diversify its revenue streams and enhance its competitive edge.

Potential Risks/Challenges Facing Pinduoduo

Pinduoduo faces several risks and challenges that could affect its growth and profitability. Some of the major ones are:

Competitive Risks: Pinduoduo operates in a highly competitive and dynamic market, where it has to contend with not only Alibaba and JD.com, but also other emerging players, such as Meituan,and Kuaishou. These competitors have their own strengths and advantages, such as larger scale, more established brands, more loyal customers, more diversified products and services, more advanced technology and infrastructure, and more financial resources. For example, Alibaba has a dominant position in the e-commerce market, with a comprehensive ecosystem of platforms, services, and affiliates that cover various segments and categories. JD.com has a strong advantage in logistics and delivery, with its own network of warehouses, distribution centers, and couriers that ensure fast and reliable service. JD.com also has a reputation for high-quality products and customer service, which attracts more premium and discerning customers.

Pinduoduo’s competitive advantage lies in its social e-commerce model, which allows users to share products with their network, invite friends to form shopping teams and purchase together at discounted prices. This creates a viral effect that drives user engagement, traffic, and sales. Pinduoduo also leverages artificial intelligence and big data to provide personalized recommendations and gamified incentives to its users, such as coupons, cashback, freebies, and lotteries.

However, Pinduoduo’s competitive advantage may not be sustainable or replicable in the long term. Pinduoduo’s social e-commerce model may face diminishing returns as users become more saturated or fatigued with group-buying deals and promotions. Pinduoduo’s artificial intelligence and big data capabilities may not be able to keep up with the rapid changes in user preferences and behavior. Pinduoduo’s focus on lower-tier cities and rural areas may limit its growth potential as these markets become more mature or penetrated by other competitors.

To stay ahead of the competition and meet the changing needs of its users, Pinduoduo should focus on continuous innovation and providing value-added products and services. It is important for Pinduoduo to differentiate itself by offering unique and appealing offerings.

Additionally, Pinduoduo should address concerns related to its brand image and customer satisfaction. It has faced criticism for selling counterfeit or low-quality products, infringing upon consumer rights, and mistreating its employees and merchants. By addressing these issues, Pinduoduo can improve trust and build a positive reputation among its customers, creating a better experience for all stakeholders involved.

● Pinduoduo faces regulatory risks in a highly regulated market. Compliance with changing rules and regulations is essential. Pinduoduo must rectify its practices, enhance its data protection, and demonstrate its social responsibility. Navigating these challenges is crucial for its sustained success and ethical business practices.

Pinduoduo’s regulatory risks could have significant impacts on its growth and profitability. The company may face increased costs and liabilities, reduced revenue and margins, suspended or restricted services, damaged reputation, and trust, or even revoked licenses or bans. The company may also face uncertainties and challenges in adapting to the evolving regulatory environment and meeting the expectations of various stakeholders.

Therefore, Pinduoduo needs to strengthen its compliance and risk management capabilities, as well as improve its communication and cooperation with regulators and other parties. Pinduoduo also needs to balance its growth and innovation with its social responsibility and contribution.

Opportunities for Growth and Expansion

Pinduoduo has identified various opportunities for growth and expansion that can significantly bolster its competitive edge and profitability. Here are some of the key opportunities:

Growth Opportunities: Pinduoduo envisions leveraging artificial intelligence to provide a targeted range of goods. By harnessing its data and AI capabilities, the company aims to better understand user and merchant preferences, offering personalized products and services. Additionally, Pinduoduo seeks to optimize its operations and efficiency by improving supply chain management, logistics, pricing, marketing, and customer service

Expansion Opportunities: Pinduoduo has the potential to expand into new markets, segments, categories, or regions to complement its existing business. For instance, it can venture into higher-tier cities or overseas markets, targeting more affluent consumers seeking quality and variety in online shopping. Moreover, Pinduoduo can explore new segments or categories that align with its social e-commerce model or offer value-added products/services.

By pursuing these expansion opportunities, Pinduoduo can diversify revenue streams, reduce dependency on specific markets, attract users with different backgrounds, and preferences, and enhance its brand image by providing a wider range of quality and diverse online shopping options.

Trading Strategies andTips for PDD Stock

Key Resistance and Support Levels of PDD Stock

Pinduoduo’s stock price has been fluctuating in a downtrend channel since February 2021, when it reached its all-time high of $212.60 per share. The stock has been facing strong resistance at the upper boundary of the channel, as well as at the 50-day and 200-day moving averages. The stock has also been finding some support at the lower boundary of the channel, as well as at some previous lows.

As of June 30, 2023, the stock’s closing price was $96.20 per share. The stock’s key resistance levels are $100.00, $120.00, and $140.00 per share. The stock’s key support levels are $80.00, $60.00, and $40.00 per share.

As you can see, the chart shows the price movements of PDD stock from January 2021 to June 2023, along with some horizontal and diagonal lines that indicate the support and resistance levels. The support levels are the areas where the price tends to bounce back or find support, while the resistance levels are the areas where the price tends to reverse or face resistance. You can use these levels to identify potential entry and exit points for your trades, as well as to set your stop-loss and take-profit orders.

