What is ESG and What is ESG Investing?

Prioritizing environmental, social, and governance (ESG) issues is known as ESG investment, or socially responsible, impact, or sustainable investing. It is comparable to investing with consideration for the economy, the environment, and human welfare. It is theorized that an organization's financial success is influenced by its treatment of people and the environment. Investment decisions were impacted by religious views centuries ago, therefore this idea is not new. Investor awareness of ethical market involvement has increased in the modern era due to the growth of corporate social responsibility.

The UN's Principles for Responsible Investments, which provide recommendations for integrating ESG considerations into company planning, helped ESG investment gain momentum in 2006. With over 2,000 endorsers, these guidelines are commonly regarded as the pinnacle of standards for ESG investment.

Moreover, third-party agencies such as Sustainalytics, ISS-ESG, and MSCI are important actors in the field of ESG investment. They assess businesses according to their governance, social responsibility, and environmental effects. Investors may evaluate a company's ESG performance in a quantifiable manner thanks to these assessments, which are represented in ESG ratings.

The ratings are influenced by open information on executive salaries, diversity policy, and carbon footprint. For people interested in making ethical investments, an elevated ESG score indicates superior sustainability. Integrating ESG factors into investment decisions is not only a moral choice, but also a calculated one that balances financial objectives with social and environmental considerations.

What Are ESG Stocks?

ESG stocks are stocks of companies that comply with environmental, social, and governance principles. Investors examine a company based on these principles when assessing its social responsibility, governance standards, and environmental effects. Companies that exhibit a dedication to sustainability, moral business conduct, and good corporate governance are represented in ESG stocks.

- Environmental (E): Companies in this category with robust ESG processes are committed to reducing their environmental effect. This covers initiatives to lower carbon emissions, use renewable energy sources, and implement sustainable resource management techniques.

- Social (S): A company's effects on stakeholders, workers, and society are assessed as part of the ESG social component. Fair labor standards, community involvement, diversity and inclusion, and ethical supply chain management are prioritized by businesses with high social ESG ratings.

- Governance (G): A company's leadership and decision-making processes are evaluated based on their effectiveness and structure using governance standards. Strong ESG governance ratings are often associated with open and responsible leadership, efficient board structures, and moral corporate practices.

Why Invest in ESG Stocks?

Global issues such as deforestation, social inequality, unethical behavior, carbon emissions, and climate change have taken precedence in today's globe for governments, businesses, and communities. Many businesses are trying to mitigate their negative impacts after realizing them. This is where ESG investing comes in: the trend toward socially and ecologically responsible methods.

When assessing an investment, ESG investing entails considering factors other than only financial ones. It includes evaluating a company's operations, stakeholder treatment, and environmental effects. ESG functions as a non-performance metric, demonstrating the beneficial effects of investments on the community, the environment, and corporate success.

With these measures, investors can assess a company's sustainability and its wider effects on workers, clients, and society. Businesses implementing ESG principles attract the interest of impact, ethics, sustainability, and other investors who want to use their money to change the world. A joint endeavor to create a future that is not only financially stable but also socially and environmentally responsible is reflected in ESG investment.

It is expected that the increasing interest in ESG-focused funds will have a favorable impact on global decision-makers' strategies. ESG is the next step forward in sustainability, focusing on economically and socially beneficial solutions. ESG rules provide local business owners more chances, which help them succeed and attract devoted clients.

Advantages of ESG Stocks

Benefiting Both the Environment and Your Wallet

There is a false belief that ethics and money are incompatible; however, new research refutes this. According to studies, standard funds do not yield significantly inferior returns to ESG investment. ESG criteria-led funds did better throughout the pandemic, with gains ranging from 27% to 55% in the first year.

Drives Market-Wide Growth

Strong ESG procedures help businesses enter new markets and succeed in current ones. Companies that use ESG draw in both B2B and B2C customers by providing sustainable goods. This, in turn, improves government and community ties, improving access to resources and favorably influencing consumer preferences.

Increasing Profits and Reducing Risks

By allocating capital to sustainable alternatives like waste reduction and renewable energy, a strong ESG offer generates excellent returns. ESG reduces investor risk by protecting against stranded investments brought on by long-term environmental challenges. To optimize profits, start with sustainable products.

