Are you ready to dive into the exciting world of Litecoin CFD trading? Get ready to ride the waves of cryptocurrency markets without the hassle of owning physical coins. Whether you're a seasoned trader or a curious beginner, Litecoin CFDs offer an exciting opportunity to speculate on the price movements of this popular digital currency.

Imagine a system where you can potentially profit from rising and falling Litecoin prices. This is what the flexibility of CFDs (Contract for Difference) offers everyone. With LTC CFDs, you can jump right into the action through user-friendly broker platforms that allow you to trade 24/7.

As with any trading adventure, there are important factors to consider. Therefore, this guide will examine Litecoin CFD trading strategies including risk management strategies, how to choose the right broker, and develop a solid trading plan.

What Are Litecoin CFDs?

Cryptocurrencies have gained significant popularity in recent years, and Litecoin (LTC) is among the leading digital assets. Litecoin CFDs (Contracts for Difference) offer an alternative method to participate in the price movements of Litecoin without actually owning the cryptocurrency itself.

CFD stands for Contract for Difference. When trading Litecoin CFDs, you enter into an agreement with a broker to exchange the difference in Litecoin's price between the opening and closing of the contract. This allows you to speculate on Litecoin's price movements without physically owning the underlying asset.

This action calls for a secure trade of LTC. Trading Litecoin CFDs is facilitated through broker platforms, which provide access to the cryptocurrency market. One of the key advantages of trading CFDs is the ability to utilize leverage, meaning you can control a larger position with a smaller amount of capital.

It is imperative to mention that LTC CFDs closely track the underlying Litecoin market, with their value directly linked to the price of Litecoin. As the price of Litecoin fluctuates, the value of the Litecoin CFDs will mirror these changes. This exposes traders to Litecoin's price movements without needing to own and manage actual LTC tokens.

Furthermore, CFDs offer the flexibility to profit from rising and falling markets by taking long or short positions. In the following sections, we will delve into the process of trading Litecoin CFDs, choosing a broker, and developing effective trading strategies to navigate this exciting and dynamic market.

Why Trade LTC CFDs?

Litecoin CFDs offer several advantages that make them an attractive choice for traders looking to engage in the cryptocurrency market. Let's explore the reasons why trading LTC CFDs can be beneficial.

i. Leverage

One of the key advantages of trading Litecoin CFDs is the availability of higher leverage compared to spot LTC trading. With leverage, traders can control a larger position in the market with a smaller amount of capital. For example, a leverage of 1:10 means that for every $1 of trading capital, a trader can control $10 worth of LTC CFDs.

The use of leverage can significantly amplify both profits and losses. When used wisely, leverage allows traders to maximize their potential returns on successful trades. However, it's important to note that increased leverage also increases the risk exposure. During adverse price movements, losses can accumulate quickly, potentially exceeding the initial investment.

ii. Short selling

Another notable perk of trading Litecoin CFDs is the ability to easily take short positions and profit from a decline in Litecoin's price. Short-selling spot LTC directly can be more complex and cumbersome.

When traders anticipate that the price of Litecoin will decrease, they can open a short position on LTC CFDs. This means they are effectively selling LTC CFDs they do not own, to buy them back at a lower price in the future. The difference between the selling and eventual buyback prices represents their profit.

Short-selling spot LTC directly requires finding a counterparty willing to lend the LTC tokens, which can be challenging and involve additional fees. In contrast, CFDs provide a more accessible and efficient way to enter short positions, as the process is facilitated through CFD broker platforms.

iii. No ownership

When trading LTC CFDs, traders are speculating on the price movements of Litecoin without actually owning the underlying asset. Instead of purchasing and holding LTC tokens in a digital wallet, traders enter into a contract with the CFD provider. This contract reflects the price movements of Litecoin, allowing traders to profit from both upward and downward price trends.

The absence of ownership provides several advantages. Firstly, it eliminates the need to worry about security risks associated with storing cryptocurrencies, such as the risk of theft or hacking. Additionally, traders are not limited by the liquidity constraints or trading hours of the cryptocurrency exchanges, as CFD trading is available 24/7 on broker platforms.

Furthermore, the absence of ownership simplifies the trading process. Traders can easily enter and exit positions without the need for complicated procedures involved in buying and selling actual LTC tokens. This enhances the flexibility and efficiency of trading, allowing for faster execution of trades and better capital utilization.

iv. 24/7 trading

The 24/7 trading availability is particularly advantageous in the cryptocurrency market, which is known for its high volatility and rapid price fluctuations. Litecoin, like other cryptocurrencies, experiences price movements at any time due to various factors such as market news, global events, or investor sentiment. With CFD trading, traders can capitalize on these market dynamics by reacting swiftly to price changes and executing trades in real time.

