If you asked Warren Buffett what the best beverage stock to buy now is, Coca Cola stock (NYSE: KO) would be the answer. Buffett purchased more than $1 billion worth of Coca-Cola shares over three decades ago and continues to hold the stock with no plan to sell.

What you may want to note is that at the time Buffett made that large purchase, KO stock price had dropped from its highs after a market crash. If you look at the Coca-Cola stock price chart right now, you'll notice that the stock is around $60. This shows that KO stock price has retreated nearly 10% from its 52-week high. As a result, now might be a great time to consider KO stock if you want to invest like Buffett.

Apart from Buffett, Coca Cola stock is a favorite of many elite investors. Read on to find out why many investors think Coca-Cola is the best beverage stock to buy in 2023.

Coca Cola News

Source: Pixabay

1. Coca-Cola Drops Another NFT Collection

The beverage giant continues to invest in the Web3 space, a sign that it is finding Web3 marketing strategies effective for promoting its products. In the latest move, Coca-Cola has launched a new NFT collection called the Masterpiece.

The Masterpiece NFT collection features digital Coca-Cola bottles with artworks by various artists. This move marks an extension of the company's involvement in the Web3 space, which many brands are leveraging in their marketing efforts.

2. Coca Cola Spared Potential Antitrust Action in Europe

European authorities opened an investigation into Coca-Cola's conduct in the region. They suspected that the beverage giant might be doing something wrong in the way it conducted some of its business with retailers.

But after looking under the bed, carpet, and everywhere for the evidence against Coca-Cola, they found nothing to pursue. Consequently, the authorities dropped the probe, sparing the Coke maker a potential antitrust lawsuit that could taint its image and cost it money.

3. Coca-Cola Launches ESG Fund to Reduce Waste

If there is one challenge that Coca-Cola has endured for a long time, it is the criticism of its environmental profile. Many critics hold that Coca-Cola products leave behind a trail of difficult wastes, such as plastic bottles that end up in the ocean.

As part of the effort to reduce its waste and protect its image, Coca-Cola has launched $137 million fund to invest in sustainability efforts. The beverage giant and several of its bottling partners launched the ESG fund that will be run by Greycroft.

Coca-Cola Company (NYSE: KO) Overview

Source: Coca-Cola

Coca-Cola is an American global beverage company best-known for its Coke soda brand. Apart from soda, its staple business, Coca-Cola's other products include bottled water, sports drinks, juices, and ready-to-drink tea and coffee.

Officially known as the Coca-Cola Company, Coca-Cola was founded in 1886 by John Stith Pemberton and Asa Griggs Candler. The company is headquartered in Atlanta, Georgia.

Coca-Cola CEO James Quincey joined the company in 1996, initially serving as the chief operations officer.

Coca Cola stock went public in 1919, offering its stock at $40 per share. KO stock is a member of the blue-chip Dow Jones Industrial Average.

Coca Cola Market Cap

With a market cap of more than $260 billion, Coca-Cola ranks as one of the biggest beverage companies in the world.

Top 5 Coca-Cola Shareholders

KO stock is a favorite of both retail and institutional investors. These are some of the major Coca-Cola shareholders and their stakes in the beverage giant:

|

Shareholder |

Stake |

|

|

1 |

Berkshire Hathaway (Warren Buffett) |

9.3% |

|

2 |

Vanguard Group |

8.2% |

|

3 |

BlackRock |

4.6% |

|

4 |

SSgA Funds |

3.9% |

|

5 |

Geode Capital |

1.8% |

Key Milestones in Coca-Cola's History

|

Year |

Milestone |

|

1948 |

Coca-Cola's share of the soda market hits about 60%. |

|

1960 |

Coca-Cola acquires Minute Maid, which becomes its fruit juice line. |

|

2011 |

Coca-Cola takes full control of bottled tea maker Honest Tea. |

|

2018 |

Coca-Cola acquires Costa Coffee in a bid to expand its coffee business. |

Coca Cola Company Business Model

The company runs a franchise business model. It supplies beverage syrup concentrate to franchisees called bottlers that use it to make finished products. Coca-Cola bottlers usually hold territorial market exclusivity. The company has stakes in some bottling partners that have regional market exclusivity. Coca-Cola also has direct bottling operations.