Invest with Confidence

Purchasing ESG stock guarantees that you are aligned with businesses that are committed to CSR, environmental responsibility, and ethical business practices. Selecting ESG funds enables you to be pleased with the businesses you support.

Reducing the Risk Index

Beyond steady returns, investing in ESG businesses is less risky. Sincere ESG companies are more likely to be stable and have better reputations since they are dedicated to following regulations and upholding just standards.

Directing Healthier, Long-Term Decisions

By addressing issues related to global sustainability, ESG practices enable investors to make well-informed, long-term decisions. Investors support environmental and social responsibility by selecting companies with strong ESG criteria.

Increasing Worker Productivity

Investments in environmental sustainability increase worker motivation, engagement, and output. When workers are happy and feel that their labor is having an impact, they perform better and increase shareholder profits.

Promoting Cost Savings

In addition to their many advantages, ESG practices can result in considerable cost savings. Businesses may show excellent environmental stewardship by cutting operating costs and greenhouse gas emissions by establishing eco-friendly buildings.

Disadvantages of ESG Stocks

As with any investment plan, it's necessary to consider all relevant factors.

Even while the benefits of ESG are undoubtedly fascinating, there are a few possible disadvantages to take into account:

Restricted Alternatives for Investment

There may be fewer publicly listed corporations than there are ESG-compliant businesses. This restriction may limit investors' access to a greater range of investment opportunities, which might reduce portfolio diversity.

Lack of Standardization

As of right now, there isn't a generally acknowledged criteria for identifying businesses that are actually "ESG-compliant." Investors find it difficult to systematically compare and assess various investment possibilities due to this lack of consistency.

Higher Costs

Businesses may have to spend more money on extra research and due diligence if they decide to include ESG factors in their investing process. Increased expenses from these extra efforts may have an impact on total profits from investing.

Possibility of "Greenwashing"

Some businesses might embellish or mislead their environmental, social, and governance (ESG) activities, a practice known as "greenwashing." Investors may be duped by this, which would defeat the goal of ESG investing and make it challenging to find truly sustainable companies.

Investments with Lower Profits

Some are concerned making investments in businesses with robust ESG policies might lead to poorer returns. Contrary to popular belief, research indicates that businesses with strong ESG policies may do better financially over the long run.

Lack of expertise in ESG investing

It might be difficult for people who are unfamiliar with this kind of investment to make ESG investments. It may be more challenging for novice investors to weigh the benefits and drawbacks of various ESG investment alternatives.

ESG Investing Strategies

It considers some key concepts when creating an ESG-focused portfolio. Guidelines for incorporating these considerations or strategies into decision-making are still being developed since sustainable investment is still in its infancy. Hence, choose the strategy that best fits your objectives, driving forces, and established workflows.

A. Negative/Exclusionary Screening

The strategy involves eliminating from investment portfolios businesses engaged in disputable businesses or operations. Fossil fuels, the manufacture of weaponry, and the tobacco industry are among examples. Investors may lower risk while aligning their investments with their ethical convictions by staying away from certain industries.

B. Positive/Best-in-Class Screening

Unlike negative screening, this method purposefully chooses businesses that are pioneers in their respective industries in terms of environmental, social, and governance (ESG) activities. Businesses with high social responsibility, environmental stewardship, and sound governance processes are highly sought after by investors. Investors support and promote sustainable business practices by concentrating on top performers in the industry.

C. Impact Investing

Impact investment strategy focuses on businesses or initiatives that directly solve environmental or social issues. Along with monetary gains, investors look for quantifiable, beneficial effects. Investing in sustainable agriculture endeavors, affordable housing programs, and renewable energy projects are a few examples. Investors might possibly earn competitive financial returns while also promoting good change through impact investing.

D. ESG Integration

Combining environmental, social, and governance factors into conventional financial analysis models is known as ESG integration. Investors can gain a greater understanding of a company's long-term sustainability and risk profile by considering ESG elements in addition to financial measures. This integrated strategy aims to improve the quality of investment decisions and maybe provide higher risk-adjusted returns.

E. Thematic Investing

Thematic investment focuses on particular ESG trends or topics, such as water conservation or sustainable energy. Companies that are well-positioned to profit from or contribute to these topics are the focus of investors. Investors may position their portfolios to take advantage of changing market possibilities and promote better social and environmental consequences by focusing on developing sustainability topics.

