Electronic Arts Inc (EA) is one of the largest video game publishers in the world. Since its founding in 1982, the company has enjoyed a long string of successes. The aim of this article is to present a comprehensive review of EA stock so that readers can have a holistic view. This article includes tips and tricks to help traders and investors make huge profits through this influential player in the gaming world.

I. What is EA: A Leading Force in the Gaming Industry

Electronic Arts Inc. is an American video game company based in Redwood City, California. It was founded in 1982 by Trip Hawkins and is now a publicly traded company on the NASDAQ stock exchange. How much is EA worth? EA has a market capitalization of $34.8 billion and a net income of approximately $1.6 billion.

The company has a long history of innovation and growth and has received numerous awards for its industry leadership. EA is committed to creating innovative and engaging entertainment experiences for gamers of all ages.

Here is a brief history of EA:

- 1982: Founded by Trip Hawkins

- 1983: Releases its first game, Skate or Die!

- 1984: Acquires Origin Systems

- 1991: Launches the EA Sports brand

- 1993: Acquires Maxis

- 2004: Acquires Pandemic Studios

- 2008: Acquires BioWare

- 2011: Acquires PopCap Games

- 2017: Acquires Respawn Entertainment

The company is organized into three business segments: Interactive Services, Mobile, and Technology. The current CEO of Electronic Arts is Andrew Wilson.

Who owns Electronic Arts

Some of the top shareholders of Electronic Arts (EA) are institutional investors and mutual funds. These could include Vanguard Group, BlackRock, State Street Corporation, and Fidelity Investments, among others.

II. Unlocking Gaming Excellence: Exploring Electronic Arts Inc.'s Business Model and Product Offerings

A. Business Model

Electronic Arts Inc. (EA websites: ea.com) is a powerhouse in the gaming industry, owning some of the most popular sports and sci-fi game franchises. With a commitment to pushing boundaries and delivering exceptional gaming experiences, EA has successfully moved into live services, mobile platforms, and streaming, driving new growth and captivating audiences worldwide.

One of EA's standout offerings is its subscription service called EA Access, which gives subscribers access to a vast library of games for a monthly fee. This innovative approach to gaming allows players to explore a diverse range of titles and experience the latest releases without having to purchase individual games. In addition, EA Access offers exclusive perks such as in-game purchases, custom content, and regular updates that keep gamers engaged and immersed in their favorite titles.

A notable revenue stream for EA comes from its commitment to enhancing the gameplay experience through features such as FIFA Ultimate Team. This popular mode within the FIFA franchise allows players to build their dream teams, make in-game purchases, and compete online. Ongoing updates and the addition of new content keep the experience vibrant and evolving, captivating fans and generating significant revenue for the company.

EA's business model emphasizes adaptability and responsiveness to the ever-changing gaming landscape. By leveraging live services, mobile platforms, and streaming technologies, EA remains at the forefront of the industry, offering gamers unparalleled access to their favorite franchises and driving new avenues for growth.

B. Main Products/Services

If you are a video gamer, you may be familiar with the following list of EA games: FIFA, Madden NFL, NBA Live, The Sims, Battlefield, Need for Speed, Mass Effect, Dragon Age, Plants vs. Zombies, Command & Conquer, Medal of Honor, SimCity, Burnout, Crysis, Dead Space, and Mirror's Edge, to name a few.

Electronic Arts is a leading publisher of video games with a broad portfolio of games. The most popular Electronic Arts video games franchises include:

Sports Games

EA is one of the leading publishers of sports games. The company's most popular sports franchises include Madden NFL, FIFA, NHL, UFC, and PGA TOUR Golf.

Who owns EA Sports? As a division of EA, EA Sports is ultimately owned by the shareholders of Electronic Arts. The specific individuals or entities that own the majority of the shares of EA also indirectly own EA Sports.

Action/Adventure Games

EA also publishes a number of action/adventure games. Some of the company's most popular action/adventure franchises include Apex Legends, The Sims, Need for Speed, and Plants vs. Zombies.

Other games

EA also publishes a number of other games, including role-playing games, strategy games, and casual games.

III. Electronic Arts Inc.'s Financials, Growth, and Valuation Metrics

A. Review of Electronic Arts Inc.'s financial statements

The EA earnings report is published on a quarterly basis to provide insight into the financial performance of EA.