For example, if you want to buy PDD stock, you can look for a bounce off the lower line of the channel or a horizontal support level, such as $80 or $60. If you want to sell PDD stock, you can look for a reach of the upper line of the channel or a horizontal resistance level, such as $120 or $140. You can also use technical indicators, such as moving averages, trendlines, or oscillators, to confirm your trading signals and identify trend reversals or continuations.

Advantages of CFD

Pinduoduo's stock can be traded through contracts for difference (CFDs), a derivative that allows traders to speculate on price movements without owning the underlying asset. CFDs offer advantages over traditional stock trading, including leverage, short selling, and diversification.

With leverage, traders can control a larger position with a smaller capital amount. For instance, a 10:1 leverage ratio allows $10,000 worth of Pinduoduo's stock to be controlled with just a $1,000 margin. Short selling enables traders to profit from falling prices by selling an asset they don't own and buying it back later at a lower price. CFDs also allow for portfolio diversification across various assets and markets.

However, CFDs come with risks. They are subject to high volatility and rapid price fluctuations, potentially resulting in significant gains or losses. Leverage increases the risk, as traders can lose more than their initial investment and must manage interest payments and maintain adequate margin levels. Overnight risk is also present, exposing traders to price movements when the market is closed and potentially incurring unexpected losses or gains.

Due to these risks, CFDs are more suited for short-term trading or hedging rather than long-term investing. Traders should be aware of the associated costs and use risk management tools like stop-loss orders, limit orders, and trailing stops to protect their investments.

Trade PDD Stock CFD at VSTAR

VSTAR is a leading online trading platform that offers CFD trading on various assets, including Pinduoduo’s stock. VSTAR has several advantages for traders who want to trade PDD stock CFD, such as:

● Competitive Spreads and Commissions: VSTAR offers low spreads and commissions on PDD stock CFD, which means traders can save on trading costs and maximize their profits.

● Fast Execution and Reliable Platform: VSTAR provides fast execution and a reliable platform that ensures a smooth and seamless trading experience. Traders can access VSTAR’s platform via web, desktop, or mobile devices, and enjoy advanced features and tools, such as charts, indicators, news, and analysis.

● Free Demo Account and Education: VSTAR offers a free demo account that allows traders to practice CFD trading with virtual money and test their strategies without risking real money. VSTAR also provides free education and resources that help traders learn the basics and advanced aspects of CFD trading.

● Customer Support and Regulation: VSTAR offers 24/7 customer support that is available via phone, email, or live chat. VSTAR’s support team is friendly, professional, and knowledgeable, and can assist traders with any issues or queries they may have. VSTAR is also regulated by CySEC (Cyprus Securities and Exchange Commission) under licence number 409/22. This means that VSTAR follows strict rules and standards to protect its clients’ funds and interests.

To trade PDD stock CFD at VSTAR, traders need to follow these simple steps:

● Open an account with VSTAR by filling out a registration form and providing some personal information.

● Verify their identity and address by uploading some documents, such as a passport or driver’s licence and a utility bill or bank statement.

● Deposit some funds into their account by choosing a payment method, such as credit card, bank transfer, or e-wallet.

● Search for PDD stock CFD on VSTAR’s platform and click on it to open a trading ticket.

● Enter the amount they want to trade and choose whether to buy or sell.

● Confirm their order and monitor their position on VSTAR’s platform.

● Deposit some funds into their account by choosing a payment method, such as credit card, bank transfer, or e-wallet.

Conclusion

Pinduoduo, a dynamic and innovative e-commerce powerhouse, has revolutionized China's online retail landscape with its social shopping concept. The company's remarkable growth in users, revenue, and market share has posed a serious challenge to established giants like Alibaba and JD.com. Pinduoduo's stock has also soared, ranking among the top-performing Chinese stocks in 2021.

Yet, Pinduoduo faces significant hurdles and uncertainties that could impact its future success and profitability. Operating in a competitive and regulated market, the company must continually innovate and differentiate itself. Balancing growth with risk management and compliance is crucial. Demonstrating long-term profitability and adaptability further add to the company's demands.

Investors intrigued by Pinduoduo's vision, strategy, execution, and potential may find its stock a compelling investment. VSTAR, a leading online trading platform, offers CFD trading on various assets, including Pinduoduo's stock. With competitive spreads, fast execution, reliable platforms, demo accounts, education, customer support, and regulation, VSTAR provides an advantageous option for trading PDD stock CFDs.

While CFD trading offers opportunities, it is a complex and risky endeavor that requires skill and knowledge. Traders must grasp the associated risks and costs and employ effective risk management tools. Prior research and analysis are essential before making trading decisions.

For those considering trading Pinduoduo's stock CFDs, evaluating both Pinduoduo and VSTAR, understanding the risks and opportunities, and conducting thorough research are crucial steps toward making informed choices.