Top 8 Best ESG Stocks

Nvidia (NVDA)

Nvidia (NVDA) is the leading manufacturer of graphics processing units (GPUs) for robotics, game consoles, supercomputers, and self-driving cars. Nvidia leads the gaming GPU market, has a 10-year total annualized return of over 50%, and is well-positioned to grow in the long run because of its successes in autonomous driving and artificial intelligence. In the fiscal year 2023, it had a 125.84% increase in sales to $60.92 billion and a 586.30% increase in GAAP EPS to $12.05.

A. Nvidia ESG Highlights

Nvidia promotes diversity and inclusion, recycles semiconductors, and prioritizes energy-efficient AI and machine learning. Notable programs include increasing the number of Black workers, compensating merchants during the COVID-19 shutdown, and creating the incredibly effective DGX SuperPOD.

NVIDIA understands that training and running Energy-Efficient AI and Machine Learning models can be very energy-intensive. That's why they focus on these factors:

- NVIDIA's GPUs are made with energy efficiency in mind. Moreover, newer generations show significant gains in processing power per watt, signaling more fuel-efficient cars to do the same work.

- NVIDIA develops software frameworks (like CUDA) and libraries (like TensorRT) that help users optimize how their AI models use the hardware.

- NVIDIA GPUs can intelligently enter low-power states when models are not actively running.

Nvidia company (NVDA) is aware of environmental safety in their business. The following steps signal a decent environmental solution for this company:

- NVIDIA collaborates with partner companies to offer recycling for end-of-life GPUs and other hardware.

- NVIDIA considers how to easily dismantle and recycle components when designing new products.

Among other steps, the diversified workforce, STEM education programs, and Employee Resource Groups (ERGs) are significant developments.

B. Nvidia Stock Forecast

Source: TradingView

In the weekly NVIDIA stock chart, the current price is trading at an all-time high area. As a result, a strong gap is visible from the dynamic line, suggesting a downside correction. In that case, the near-term demand zone of 505.00 to 388.00 area could be a target point.

In the long term, the NVDA stock price may continue to move higher toward the $900 price level and even above the $1000.00 level. A considerable downside correction on a short-term basis could offer a trend trading opportunity.

Microsoft (MSFT)

Microsoft (MSFT) is a prominent participant in cloud platform provisioning and the largest software corporation in the world. It leads the cloud computing space with Azure and has seen a strong increase in subscription income from its software offerings.