How Coca-Cola Makes Money

About 56% of the company's revenue comes from beverage syrup sales to the bottlers. About 44% of its revenue comes from finished product sales.

The U.S. market accounts for 35% of Coca-Cola's revenue, making it the company's single-largest market.

Coca-Cola's primary customers are the bottling partners that purchase the beverage syrup for their soda production. For the finished products, the company's customers include wholesale distributors, grocery stores, and food service businesses.

Source: Pixabay

Coca-Cola Major Products and Brands

The company has hundreds of drink product brands. The company's oldest soda brands are the flagship Coca-Cola, Sprite, and Fanta.

The company's other famous brands include Minute Maid, which is a line of juices, and Dasani, which is a bottled water product.

The namesake Coca-Cola, also called Coke, is the company's best-selling soda product in most countries.

Coca Cola Company's Financials

It is difficult to determine the best stock to buy without looking at the financial standing of your potential investments. For that reason, it helps to explore Coca-Cola's financial performance and balance sheet condition.

1. KO Earnings

Coca Cola Revenue

The soda powerhouse released its 2023 second-quarter results in July. Revenue for that period rose 6% year-over-year to $12 billion, surpassing the Wall Street's expectation of $11.8 billion.

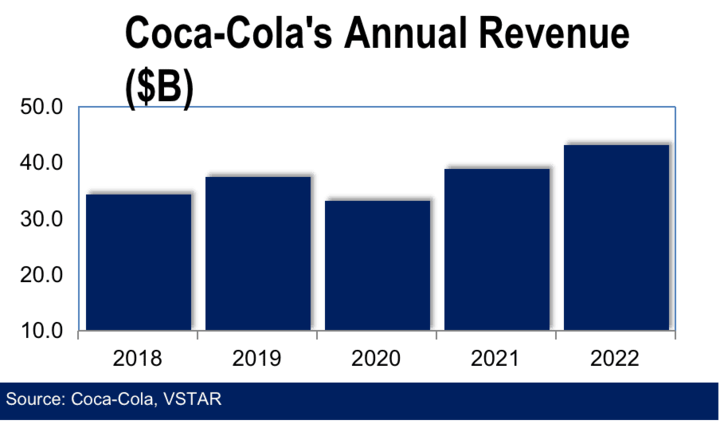

In full-year 2022, the Coca-Cola Company generated revenue of $43 billion, which increased from $38.7 billion in 2021 and $33 billion in 2020.

As you can see in the chart above, the company's revenue can fluctuate from year to year. The revenue fluctuations can be caused by changes in economic conditions that impact demand for soda and other products that Coca-Cola sells.

Wall Street expects Coca-Cola's annual revenue to come to $46.4 billion in 2023, implying nearly 8% growth from 2022.

Coca-Cola's Net Income

Coca-Cola Company has been consistently profitable for decades on both a quarterly and annual basis. In Q2 2023, it reported a profit of $2.6 billion, which jumped sharply from a profit of $1.9 billion in the same period the previous year.

In 2022, the Coke maker made a profit of $9.5 billion. The profit was $9.8 billion in 2021 and $7.7 billion in 2020.

Coca Cola stock boasts a return on equity of 43%, which is much higher than the beverage sector's average return.

Coca-Cola's Profit Margin

The company achieved an adjusted operating profit margin of 32% in Q2 2023, which improved from 31% in the same period the previous year. The company achieved an operating margin of 28.7% in 2022, which was flat from the prior year.

2. Coca-Cola's Cash Position and Balance Sheet Condition

The company produced $4.5 billion in cash from operations in Q2 2023, resulting in free cash flow of $3.8 billion. It wrapped up the quarter with a cash balance of $12.8 billion.

Coca-Cola's balance sheet shows $98.5 billion in assets against $40 billion of debt. With a quick ratio of 0.82 and a current ratio of 1.14, Coca-Cola's balance sheet is generally in great shape.

