WTI oil price may see downside pressure as the inventory report is about to be released today

The oil market is currently in a state of flux, with several key factors influencing its trajectory. Oil prices, which recently reached 10-month highs, have experienced a retreat due to uncertainty surrounding the U.S. Federal Reserve's upcoming interest rate decision. This decision has left investors pondering when peak interest rates will be reached and how this will impact energy demand.

Despite the setback in oil prices, there are indicators of a tightening crude supply for the remainder of 2023. Notably, U.S. oil stockpiles saw a more substantial than expected drawdown of approximately 5.25 million barrels, well surpassing the 2.2 million-barrel decline anticipated by analysts. Furthermore, U.S. shale output has remained sluggish, adding to concerns about supply constraints. Saudi Arabia and Russia's decision to extend their combined supply cuts of 1.3 million barrels per day until the year-end has compounded these worriesThe pivotal role of the Federal Reserve's decision suggests that the oil market remains tight and will continue to do so in the short term. However, he notes that unless Wall Street becomes apprehensive about the Fed's potential impact on the economy, the outlook for crude demand should gradually soften, but a supply deficit is likely to persist throughout the winter.

The global oil production landscape has also seen developments, with Saudi Arabia extending its voluntary crude oil production cut of 1 million barrels per day through the end of the year. This extension is anticipated to lead to a 0.2 million barrels per day reduction in global oil inventories in the fourth quarter of 2023. Consequently, the Brent crude oil price is expected to average $93 per barrel during this period, up from $86 per barrel in August. However, the price is projected to ease to an average of $87 per barrel by the second half of 2024 as global oil inventories are expected to rise.

US energy consumption

In the United States, there are notable changes in energy consumption patterns. U.S. gasoline consumption forecasts have been revised downward due to population estimates that include fewer working-age individuals and more retirees, who tend to drive less. As a result, U.S. gasoline consumption is predicted to average 8.9 million barrels per day in 2023 and 8.7 million barrels per day in 2024. Total U.S. liquid fuel consumption is also expected to decrease, with an average of 20.1 million barrels per day in 2023, down 0.3 million barrels per day from the previous forecast. These changes are partly driven by the reclassification of natural gasoline and unfinished oils.

US natural gas consumption

In contrast, U.S. natural gas consumption is on the rise, with an average of 80.5 billion cubic feet per day in September, marking a 5% increase from the previous year. This increase is attributed to elevated natural gas-fired electricity generation, driven by strong demand for air conditioning and reduced generation from coal-fired plants during the summer months.

