Following the release of its fiscal second-quarter earnings report, which beat estimates and delivered a strong forecast driven by AI-driven demand, Micron Technology (MU 15.81%) had a notable spike in its shares yesterday.

MU Quarterly Earnings Outlook

Micron has had hurdles in the past, including a decline in chip demand and an excess of supply during the pandemic. However, the company's success in the second quarter suggests that these issues have been resolved.

The quarter's revenue surpassed projections of $5.34 billion, rising 58% yearly to $5.82 billion.

Profits are also greatly above estimates. Thanks partly to a tax gain, Micron ended the quarter with an adjusted operating profit of $204 million, or $0.42 per share. This considerably outpaced the $0.25 predicted loss per share.

Micron Showed An Optimistic Earnings Forecast

The CEO expressed confidence in Micron's position as a major beneficiary in the semiconductor sector amidst the multi-year AI potential and highlighted the company's progress heading into the year's second half.

Micron predicts revenue for the third quarter of $6.4 billion to $6.8 billion, with adjusted earnings per share falling between $0.38 and $0.52 due to a notable increase in gross margin.

Both estimates are significantly above Wall Street's $6 billion in revenue and $0.20 per share earnings projections.

These numbers and the company's optimistic outlook highlight Micron's competitive advantage in the AI-driven market. Continued margin improvements set the company's stock up for future gains.

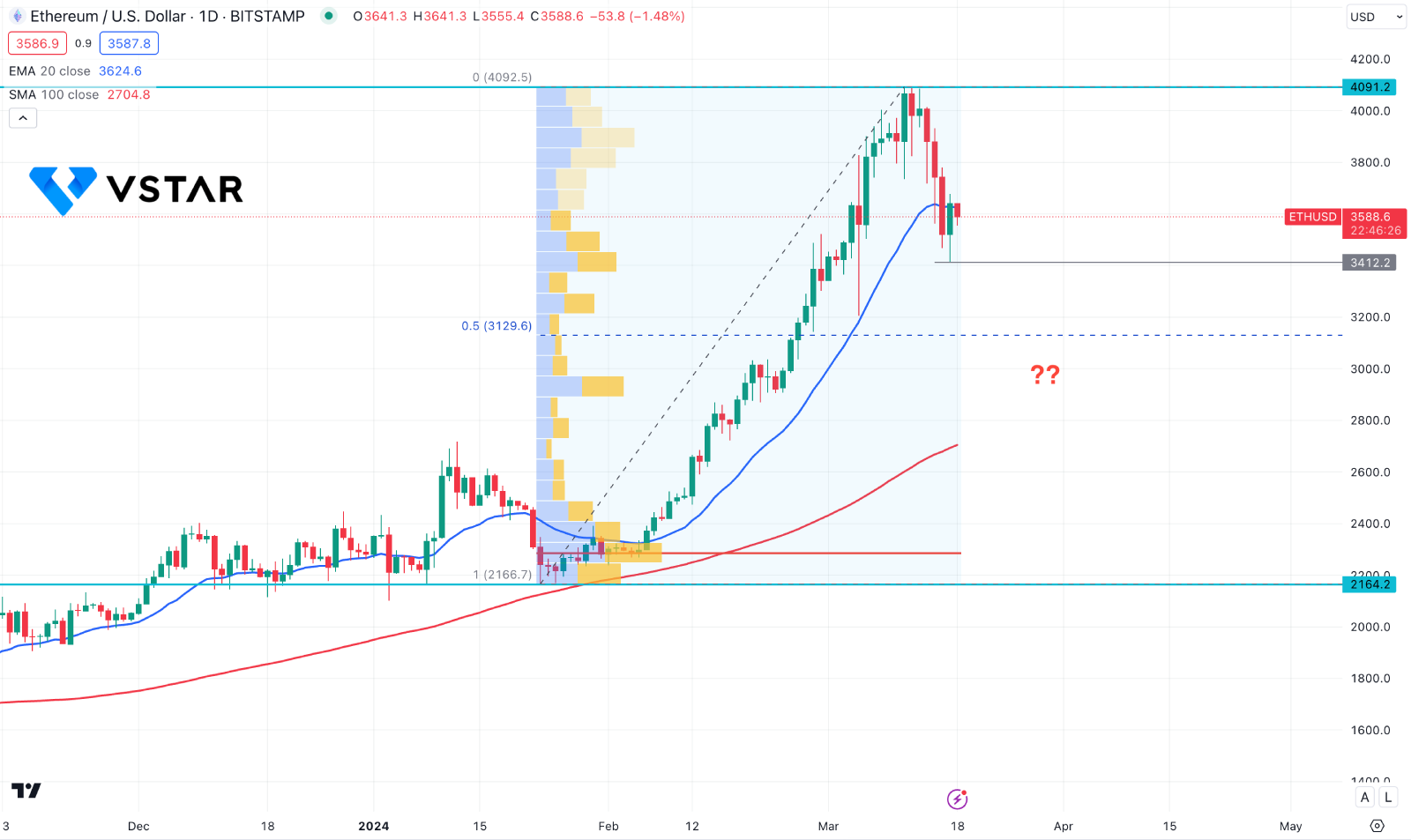

Micron Stock Technical Analysis

In the daily chart of MU stock price, upward pressure is clear, where the recent upbeat results in the earnings report make a remarkable gain. As a result, The Micron stock price moved above the 100.00 psychological line and formed a bullish candle above it. Now, investors should monitor how the price holds momentum above this line before anticipating a continuation signal.

The dynamic 20-day EMA is the immediate support level for this stock, which remains with an upward slope from the 100.00 static line. Moreover, the 100-day SMA is also below the current price and is working as a major support.

Based on the daily outlook of Micron Technology stock, a bullish continuation is potent, where any bearish correction offers a trend trading opportunity from the discounted price. However, investors should closely monitor the intraday price to find a bullish opportunity. Primarily, a rebound is possible from the 100.00 line, but it can extend the downward pressure towards the 90.30 static level.