As per the recent data from Santiment, the number of large Bitcoin wallets has increased by 8.1% in the last 20 months. In particular, a wallet holder with 3,000 BTC Worth Over $83,000,000 passed transactions after 2017.

Bitcoin Showed A Significant Whale Accumulation

There has been a significant increase in BTC holdings in addresses with a minimum of 10 BTC, suggesting a discernible pattern of heightened ownership. According to data from Santiment, more than 11,000 accounts have joined the league of large Bitcoin holders, which is an all-time high.

Notwithstanding this favorable trajectory, long-term Bitcoin holders have documented a "fear" a prominent crypto analyst expressed. These individuals are apprehensive regarding the possibility of a substantial price correction.

The market continues to be bustling with significant transactions. According to a report from IntoTheBlock, the cumulative value of transactions surpassing $100,000 over the past week has been close to $37 billion.

Average Bitcoin Holders Are Profitable

A critical on-chain metric from IntoTheBlock, which compares the present value of tokens to their average purchase price, reveals that 67% of token holders are presently profitable. According to the In The Money indicator, 10% of holders are in a break-even position, whereas 22% are in a loss position.

The decision by the US Securities and Exchange Commission not to challenge Grayscale's application to convert the Bitcoin Trust Fund into an exchange-traded fund (ETF) by the deadline has positively impacted the market.

Can Bitcoin (BTC) Make A New All-time High?

