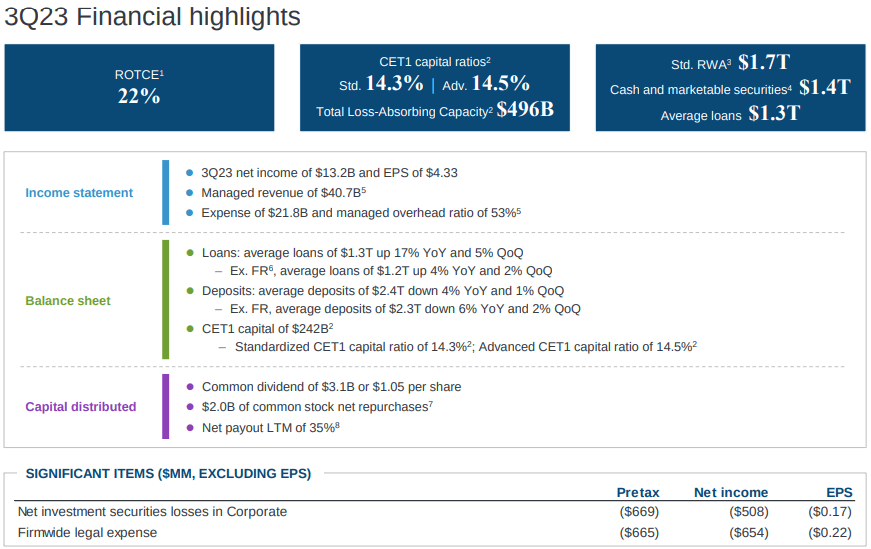

- JPMorgan Chase reported a net income of $13.2 billion and an EPS of $4.33 in Q3 2023, surpassing expectations.

- The bank's diverse segments, including Consumer & Community Banking, Corporate & Investment Banking, Asset & Wealth Management, Commercial Bank, and Markets, contribute to its growth potential.

- JPMorgan Chase maintains a robust capital position with a CET1 ratio of 14.3%, demonstrating its resilience and ability to meet regulatory requirements while returning value to shareholders through share repurchases.

- The bank's effective expense management, credit risk practices, and proactive engagement with regulators position it for growth in a changing economic landscape.

JPMorgan Chase (NYSE: JPM) reported its Q3 2023 result, an EPS of $4.33 (beating the street estimates by $0.36), and revenue of $40.7 billion (beating the street estimates by $472 million). The article explores several specific fundamental strengths of the financial behemoth, each of which contributes to its rapid growth potential.

Financial Performance and Profitability

JPMorgan Chase's financial performance is a testament to its strength and growth potential. In its most recent financial report, the company reported a net income of $13.2 billion, an EPS of $4.33, and revenue of $40.7 billion. These figures highlight its robust profitability, showcasing its ability to generate substantial profits and create value for shareholders.

Net Income: The reported net income of $13.2 billion reflects the company's ability to generate significant profits. This is a key metric demonstrating the strength of its business operations.

Earnings Per Share (EPS): JPMorgan Chase's EPS of $4.33 signifies efficient capital management and a commitment to creating value for its shareholders. Higher EPS is a clear indicator of the company's ability to deliver returns to investors.

Revenue Growth: With revenue amounting to $40.7 billion, the bank displays impressive growth and the capability to expand its revenue base. This growth is a result of its diverse range of financial services and its ability to seize market opportunities.

Return on Tangible Common Equity (ROTCE): JPMorgan Chase achieved an ROTCE of 22%, demonstrating its efficient use of capital. A high ROTCE reflects a strong return on shareholders' equity, which is essential in the financial industry, as it signifies profitability and performance.

Source: 3Q23 Earnings Presentation

Diversified Business Segments

JPMorgan Chase's business is diversified across multiple segments, each of which contributes to its growth potential. These segments include Consumer & Community Banking (CCB), Corporate & Investment Banking (CIB), Asset & Wealth Management (AWM), Commercial Bank, and Markets.

Consumer & Community Banking (CCB): In this segment, JPMorgan Chase reported a net income of $5.3 billion, reflecting a 19% year-on-year growth in revenue. This indicates the bank's ability to serve a wide range of retail and consumer clients effectively.

Corporate & Investment Banking (CIB): The CIB segment reported net income of $3.1 billion, highlighting its resilience in challenging market conditions. Despite a 6% decline in investment banking revenue, JPMorgan Chase maintained its leadership position in terms of market share, demonstrating its strength in navigating volatile markets.

