- Nvidia's Q3 earnings report shows a 279% year-on-year increase in Data Center revenue, reaching $14.5 billion.

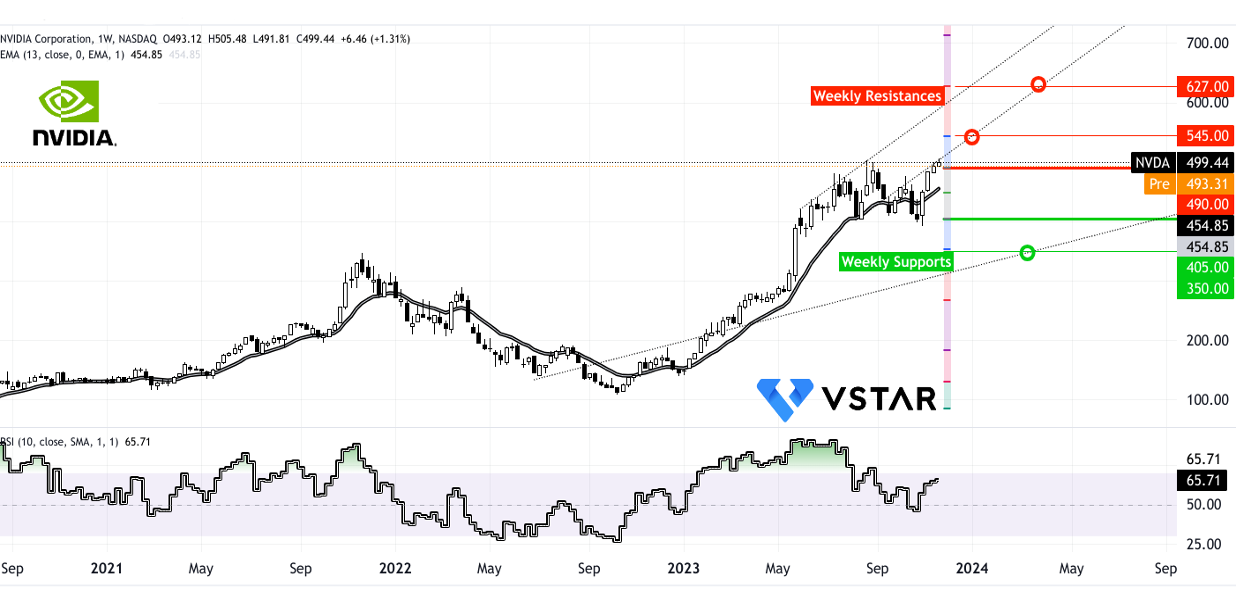

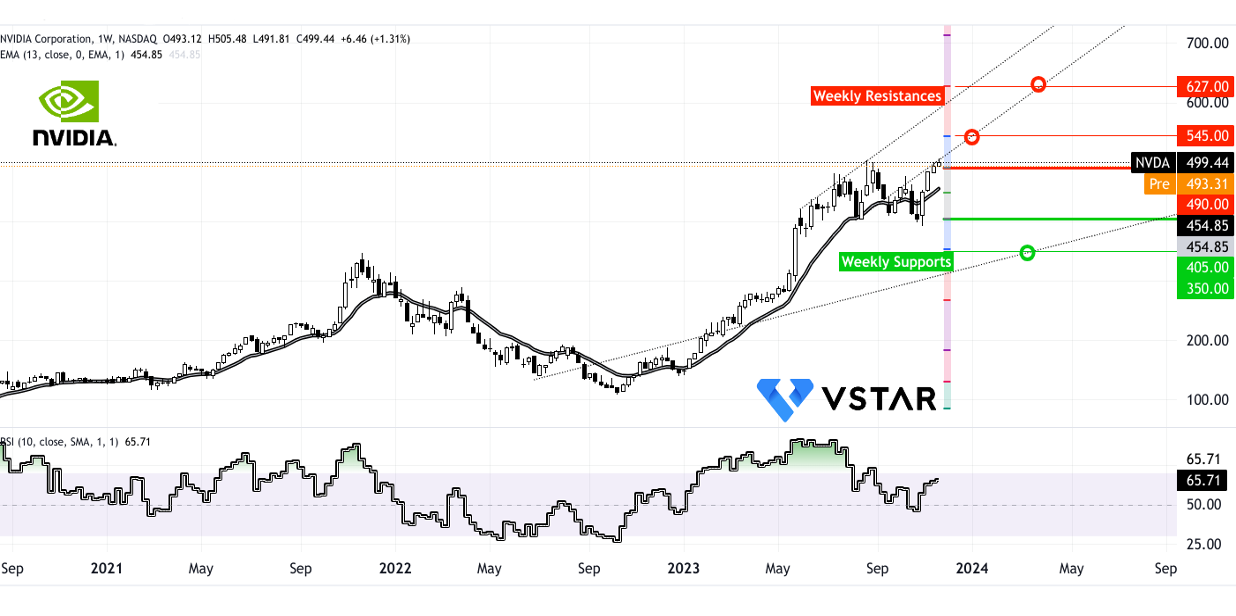

- The company faces resistance at $490, with RSI at 65, potentially stalling further stock upside.

- Anticipated resistance at $545 could trigger a pullback to retest $490, following the principle of change of polarity.

- Speculation suggests potential price volatility, with a bullish scenario reaching $627 due to AI excitement and investor fervor.

NVIDIA Corporation (NVDA) has exhibited a robust growth in Q3 FY2024 trajectory propelled by specific fundamental strengths that solidify its position as a frontrunner in the technology industry, particularly in the realm of artificial intelligence (AI), data centers, gaming, professional visualization, and automotive sectors. The company's exceptional growth can be dissected into key factors that elucidate its rapid expansion and potential for continued growth.

