I. Introduction

A. Introduction of gold CFD

Gold CFDs, or contracts for differences in gold, are financial derivatives that enable traders to speculate on gold's price movements without owning the underlying asset. These instruments have gained popularity among investors due to the volatility of gold prices and its status as a safe-haven asset during economic uncertainty.

B. Explanation of a Diversified Investment Portfolio

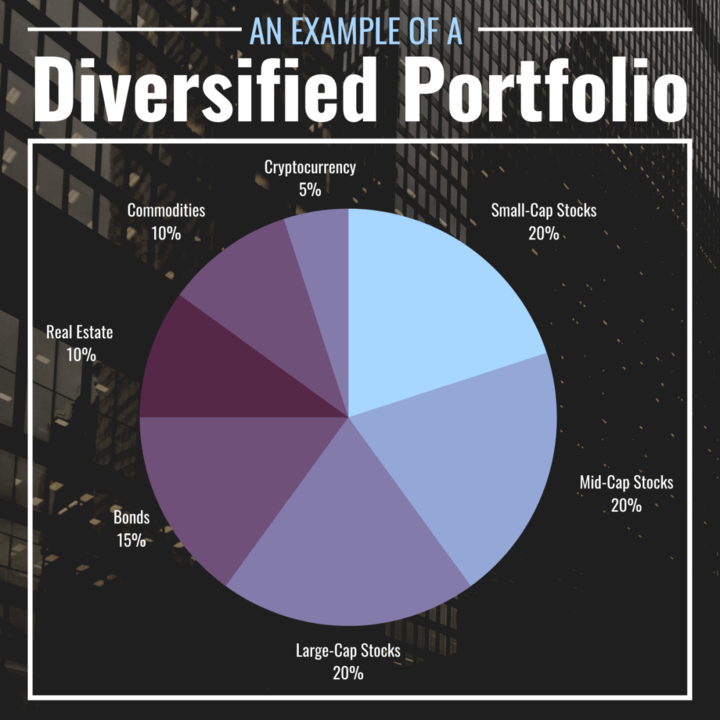

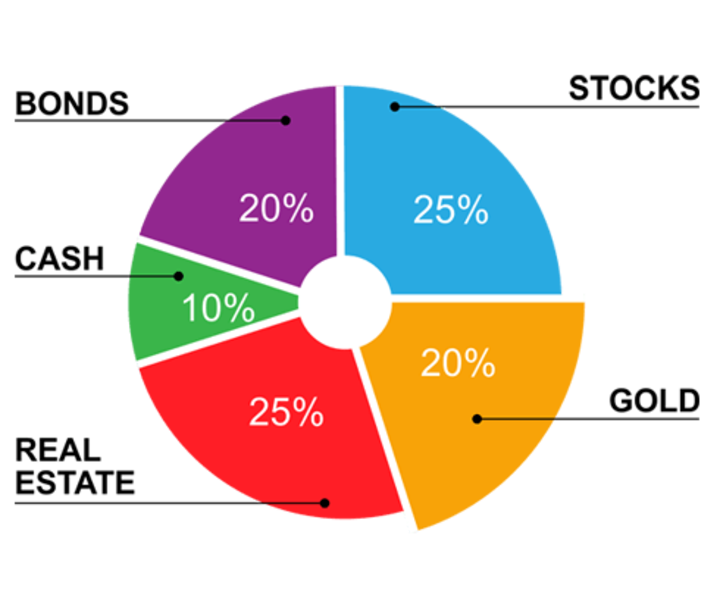

A diversified investment portfolio is an investment strategy that aims to reduce risk and increase returns by investing in various asset classes. The principle behind diversification is that by spreading investments across different assets, investors can minimize the impact of any asset's poor performance on their overall portfolio.

Gold CFDs can play an essential role in a diversified portfolio as a safe-haven asset that can help mitigate the risks of market volatility. During economic uncertainty, gold performs well as investors flock to safe-haven assets, seeking protection against potential losses. By including gold CFDs in their portfolios, investors can take advantage of gold's safe-haven status while maintaining the flexibility and liquidity of financial derivatives.

Moreover, gold CFDs offer several advantages over physical gold investments. Unlike physical gold, gold CFDs can be traded quickly and easily, providing investors with greater flexibility and liquidity. Gold CFDs do not require investors to store or transport physical gold, which can be cumbersome and costly.