Revenue growth over the past 5 years

EA's revenue has grown at a compound annual growth rate (CAGR) of 5.5% over the past 5 years. This is a good growth rate.

Profit margins

EA's profit margins have been relatively stable over the last 5 years. The company's gross margin has averaged 71.5%, and its operating margin has averaged 18.6%. These are healthy margins and are in line with those of other major video game publishers.

Cash from operations (CFFO)

EA's cash flow from operating activities has been strong over the last 5 years. The company generates an average of $1.8 billion in cash from operations each year. This is a healthy amount of cash flow that has allowed EA to invest in its business and return capital to shareholders.

Balance sheet strength and implications

EA has a strong balance sheet. The company has $5.2 billion in cash and short-term investments and no debt. This gives EA great financial flexibility, allowing the company to invest in its business and return capital to shareholders.

In addition, EA net worth refers to the company's total assets minus its liabilities. It represents the value of the company's equity or ownership interest. It is an important measure of the company's financial strength and stability. It's worth noting that EA net worth can fluctuate over time due to various factors, such as changes in asset values, acquisitions, and business performance.

B. Key financial ratios and metrics

EA's key financial ratios and metrics are as follows:

- Price-to-earnings ratio (P/E): 24.3

- Price-to-book ratio (P/B): 3.3

- Return on equity (ROE): 20.1%

- Return on assets (ROA): 11.1%

The company's forward P/E ratio is 24.3, which is in line with the P/E ratios of other major video game publishers. Based on these factors, EA stock appears to be fairly valued at current levels.

However, it is important to note that the price of EA stock is volatile and can be affected by a number of factors, including the company's financial performance, the overall economy, and investor sentiment. Therefore, it is important to do your own research before investing in EA stock.

IV. EA Stock Performance

A. EA trading information

When was EA listed? EA was listed on the NASDAQ stock exchange on May 27, 1982.

Primary exchange & Ticker: EA's primary exchange is the NASDAQ stock exchange, and its ticker symbol is EA.

Country & Currency: EA is a US-based company, and its stock is traded in US dollars.

Trading hours: EA's stock trades during regular trading hours on the NASDAQ stock exchange, which are Monday through Friday from 9:30 a.m. to 4:00 p.m. ET.

Pre-market: EA's stock can be traded during pre-market hours, which are Monday through Friday from 4:00 AM to 9:30 AM ET.

After-market: EA's stock can be traded during after-market hours, which are Monday through Friday from 4:00 PM to 8:00 PM ET.

Stock splits: EA has split its stock 10 times since it was listed on the NASDAQ stock exchange. The most recent stock split was in 2020, when EA split its stock 5-for-1.

Dividends: EA has paid dividends to its shareholders every year since 1999. The company's most recent dividend was paid in February 2023 for $0.18 per share.

Latest developments investors/traders should note:

- EA's stock price has been volatile in recent months. The stock has fallen by about 30% from its peak in November 2022.

- EA has faced challenges in its business. The company has been criticized for its aggressive monetization practices, and it has also been facing competition from new entrants in the gaming industry.

- EA also released its fiscal 2023 earnings report on May 10, 2023.

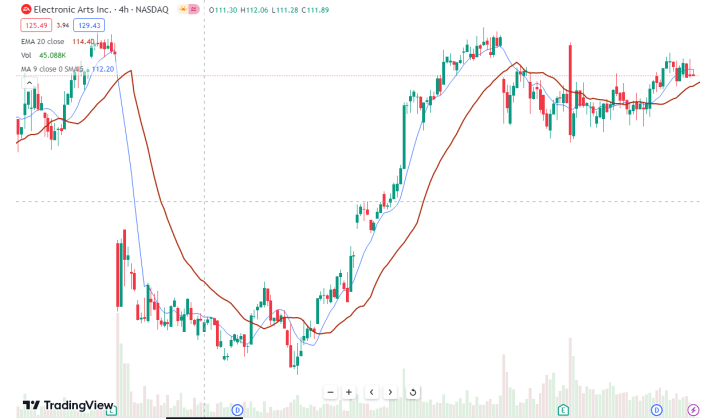

B. Overview of EA Stock Performance

As of June 6, 2023, Electronic Arts Inc. EA stock is trading at $127.02 per share. The stock has been on an upward trend in recent months, rising 8.1% over the past three months and 15.3% over the past year. The stock's 52-week high is $142.23 and its 52-week low is $108.53.