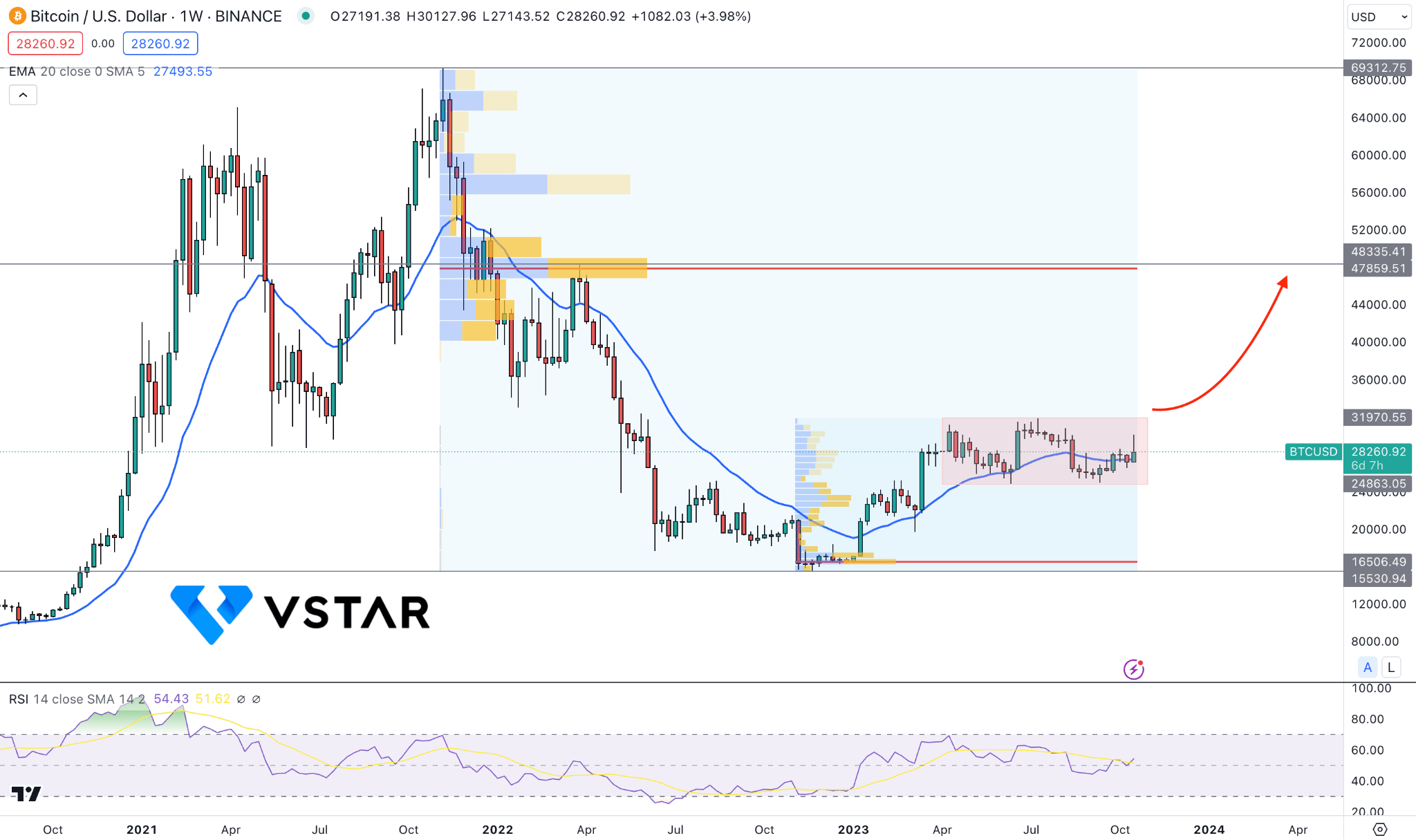

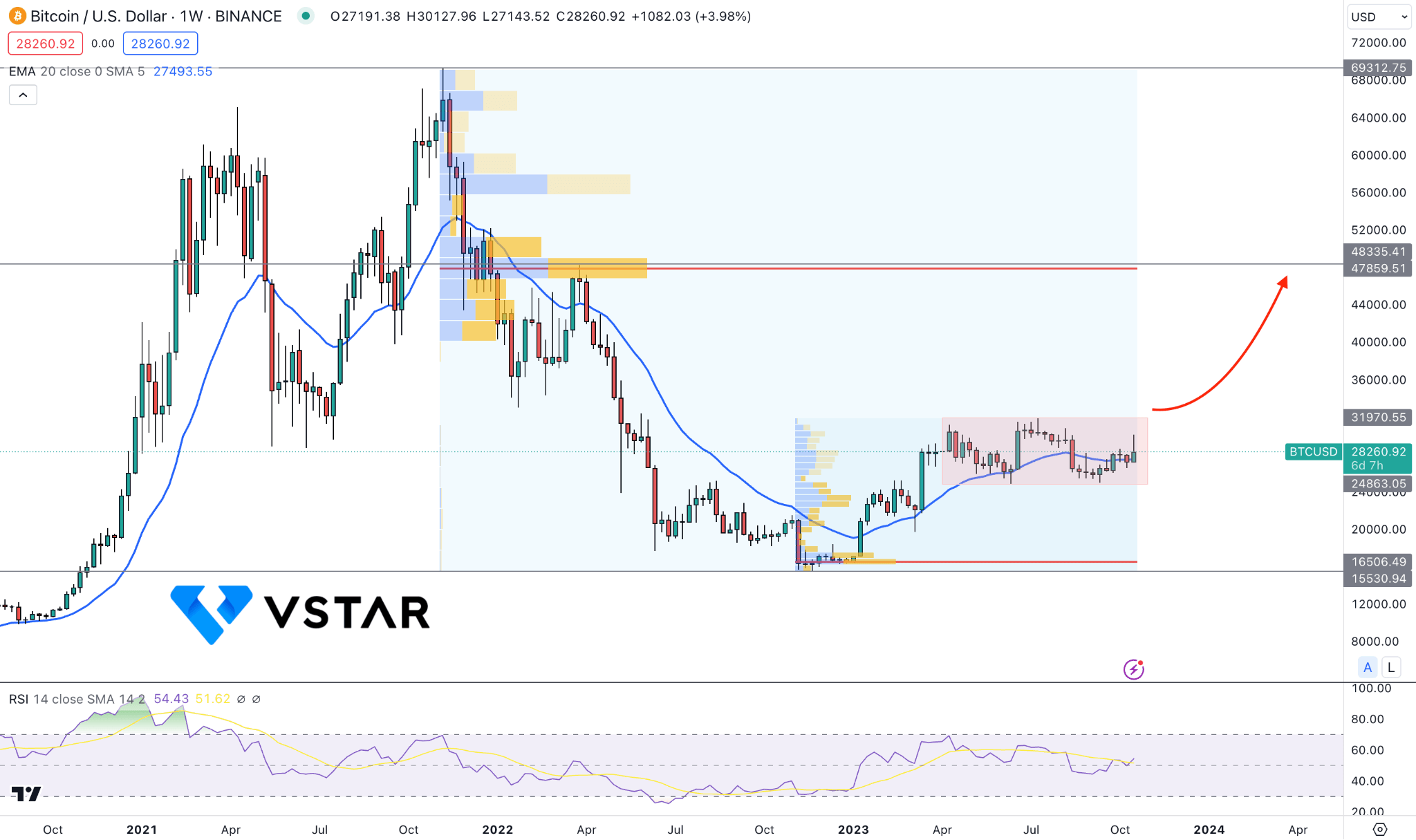

In the BTCUSDT weekly chart, the recent consolidation came with a higher trading volume level formation near the 16,506.49 bottom, which signals a strong bullish possibility.

The dynamic 20-week EMA hovers below the current price, which is a near-term support level. Considering the safe haven nature of Bitcoin during the war situation, with the positive sentiment from the Bitcoin ETFs, acceptance could work as a long signal.

Based on the current technical outlook, a bullish weekly close above the 32,000.00 level could be a strong bullish opportunity, targeting the 47,000.00 level.

On the other hand, a deeper downside correction is possible if bulls fail to hold the price above the 20-week EMA. In that case, the price could move down toward the 16,500.00 level.