Investors must be cautious when investing in gold CFDs, as they are not without risks. One of the main risks associated with CFD trading is the use of leverage, which can magnify gains but also magnify losses. Therefore, investors must comprehensively understand the market and underlying assets before making investment decisions. They should also set clear risk management strategies and monitor market trends closely.

II. Benefits of Gold CFDs in a Diversified Investment Portfolio

Gold CFDs offer several benefits for investors seeking to optimize their investment portfolio. By including gold CFDs in a well-diversified portfolio, investors can hedge against inflation, diversify their holdings, and protect their investments against market volatility. Gold CFDs can also act as insurance, helping investors manage risk and minimize potential losses. Additionally, the liquidity of gold CFDs makes them an attractive option for investors seeking flexible and accessible investments.

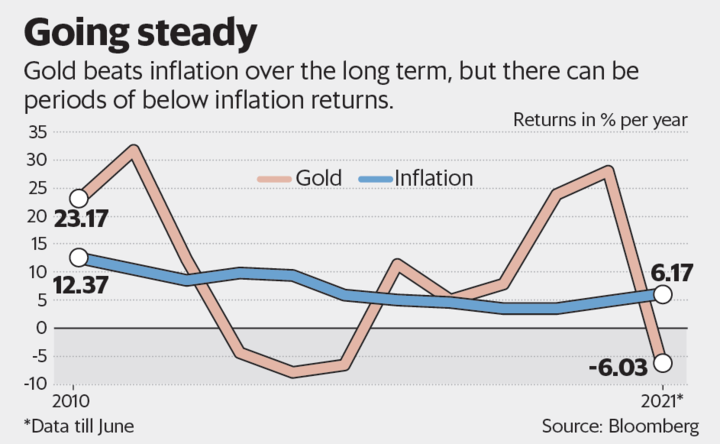

A. Hedging Against Inflation

Gold is applied as a hedge against inflation due to its intrinsic value and scarcity. When inflation rises, currencies' purchasing power decreases, and investors may turn to gold for value accumulation. Gold CFDs allow investors to profit from rising prices without owning physical gold. It can benefit investors who want to hedge against inflation while avoiding the storage and transport costs associated with physical gold investments.

B. Portfolio Diversification

Diversification is a crucial strategy for managing risk in an investment portfolio. By investing in various asset classes, investors can spread their risk and minimize the impact of any one asset's poor performance on their overall portfolio. Gold CFDs can be an essential component of a diversified portfolio, as they offer exposure to the gold market without requiring investors to purchase physical gold. By diversifying their portfolio with gold CFDs, investors can take advantage of the benefits of gold while maintaining the flexibility and liquidity of financial derivatives.

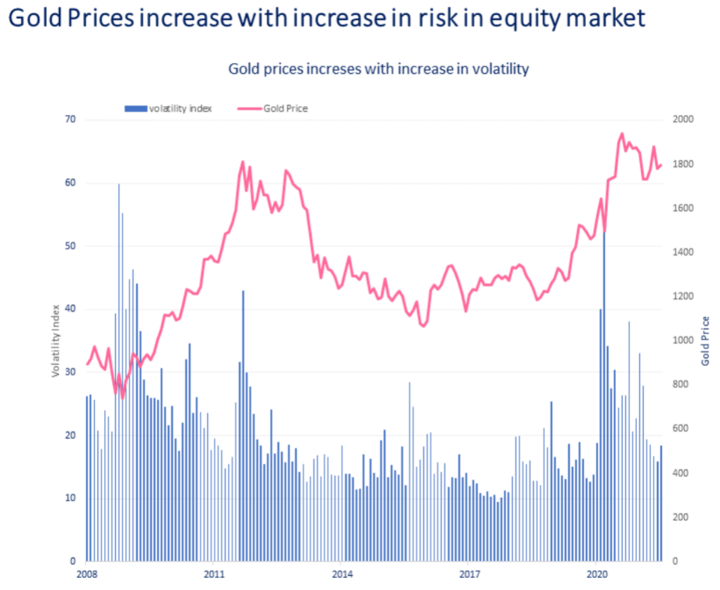

C. Safe-Haven Asset

Gold is considered a safe-haven asset due to its perceived value during economic and political uncertainty. When markets are volatile, investors often flock to safe-haven assets like gold to protect their investments. Gold CFDs allow investors to profit from rising gold prices during turbulent times, making them a valuable addition to a well-diversified portfolio.

