According to a recent report, Ethereum billionaires have acquired over 700,000 ETH tokens (equivalent to approximately $2.45 billion) in the past three weeks. Despite the substantial accumulation, Ethereum is experiencing difficulty regaining its optimistic momentum.

Ethereum ETF Possibility Vs. Rate Cut Possibility

Last Wednesday, Ethereum and Bitcoin surged in value due to inflation data from the United States that exceeded expectations. Nevertheless, hawkish remarks from Federal Reserve Chair Jerome Powell doubted the probability of multiple rate cuts this year, causing cryptocurrency and other risk assets to retrace.

The U.S. The Securities and Exchange Commission unexpectedly approved numerous 19b-4 forms for Ethereum exchange-traded funds (ETF) last month, resulting in a substantial rally. Investor enthusiasm nearly regained the $4,000 mark on May 27. Nevertheless, this enthusiasm diminished as market participants recognized that the SEC had yet to approve the S-1 registration forms required for these products to begin trading.

During a recent congressional hearing, SEC Chair Gary Gensler stated that the ultimate approval of Ethereum ETFs is anticipated this summer, as reported by U.Today.

Analysts Opinion On ETH

However, JPMorgan, a renowned banking institution, has expressed skepticism regarding Ethereum ETFs, predicting they will only generate modest inflows.

A recent research report by Liquid Collective and Obol has identified several associated risks as Ethereum prepares for the Pectra upgrade in early 2025.

The report emphasizes the significance of client, operator, and cloud diversity, as well as the limited adoption of distributed validator technology (DVT).

The upcoming Pectra upgrade, which combines the Prague and Electra upgrades, is intended to improve the network's execution and consensus layers. This modification to the staking limit will alleviate the strain on Ethereum's communication layer and decrease the necessary validators.

Ethereum Price Prediction Technical Analysis

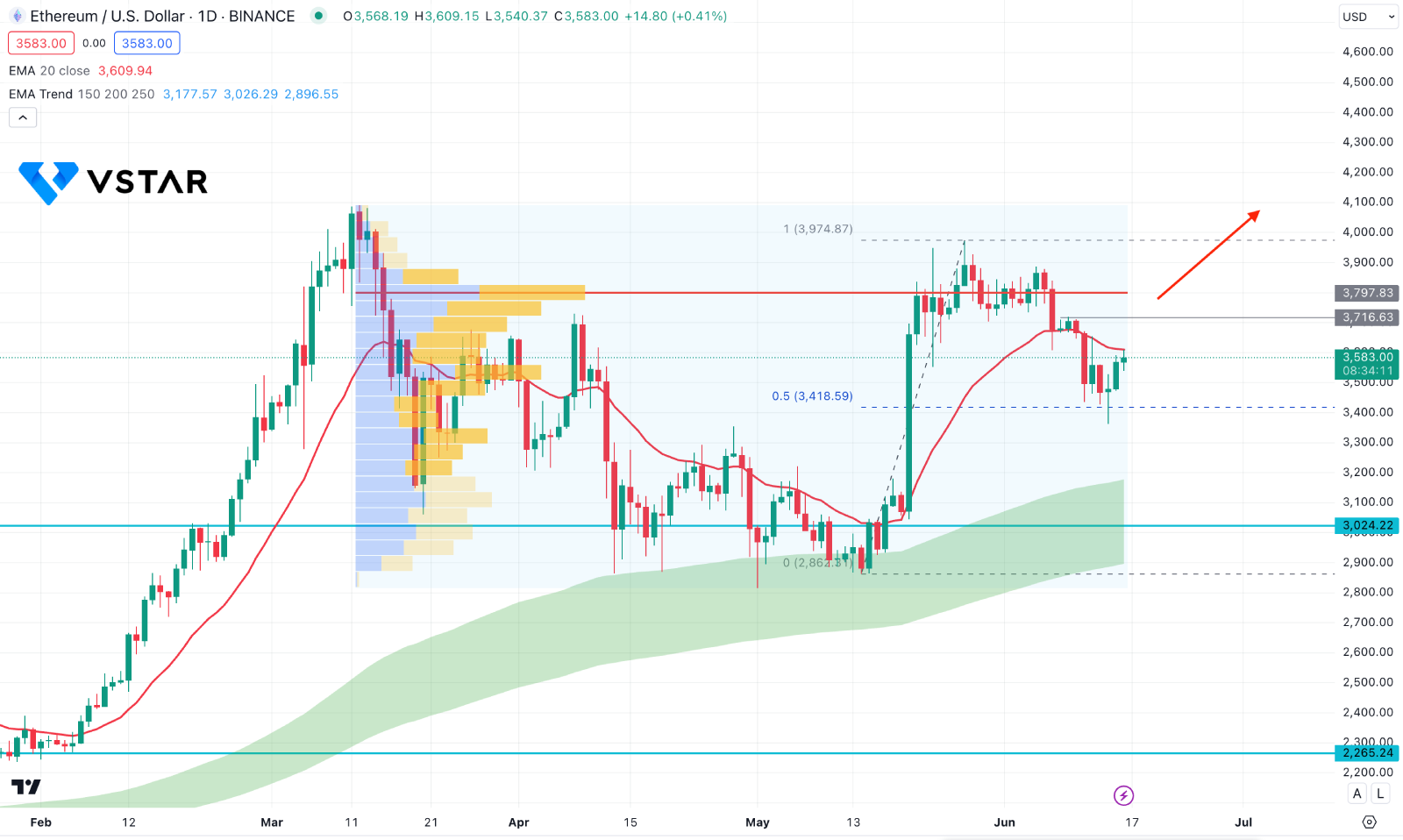

In the daily chart of ETHUSD, the recent price showed a downside correction after finding a peak at the 3978.87 level. As a result, a deeper discount came, taking the price below the 50% Fibonacci Retracement level of the most recent swing. However, an immediate bullish reversal came from that crucial point, suggesting buyers' presence.

In the volume structure, bears are still active in the market as the largest activity level since March 2024 is above the current price. Moreover, the dynamic 20 day Exponential Moving Average is above the current price and working as a minor resistance level.

Although the buying pressure is limited from the near-term dynamic level, major support from EMA could be still below the current price.

Based on this structure, a valid bullish breakout above the 3716.63 static point could be a high probability of a long opportunity, targeting the 4000.00 psychological line.

However, a downside continuation might find support from the MA cloud, from where another long opportunity might come.