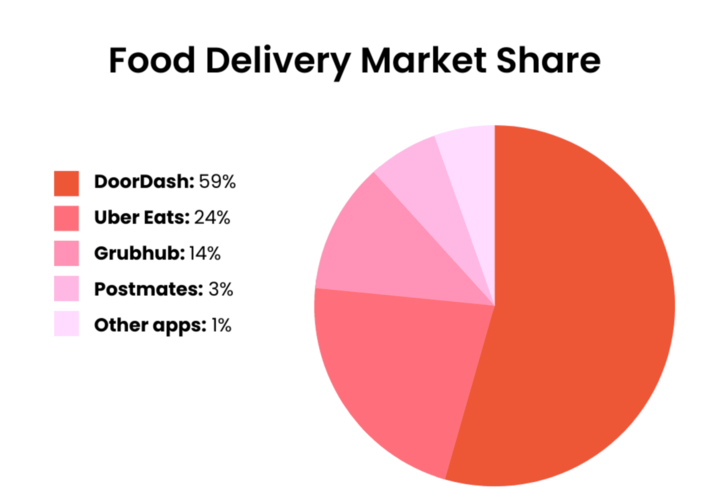

DoorDash might just be the most popular food delivery service in the United States and has succeeded in competing with bigger companies like Uber Eats and Postmates. It is partnering with major food companies like Wendy’s and Jason Biggs ice cream and gradually building a food empire by opening its restaurant and providing services for grocers. Its current partnerships and expansion in the food business are why DoorDash could be bigger than Uber Eats in 3 years.

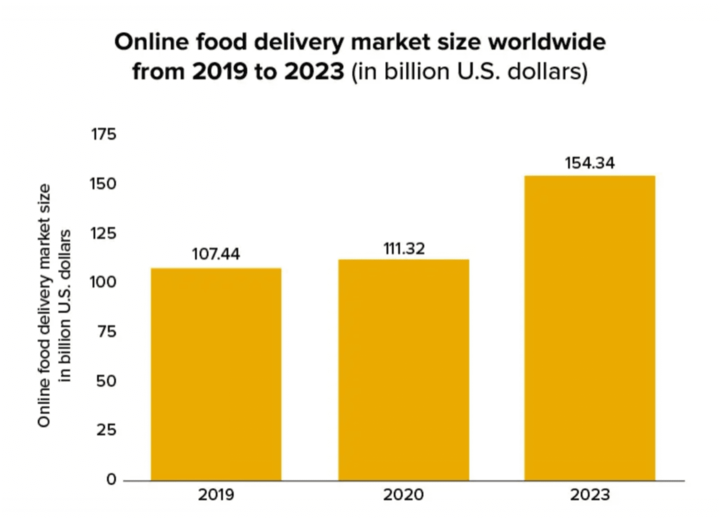

The on-demand food delivery market is expected to rise to $365 billion by 2023 and with its current expansion plans, DoorDash could most likely continue to grow its current 35% market share making it an attractive investment opportunity.

How DoorDash Started

DoorDash goes all the way back to 2013 when 4 Stanford students Tony Xu, Evan Moore, Andy Fang, and Stanley Tang created a platform called PaloAltoDelivery.com. When they tested out their business model, the platform was rebranded to DoorDash. In just two years, the company had rapidly expanded to 18 cities with a valuation of over $600 million. The food delivery company is currently present in over 4,000 cities in countries like the United States, Australia, Canada, Germany, and Japan.

Tony Xu still holds the position of CEO and the company went public with its IPO at the end of 2020.

Source: Reuters

Business Model and Products

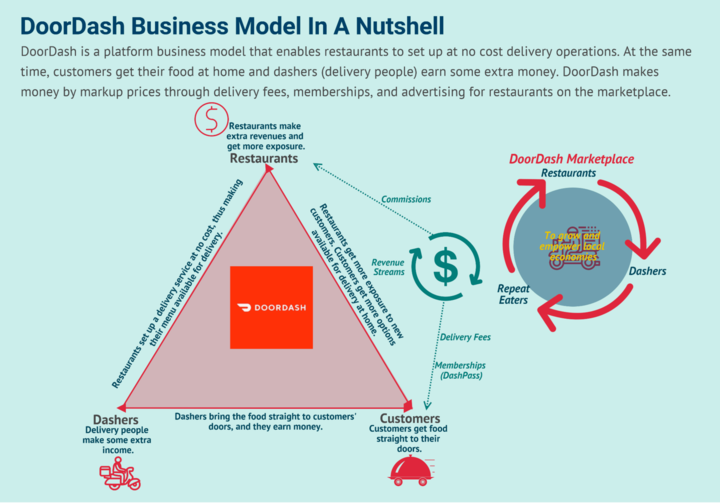

DoorDash business model is quite similar to that of Uber. It partners with grocers, and restaurants to deliver food and groceries at a fast and affordable rate. Customers can easily place their orders using the website or apps for both iOS and Android and an available Dasher within the area will bring your order to your location. Dashers are allowed to use any mode of transport like cars, bikes, bicycles, and more.