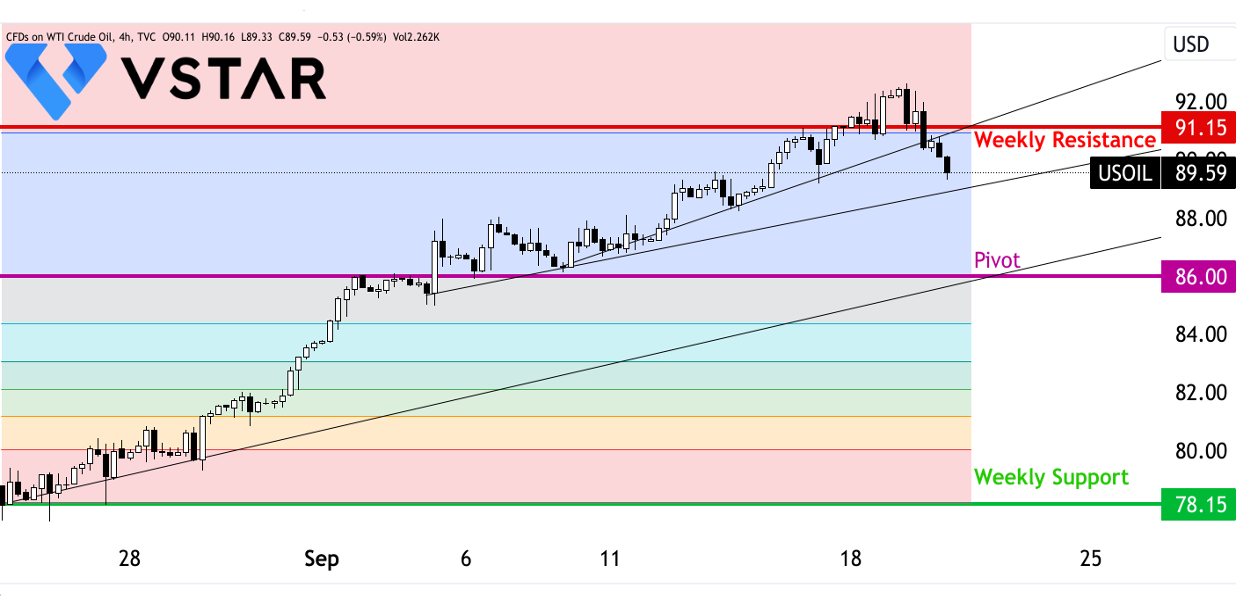

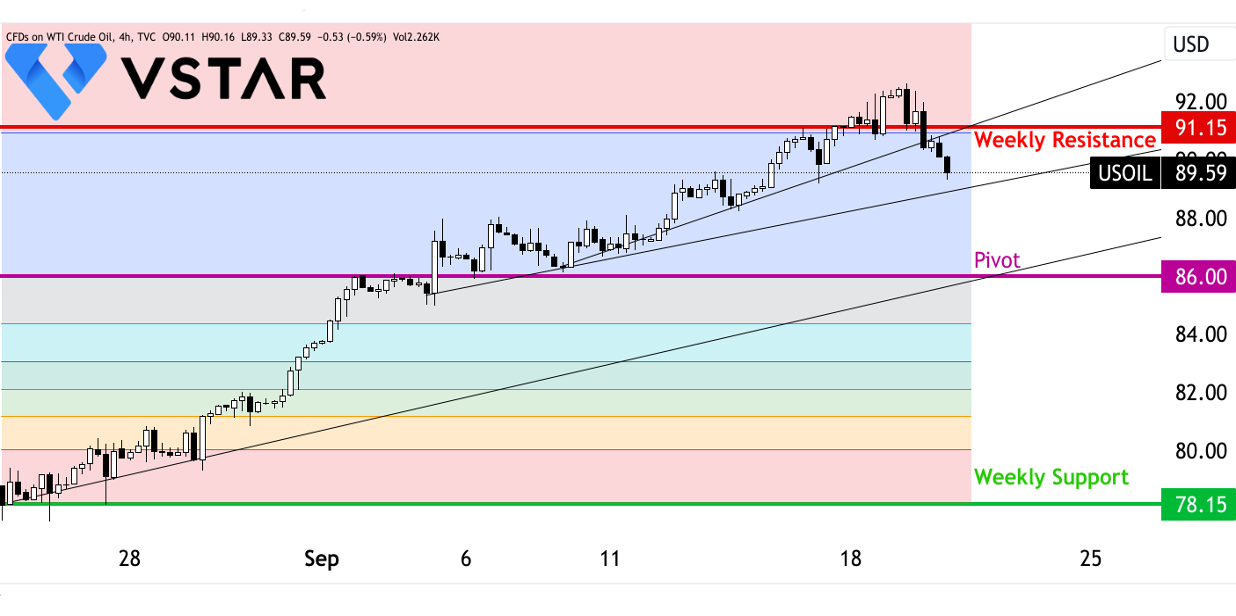

Ahead of the weekly inventory report by EIA, it is forecasted to be negative 1.912 million barrels; however, oil inventories can repeat the trend of last week, where oil negative 6.307 million barrels was predicted by the market but the actual outcome was 3.954 million barrels. Here are a few technical levels for the week.

Data source: tradingview.com