Data Center Dominance

Revenue Surge: Nvidia's Data Center segment has been a standout performer, witnessing an exponential surge in revenue—up by a staggering 279% year-on-year and 41% sequentially to $14.5 billion. This unparalleled growth is underpinned by a robust demand for its HGX platform and InfiniBand networking, establishing it as the go-to reference architecture for AI supercomputers and data center infrastructures.

AI Infrastructure Prowess: The integration of the HGX platform and InfiniBand stands as a testament to Nvidia's stronghold in the AI domain. Major companies, including Adobe, Microsoft, ServiceNow, and Zoom, leverage Nvidia's technology for groundbreaking AI applications such as generative AI, chatbots, and deep learning.

Diverse Demand: The company's strategic investments in AI infrastructure for various applications like deep learning, recommender systems, and generative AI have propelled substantial and diverse demand in the Data Center segment. Notably, consumer internet companies and enterprises have been instrumental in driving exceptional sequential growth, accounting for nearly half of the Data Center revenue and surpassing overall growth rates.

Global Expansion and Geopolitical Strategies

Strategic Diversification: Despite encountering challenges due to new export control regulations impacting certain regions like China and the Middle East, Nvidia's proactive approach aims to offset this decline by bolstering growth in other global markets. The company's resilient strategy emphasizes geographic diversification and market penetration across regions, showcasing its global presence and adaptability.

National AI Infrastructure Investments: Nvidia's collaborations with countries like India and France, in tandem with tech giants such as Infosys and Reliance, illustrate its efforts to bolster sovereign AI infrastructure. This strategic alliance positions Nvidia to tap into a multi-billion dollar opportunity while supporting countries in developing their AI capabilities.

Product Innovation and Expansion

Cutting-edge Product Releases: Nvidia's introduction of groundbreaking products such as the H200 GPU equipped with HBM3e memory and the Grace Hopper Superchip—integrating ARM-based Grace CPU with Hopper GPU—represents a significant leap forward. These innovations signify a new multi-billion dollar product line and reaffirm Nvidia's commitment to advancing AI computing.

AI Supercomputing Leadership: Collaborations with renowned supercomputing centers and governments in the US, Europe, and Japan underscore Nvidia's prowess in building some of the world's most potent AI supercomputers. Noteworthy projects include collaborations with Los Alamos National Lab, the Swiss National Supercomputing Center, the UK government's Isambard-AI, and Germany's Julich—solidifying Nvidia's pivotal role in the AI computing landscape.

AI Acceleration and Performance: Continuous advancements in enhancing performance and reducing costs for inference and AI training models through initiatives like TensorRT-LLM and H200 signify Nvidia's unwavering dedication to driving progress in AI computing. Achieving a 4x increase in performance or cost reduction within a year is a testament to Nvidia's innovation and commitment to improving AI technology.

Strategic Partnerships and Services

Cloud Service Collaborations: Deepening partnerships with major cloud service providers like Microsoft Azure and the provision of AI foundry services and confidential computing instances based on H100 GPUs bolster Nvidia's presence in the cloud computing domain. These collaborations signify Nvidia's strategic alignment with industry leaders, enabling it to offer cutting-edge services and technologies.

Software Offerings and Revenue Streams: Nvidia's steady growth in recurring software, support, and services offerings, aiming to reach an annualized revenue run rate of $1 billion, indicates an additional avenue for revenue generation. Collaborations with enterprises such as Adobe, Dropbox, SAP, and Snowflake further expand Nvidia's reach and offerings in the enterprise AI domain.

Gaming and Professional Visualization Sectors

Gaming Expansion: Nvidia's Gaming segment has experienced substantial revenue growth—up by over 80% year-on-year—fueled by innovations like RTX ray tracing and DLSS available at various price points. The flourishing RTX ecosystem, supported by over 475 RTX-enabled games and applications, solidifies Nvidia's position as a leader in the gaming technology landscape.

Professional Visualization Advancements: The Professional Visualization segment, driven by Nvidia RTX as the preferred platform for professional design, engineering, and simulation, is also leveraging AI applications in healthcare and smart spaces. The launch of new desktop workstations based on Nvidia RTX Ada Lovelace GPUs and ConnectX SmartNICs underscores Nvidia's commitment to enhancing AI workloads and performance.

Automotive Innovation

Strategic Partnerships in Automotive: Nvidia's collaboration with Foxconn to develop next-generation automotive systems-on-chip (SOCs) and AI cockpit solutions fortifies its position in the automotive tech landscape. By providing a standardized AV sensor and computing platform, Nvidia enables customers to build safe and secure software-defined vehicles.

Nvidia Stock (NVDA) Technical Take

Nvidia stock recently surged to a new high due to the earnings effect. However, it's currently encountering resistance around the $490 mark, accompanied by an RSI (Relative Strength Index) of 65, suggesting potential limitations for further upward movement among buyers. The current trend indicates a possible significant resistance level at $545, which could prompt a pullback to retest the $490 level—a phenomenon known as the change of polarity.

It's crucial to observe that heightened volatility, driven by hype around AI and enthusiastic investor sentiment, might drive the price even higher, possibly reaching $627. This exuberance could lead to substantial fluctuations in the stock's value.

Source: tradingview.com

In conclusion, Nvidia's rapid growth is underpinned by its dominant position in AI infrastructure, global expansion strategies, relentless focus on innovation in product development, strategic partnerships, diversified revenue streams across multiple segments, and a commitment to advancing technological frontiers. These key pillars collectively form the bedrock of Nvidia's current growth and paint a promising picture for its future growth trajectory in the technology industry.