D. Portfolio Insurance

Gold CFDs can also act as portfolio insurance, protecting investors against potential losses in other areas of their portfolio. During market downturns, the value of gold tends to rise as investors seek out safe-haven assets. By including gold CFDs in their portfolio, investors can offset potential losses in other areas, thereby reducing their overall risk exposure.

E. Liquidity

One of the benefits of gold CFDs is their high liquidity. Unlike physical gold, which can be difficult and costly to buy and sell, gold CFDs can be traded quickly and easily on financial markets. This makes them an attractive option for exposure to the gold market without engaging in physical ownership.

III. Risks of Gold CFDs in a Diversified Investment Portfolio

While gold CFDs can offer several benefits when included in a well-diversified investment portfolio, investors must also consider the risks associated with this financial instrument. Gold CFDs are not without risks, and investors should acknowledge potential drawbacks before investing in them. This section discusses some of the risks associated with gold CFDs and how they can impact an investment portfolio.

A. Volatility

One of the primary risks associated with gold CFDs is their volatility. Like other financial instruments, the value of gold CFDs can fluctuate rapidly and unpredictably, making them a high-risk investment. During economic and political uncertainty, gold prices can spike, causing the value of gold CFDs to rise. However, the opposite can also occur, causing significant losses for investors. It is essential for investors to be aware of the potential for volatility when investing in gold CFDs and to have a strategy in place for managing this risk.

B. Trading Costs

Another risk associated with gold CFDs is trading costs. These costs can include commissions, spreads, and other fees, which can eat into investors' returns. Additionally, some brokers may charge higher fees for gold CFDs than other financial instruments. Investors should carefully evaluate the trading costs associated with gold CFDs before investing in them to ensure they are paying what is necessary.

C. Speculative Investments

Gold CFDs are often considered speculative investments, as they are highly leveraged and require significant capital. It makes them attractive to investors seeking high returns but also increases the risk of loss. Additionally, some investors may use gold CFDs for short-term trading strategies, which can increase the volatility of this financial instrument.

D. Unpredictability

Gold prices can be challenging to predict, and this unpredictability can make gold CFDs a risky investment. While gold is considered a safe-haven asset during economic uncertainty, it is not immune to market forces. Various factors, including geopolitical events, interest rates, and global economic conditions, can influence gold's value. It makes it difficult to predict the direction of gold prices, and investors should be prepared for unexpected changes in the value of their gold CFDs.

E. Counterparty Risk

Finally, investors in gold CFDs must be aware of counterparty risk. This risk refers to the possibility that the counterparty to a trade, such as a broker or financial institution, may fail to fulfill its obligations. In the case of gold CFDs, this could mean that the counterparty fails to deliver the agreed-upon amount of gold or cash. To mitigate this risk, investors should choose reputable brokers and financial institutions and consider using risk management strategies like stop-loss orders.

To minimize these risks, investors should carefully evaluate the trading costs associated with gold CFDs, have a strategy in place for managing volatility, and choose reputable brokers and financial institutions. Additionally, investors should approach gold CFDs with caution and sound investment principles, using them as part of a diversified investment portfolio rather than as a standalone investment. By doing so, investors can take advantage of the benefits of gold CFDs while minimizing the risks associated with this financial instrument.

IV. Strategies for Building a Diversified Investment Portfolio with Gold CFDs

Investors can configure a diversified portfolio with gold CFDs as part of their investment strategy. Gold CFDs can offer several benefits when included in a well-diversified investment portfolio, including hedging against inflation, portfolio diversification, safe-haven assets, portfolio insurance, and liquidity. This section will discuss some strategies for building a diversified investment portfolio with gold CFDs.

A. Asset Allocation and Rebalancing

One strategy for building a diversified investment portfolio with gold CFDs is asset allocation and rebalancing. Asset allocation involves dividing an investment portfolio into numerous asset classes, such as stocks, bonds, and commodities, based on the investor's goals, risk tolerance, and time horizon. Rebalancing involves periodically adjusting the portfolio's asset allocation to maintain the desired balance of assets. Including gold CFDs as part of a diversified investment portfolio can help reduce overall portfolio risk and increase potential returns.

For example, an investor may allocate 5% of their portfolio to gold CFDs as a hedge against inflation and market volatility. Over time, the value of the gold CFDs may increase or decrease, causing the portfolio's asset allocation to shift. Rebalancing the portfolio regularly can help maintain the desired allocation and ensure that the portfolio continues to meet the investor's goals and risk tolerance.