Asset & Wealth Management (AWM): AWM reported a net income of $1.1 billion, with a pretax margin of 31%. This segment exhibited resilience and growth, driven by strong net inflows and higher average market levels.

Commercial Bank: The Commercial Bank segment achieved a net income of $1.7 billion, reflecting a 20% year-on-year growth in revenue. This underscores JPMorgan Chase's ability to cater to the needs of corporate clients effectively.

Markets: Despite a 3% year-on-year revenue decline in the Markets segment, the bank demonstrated its adaptability and ability to navigate challenging market conditions.

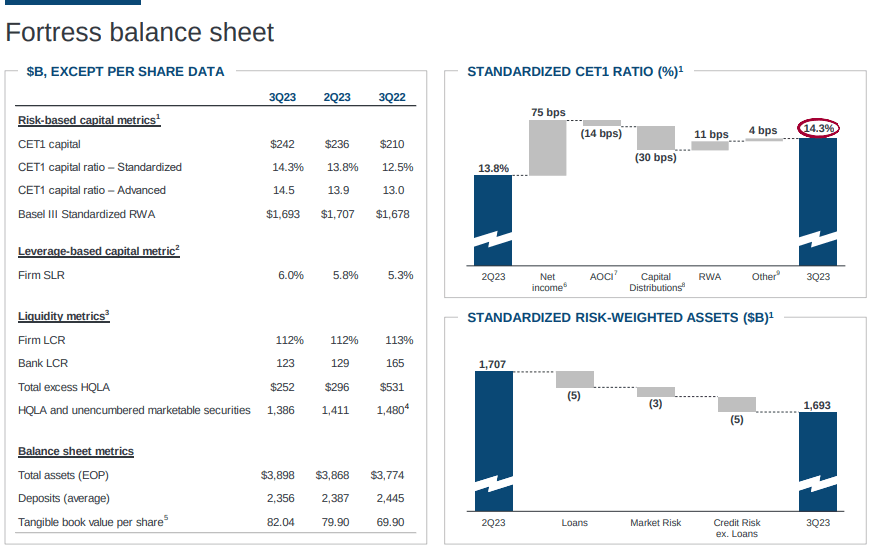

Strong Capital Position

JPMorgan Chase maintains a robust capital position, which is essential for its growth potential and resilience in the face of economic uncertainties and regulatory requirements.

Common Equity Tier 1 (CET1) Ratio: The bank's CET1 ratio is 14.3%, signifying strong capital adequacy. This ensures the bank's resilience and ability to meet regulatory capital requirements, allowing it to thrive in a rapidly changing financial landscape.

Share Repurchases: JPMorgan Chase repurchased $2 billion worth of shares during the quarter. This demonstrates a disciplined approach to capital allocation and a commitment to returning value to shareholders.

Capital Buffer: The bank's capital hierarchy reflects a responsible approach to capital management, enabling it to adapt to evolving circumstances and capitalize on growth opportunities.

Operational Efficiency

JPMorgan Chase's operational efficiency is reflected in its ability to manage expenses, maintain credit quality, and adapt to regulatory changes.

Expense Management: Despite revenue growth, the bank has been effective in managing expenses. This includes ongoing investment in front office and technology staffing, wage inflation, and legal expenses. Effective cost management is crucial for sustained profitability.

Credit Quality: The bank's ability to manage credit risk is evident in its $1.4 billion in credit costs, driven by net charge-offs in the Card segment. JPMorgan Chase's risk management practices help maintain the quality of its loan portfolio.

Geopolitical and Regulatory Considerations

JPMorgan Chase is proactive in engaging with regulators and advocating during the comment period for regulatory changes. This commitment to regulatory compliance and proactive engagement is vital to the bank's growth potential.

Basel III Endgame Proposal: The bank highlights its proactive engagement with regulators and its advocacy during the comment period. This demonstrates its commitment to maintaining a regulatory environment that supports responsible banking while minimizing unnecessary increases in capital requirements.

Resilience to Regulatory Changes: The bank's ability to adapt to regulatory changes, such as the Basel III endgame and stress tests, is a testament to its risk management and regulatory compliance capabilities.

Specific Risks

Economic Downturn: JPMorgan Chase is susceptible to economic cycles. Given the Fed’s higher-for-longer stance, a severe economic downturn, recession, or financial crisis could lead to increased loan defaults, reduced consumer and business spending, and lower demand for financial services.