Unlike traditional financial markets that operate within specific trading hours, CFD platforms are accessible 24/7. This means that traders can monitor and execute trades at their convenience without being restricted by geographical or time-zone limitations. Whether early morning or late at night, traders can participate in the market whenever they deem appropriate.

v. Extra fees

While trading Litecoin CFDs offers various advantages, it is important to understand the associated costs and fees. CFDs incur additional charges such as spreads, commissions, and overnight financing fees, which can significantly affect your overall profits and losses if not properly managed.

Spreads refer to the difference between a CFD's buying and selling price. They serve as the primary source of income for brokers. When opening a CFD trade, you enter at the buy price, and if you close the trade immediately, you will do so at the sell price. The difference between these prices represents the spread, which is essentially the cost of executing the trade. It is crucial to consider the size of the spread, as wider spreads can eat into potential profits.

In addition to spreads, brokers may also charge commissions for each CFD trade. Commissions are typically a fixed fee or a percentage of the trade value. It is important to understand the commission structure of your chosen broker to accurately assess the costs involved in your trading activities.

Furthermore, overnight financing fees, swap or rollover fees, may apply to CFD positions held overnight. These fees are associated with the cost of maintaining leveraged positions beyond the market's closing time. Overnight financing fees can either be positive or negative, depending on the direction of your position and the prevailing interest rates. It is essential to be aware of these fees and consider them when holding positions for an extended period.

Choosing a Broker

Choosing a reliable and reputable broker is crucial for Litecoin CFD trading. VSTAR is a reputable and regulated broker with exceptional features and services. Here are some reasons to consider choosing Vstar:

User-Friendly: One of the outstanding features of VSTAR is its user-friendly trading platform. The platform has a clean and intuitive interface, providing traders easy navigation and efficient trade execution. Whether you are a beginner or an experienced trader, VSTAR's platform offers a seamless trading experience, allowing you to focus on analyzing the markets and making informed trading decisions.

Affordable Fees: Another feature of VSTAR is its competitive fees. We offer transparent pricing, ensuring traders clearly understand the costs of their trades. With competitive spreads and low commission rates, VSTAR aims to provide traders with cost-effective trading solutions, allowing them to maximize their potential profits.

Excellent Trading Tools: Besides its user-friendly platform and competitive fees, VSTAR offers a wide range of trading instruments. Alongside Litecoin CFDs, you can access various financial instruments, including other cryptocurrencies, forex, stocks, and commodities. This variety lets you diversify your trading portfolio and exploit various market opportunities.

Responsive Customer Service: VSTAR broker provides excellent customer support, ensuring traders receive prompt assistance and guidance whenever needed. Whether you have questions about the platform, account management, or trading-related inquiries, VSTAR's dedicated support team is readily available to address your concerns and provide valuable support along your trading journey.

Regulations: Regulation is of utmost importance when choosing a broker. VSTAR prioritizes the safety and security of its client's funds. VSTAR is regulated by CySEC (the Cyprus Securities Exchange Commission), a member of the European Union which aims to protect customers' funds. Your trading funds are secure with VSTAR because over ten bodies across the continent regulate the platform.

Developing an LTC CFD Trading Plan

Developing a well-defined trading plan is essential for successful Litecoin CFD trading. When formulating your plan, it is crucial to incorporate some basic analysis to make informed trading decisions. Let's explore the importance of these analyses and how they can help you determine key entry and exit price points for your trades.

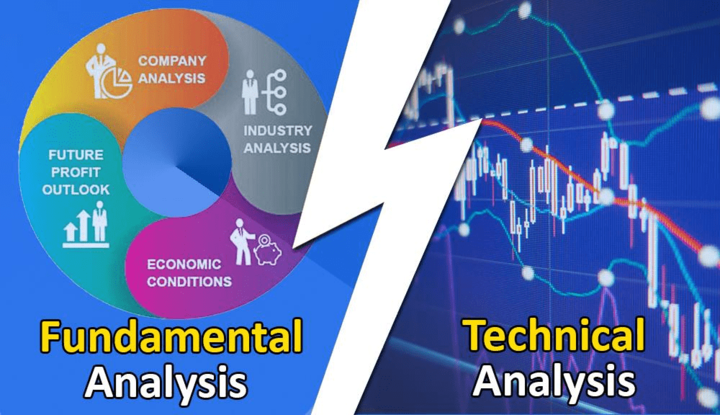

a. Technical and Fundamental Analysis

Technical analysis involves studying historical price data, charts, and indicators to identify patterns and trends in Litecoin's price movements. By analyzing price charts, you can identify support and resistance levels, trend lines, and chart patterns that can provide valuable insights into future price direction.