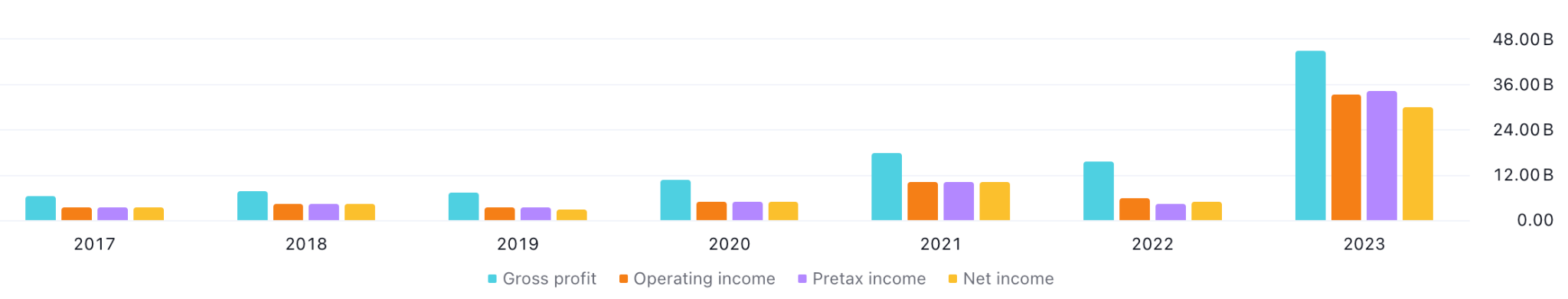

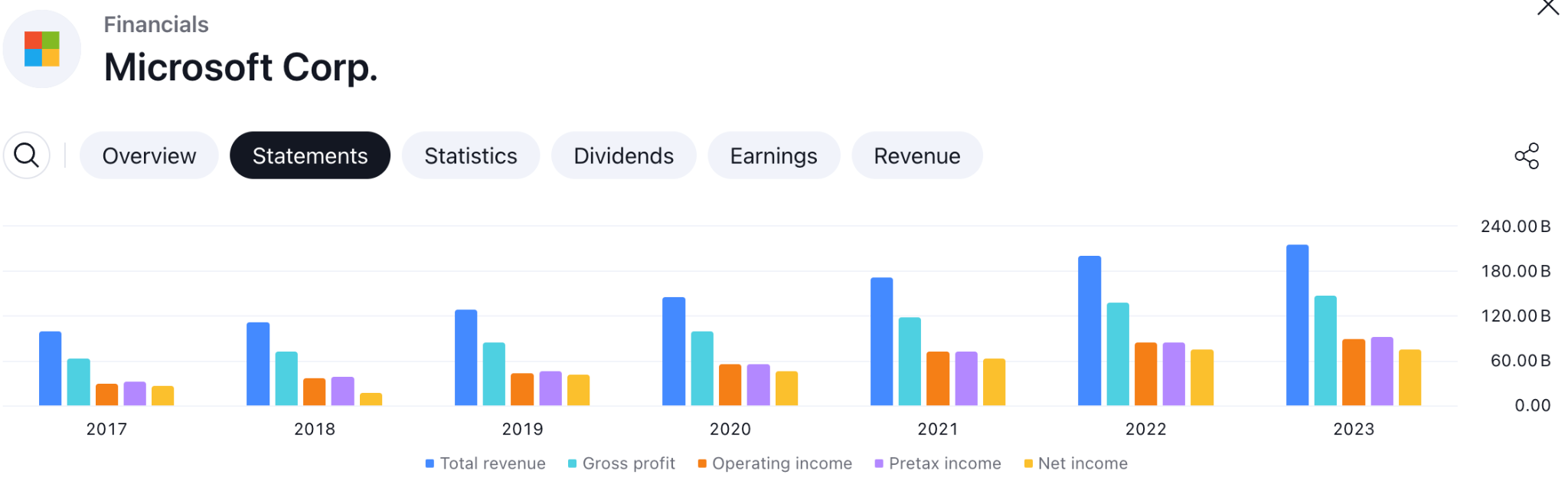

Over the last 15 years, investors have seen an astounding 25% total annualized return. Microsoft reported 6.88% higher revenues of $211.92 billion for the fiscal year that ended on June 30, 2023, and 0.39% higher diluted EPS of $9.68.

A. Microsoft ESG Highlights

Microsoft represents its commitment to Environmental, Social, and Governance (ESG) programs by putting renewable energy first, encouraging diversity, fairness, and inclusion, and enforcing strict cybersecurity and data privacy policies.

Let's look at some of the key factors of this company to consider:

- Renewable Energy Use: Microsoft is committed to becoming carbon negative by 2 by investing in renewable energy sources and carbon removal techniques. They've set ambitious goals and track their progress in sustainability reports.

- Diversity, Equity, and Inclusion (DE&I) Programs: Microsoft prioritizes fostering a diverse and inclusive workplace. They have programs focused on attracting and retaining talent from underrepresented groups and achieving their Racial Equity Initiative goals by 2025 https://www.microsoft.com/en-us/diversity/inside-microsoft/annual-report. You can find more details in their CSR reports.

- Data Privacy and Cybersecurity Policies: Microsoft emphasizes data privacy and security. They offer various tools and resources for users to control their data and prioritize robust cybersecurity measures to protect user information. Their privacy principles and security practices are detailed on their official website.

B. Microsoft Stock Forecast

Source: TradingView

MSFT stock is currently residing at a historic high, where the 161.8% Fibonacci Extension level would be the primary target to look at. A failure to hold the price above this line might initiate a decent downside correction towards the 281.69 level.

In the long term, if the price retraces toward the $380 support level and has a strong W1 bullish candle close, the price may recover further upside toward the $450 key level in the upcoming days.

Adobe (ADBE)

Among the software giants, Adobe (ADBE) stands out for providing tools for creatives, cloud storage, and marketing analytics. When it comes to commercial achievements, Adobe is at the forefront of digital content production with products like Photoshop, which generates significant income via subscriptions. Their marketing package seeks to increase client involvement to set the stage for future expansion.

Revenue for the fiscal year 2023 was around $19.37 billion, an 11.12% increase over the previous year. Having generated $4.39 billion in sales in the fourth quarter of 2023, Adobe has given its stockholders about 30% yearly returns over the previous ten years.

