Investors looking for the best cryptocurrency stocks to buy now have many choices. Marathon Digital (NASDAQ: MARA) has caught the attention of investors looking for the top crypto stocks to buy in 2023.

MARA stock price has soared more than 300% since January, making it one of the best bitcoin mining stocks in 2023. Yet at about $15 currently, the MARA stock price still remains more than 80% below its all-time high.

Marathon Digital Holdings Stock News

Marathon Hires Former Occidental Petroleum Executive As Its CFO

The company has tapped Salman Khan as its chief finance officer. Khan is a former executive at energy companies Occidental Petroleum (NYSE: OXY) and California Resources (NYSE: CRC). Most recently, Khan served as the CFO of Verb Technology Company (NASDAQ: VERB), a sales software provider. Previously, Khan worked for accounting firms PricewaterhouseCoopers, Ernst & Young, and Arthur Andersen.

Marathon Partners With Brink to Support Bitcoin Developers

In an effort to support innovations in the Bitcoin ecosystem, Marathon has teamed up with Brink to raise $1 million to support Bitcoin developers. Brink is an entity dedicated to supporting research and development on the Bitcoin network. As part of the fundraising effort, Marathon has agreed to match donations made to Brink in 2023.

Source: Pixabay

Marathon Digital Overview

Marathon Digital is a cryptocurrency mining company. It specializes in mining Bitcoin, the flagship cryptocurrency. The company is headquartered in Las Vegas, Nevada.

Founded in 2010, Marathon started off as a patent licensing company. The company went public in February 2012.

Marathon CEO Fred Thiel took the helm of the company in April 2021. Thiel founded and led many companies before joining Marathon. For example, he was the CEO of GameSpy, Lantronix, and Local Corporation. At Lantronix, Thiel's accomplishments included doubling the company's revenue and taking it public.

Marathon Digital Business Model and Products

Source: Pixabay

How Marathon Digital Makes Money

As a Bitcoin mining company, Marathon Digital has two main revenue sources: block rewards and transaction fees. The block reward is compensation for Bitcoin miners for contributing to maintaining the Bitcoin blockchain by verifying transactions. The reward amount is currently 6.25 Bitcoin for every block added to the Bitcoin blockchain.

The transaction fee is the cost of using the Bitcoin network to complete a transaction. The fee is paid in Bitcoin by parties to a transaction. Bitcoin transaction fee fluctuates based on network demand.

Bitcoin miners compete for a chance to verify transactions to earn block rewards and transaction fees. Marathon Digital recognizes the Bitcoin it receives from rewards and fees as revenue.

Marathon Digital's Main Product

The company currently mines Bitcoin exclusively using specialized machines and software. However, the company has the potential to mine other cryptocurrencies as its technology and capacity improves.

Marathon Digital Financials

Earnings reports tend to have significant impacts on Marathon Digital stock price. As a result, it helps to assess Marathon's financial performance and balance sheet before investing in MARA stock. Let's explore Marathon's financials.

Mara Earnings

Marathon Digital's Revenue

The company released its first quarter earnings in May. It reported revenue of $51.1 million, which was mostly flat from a year ago but exceeded Wall Street expectation by more than $2.3 million.

Marathon appears to be on track for strong revenue growth in the second quarter. Wall Street's Q2 revenue estimate of $92.8 million represents potential growth of 270% over the $25 million in revenue the company reported in the same period last year.

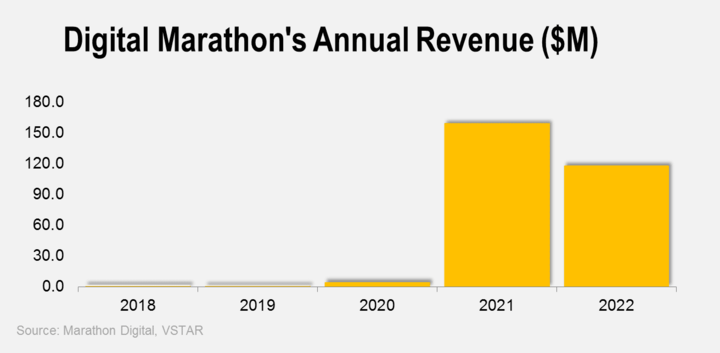

The company reported revenue of $117 million in 2022. Analysts are expecting revenue of $424 million from Marathon in 2023. The chart below shows Marathon's annual revenue trend.

