- Global cotton production may rise by 3.7 million bales in 2024/25, with the U.S. leading the increase.

- US cotton outlook anticipates 7.5% increase in planted area, yielding 16.0 million bales.

- Global cotton consumption may reach 116.0 million bales, driven by economic factors and depleted inventories.

- World cotton trade is expected to rise by nearly 6%, with higher imports in China and increased exports from major producing countries.

As the world gears up for another year in the cotton industry, anticipation brews amidst forecasts of production shifts, consumption trends, and trade dynamics. The cotton market, a cornerstone of the global textile industry, is set for a whirlwind of activity in the upcoming 2024/25 season. With major producing countries like the U.S., China, India, and Brazil at the forefront, stakeholders are poised to navigate a landscape of opportunities and challenges.

The article delves into the USDA data surrounding world cotton production, consumption patterns, and trade dynamics. From the projected rebound in global cotton production, driven predominantly by the resurgence of the U.S., to the nuanced implications of rising global consumption and evolving trade dynamics, multiple aspects are scrutinized for its potential impact on cotton prices and market stability.

World Cotton Production, 2024/25

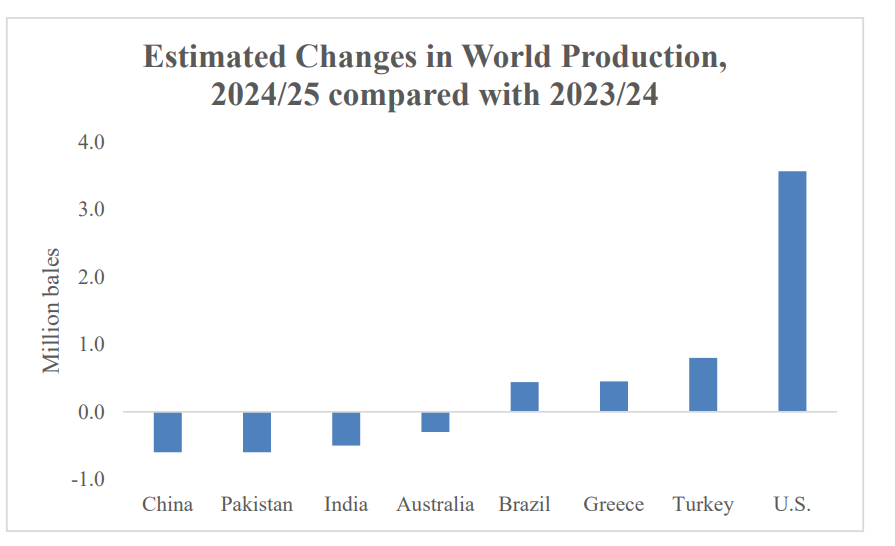

Global cotton production is anticipated to increase by 3.7 million bales in the 2024/25 season, reaching a total of 116.5 million bales, representing a growth rate of over 3 percent. The primary driver of this increase is a significant rise in U.S. cotton production, accounting for most of the global increment. However, this rise is offset by decreases in production from major cotton-producing countries such as China, India, Pakistan, and Australia. Turkey, Greece, and Brazil are expected to witness increases in output.

In China, despite maintaining its position as the world's largest cotton producer, a slight decline in production by 600,000 bales is forecasted. This reduction is attributed to potential decreases in cotton area due to lower relative prices and projections of decreased yields. Conversely, Turkey and Greece are expected to see notable production increases, with Turkey's output projected to rise by 800,000 bales due to an expansion in cotton area and improved yields. Brazil's production is also forecasted to increase by 400,000 bales, continuing its trend of growth over the past decade.

Source:usda.gov

World Cotton Consumption, 2024/25

Global cotton consumption is expected to rise to its highest level in three years, reaching 116.0 million bales, implying a growth rate of 3.1 percent. This increase is driven by more favorable economic conditions, including lower U.S. interest rates, a decreased value of the U.S. dollar, and lower global inflation. These factors are expected to reduce financing costs and ease importers' pressures in executing Letters of Credit.

Another pivotal factor favoring increased consumption is the expectation of severely depleted pipeline inventories by August 2024 relative to the previous year. Clothing retailers had significantly reduced product orders in 2023, leading to pressure on consumption. However, with robust levels of consumer discretionary income, low unemployment, and higher wage growth in the U.S., consumer demand has remained resilient.

