- CVS Health's Q3 2023 adjusted EPS and adjusted operating income demonstrate not only profitability but also its resilience and adaptability in a dynamic healthcare environment.

- The company's diversified model, with robust performance in segments like Health Services and Health Care Benefits, ensures stability and minimizes risks in a rapidly changing market.

- CVS Health's strategy to achieve high Star ratings in Medicare Advantage plans enhances its revenue potential, attracting and retaining beneficiaries with larger government reimbursements.

- By entering the biosimilars market, CVS Health is well-prepared to tap into a projected $100 billion opportunity by 2029, aligning with its goal of becoming a leading healthcare solutions provider and diversifying its revenue streams.

As the healthcare industry evolves, CVS Health (NYSE: CVS) emerges as a prominent player with impressive growth potential. In Q3 2023, CVS Health's financial performance stood out, showcasing its profitability and operational efficiency. The company's diversified business model, including Pharmacy & Consumer Wellness, Health Services, and Health Care Benefits, minimizes risks and offers stability. With a focus on Medicare Advantage and biosimilars, CVS Health is well-positioned to capture the booming healthcare market. Here is a more detailed analysis of CVS Health's specific fundamental strengths as of Q3 2023 that support the company's rapid growth potential.

Strong Financial Performance

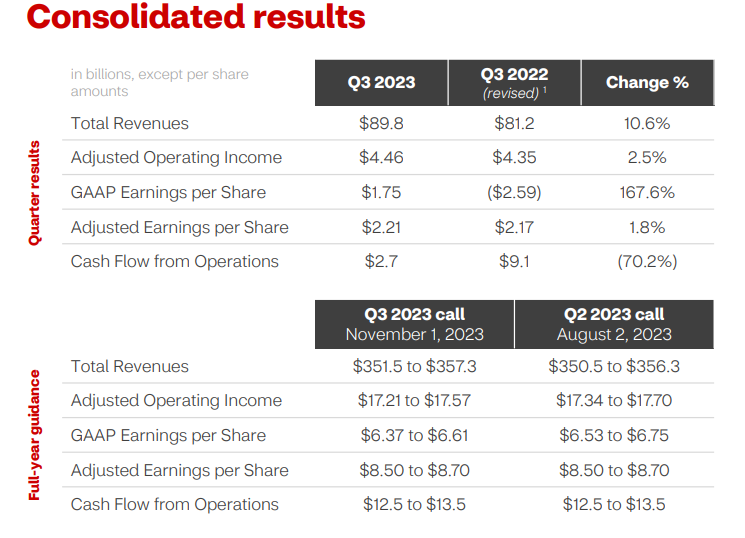

CVS Health's financial performance is a standout feature that underscores its growth potential. In the third quarter, the company reported robust financial figures. Key financial metrics include an adjusted EPS of $2.21 and adjusted operating income of nearly $4.5 billion. This is a clear indication of the company's profitability and operational efficiency.

These figures are reflective of CVS Health's strong financial foundation, which is essential for fueling its growth initiatives. A company with a solid financial base can invest in research and development, expand its services, make strategic acquisitions, and withstand economic downturns.

The fact that CVS Health was able to maintain and even improve its financial performance is a testament to its resilience and adaptability in a rapidly evolving healthcare landscape.

Impressive Revenue Growth

CVS Health's consolidated revenues for the quarter reached almost $90 billion, marking an impressive year-over-year increase of nearly 11%. Such substantial revenue growth is a compelling indicator of the company's expanding market presence and ability to capture a larger share of the healthcare industry.

This remarkable revenue growth is driven by CVS Health's multifaceted approach to healthcare services. The company operates across various segments, including Pharmacy & Consumer Wellness, Health Services, and Health Care Benefits. Each of these segments contributes to CVS Health's overall revenue, offering diversification and stability.

Rapid revenue growth is a key factor in determining a company's growth potential. It not only indicates increased market demand for its services but also suggests successful strategic moves to capture that demand. In the case of CVS Health, its diversified business model allows it to tap into multiple revenue streams, further enhancing its growth prospects.

Source: Earnings Presentation

Exceptional Operating Cash Flows

CVS Health's ability to generate outstanding operating cash flows is a pivotal factor in supporting its growth potential. The year-to-date total operating cash flow reached $16.1 billion. Operating cash flow represents the cash generated from the company's core operations, providing essential liquidity for reinvestment and expansion.

High operating cash flows indicate that CVS Health is effectively managing its financial resources and converting its operational activities into cash. This is crucial for funding growth initiatives, such as acquisitions, research and development, and expanding its service offerings.

In addition to the robust cash flow, CVS Health's commitment to retaining its investment-grade ratings ensures access to capital markets at favorable terms. This further strengthens the company's financial position, enabling it to pursue growth opportunities and withstand economic challenges.

Diversified Business Model

CVS Health's diversified business model is a central pillar of its growth strategy. The company operates across various segments, including Pharmacy & Consumer Wellness, Health Services, and Health Care Benefits. This diversification minimizes risks associated with relying on a single market or service, and it enhances the company's ability to adapt to changing market conditions.

