On March 19, 2025, the stock price of Mixue Ice City (2097.HK) climbed to HK$469.8/share again in the morning trading, and the total market value exceeded HK$177.1 billion, setting a new high since its listing. This performance not only attracted the attention of the market, but also caused people to think: Why did Mixue Ice City's stock price still rise against the trend after being exposed on March 15 for food safety issues such as "using overnight lemon slices"? The logic behind it is the "double tolerance" of consumers and the capital market, or the "hard power" of the business model and growth potential?

Stock price performance: "Mi Xue speed" from dark market to new highs

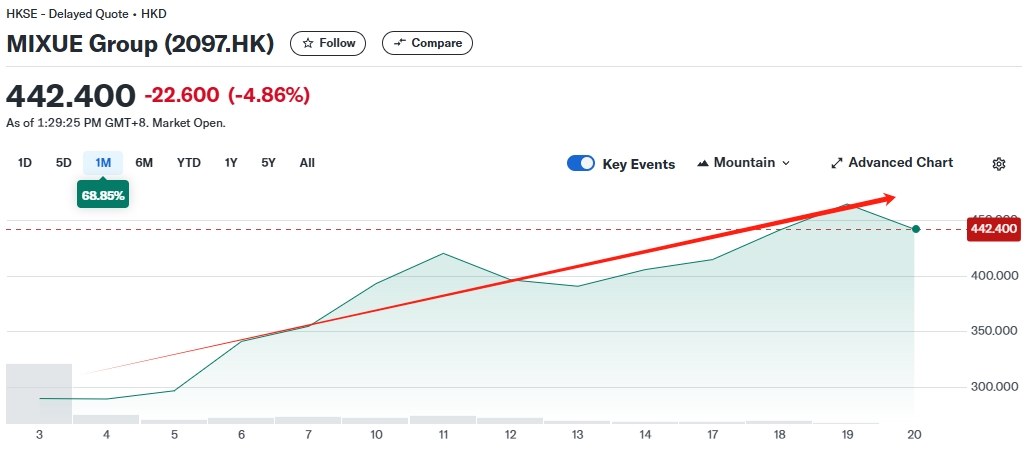

Mi Xue Bing Cheng officially landed on the Hong Kong Stock Exchange on March 3, 2025, with an issue price of HK$202.5, and rose nearly 30% during the dark market trading stage. The opening price on the first day of listing was HK$262, and it has been rising since then. As of March 19, the increase was 79%, far exceeding the performance of the Hong Kong stock consumer sector during the same period. In contrast, brands in the same industry such as Nayuki's Tea (2150.HK) and Cha Baidao (2555.HK) have experienced price drops and valuation cuts after listing, but Mi Xue Bing Cheng has become a rare "counter-trend benchmark" in the new tea beverage track.

"Overnight Lemon" Incident: A Crisis Dispelled

On March 14, Hubei Economic TV's "3.15 Special Report" exposed the illegal use of overnight lemon slices and orange slices and hygiene issues in the Yichang store of Michelle Ice City, which triggered an investigation by the regulatory authorities. However, the reaction of the capital market and consumers was surprisingly calm:

- Consumers' tolerance exceeded expectations

On social media, a large number of netizens expressed their support with jokes such as "What else do you want for a bicycle for 4 yuan?" and "He doesn't think I'm poor, so why should I think about overnight?", and even derived black humor of "lowering the bottom line". This "fan economy"-style tolerance stems from the user stickiness formed by Michelle Ice City's extreme cost-effective strategy - the average price of its core products is only 6 yuan, far lower than its peers. - The capital market "understated"

The day after the incident was exposed (March 17), Michelle Ice City's stock price opened low and then rebounded rapidly, eventually closing up 2.22%; on March 19, it broke through the historical high. Investors are obviously more concerned about its scale profitability: in the first three quarters of 2024, the company's revenue was 18.7 billion yuan, net profit was 3.5 billion yuan, gross profit margin was 32.4%, and the total number of stores exceeded 45,000, firmly ranking the global leader in ready-made beverages.

The underlying logic of stock price resilience: business model and moat

The risk resistance of Mixue Ice City is rooted in its unique business structure:

- Light asset expansion driven by franchise model

More than 90% of the company's revenue comes from selling raw materials and equipment to franchisees, rather than directly operating 510 stores. Although this model leads to high difficulty in terminal quality control (fined 23 times for food safety issues in 2024), it greatly reduces capital expenditure risks and achieves rapid expansion. - Supply chain and cost control advantages

As the largest lemon purchaser in China (purchasing 115,000 tons in 2023), Mixue Ice City reduces costs by building its own supply chain to support its low-price strategy. Its core product, chilled lemonade, has an annual sales volume of more than 1.1 billion cups, with significant economies of scale. - Capital endorsement and market scarcity

Cornerstone investors such as Sequoia China and Hillhouse Capital accounted for 45% of the subscription, demonstrating institutional confidence. In addition, there are no competing products of the same price in the current market that can shake its position as the "king of affordable prices" and form a moat.

Hidden worries and challenges: How to maintain long-term trust?

Although the stock price has not been impacted in the short term, Mixue Ice City needs to be alert to the following risks:

- Food safety bottom line cannot be broken

The Black Cat Complaint Platform has accumulated 8,779 complaints, far exceeding its peers. If franchisees are allowed to violate regulations, consumers' "tolerance" will eventually run out, and the brand image may be backfired. - Sustainability of low-price strategy

Rising raw material costs and labor costs may squeeze profit margins, and gross profit margins need to be maintained through technology upgrades and supply chain optimization. - Overseas expansion and category innovation

At present, the proportion of overseas revenue is low, and the coffee brand "Lucky Coffee" is still in the incubation period. Whether it can replicate the success of tea drinks remains to be verified.

Conclusion: The "Mi Xue Paradox" of the Capital Market

The stock price myth of Mi Xue Bing Cheng reflects the special logic of the consumer stratification era - in the face of extreme cost performance, some consumers and investors choose to "vote with their feet" and tolerate defects in exchange for low-price dividends. However, food safety is the sword of Damocles hanging over our heads. If the brand ignores bottom-line management due to the short-term stock price boom, the long-term collapse of trust may be difficult to recover. As netizens said: "Today's tolerance should not be an excuse for luck, but a starting point for cherishing trust."

(Note: The data and event background of this article are compiled from public reports)

*Disclaimer: The content of this article is for learning only, does not represent the official position of VSTAR, and cannot be used as investment advice.