KO Stock Analysis

1. KO Stock Valuation

Coca Cola stock currently trades at a forward P/E ratio of 21, forward P/S of 5.51, P/B ratio of 10, and P/FCF ratio of 27. See below how Coca-Cola's valuation figures compare to those of its major peers in the beverage industry.

|

Coca Cola stock (KO) |

Monster stock (MNST) |

PepsiCo stock (PEP) |

Keurig Dr Pepper stock (KDP) |

|

|

Forward P/E |

21.59 |

35 |

28.3 |

18 |

|

Forward P/S |

5.51 |

7.97 |

2.65 |

3.06 |

|

P/B ratio |

10 |

7.84 |

14.29 |

1.86 |

|

P/FCF |

27 |

46 |

43 |

28 |

As you can see from the table, Coca-Cola stock offers one of the best forward P/E and P/FCF ratios among the featured beverage stocks. It also has a better P/B ratio than its archrival PepsiCo.

2. KO Stock Trading Information

Coca-Cola stock is listed on the NYSE and trades under the ticker symbol "KO".

Trading in KO stock begins as early as 4 a.m. ET and extends to as late as 8 p.m. ET, accounting for premarket and post-market sessions.

More than 10 million Coca-Cola shares are traded on an average day, making it one of the most active beverage stocks.

Coca Cola Stock Split History

KO stock has undergone multiple splits since the IPO. The first KO stock split was a 4-for-1 in 1935. The latest KO stock split was a 2-for-1 in 2012. After accounting for all the KO stock splits, an original position of 1,000 shares of Coca-Cola has increased to 9.2 million shares.

KO Dividend

The company has been paying dividends since 1920. It distributes the dividend on a quarterly basis, resulting in four distributions in a year. Its latest dividend payment was $0.46 per share in July. Coca-Cola has increased its quarterly dividend each year for at least the past 10 years.

3. KO Stock Forecast

KO stock price has ranged $54 - $65 over the past year. At the current price of about $60, Coca Cola stock has climbed more than 10% over its 52-low but stands 8% below its 52-high.

More than a dozen analysts have weighed in on Coca Cola stock outlook with various price targets. The average KO stock price forecast of $70 indicates over 15% upside potential. The peak KO stock price target of $76 implies an upside of 25%. The base KO stock price prediction of $63 also suggests nearly 5% upside.

Wall Street has a consensus Buy rating on Coca Cola stock.

4. KO Stock Technical Analysis

The chart above shows Coca Cola stock price action since January, along with the RSI and MACD indicators.

As you can see, KO stock price has been on a general decline since late July. The stock has found support at $60 while it faces resistance at $65.

If you look carefully, you'll notice that the decline started shortly after the stock's RSI reading neared the overbought level at 70. At that time, the MACD line also dipped below the Signal line, indicating an impending decline that actually turned out to be true.

At this point, the Coca Cola stock's RSI reading is trending down toward the oversold zone and the MACD line looks primed for an upside crossing with the Signal line. If you take these indicators together, the signal is that the dip in KO stock price appears to present a discount buying opportunity.

Coca-Cola's Opportunities and Challenges

In the beverage business, Coca-Cola has many growth opportunities but challenges aren't lacking either. Let's explore the beverage giant's opportunities and problems.

Coca-Cola's Opportunities

1. Functional Beverage Market

While consumers' increasing focus on healthy lifestyles may be a threat to Coca-Cola's traditional soda business, it also presents a great opportunity for the company with new products.

According to a Kerry Group study, the Covid-19 pandemic has made more than 65% of consumers become more concerned about their health. The increasing health awareness is fueling demand for functional drinks, which offer health benefits in addition to their nutritional value.

The global functional beverage market size is on track to surpass $200 billion by 2030, from $110 billion in 2020, according to the Allied Market Research. Coca-Cola already offers a range of functional drinks and it still has more room to expand in this space with additional products, which would also further diversify its product portfolio.

2. Product Reformulation

In addition to introducing new products, Coca-Cola has also taken to reformulating many of its existing products. For example, the company has come up with varied versions of its flagship Coke soda drink. With the reformulated drinks, the company attempts to extend the market for its products by making them more attractive to consumers who may not already be loyal customers.

Additionally, Coca-Cola has been introducing alcoholic versions of some of its popular drinks. For example, it teamed up with Molson Coors to launch Simply Spiked Lemonade, an alcoholic drink based on its Simply juice brand.

Flavored alcoholic drinks are targeted at consumers seeking unique and a variety of flavors beyond standard beer and spirits. These drinks are particularly popular with young people, and the demand for them is strong.