5 main sources account for how DoorDash generates revenue and profits:

Fees: DoorDash collects service fees, delivery fees, and small order fees which may vary depending on location and demand.

Commissions: Every time a transaction is completed on its platform, it takes a certain percentage of the order as a commission.

Subscription: For $9.99 a month, DashPass subscribers can enjoy unlimited deliveries on any order over $15.

Ads: Restaurants have to pay DoorDash to run ads on their platforms

SaaS: For a monthly fee, restaurants can get their own personalized ordering and delivery system.

Source: FourWeekMBA

Products/Services

The company offers delivery services for restaurants and retail stores along with marketing tools. To increase brand awareness, it also offers advertising opportunities to its partners.

How is DoorDash doing financially?

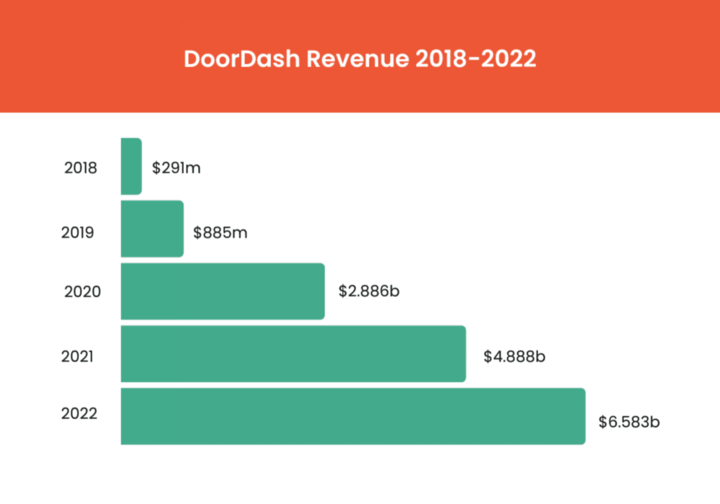

It's important to note that DoorDash is not a profitable company. The company’s revenue did grow by over 5x between 2019 and 2021 but what keeps the company in the red is its massive losses. It increased again in 2022 to $1.3 billion compared to $468 million in net losses from 2021. DoorDash also has a $171 million operating loss in Q1 2023. However, other key performance metrics are strong.

Gross order volume has increased by 29% to $15.9 billion while total orders grew 27% year over year amounting to 512 total orders. This resulted in overall revenue growth of 40% year-over-year to $2 billion despite experts believing that the platform would go down as the lockdowns ended.

The rising revenue also shows that DoorDash is growing faster than your average company. The management sees the company as more of a tech-based company than a food one and since it is trading at 3.6x its trailing revenue, this means that it is trading higher than the higher stock on the S&P 500. In addition, its balance sheet also looks reasonably healthy with total assets at around $9.79 billion and liabilities of $6.77 billion at the end of 2022.

Source: The Rideshare Guy

Key ratios and metrics

Although it is still reeling from its losses, DoorDash's Y/Y revenue growth of 39.77% places it above Uber and GrubHub both with Y/Y revenue growth of 28.73% and 5% respectively. However, the P/E ratio of DoorDash, Uber, and GrubHub are in the negative, standing at -20.8x, -25.6x, and -28.3x meaning that it is reasonably valued at their current stock price.

DoorDash Stock Performance

A. Trading Information

Primary Exchange & Ticker: NYSE: DASH

Country & Currency: USA (USA)

DoorDash IPO: $102 on December 2020

Trading Hours: Investors can trade in the Pre-Market (4:00 - 9:30 am ET) and the After Hours Market (4:00 - 8:00 pm ET)

Stock Splits: N/A

Dividends: N/A

B. DoorDash Stock Performance

2022 was not a great year for DoorDash stock as it declined by over 45% and continued to take a beating up until the beginning of the year when things started to pick up after the stock price had fallen to $48. Now at $80.06, DoorDash stock is up 50.66% in the last 6 months. However, given that the market gained 1.0% in the last year, DoorDash investors have lost 12% since the stock is underperforming the market. It is also 57.8% down from its all-time high. Some analysts speculate that the current uptick in stock price could be because the selling was too aggressive, predicting that there is most likely to be a rebound later this year.

It also doesn't help that multiple insiders have been selling shares worth millions well below the current price.

Key Drivers of DoorDash Stock Price

Q1 2023 Earnings Report

DoorDash Q1 2023 earnings report showed an improvement from 2022. The company delivered a 40% revenue increase and even though there were still losses, its net loss of $162 million was a significant decrease from the loss of $642 million in the last quarter.

Growth in the US on-demand grocery delivery business

The food delivery business is highly competitive but the pandemic provided the perfect opportunity for DoorDash to expand and partner with big brands like Starbucks and Walmart. It has one of the best food delivery apps and continues to innovate its platform. It also opened its restaurants and works with the White House in the United States to reduce hunger.