EA's stock performance has been driven by a number of factors, including the release of successful new games such as "FIFA 23" and "Madden NFL 23" and the company's focus on live services that generate recurring revenue from players. EA has also expanded its business into new areas such as e-sports and mobile gaming.

Despite the recent gains, EA stock is still trading below its all-time high. Some analysts believe the stock has room to run, while others believe it is overvalued.

C. Key Drivers of EA Stock Price

The key drivers of EA's stock price include:

- New game releases: EA releases a number of new games each year, and these releases can have a significant impact on the company's revenues and earnings. For example, the release of FIFA 23 in September 2022 was a huge success for EA, and it helped to drive the company's stock price to an all-time high.

- Esports: EA is a major player in the esports industry, and its games are featured in a number of esports tournaments each year. The growth of esports has been a positive driver for the esports stock price, helping to increase the company's brand awareness and reach a broader audience.

- Media deals: EA has a number of media deals in place, including a deal with Disney to produce Star Wars games. These deals provide EA with a steady stream of revenue and help to support the company's stock price.

D. Analysis of Future Prospects for EA Stock

The outlook for Electronic Arts stock is positive. The company is well-positioned to benefit from the growth of the video game industry and has a strong pipeline of new game releases. In addition, EA is a major player in the e-sports industry, which is expected to continue to grow in the coming years. As a result, Electronic Arts (Nasdaq: EA) stock should continue to rise over the long term.

However, some risks could weigh on EA stock in the short term. These risks include

Competition: The video game industry is highly competitive, and EA faces competition from several other companies, such as Activision Blizzard and Take-Two Interactive. If EA is unable to maintain its competitive edge, its video game stock price could suffer.

Regulation: The video game industry is subject to several regulations, and changes in these regulations could adversely affect EA's business. For example, the loot box controversy has led to calls for regulation of the practice, and if such regulation is implemented, it could harm EA's revenues.

Economic Conditions: The video game industry is cyclical and EA's business is affected by the general economic climate. In the event of a recession, EA's revenues and earnings could decline, which would adversely affect its stock price.

V. Risks and Opportunities

A. Potential risks facing Electronic Arts Inc.

Competitive Risks

The video game industry is highly competitive, and EA faces competition from a number of other companies, including Activision Blizzard, Take-Two Interactive, Microsoft, Nvidia, Roblox, Sea Limited, and NetEase. These companies have a variety of strengths and weaknesses, and EA must be able to compete effectively on a number of fronts, including game development, marketing, and distribution.

Activision Blizzard is a major video game publisher and developer based in Santa Monica, California. The company is best known for its Call of Duty franchise, one of the best-selling video game franchises of all time. Activision Blizzard also owns a number of other popular video game franchises, including World of Warcraft, Overwatch, and Diablo.

Take-Two Interactive is a video game publisher and developer based in New York City. The company is best known for its Grand Theft Auto franchise, one of the best-selling video game franchises of all time. Take-Two Interactive also owns a number of other popular video game franchises, including Red Dead Redemption, NBA 2K, and Borderlands.

EA has a number of competitive advantages over these competitors. The company has a strong portfolio of intellectual property, including popular franchises such as FIFA, Madden NFL, and The Sims. EA also has a strong track record of developing and publishing successful video games. In addition, EA has a larger global distribution network that allows it to reach a broad audience of gamers.

Other Risks

In addition to competitive risks, EA faces a number of other risks, including rising costs, competition for entertainment, and economic downturns that reduce spending.

Rising costs: The cost of developing and publishing video games has increased in recent years. This is due to a number of factors, including the increasing complexity of video games and the rising cost of marketing. EA must be able to manage its costs effectively in order to remain profitable.

Competition for entertainment: The video game industry faces increasing competition from other forms of entertainment, such as streaming services and social media. EA must be able to create innovative and engaging video games that attract and retain players.