U.S. Cotton Outlook, 2024/25

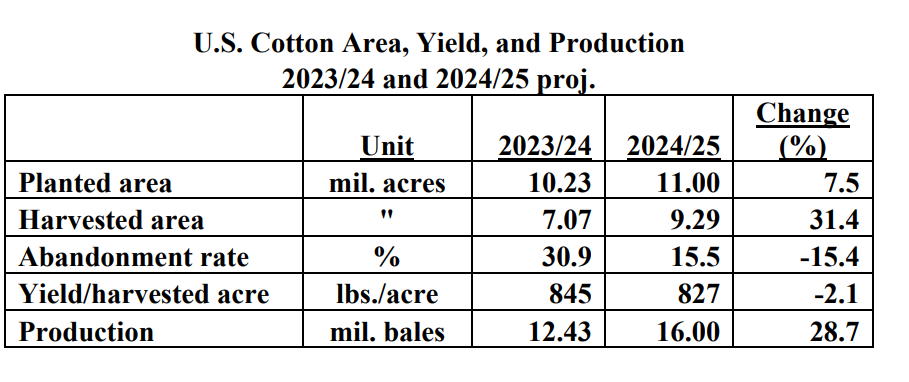

The U.S. cotton outlook for the 2024/25 season reflects a significant increase in planted area by 7.5 percent compared to the previous year. This rise is influenced by relative crop prices, where cotton appears more competitive against alternative crops such as corn and soybeans. Despite a slight reduction in yield, the increased planted area is expected to lead to a substantial increase in U.S. cotton production, reaching 16.0 million bales.

The higher production is anticipated to support a 12 percent increase in U.S. cotton exports, driven by expectations of increased global cotton mill use and a larger domestic crop. However, U.S. cotton mill use is projected to remain unchanged, facing competition from foreign manufacturing of both cotton and synthetic fibers. Consequently, U.S. cotton ending stocks are forecasted to increase by 25 percent compared to the previous year.

Source:usda.gov

World Trade and Stocks

World cotton trade is projected to rise by nearly 6 percent to 45.3 million bales in 2024/25. This increase is supported by higher imports in China and rising consumption in other importing countries, with major producing countries like the U.S. and Brazil expected to meet the increased import demand. However, concerns such as fluctuating global interest rates, geopolitical conflicts, and economic uncertainties could potentially hinder consumption growth.

World ending stocks of cotton are expected to continue rising in absolute terms but decline slightly as a share of global consumption. At 84.6 million bales, stocks are forecasted to be up by 900,000 bales compared to the previous year, but down 1.5 percentage points as a share of consumption. Tighter stocks relative to consumption are expected to drive up prices in the U.S. and globally, with the A Index forecasted to increase by about 3 cents to 97.5 cents per pound.

Implications on Price of Cotton

Increased Global Production:

The significant rebound in global cotton production, particularly driven by the U.S., could exert downward pressure on cotton prices. The higher supply levels resulting from increased production may outweigh the positive effects of decreased production in other major producing countries.

However, the declines in production in countries like China, India, Pakistan, and Australia may help mitigate some of the downward pressure on prices. These reductions in production could contribute to balancing global supply and demand dynamics, potentially supporting prices.

Rising Global Consumption:

The anticipated increase in global cotton consumption is a positive sign for prices, as higher demand could counterbalance the effects of increased production. Factors such as improved economic conditions and expectations of depleted inventories may drive up consumption, contributing to price support.

Additionally, the resilience of consumer demand, particularly in major importing countries like the U.S., could further bolster cotton prices. Strong consumer discretionary income, low unemployment, and higher wage growth in these countries provide a favorable environment for sustained demand for cotton products.

Trade Dynamics:

Higher world cotton trade, driven by increased imports in China and rising consumption elsewhere, could enhance demand and provide support for prices. The projection of increased global cotton exports, particularly from major producing countries like the U.S. and Brazil, suggests a positive outlook for trade dynamics.

However, competition from other cotton-producing countries and concerns regarding geopolitical tensions introduce uncertainties in trade dynamics. These factors could impact the volume and direction of cotton trade, influencing price movements in the market.

U.S. Cotton Outlook:

The significant increase in U.S. cotton production and exports could have mixed implications for prices. While higher production may contribute to downward pressure on prices due to increased supply, the rise in exports could partially offset this impact by supporting demand in global markets.

Additionally, the projected increase in U.S. ending stocks may exert downward pressure on domestic prices. However, a larger U.S. crop size and higher exports could help alleviate some of this pressure by balancing supply and demand dynamics in the domestic market.

Cotton Price Forecast [March 2024]: Cotton CFD/No.2 Futures (ICEUS)

The price of Cotton futures may hit $88.78 by the end of the month based on the current momentum of lower highs. On the upside, the price can hit a maximum of $99.97, which is less likely. These levels are derived from the Fibonacci retracement of the current swing.

At the current level, the prices are near dynamic support (the purple trend line), which may force the prices to go sideways in the coming days. But downside price movement holds higher possibilities. Looking at the Relative Strength Index, or RSI (at 46), there is more room for further downward price movement. Critical levels to note are $97.28 (pivot) and $94.59 (lower bond of recent price consolidation).

As of now, $88.78 and $99.97 can be considered as ideal price levels to establish long- and short-positions under the Dollar-Cost Averaging.

Source: tradingview.com

In conclusion, the cotton market in the 2024–25 season presents a complex interplay of factors influencing price direction. While increased global production, led by the U.S., may exert downward pressure on prices, reduced production in other major producing countries could offer some support. Rising global consumption and trade dynamics, especially higher imports in China and increased exports from major producers like the U.S., may counterbalance the effects of increased supply. However, technical analysis suggests a bearish outlook (March 2024) for cotton futures, with potential downside movement indicated by lower highs and price crossings of the trendline. Critical monthly price levels to monitor include $97.28 and $94.59, with downside and upside targets of $88.78 and $99.97.