A. Adobe ESG Highlights

Adobe accomplished worldwide gender pay parity and invested approximately $87 million in underrepresented minority communities, positively impacting 1.6 million people, as a demonstration of their commitment to Environmental, Social, and Governance (ESG) efforts.

Adobe hopes to reach 100% renewable energy by 2035, with half of its energy already coming from renewable sources. In December 2021, Adobe's ESG score was raised from AA to AAA by MSCI, demonstrating the company's commitment to sustainability and ethical business practices.

B. ADBE Stock Forecast

Source: TradingView

ADBE nose dive below the $570 psychological support level and currently trading around the $551.80 price area. In the short term, the price may return toward the $500 price area as a mean reversion.

In the long term, if bulls find support around the $500 price level, ADBE may continue the bullish bias toward the $700 key resistance area in the days ahead.

Intuit (INTU)

Accounting software subscriptions for TurboTax, Mint, Credit Karma, and QuickBooks are offered by Intuit (INTU) to small and medium-sized enterprises as well as individuals. Gaining market share with the acquisition of Mailchimp, Intuit is now a leader in company accounting and tax preparation.

With a revenue of over $14.37 billion and a net income of over $3.14 billion in 2023, Intuit was a profitable company. Purchases like Mailchimp and Credit Karma improve its operations, providing almost 30% annualized returns to stockholders over five years.

A. Intuit ESG Highlights

Since 2015, Intuit has been carbon neutral in Environmental, Social, and Governance (ESG) programs; by 2030, the company hopes to be climate-positive. Consistently ranked among the best tech employers, it achieved equal pay for minority groups in the United States and achieved worldwide gender pay fairness.

B. Intuit Stock Forecast

Source: TradingView

INTU stock is currently trading around $659.15 in the price area and trying to recover higher. In the short term, the price may continue the bullish trend toward the $700 key resistance area. A stable bullish breakout above this line could extend the gain toward the 1000.00 area.

In the long term, if the price finds resistance around the $700 key resistance level, INTU bears may regain momentum and push the price down to the $600 price area in the coming days. However, the long-term bullish trend is still valid and a rebound is possible until the price comes below the 480.00 support line.

Salesforce (CRM)

Regarding customer relationship management (CRM) software, Salesforce (CRM) sets the standard by allowing companies to leverage client data to increase sales and enhance services. Salesforce is a business achievement that caters to major corporate clients. It guarantees consistent performance, a dominant market share, and dependable revenue from subscriptions.

Slack, a team management tool, was just added, expanding its extensive selection. Salesforce has a track record of generating double-digit yearly returns. Its revenues for the fiscal year 2023 reached $34.86 billion, a remarkable 11.18% rise.

A. Salesforce ESG Highlights

Salesforce has demonstrated its dedication to Environmental, Social, and Governance (ESG) activities by achieving net-zero carbon emissions across its value chain and by exclusively utilizing renewable energy sources. As an example of good corporate citizenship, the corporation further highlights its commitment to racial equality by investing $16 million in equal pay programs and creating a task force specifically focused on this issue.

B. CRM Stock Forecast

Source: TradingView

CRM stock is currently trading around the $299.75 price level. In the short-term perspective, CRM stock price may continue the bullish momentum and test the $310 weekly key resistance area. Investors should closely monitor how the price reacts on the $700.00 level to gauge the upcoming movement.

In the long term, if the price faces strong resistance around the $310 price area, bears may regain momentum and push the price down to the $250 psychological area in the days ahead.

Cadence (CDNS)

The company Cadence (CDNS) focuses on hardware and software for creating integrated circuits and effective systems, meeting the growing need for specialized chips and cutting-edge technologies like 5G, artificial intelligence, and driverless vehicles. Business-wise, Cadence's emphasis on developing quicker, smaller, and more effective processors fits in nicely with the prevailing market trends.

Along with innovations like the Xcelium app, its forays into 5G, AI, and driverless cars have paved the way for future expansion. With actual revenues of $4.09 billion or more for the fiscal year 2023, Cadence has produced exceptional total annualized returns of 29% over the last ten years.

A. Cadence ESG Highlights

Cadence has accomplished worldwide gender pay equity as well as race and ethnicity pay fairness in the United States, demonstrating its dedication to Environmental, Social, and Governance (ESG) goals.