Economic downturns reduce spending: Economic downturns can lead to reduced spending on discretionary items, such as video games. EA must be able to weather economic downturns by having a strong portfolio of games that appeal to a wide range of gamers.

B. Growth and Expansion Opportunities

EA has many opportunities for growth. One significant advantage is its partnerships with major sports leagues and film/media franchises such as the NFL, FIFA and Star Wars. These partnerships give EA a competitive advantage in the marketplace, allowing it to leverage the popularity and recognition of these brands to attract a larger customer base.

In addition, EA has a strong portfolio of intellectual property, including highly successful franchises such as Madden NFL, FIFA and The Sims. By continuing to develop new games within these franchises and potentially acquiring other established franchises, EA can expand its intellectual property portfolio and appeal to a broader range of consumer interests.

In addition, EA has experienced positive momentum with its live services, which provide ongoing content and updates to its games. This approach not only increases player engagement and retention, but also provides opportunities for additional monetization through in-game purchases and subscriptions.

Exploring new geographies and platforms is another avenue for growth. By entering untapped markets and partnering in regions where its presence is currently limited, EA can reach new audiences and increase its market share. In addition, investments in emerging technologies such as cloud gaming and virtual reality can provide new opportunities for growth and innovation.

Future Outlook and Expansion

The outlook for EA is positive. The company is well-positioned to capitalize on the growth of the video game industry. EA's strength lies in its broad range of mind-blowing properties, coupled with its impressive history of publishing record-breaking video games while maintaining a colossal worldwide distribution network that makes it virtually unbeatable in the industry. If you invest in EA now and hold on for the long term, the profit potential is high.

VI. Unlocking Investment Potential: Exploring Opportunities to Invest in EA Stock

A. Three ways to invest in EA Stock

There are three ways to invest in EA stock:

Hold the share

This is considered the most traditional approach to investing in stocks, and a long-term investment in a share of EA stock is possible if you buy it.

Option

An option allows you to buy or sell EA stock on or before the contract's expiration date at a set price without any obligation. Although it may be a more complicated way to invest in stocks than traditional methods, options trading offers immense profit potential when executed with expertise.

CFD

Using a CFD (Contract for Difference) and working with a broker that deals in these contracts allows one to speculate on the price of EA stock without having to purchase any shares.

B. Why trade EA Stock CFD with VSTAR

There are a number of reasons to trade EA Stock CFDs with VSTAR:

- Low spreads: VSTAR offers some of the lowest spreads in the industry. This means that you can trade EA Stock CFD at a very competitive price.

- Leverage: VSTAR offers up to 1:200 leverage on EA Stock CFDs. This means that you can control a larger position with a smaller amount of capital.

- 24/7 trading: VSTAR offers 24/7 trading with EA Stock CFD. This means that you can trade EA Stock CFD whenever the market is open.

- Regulated broker: VSTAR is a regulated broker, authorized and regulated by the Financial Services Commission, Mauritius and the Cyprus Securities Exchange Commission (CySEC).

C. How to trade EA Stock CFD with VSTAR - Quick Guide

To trade EA Stock CFDs with VSTAR, you need to open an account with VSTAR and deposit funds into your account. Once you have deposited funds, you can then open a trade on the EA Stock CFD.

To open a trade, you need to select the number of shares you want to trade and the direction you think the price of EA stock will go. You can also set a stop loss and take profit order.

Once you have opened a trade, you can monitor your position on the VSTAR trading platform. You can close your trade at any time by clicking on the "Close" button.

When you close your trade, you will either make a profit or a loss. If you make a profit, the profit will be credited to your VSTAR account. If you make a loss, the loss will be deducted from your VSTAR account.

VII. Conclusion

EA is a well-established video game company with a strong track record. The company has a number of competitive advantages, including a strong intellectual property portfolio, a strong track record of developing and publishing successful video games, and a large global distribution network. EA also has a number of growth opportunities, including expanding its intellectual property portfolio, expanding its distribution network, and investing in new technologies.

Overall, the outlook for EA is positive. The company is well-positioned to benefit from the growth of the video game industry. However, there are some risks that could affect EA stock in the short term, such as competition, regulation, and economic conditions.

If you are considering investing in EA stock, it is important that you do your own research and understand the risks involved. You should also consider your investment objectives and risk tolerance before making an investment decision.