Marathon's revenue fluctuates in step with Bitcoin price. The company's highest annual revenue on record is $159 million, which it attained in 2021. That was the year that the Bitcoin price soared to a record high of nearly $69,000. The company's revenue has increased at a compound annual rate of 140% over the past 5 years.

Marathon Digital's Net Income

Although Marathon Digital (NASDAQ: MARA) is still aiming to turn a profit, its losses are narrowing as recent quarterly reports show. It made a loss of $7.2 million in Q1, which narrowed from a loss of $12.9 million in the same quarter the previous year.

The company made a loss of $687 million in 2022, representing its biggest annual loss ever. The company experienced several unfavorable events in the year, including large impairment of investments and higher interest rates.

Marathon Digital's Profit Margins

The company recorded a gross profit margin of 0.04% in Q1. The operating margin came to -7.6% and the net margin was -14%. Marathon's profit margins have shown strong improvements in recent quarters as the company takes steps to rein in costs.

Marathon Digital's Cash Position and Balance Sheet Condition

Money isn't a big problem for Marathon Digital because this is a company that essentially mints money in the form of Bitcoin. The company finished Q1 with $125 million in cash and about 11,500 Bitcoin worth more than $325 million.

The company's balance sheet shows $1.3 billion in assets and only $760 million in total liabilities. A current ratio of 16 and a debt-to-equity ratio of 1.35 further confirm that Marathon Digital's balance sheet is in great shape.

Marathon Stock Analysis

The best crypto stock to buy is the one that you can count on to make you money. If you're considering investing in MARA stock, it helps to get behind its historical stock performance and price targets. Read on for MARA stock analysis.

MARA Stock Trading Information

Marathon Digital shares trade on the Nasdaq exchange under the MARA ticker symbol. MARA stock is among the most widely traded crypto stocks. More than 40 million Marathon shares exchange hands on an average trading day.

The regular trading in MARA stock starts at 9:30 a.m. ET on weekdays and continues until 4 p.m. Traders looking for extra trading time can take advantage of Marathon's extended trading hours.

MARA premarket trading begins at 6.30 a.m., giving you extra three hours of trading before the opening bell for the regular session. The post-market trading in MARA stock starts immediately after the regular session stops and runs until 8 p.m., giving you extra four trading hours after the closing bell.

MARA Stock Split History

Crypto stock Marathon Digital has undergone three splits since the IPO. The first MARA stock split was a 2-for-1 and it occurred in 2014. This type of split meant that those who held 1,000 shares of Marathon Digital ended up with 2,000 shares after the split.

The Marathon implemented a 1-for-4 reverse stock split in 2017. It implemented another 1-for-4 reverse stock split in 2019. These types of reverse splits consolidate the shares rather than increase the share count.

Marathon Digital doesn't pay cash dividends yet.

MARA Stock Performance

As you can see in the chart above, MARA stock price has more than quadrupled in 2023, outperforming all the other major crypto stocks.

Notably, MARA stock's rise has come alongside increasing volume. This indicates growing investor interest in this crypto stock.

The rise in MARA stock price has come along with the Bitcoin rebound. Marathon Digital is one of the largest Bitcoin miners. Consequently, MARA stock tends to track Bitcoin price as you can see in the chart below.

Despite its recent spike, MARA stock is still far below its peak. Marathon Digital stock's all-time high reached since the company made Bitcoin mining its primary focus stands at $83. At the current price, MARA stock is close to retesting its 52-week high of $18 but remains 80% off its all-time high.

Why Is MARA Stock Going Up?

MARA stock is soaring because of various factors. These are some of the reasons why the Marathon stock price is going up:

Crypto rebound: Although the economic climate remains challenging, inflation is abating. Consequently, many investors are returning to crypto. MARA stock offers investors a chance to get exposure to crypto rebound without having to handle cryptocurrencies directly.

Improving financials: While Marathon Digital may still be making losses, investors appreciate that its losses are shrinking. In Q1, the company's loss narrowed sharply compared to the same period the previous year.