The global market for ready-to-drink cocktails is on track to grow from $853 million in 2022 to $2.4 billion by 2030, according to Grand View Research. Coca-Cola is targeting this market with its flavored alcoholic beverages like Simply Spiked Lemonade fits. Therefore, Coca-Cola has an enormous market opportunity with its flavored alcoholic beverage products.

3. International Expansion

While Coca-Cola already has a footprint in virtually every country in the world, there is still plenty of room for the company to expand abroad. Coca-Cola may be the dominant non-alcoholic beverage brand globally, but it still has low penetration in many international markets, especially the developing countries.

For example, beverage consumption is increasing in emerging markets in Asia, the Middle East, and Africa where there is a large and growing population and middle-class demographic. As a result, Coca-Cola still has plenty of room to grow in these markets, especially with its expanding portfolio of reformulated beverages and flavored alcoholic drinks.

4. Strategic Partnerships

Coca-Cola has forged multiple partnerships aimed at benefiting its business. For example, the Coke maker invested more than $2 billion in Monster Beverage in 2014 to purchase a stake of about 17% in the company. It has an option to increase its stake to 25% in Monster.

Alongside the economic interest in Monster, Coca-Cola has a long-term marketing and distribution partnership with Monster. Monster is a leader in the energy drinks market, which is an area of interest to Coca-Cola. The global energy drinks market size was valued at $45.8 billion in 2020 and is forecast to surpass $108 billion by 2031, according to Allied Market Research.

Coca-Cola can reach out to more partners like Monster to help it expand and diversify its product portfolio and boost sales. Moreover, there are still many opportunities for the company to leverage sports sponsorships to boost its marketing efforts.

Coca-Cola's Challenges

1. Shifting Consumer Preferences

Amid growing health-consciousness, an increasing number of consumers are shifting away from sugary drinks. This trend is shrinking the market for Coca-Cola's soda products.

But the company is attempting to change with the times by offering products that consumers want, like sugar-free drinks.

2. Reliance on Bottlers

The actual production of Coca-Cola products is primarily done by authorized bottlers. These bottling partners are largely independent and have geographic market exclusivity.

While Coca-Cola seeks to work with strong bottling partners, problems can arise that disrupt the production and distribution of Coca-Cola products in local markets. Such problems can lead to a loss of market share to competitors.

3. Tough Competition

As the soft drink market leader, Coca-Cola is the prime target of competition. It faces competition on multiple fronts, such as product pricing, quality, taste, and variety. There is also competition for brand loyalty. These are the major Coca-Cola competitors:

|

Competitor |

Threat |

|

PepsiCo |

Coca-Cola and PepsiCo are fierce competitors in the soda business. They are both highly popular brands with a global reach offering popular products. |

|

Keurig Dr. Pepper |

As Coca-Cola extends its business beyond the traditional soda market, it faces competition from Keurig Dr. Pepper in the coffee and non-carbonated beverages market. |

|

Red Bull |

Coca-Cola's foray into the energy drinks market brings it into competition with Red Bull. With a footprint in more than 170 countries and a range of product options, Red Bull is a major rival to the Coke maker in the energy drinks market. |

|

Starbucks |

Coca-Cola also faces a challenge from Starbucks in its bid to diversify beyond the regular soda market. Starbucks is one of the fierce rivals in the coffee drinks market. |

Coca-Cola's Competitive Advantages

1. Strong Market Share

Coca-Cola is the world's largest non-alcoholic beverage company with a global market share of more than 43%. As a result, the company captures most of consumers' spending on soft drinks and others.

As the world's population grows and more people join the middle-class, driving demand for processed beverages, Coca-Cola is well positioned to capitalize on this opportunity.

2. Strong Brand Identity

Coca-Cola is one of the most recognized brands in the world. Coca-Cola is a household brand in most countries and more than 90% of consumers worldwide are familiar with the company's iconic red and white logo. The strong brand position is a function of Coca-Cola's innovative and effective marketing strategies.

Coca-Cola's solid brand identity is a great asset in gaining customer trust and loyalty. Moreover, the premium Coca-Cola brand makes it easier for the company to win over important partners.

3. Broad Product Portfolio

The company's product portfolio includes hundreds of brands across an array of categories like soda, water, juice, and sports drinks. The diverse product portfolio helps Coca-Cola reduce the risk of shifting consumer preferences. It also helps the company weather fluctuating economic conditions. Demand for some of Coca-Cola's products is less sensitive to economic downturns than others.