The Pharmacy & Consumer Wellness segment focuses on retail pharmacy operations, serving consumers' prescription and wellness needs. The Health Services segment provides pharmacy services and health management solutions, while the Health Care Benefits segment offers a range of health insurance products.

The strength of CVS Health's diversified model is evident in the individual performance of these segments. For instance, the Health Services segment saw revenues grow to nearly $47 billion, reflecting an increase of more than 8%. Similarly, the Health Care Benefits segment experienced significant revenue growth, surpassing $26 billion with an increase of nearly 17%. The Pharmacy & Consumer Wellness segment generated revenue of nearly $29 billion, marking a 6% increase.

The diversification of these segments, each contributing to the overall success of CVS Health, ensures a broader revenue base and minimizes the company's exposure to economic fluctuations or changes in consumer preferences.

Medicare Advantage Star Ratings

CVS Health's success in restoring its Medicare Advantage Star ratings is a critical element in its growth strategy. Medicare Advantage is a key growth area for the company, and high Star ratings are crucial for attracting and retaining Medicare beneficiaries. CVS Health is projected to have 87% of its Medicare Advantage members and plans rated 4 stars or better by 2024.

These Star ratings are significant because they are directly tied to Medicare Advantage plan payments. Plans with higher ratings receive larger government reimbursements. Therefore, achieving high Star ratings not only reflects the quality of care provided by CVS Health but also directly impacts its revenue in this segment.

The ability to restore and maintain high Star ratings demonstrates CVS Health's commitment to delivering high-quality healthcare services, which, in turn, strengthens its position in the Medicare Advantage market. This will drive member acquisition and retention, ultimately contributing to the company's growth potential in this key sector.

Medicare Advantage Growth

Medicare Advantage represents a strategic growth area for CVS Health. CVS Health is confident in its competitive offerings and attractive benefit designs in the Medicare Advantage market. This confidence is substantiated by the fact that approximately 84% of Medicare eligibles will have access to Aetna plans in this category in 2024.

The Medicare Advantage market is expanding rapidly, driven by an aging population and the desire for more comprehensive healthcare coverage. CVS Health's strong presence in this market, coupled with its attractive offerings, positions it well to capture a larger share of this growing market.

As the company expands its reach in the Medicare Advantage segment, it will have the opportunity to increase its customer base and revenue, further fueling its overall growth potential.

D-SNP Expansion

CVS Health's expansion of its Dual Eligible Special Needs Plans (D-SNP) footprint is another indicator of its growth potential. These plans are designed to provide coordinated medical management for individuals eligible for both Medicare and Medicaid, offering a comprehensive healthcare solution.

CVS Health now covers more than two-thirds of Medicare eligibles, marking a 6% increase from the previous year. This expansion allows CVS Health to introduce these individuals to care delivery options, such as Oak Street Health, where appropriate.

The ability to offer access to convenient sites of care and integrated benefits that seniors value most positions CVS Health to grow at or above the market in 2024. This strategic growth aligns with the increasing need for coordinated care for dual-eligible individuals, and CVS Health is well-poised to capture this market share.

Innovation and Biosimilars

CVS Health's foray into biosimilars, as exemplified by the creation of Cordavis, demonstrates its commitment to innovation and its recognition of significant growth opportunities in the biosimilar market.

The U.S. biosimilar market is expected to be a $100 billion opportunity by 2029. CVS Health, through Cordavis, is working directly with manufacturers to bring a portfolio of biosimilar products to the market. This initiative not only drives growth but also ensures significant cost savings for consumers and the U.S. healthcare system.

Biosimilars offer a more affordable alternative to biologic drugs, and as the market for these products expands, CVS Health is well-positioned to capture a share of the savings potential. This strategic move aligns with the company's goal of becoming a leading healthcare solutions provider and diversifies its revenue streams.

CVS Stock Technical Take: Ideal Position For New Bulls

Source: tradingview.com

CVS stock price is currently positioned at a critical long-term pivot level of $66.8, indicating a change in polarity. It's finding support around the mid-term support level of $65.15. A notable development at this support is the formation of a triple bottom pattern, suggesting the potential for a significant bullish trend in the coming weeks.

As the price potentially moves upward, it may encounter a short-term pivot at $85.85, which could act as a resistance point. Subsequently, there's a likelihood of the price revisiting this pivot as a support before progressing towards the mid-term target of $106.5, which serves as a robust resistance level.

It's worth noting that along this upward trajectory, the stock faces a dynamic resistance represented by the 200-week EMA (Exponential Moving Average). Failure to secure a proper close above the EMA might trigger a return to the downtrend, with a possible target at the long-term support of $39.75 in the months ahead.

Moreover, the Relative Strength Index (RSI) has already indicated a bullish divergence in May 2023, suggesting a prevailing bullish sentiment in the stock. This divergence makes a continued downtrend less probable.

In conclusion, CVS Health's comprehensive analysis reveals a company well-prepared for future growth. Its strong financial performance, impressive revenue growth, exceptional operating cash flows, and diversified business model set the stage for expansion. With a focus on Medicare Advantage and biosimilars, CVS Health is poised to capture significant market share and provide innovative, cost-effective healthcare solutions. While its stock position shows signs of bullish potential, the company's strategic initiatives position it for a bright future in the evolving healthcare industry.