In 2020, the firm created a supplier code of conduct to ensure governance standards are upheld throughout its supply chain, and it also plans to reduce carbon emissions by 15% between 2019 and 2025. Cadence's adherence to ESG guidelines demonstrates their commitment to ethical business practices.

B. CDNS Stock Forecast

Source: TradingView

CDNS stock hit an all-time high of $315.40 and is currently trading around the $300.58 price area. In the short term, the price may retrace down toward the dynamic level of 20 EMA on the weekly timeframe.

In the long term view, if the price finds support at the 20 EMA, CDNS stock may continue the bullish trend toward the $350 price level in the upcoming days.

Costco Wholesale (COST)

Costco Wholesale (COST) is a premium membership warehouse club retailer committed to providing premium goods at affordable costs. With a focus on customer happiness, Costco constantly grows internationally and provides its devoted members with a wide selection of products and services.

A. Costco ESG Highlights

Regarding ESG programs, Costco is committed to environmental sustainability and has taken steps to lower its carbon footprint, cut waste, and improve energy efficiency. For moral and open supply chains, the organization places a high priority on responsible sourcing. Their focus is placed on the well-being of employees, providing them with chances for professional progress, competitive pay, and extensive benefits.

Costco is a socially conscious company that gives back to the community through outreach initiatives and philanthropic contributions, improving the environment as well as society.

B. Costco Stock Price Forecast

Source: TradingView

COST stock is currently trading around the $747.96 price level after hitting an all-time $752 price area. In the short term, the price may retrace toward the $700 psychological demand level before continuing further higher.

From the long-term perspective, if the price retraces towards the $700 demand zone area, there is a high chance that COST may continue the bullish trend toward the $800 key price area in the days ahead.

Marriott (MAR)

Marriott (MAR) is a multinational hospitality enterprise that operates and franchises hotels and resorts around the world. Marriott serves a spectrum of market segments by providing various lodging options, from luxurious to affordable. Its dedication to corporate governance, social responsibility, and environmental sustainability strengthens the business's operations.

A. Marriott ESG Highlights

Marriott prioritizes environmental sustainability through trash reduction, water conservation, and energy-efficient procedures as part of its ESG (Environmental, Social, and Governance) programs. Their activities rely on community development, promotion of diversity and inclusion, and ethical corporate practices.

Marriott seeks to minimize its environmental effect and increase its social impact while maximizing long-term value for stakeholders by integrating ESG principles.

B. MAR Stock Forecast

Source: TradingView

MAR stock hit an all-time high of $252 and is currently residing around the $249 price area. In the short term, the MAR stock price may retrace down toward the $210.50 support level.

In the long term, if the price retraces toward the $210.50 support level and has a weekly bullish candle close, bulls may regain momentum and push the price upward toward the $280 price area in the coming days.

How to Trade ESG Stocks CFD with VSTAR

ESG investing is becoming increasingly popular, and one effective way to get involved is by trading ESG stocks using Contracts for Difference (CFD) on platforms like VSTAR. Through CFDs, VSTAR makes it easier to trade top ESG stocks like NVDA (Nvidia), MSFT (Microsoft), and ADBE (Adobe) and allows for price movement speculation without requiring ownership of the underlying assets.

To trade ESG stocks on VSTAR, take the following actions:

- Create an account: Register on the VSTAR Broker.

- Research and choose: Examine ESG stocks that fit your objectives and ideals.

- Determine and plan: Utilize VSTAR's tools to design strategies and analyze stock performance.

- Carry out trades: Start trading CFDs and open positions on certain ESG stocks.

- Control risk: To safeguard your investment, use the risk management solutions offered by VSTAR.

Conclusion

ESG stocks are appealing for reasons other than just making money. With their dedication to sustainability, diversity, and innovation, businesses like NVDA, MSFT, and ADBE demonstrate the possibility of morally sound and financially rewarding investments. The essay emphasizes the long-term advantages of assisting companies committed to having a positive environmental and social effect while highlighting how investing in ESG is consistent with more general sustainability aims.

Looking ahead, we see a bright future for ESG investing. There is a steady and growing demand for socially and environmentally sensitive investments, as evidenced by the rising incorporation of ESG elements into investment decisions and the growing awareness of corporate responsibility.