B. Long-Term Investment Horizon

Another strategy for building a diversified investment portfolio with gold CFDs is to have a long-term investment horizon. Gold CFDs can be volatile in the short term, but over the long term, they have historically provided a hedge against inflation and a safe-haven asset. By taking a long-term investment horizon, investors can reduce the impact of short-term market volatility and harvest the potential benefits of gold CFDs.

For example, an investor may purchase gold CFDs as part of a long-term investment plan that includes regular contributions over several years. By taking a long-term investment horizon, the investor can minimize the impact of temporary market fluctuations and harness the benefits of gold CFDs as a hedge against inflation and market volatility.

C. Combining Gold CFDs with Other Assets

Investors can also combine a diversified investment portfolio with gold CFDs and other assets. For example, an investor may hold a combination of stocks, bonds, and commodities, including gold CFDs, in their investment portfolio. Diversifying across different asset classes can reduce overall portfolio risk and increase potential returns.

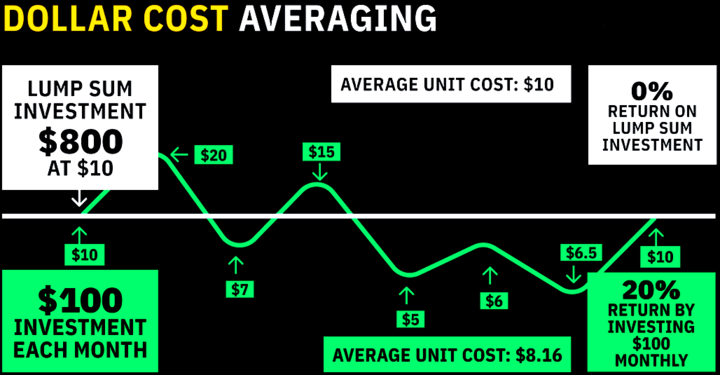

D. Dollar-Cost Averaging

Another strategy for building a diversified investment portfolio with gold CFDs is to use dollar-cost averaging. It signifies investing a fixed amount of money in gold CFDs at regular intervals, regardless of the market price. It can reduce the impact of short-term market volatility and allow investors to take advantage of potential buying opportunities.

For example, an investor may invest $500 monthly in gold CFDs using dollar-cost averaging. Over time, this can reduce the impact of short-term market volatility and allow the investor to take advantage of potential buying opportunities as the market price fluctuates.

E. Risk Management Strategies

Finally, investors can build a diversified investment portfolio with gold CFDs by using risk management strategies. These strategies can include setting stop-loss orders, limiting the amount invested in gold CFDs, and choosing reputable brokers and financial institutions. By using risk management strategies, investors can help reduce the impact of potential risks associated with gold CFDs.

For example, an investor may use a stop-loss order to automatically sell their gold CFDs if the market price falls below a certain level. It can help limit potential losses and reduce the impact of market volatility. Additionally, investors may limit the amount invested in gold CFDs.

V. Comparing Gold CFD to Other Investment Options

When investing in gold, numerous options are available to investors, including gold CFDs, ETFs, mutual funds, physical gold bullion, gold mining stocks, sovereign bonds, and cryptocurrencies. Each investment option has advantages and disadvantages, and investors must consider their goals, risk tolerance, and time horizon before deciding. In this section, we will compare gold CFDs to other investment options.

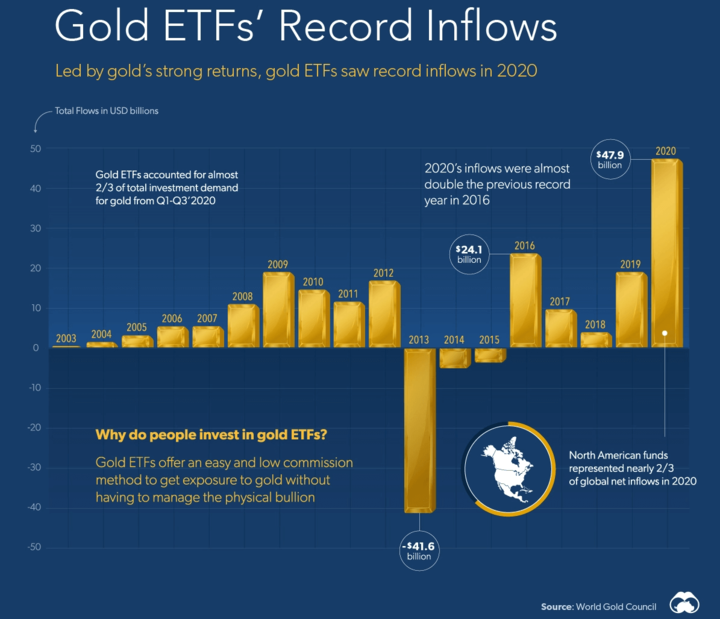

A. Gold ETFs and Mutual Funds

Gold ETFs and mutual funds are investment vehicles that track the price of gold. These funds hold physical gold or gold futures contracts, and investors can buy and sell shares in these funds on stock exchanges. Gold ETFs and mutual funds are relatively easy to trade and offer investors exposure to the gold market without physical ownership.