4. Vast Distribution Network

The company boasts an extensive product distribution network, made possible by its large bottling partnership. As a result, Coca-Cola can sell its products in virtually every corner of the country in which it operates. Coupled with a strong brand identity, the vast distribution network gives Coca-Cola a head start in capturing business opportunities.

5. Bottler Investment Program

Coca-Cola formed an entity called Bottling Investment Group (BIG). Through BIG, Coca-Cola invests in select bottling partners and provides them with other support. Through this program, the company is consolidating its bottling network and making its bottling partners more resilient to survive economic downturns.

Why Traders Should Consider KO Stock

Source: Pixabay

The Coca-Cola Company is the non-alcohol beverage market leader. The company is consistently profitable, has plenty of room to grow, and boasts many strong competitive advantages. Moreover, KO stock forecast suggests substantial upside potential.

Coca-Cola Stock Trading Strategies

If you've determined Coca-Cola stock as the best beverage stock to buy now, the next important step is to choose the trading strategy that works best for you.

Depending on your investment goal and capital size, you can approach KO stock trading in various ways. These are the two popular Coca Cola stock investing strategies:

1. Buying and Holding Coca-Cola Stock Shares

If you're looking for the traditional investing method, this is it. With this method, you purchase and keep Coca-Cola shares for an extended period, usually over at least a year. Many investors hold their shares for several years since this method is considered a long-term investment strategy.

When you invest in this way, you hope that KO stock price would appreciate during your holding period to allow you to make a profit.

Buying and holding Coca-Cola shares has its benefits and drawbacks as explored below:

Pros:

- You're eligible for Coca-Cola's dividend distributions.

- You can vote at Coca-Cola's shareholder meetings.

- Your share count may increase if Coca Cola stock undergoes a stock split.

Cons:

- You require a large upfront investment capital to get started.

- It can take a long wait before you see returns.

- You can only profit when the stock is going up. But stocks don't rise all the time.

2. Trading Coca-Cola Stock CFD

If you're looking for an opportunity to profit from short-term fluctuations in Coca Cola stock price, trading Coca-Cola stock CFD may be for you. It involves betting on the direction of KO stock price movements. Your profit is calculated by multiplying the price change by the number of contracts purchased.

With Coca-Cola stock CFD trading, you can capture profits over short timelines such as over an hour, a day, or a week. CFD trading gives you easy exposure to Coca Cola stock because it doesn't involve holding shares for long periods.

Moreover, CFD contracts are usually priced lower than a stock's market price. Consequently, you can get started trading Coca-Cola stock CFD with less money than you might need for the buy-and-hold strategy.

Trading Coca-Cola stock CFD has its pros and cons, which are explored below:

Pros:

- You can profit whether Coca Cola stock is in a bull or bear market.

- It allows you more control over your investment period. You can capture profits over an hour, a day, or a week.

- You require minimal initial capital as Coca-Cola stock CFD contracts are usually cheaply priced.

Cons:

- You're not eligible for Coca-Cola dividends.

- You don't get shareholder voting rights.

Trading Coca-Cola Stock with VSTAR

If you've decided to trade Coca-Cola stock CFD, the next important step for you is choosing your CFD broker. You should select your CFD broker carefully to avoid platforms with excessive fees and restrictions that can limit your profit opportunities. If you're looking for the best CFD broker for pros and beginners alike, consider using VSTAR.

As a fully licensed and regulated CFD broker, VSTAR offers a secure trading platform because your funds are safe no matter what device you're using or where you're trading.

If you're wondering what makes VSTAR the favorite CFD trading platform for many, it's the tight spreads and no-commission accounts that allow you to maximize your profits.

You can start trading Coca-Cola stock CFD on VSTAR with only $50 in initial capital. The platform offers generous leverage for traders with little money to boost their positions and maximize their gains.

Consider opening your free VSTAR account today to start trading KO stock CFD. VSTAR offers a demo account with as much as $100,000 to allow you to practice your strategies before you start investing real money.

Final Thoughts

Coca-Cola stock (NYSE: KO) looks to be the best beverage stock to quench your thirst for profits. With the recent pullback, you can now enter KO stock at a discount to what some investors were paying for it just a few months ago.