Plans for international expansion

Through the acquisition of Wolt in 2022, DoorDash officially entered into the Asian and European markets and is expected to continue growing this year.

Future Prospects of DoorDash Stock

First of all, what type of stock is DoorDash- growth or speculative? Even though it currently has a low stock price and looks like a screaming sell on the face of it, the company has the same potential as Uber making it a growth stock. DoorDash has also risen 6.99% within 12 months but the business is yet to be profitable. For now, DoorDash only enjoys a competitive advantage against Uber in the US market.

Source: The Rideshare Guy

While the stock has the potential to trend higher in the future, analyst consensus puts it as a long-term hold with an average 12-month price forecast of $75 and a high estimate of $105.

But will DoorDash stock price double in the next year? That is quite uncertain. Q1 2023 was a major improvement from the same quarter last year but for the near term, DoorDash has to find ways to cut down its losses and expand more in the international market.

Challenges and Opportunities

Competitive Risks

Main Competitors: There are other strong players like Uber Eats, Amazon, and Grubhub offering competitive prices to DoorDash.

Issues with DoorDash Drivers: DoorDash has had issues with its drivers multiple times with Dashers even going on a strike back in 2021. If the company is forced to turn its drivers to full-time employees that might become a big issue in terms of cost.

Billion-dollar lawsuits: DoorDash has been involved in a series of lawsuits over the years including the present $1 billion amid accusations that customers with iPhones were charged more than those with Android.

Growth Opportunities

Expansion in markets: The company has the potential to grow beyond the current food delivery market and enter into other logistics segments.

Acquisitions: DoorDash can keep reducing its competition by acquiring smaller competitors and leveraging its infrastructure. For instance, their acquisition of Wolt, a Finnish food delivery platform helped DoorDash to expand its reach in that region.

Source: Forbes

Global growth: For now, DoorDash majorly operates in 4 countries meaning that there are still a lot of unexplored locations with potential customers that it can tap into.

Future Outlook and Expansion

DoorDash might not have the reach of Uber Eats yet, but its expansion plans are promising. They intend to continue expanding in Europe under the name Wolt to avoid making changes that will confuse customers and annoy drivers and restaurants. Also, in order to deliver orders to customers quicker, they are collaborating with General Motors to test out driverless vehicles that are capable of making deliveries.

Source: Appinventiv

However, the risks DoorDash faces expanding into new categories are considerable because international expansion always comes with considerable difficulty. The company still needs to learn a lot to thrive internationally, especially in markets where there is a strong degree of unionization. In addition, they’ll need to establish a high level of brand awareness beyond the US and North America in general to succeed.

Trading Strategies and Guide for DoorDash Stock

The easiest way to trade DoorDash stock is to use its support and resistance levels. These levels are divided into major and minor depending on how easy they are to break. When the price drops below the minor support level, it means that the current downtrend is still intact and vice versa. On the other hand, major support and resistance levels are difficult to break through and typically indicate how strong the reversal is.

To trade DASH stock using this method, you can buy when the price is close to the support level in an uptrend and sell when it is near the resistance level in a downtrend. For instance, at DASH stock current price level, the key resistance and support levels are $77.73 and $71.75. The first thing you want to consider is what the price is doing at that level. Is it going to break it or going to reverse?

If the support or resistance lines are tested multiple times, it means that it is getting weaker and price is likely to breakout soon. Since there is no assurance that either the support or resistance level would hold, it is advisable to wait for some confirmation before making any decision. One confirmation is the moving average on the chart. Overtime, the MA has been consistently moving below the candlesticks which is a likely indication that the trend is going to continue. If there is a moving average cross over and the it is above the candlesticks, then a reversal is about to take place.

Place a buy order once the price breaks through the resistance level or bounces off the support level and your stop loss at at least 10 - 15% of your buy order. To spot a potential reversal, look out for candlestick patterns such as the bullish or bearish engulfing candlestick patterns and evening star patterns that provides useful information on what the market is doing.

The support and resistance trading strategy can also be used to profit from DASH Stock CFD because you can easily identify potential trend reversals or massive price changes and make a profit based on the difference.

Trade DoorDash Stock CFD at VSTAR

Trade DoorDash Stock CFD at VSTAR commission-free and benefit from competitive transaction costs.

VSTAR is designed to support fast order execution while providing traders the opportunity to trade any day, any time with up to 1:200 leverage available.

If you are still trying to find your foot in CFD trading, VSTAR offers a real-time demo account and practice with up to $100,000 before moving on to the real market.

Conclusion

DoorDash stock still has a lot of room for growth, especially with the current plans for more expansion in Europe and Asia. The company is also making active plans to cut down its costs and reduce losses and its partnership with major players in the food industry, makes investors more positive about the future growth of the company.

The best thing is to hold DoorDash stock long-term but you can also choose to trade the stock short-term to gather quick profits.