Interest Rate Risk: As a bank, JPMorgan Chase's profitability is heavily influenced by interest rates. A significant and unexpected change in interest rates can impact its net interest income and the valuation of its securities portfolio.

Credit Risk: The bank is exposed to credit risk from lending to individuals and businesses. If borrowers fail to repay their loans due to economic stress, it could result in substantial losses.

In conclusion, JPMorgan Chase's strengths, including its strong financial performance, diversified business segments, robust capital position, operational efficiency, and adaptability to regulatory changes, position it for rapid growth. The bank's ability to navigate challenges and its commitment to delivering value to shareholders and clients make it a formidable player in the financial industry.

JPMorgan Chase's financial performance, profitability, and EPS underscore its ability to generate substantial profits and create value for shareholders beyond the market’s expectations. Its diversified business segments, including CCB, CIB, AWM, Commercial Bank, and Markets, contribute to its growth potential by serving a broad range of clients effectively. The bank's strong capital position, as reflected in its CET1 ratio and share repurchases, ensures resilience in the face of economic uncertainties and regulatory requirements. Operational efficiency is another key strength, as the bank effectively manages expenses and maintains credit quality. Its proactive engagement with regulators and commitment to regulatory compliance position it well for growth in a changing regulatory landscape.

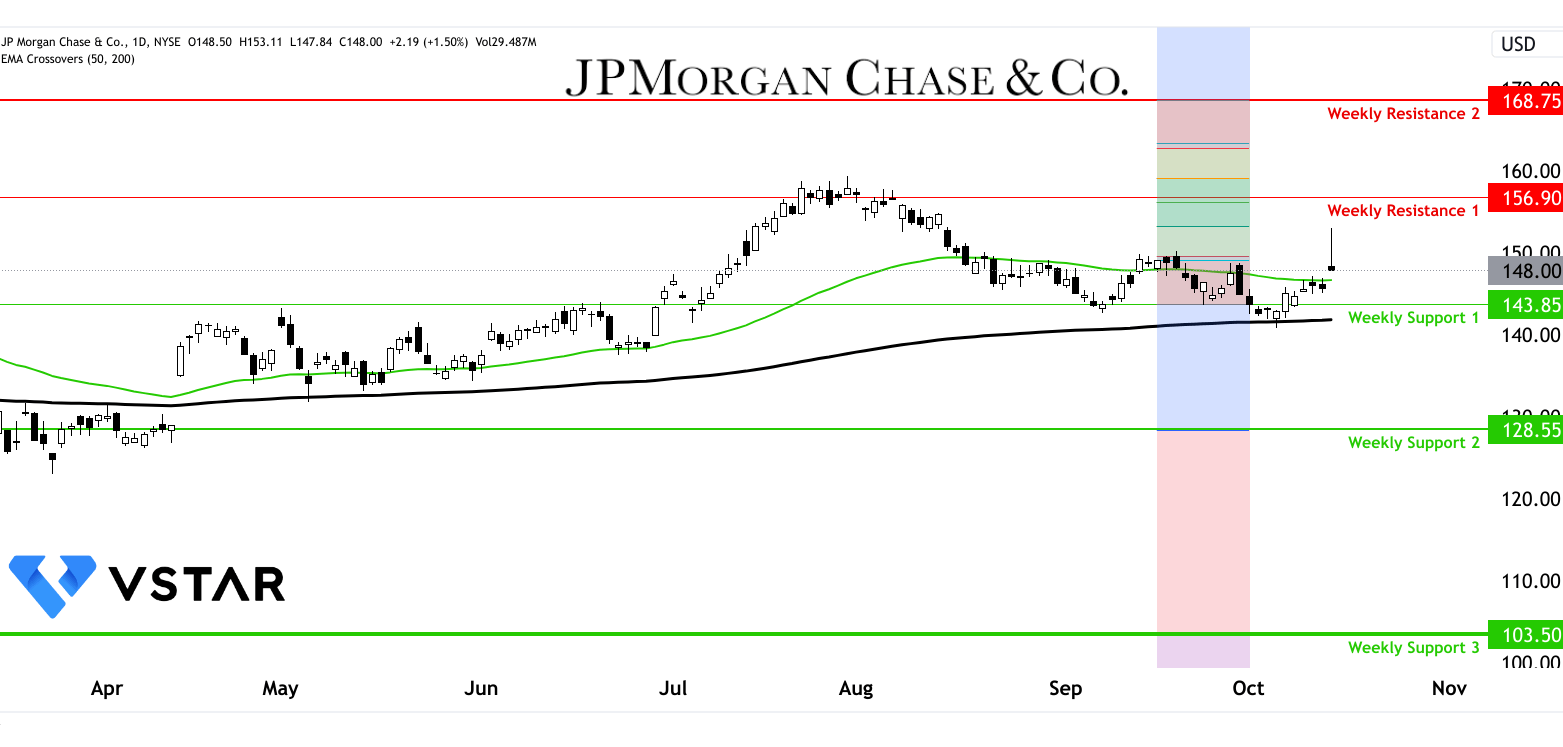

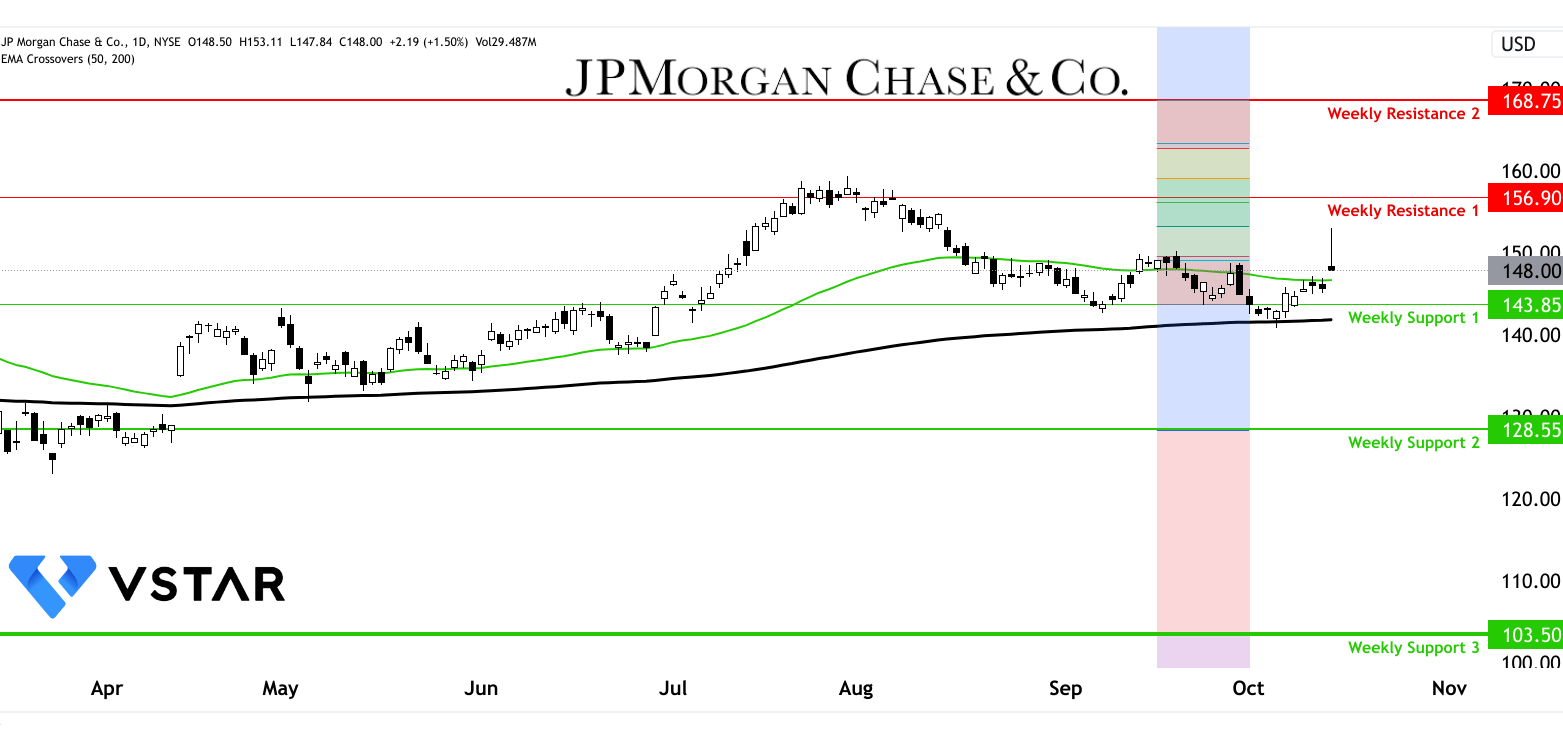

The technical perspective on the weekly price moves of JPM stock can be comprehended as follows:

Source: tradingview.com