Huge upside potential: Even after its recent rise, MARA stock looks to have plenty of room to run. At the current price, for example, there is a long runway for MARA stock to retest its $83 all-time high.

Insiders buying MARA stock: Marathon Digital corporate insiders are using their own money to purchase MARA shares. According to TipRanks data, Marathon executives and directors have bought nearly $2 million worth of MARA shares in the past three months.

MARA Stock Forecast

A look at MARA stock price targets can give you a sense of how much upside is left in this crypto stock or what direction Wall Street expects the stock to move.

It appears that MARA stock is sprinting faster than analysts expected. It has already breached Wall Street's average MARA stock forecast of $13.50. The crypto stock is closing in on Wall Street's peak price target of $20, which currently suggests nearly 30% upside potential.

In its ascent, MARA stock has breached several key resistance levels. As you can see in the chart above, the stock has not only breached the long $12 resistance point, but also turned it into a new support level. A new resistance level is now at $16, and breaching it could see MARA share price soar further.

Marathon Digital's Challenges and Opportunities

The Bitcoin mining company faces a number of challenges but opportunities are also plenty. Let's explore Marathon Digital's challenges and opportunities to gauge what might lie ahead for the company.

Marathon Digital's Risks and Challenges

Business concentration: Marathon Digital currently mines Bitcoin exclusively, which means the company's fortunes are tied to Bitcoin's fate. While this kind of concentration may have its benefit because Bitcoin is the crypto industry bellwether, it can lead to problems to the company if Bitcoin underperforms the broader crypto industry.

Regulatory pressures: Regulations remain largely unfriendly to the crypto industry. For example, many cryptocurrencies have been delisted from exchanges because of regulatory crackdowns. These crackdowns have the adverse effect of diminishing capital inflow into the crypto space, which can cause a slow advance in Bitcoin price.

Competitive pressures: Although it can be lucrative, Bitcoin mining is a highly competitive business. These are the main Marathon Digital competitors and the threats they pose:

1. Marathon Digital vs. Riot Platforms

Marathon Digital and Riot Platforms (RIOT) are in a fierce race to expand their crypto mining capacity. Consequently, they're investing heavily in mining rigs. Marathon has about 11,500 Bitcoin in its treasury, while Riot has about 7,200 in Bitcoin holding.

2. Marathon Digital vs. Hive Blockchain

Hive Blockchain (HIVE) is a Canadian crypto mining company. It mines Bitcoin along with other cryptocurrencies. The company has about 3,200 Bitcoin in its treasury. It is increasingly expanding its mining capacity to challenge Marathon.

3. Marathon Digital vs. CleanSpark

Similar to Marathon, CleanSpark (CLSK) also primarily mines Bitcoin. It has mined about 3,500 Bitcoin since the beginning of the year. But CleanSpark is more active in selling Bitcoin than Marathon.

Marathon Digital's Competitive Advantages

Increasing crypto capacity: Marathon is expanding its mining capacity at a more rapid pace than many of its competitors. The company has doubled its hashrate or mining computing power since January. It plans to continue increasing its capacity. That puts it on track to capture more block rewards and transaction fees.

Advanced mining machines: Marathon regularly upgrades its mining system. Consequently, the company has among the most modern and most energy efficient mining machines in its fleet. This enables Marathon to not only produce more Bitcoin, but also control its operating costs better than its competitors.

Proprietary crypto mining software: Alongside advanced mining hardware, Marathon uses proprietary software in its mining operations. The software enables the company to control mining machines uptimes, output, and speed in ways that gives it an edge in the business.

Bitcoin focus: Marathon Digital's exclusive focus on Bitcoin mining offers it an important advantage. Although the regulatory environment remains largely adverse toward crypto, Bitcoin is treated a little differently. Consequently, the Bitcoin business presents fewer regulatory problems compared to other cryptocurrencies.

Diversified footprint: The company has taken steps to diversify its footprint and spread its risks. It runs mining operations in the U.S. and the UAE. In the U.S., Marathon operates mining sites in several states. The company aims to be 50% onshore and 50% offshore for its operations.