Fundamental analysis involves assessing the underlying factors that can impact the value of Litecoin. This analysis evaluates economic, financial, and market factors that can influence Litecoin's price. Key elements to consider include- news, events, market trends, and sentiment.

Combining technical and fundamental analysis allows you to develop a comprehensive trading plan incorporating both short-term price movements and long-term market trends.

b. Start Small and Manage Leverage

Starting with smaller trade sizes allows you to manage risk effectively. Trading CFDs with high leverage can amplify both profits and losses. While higher leverage may offer the potential for greater returns, it also increases the risk of substantial losses. Starting small and managing leverage helps you effectively prevent significant capital erosion.

c. Establish Clear Risk Management Rules

Implementing risk management rules is crucial in LTC CFD trading. Set clear stop-loss orders to limit potential losses and take-profit orders to secure profits. Determine your risk tolerance and adjust position sizes accordingly. Consistently follow your risk control rules to protect your trading capital.

d. Demo Trade for Experience

Before trading with real capital, consider utilizing a demo trading account. This allows you to practice and gain experience in executing trades and testing your trading strategy without risking actual funds. Demo trading provides valuable insights and helps refine your approach.

e. Monitor Positions Closely

Due to the high leverage involved in LTC CFD trading, positions can experience rapid changes. Monitor your trades to stay informed about market movements and adjust your strategy accordingly. Stay vigilant and be prepared to take action when necessary.

By developing a well-rounded trading plan that incorporates technical and fundamental analysis, risk management, and continuous monitoring, you can enhance your chances of success when trading LTC CFDs. Remember to adapt your strategy as market conditions evolve and to always trade within your means.

Managing Risk

Effectively managing risk is a critical aspect of LTC CFD trading. Here are some risk management considerations to help protect your capital:

i. Risk Capital Allocation

One of the golden rules of risk management is limiting the amount of capital you risk on any trade. Never risk more than 1-2% of your trading capital on a single LTC CFD trade. By adhering to this guideline, you ensure that even if a trade goes against you, the potential loss will not significantly impact your overall trading capital.

ii. Implement Stop Loss Orders

Stop losses are an essential risk management tool that helps protect your capital by automatically closing a trade at a predetermined price level. By setting a stop loss, you define the maximum amount you are willing to lose on a trade. It is crucial to place stop losses at logical levels based on technical analysis or key support/resistance levels.

iii. Consider Price Slippage

While stop losses are useful, it's important to understand that price slippage can occur in volatile markets. Price slippage refers to the difference between the expected execution price of a trade and the actual executed price. During periods of high market volatility or rapid price movements, the execution price can deviate from your stop loss level. Use stop-limit orders and closely monitor your trades during volatile market conditions to mitigate risk.

iv. Stay Informed

Keeping yourself informed about the latest market trends, news, and events is essential for making informed trading decisions. Stay updated with factors that can impact the price of Litecoin, such as regulatory developments, industry news, and market sentiment. This information can help you adjust your trading strategy and manage risk effectively.

v. Monitor and Adapt

The financial markets are dynamic and can change rapidly. As a trader, staying alert and ready to adapt your positions as market conditions evolve is crucial. If new information or price action indicates a change in the market sentiment or invalidation of your trading thesis, be prepared to adjust your positions or close them to limit potential losses.

vi. Explore Hedging and Diversification

Hedging strategies can help mitigate risk in your LTC CFD trading. Additionally, diversifying your portfolio by trading other instruments or across different markets can reduce the impact of a single trade or market on your overall portfolio.

By following these risk management practices, you can protect your capital, reduce the impact of losses, and improve your overall trading performance when trading LTC CFDs.

Conclusion

Trading is not just about adrenaline and excitement—it requires careful planning and risk management. By developing a solid trading plan, utilizing stop losses, and continuously monitoring your positions, you can confidently navigate the highs and lows of Litecoin CFD trading.

When it comes to trading LTC CFDs, choosing a regulated exchange such as Vstar is critical. We offer institutionalized-level trading including encompassing the lowest trading costs, tight spreads, and lightning-fast execution. Additionally, beginner traders can benefit from comprehensive educational resources and a free demo account to practice trading strategies and mitigate potential losses before engaging in live trading.

Take charge of your trades as you explore LTC CFD’s universe. Visit Vstar today to begin this journey of exploring new heights of success!