However, gold ETFs and mutual funds can have high management fees, which can eat into potential returns. Additionally, these funds offer a different level of flexibility than gold CFDs, as investors cannot leverage their positions or trade on margin.

B. Physical Gold Bullion

Physical gold bullion involves buying and holding physical gold, such as coins or bars. Physical gold can be kept at home or in a safe deposit box, and investors can sell their gold when they choose. Physical gold offers investors the security of owning a tangible asset and can serve as a hedge against inflation and market volatility.

However, physical gold can be expensive to purchase and store, and it can be difficult to sell quickly in market volatility. Additionally, physical gold offers a different level of flexibility than gold CFDs, as investors cannot leverage their positions or trade on margin.

C. Gold Mining Stocks

Stocks in companies that mine for gold can offer investors exposure to the gold market and potential capital gains if the price of gold rises. However, gold mining stocks are subject to company-specific risks, such as operational and financial risks, which can affect their performance.

Additionally, gold mining stocks are subject to market volatility and may not track the price of gold as closely as other investment options. Gold mining stocks also offer a different level of flexibility than gold CFDs, as investors cannot leverage their positions or trade on margin.

D. Sovereign Bonds

Governments issue these debt securities, offering investors a fixed income stream. Sovereign bonds are considered safe investments and can serve as a hedge against market volatility.

However, sovereign bonds do not offer the same potential for capital gains as gold CFDs or other investment options. Additionally, sovereign bonds are subject to interest rate and inflation risks, which can affect their performance.

E. Cryptocurrencies

Cryptocurrencies, such as Bitcoin and Ethereum, have been recognized as an alternative investment option in recent years. These decentralized digital currencies, transacted and processed on blockchain technology, can expose investors to a new high-growth asset class.

However, cryptocurrencies are highly volatile and can experience significant price swings quickly. Cryptocurrencies are also subject to regulatory and security risks, which can affect their performance. Additionally, cryptocurrencies offer a different level of diversification than gold CFDs or other investment options, as they are a relatively new asset class.

When comparing gold CFDs to other investment options, investors must consider their goals, risk tolerance, and time horizon. Gold CFDs offer several advantages, including leverage, flexibility, and potential capital gains, but they are subject to market volatility, trading costs, and counterparty risk. Ultimately, deciding to invest in gold CFDs or another investment option depends on the investor's circumstances and preferences.

VI. Conclusion: The Role of Gold CFDs in a Diversified Investment Portfolio

A. Summary of Benefits and Risks

Gold CFDs can play an essential role in a diversified investment portfolio. As discussed, they offer various benefits, including hedging against inflation, portfolio diversification, and serving as a safe-haven asset. However, there are also potential risks to consider, such as volatility, trading costs, and counterparty risk.

Despite these risks, with proper risk management strategies, such as asset allocation, long-term investment horizons, and combining gold CFDs with other assets, investors can minimize the risks associated with investing in gold CFDs.

B. Key Takeaways

Compared to other investment options, gold CFDs offer a unique set of advantages and disadvantages. For example, gold ETFs and mutual funds provide exposure to gold, but they may have higher expense ratios than CFDs. Physical gold bullion can offer a tangible asset but may require additional storage and insurance costs. Gold mining stocks provide leverage to the gold market, but they may be subject to operational risks and geopolitical uncertainties. Sovereign bonds offer a low-risk investment option but may provide a different level of diversification or potential returns than gold CFDs. Cryptocurrencies, being highly speculative assets, may offer high potential returns but also significant volatility and regulatory risks.

C. Final Thoughts

In conclusion, gold CFDs can be valuable to a diversified investment portfolio. While they come with certain risks, with proper risk management strategies, investors can mitigate those risks and benefit from the advantages of gold CFDs. Ultimately, investors should systematically assess their investment goals, risk tolerance, and overall portfolio objectives when deciding whether to invest in gold CFDs or other asset classes.