Marathon Digital's Opportunities

Rising Bitcoin value: Bitcoin price has a direct impact on Marathon's financial performance. The increasing adoption of Bitcoin as an investment and means of payment should drive the crypto's value higher in the future. Bitcoin price predictions suggest the crypto could hit a new all-time high at $100,000 by the end of 2024.

Increasing activity on the Bitcoin network: The Ordinals technology has made it possible to develop NFTs and other crypto features on the Bitcoin platform. The coming of NFTs has the potential to increase transaction demand on the Bitcoin network, which can boost transaction fees for miners like Marathon Digital.

Additional mining opportunities: Although Marathon Digital has currently concentrated its efforts on mining Bitcoin, there are many other crypto mining opportunities. The other mineable cryptocurrencies include Bitcoin Cash, Ethereum Classic, Litecoin, and Monero.

Renewable energy production: Electricity is a major cost item for crypto miners. Marathon Digital is investing in renewable energy sources. These efforts have the potential to not only lower the company's electricity bill, but also reduce Bitcoin's carbon footprint, which can boost interest in crypto.

Marathon Digital Stock Investing Strategies

There are two main methods you can make money with Marathon Digital (NASDAQ: MARA) stock. Let's explore these MARA stock investing strategies:

1. Buying and Holding Marathon Digital Shares

If you're seeking long-term returns and shareholder voting rights, buying and holding Marathon shares may be the best strategy for you. The downside to this method is that it requires a large amount of starting capital and you can only make money when MARA stock price is going up.

2. Trading Marathon Digital Stock CFD

This is an alternative investment method for those with little money to start with. It is also the ideal investing strategy for those seeking short-term profit with MARA stock.

In this strategy, you profit from correctly predicting the direction of MARA stock price. It involves purchasing CFD contracts, which usually costs less than the stock's market price.

Let's say you expect MARA stock price to go up. You purchase 1,000 contracts for this trade. If MARA stock price jumps by $3 in a day or after a few hours, your profit would be $3,000. If you predicted the stock would go down and it dips by $2, your profit would be $2,000.

As you can see, CFD trading allows you to make money both when MARA stock is going up and when it is going down.

Marathon Digital Stock CFD Trading Tips

● Buy MARA stock near the support level if you're betting on the stock going up.

● Sell MARA stock near the resistance level if you're betting on the stock going down.

● Apply the 1% asset allocation technique to reduce the impact of losing trades on your account.

● Apply risk management techniques such as stop-loss and take-profit orders.

Trading MARA Stock CFD with VSTAR

If you have decided that Marathon Digital is the best crypto stock to buy now, the next thing you want to do is choose the best CFD broker. With the right broker, you can not only maximize your profit with lower trading costs but also improve your trading skills over time. For Marathon stock CFD trading, consider using VSTAR.

VSTAR is a fully regulated CFD broker that offers high-speed and low-cost trading. VSTAR is designed for both beginner and professional traders, offering tight-spreads and commission-free trading on its standard accounts.

You can start trading Marathon stock CFD on VSTAR with as little as $50 in upfront investment. The platform offers generous leverage that enables traders with little money to boost their positions and maximize their profit. VSTAR has garnered highly positive reviews on Trustpilot because of its outstanding service.

Consider opening your VSTAR account today and start trading Marathon Digital stock CFD. If you're a new trader, VSTAR offers a demo account with up to $100,000 in virtual cash to enable you to practice your strategies before you start investing real money.

Final Thoughts

If you're looking for the best crypto stock to buy now, Marathon Digital (NASDAQ: MARA) stock is worth considering. You can purchase and hold Marathon shares for long-term gains or trade Marathon stock CFD for short-term profit opportunities.

FAQs

1. Is MARA a good stock to buy?

Yes, MARA stock currently looks undervalued. As a leading Bitcoin miner, MARA should benefit as Bitcoin prices recover.

2. What is the target price for MARA in 12 months?

The 12-month price target for MARA stock is $30-35.

3. What will MARA be worth in 2030?

Given the long-term outlook for crypto adoption, MARA could be worth over $100 per share by 2030. However, there are risks associated with bitcoin price volatility.

4. What is the future of MARA?

MARA's future looks positive if Bitcoin gains more mainstream adoption. As one of the largest US-based miners, MARA stands to benefit from crypto tailwinds.