Consumer staples are the fundamental products that people purchase to use in their daily lives. Actually, the Consumer staples sector is the market area where we can find continuity and stability. But 2023 was not a good year for consumer staples. Compared to the previous year, this sector was lagging behind the market. Will consumer staple stocks play well in 2024? What are the best consumer staples stocks, you may wonder?

The S&P 500 closed 2023 with around 26% total gain, which is moderate since the 2008 financial crisis. Due to this crisis, high inflation, a rising interest rate, circumstances, and uncertainty over the potential for a significant recession in the US economy. That's why many investors are looking for safety.

Want to know the best part? Based on this, here we have furnished four consumer staples stocks. All offer something different and pay dividends above the possible share appreciation. Use this guide to help optimize your consumer staples holdings for years.

What Are Consumer Staples?

Consumer staples are a set of necessary products used by consumers. The category includes household products, food and beverages, hygienic things, etc. Since these goods are essential for people, they can't avoid purchasing them when they suffer financial problems.

Consider the consumer staples as non-cyclical, which means these products are always in demand. No matter how well or performing - the economy is. Also, the consumer staples sector is a refuge for investors during the recession.

Generally, comprising about 70% of a country's Gross National Product (GNP), consumer spending dramatically impacts the economy. Consumer spending is responsible for economic decline and growth, which occurs cyclically. Cyclical means the ebb and flow or periods when customers have more traditional spending habits.

Nonetheless, spending on products sold by the consumer staples sector is much less cyclical because of low price demand elasticity. Price elasticity describes the change in consumer quantity demanded as price changes. Demand for consumer staples products is reasonably steady regardless of the economy's condition or the product's price.

Consumer Staples Sector Financial Performance

Since 1962, this sector has outperformed every but one sector. For the ten years ending April 26, 2021, this sector returned 8.20% annually, according to S&P Dow Jones Indices. Compare that to an 11.86% return for the S&P 500 within the same time. But the two usually run parallel to each other.

Specifically, the consumer staples sector has outperformed the S&P 500 during the past three recessionary periods. Because of their low volatility, consumer staples stocks play an important role in defensive strategies.

Sectors of Consumer Staples

Every stock market sector has many industries and sub-sectors. Generally, consumer staples stocks sub-sectors are:

Retail

These companies manage wholesale operations, store chains, and e-commerce sites. This means the place where we can find consumer staples products. While not exclusively focused on consumer staples, companies like Walmart, Costco, and Kroger have significant portions of their sales from these products.

Household Products

Furniture, cleaning, and decor products can be found in this sector. Procter & Gamble, Clorox, Kimberly-Clark, and Colgate-Palmolive are key players here.

Food And Drink

Food and drink consumer defensive stocks include companies that manufacture snacks, cereals, and dry goods. Drinks will consist of alcohol but are most often colas and energy drinks. Examples include Nestle, PepsiCo, Coca-Cola, General Mills, and Kraft Heinz.

Personal Products

We can find cosmetics and personal hygiene products, from perfumes and deodorants to mouthwash, in this sector. Unilever, Estée Lauder, and Johnson & Johnson are notable in this segment.

Tobacco

The controversial member of the consumer defensive stock family is tobacco due to changing public attitudes. But this sub-sector represents big business for cigarettes and related products companies. Examples include Philip Morris International and British American Tobacco.

Investing In Consumer Staples Stocks

People always depend on consumer staples. Regardless of economic condition, you purchase consumer staples, and the amount you purchase is steady through good and bad times. Hence, this sector behaves differently from consumer discretionary businesses like hotels, consumer products, and restaurants.

Notably, consumer staple companies might have lower annual earnings or revenue growth. The reason is that these consumer staples stocks tend to be big and mature companies. Historically, the consumer staples sector relatively suffered a few disruptions. Besides, consumer staples make for modest growth with reliable profits, dividends, low-price volatility, and defensive positions.

Advantages of Investing in Consumer Staples Stocks

Basically, consumer staples stocks are defensive positions. Though they won't provide world-beating returns, they at least won't fail. Most give dividends, which is a cash advance on growth. There are three primary reasons to start consumer staples exposure in your portfolio:

Profitable Performance Under All Market Circumstances

People like to purchase staples at perfect times to make consumer staples stocks better performers. And it's no matter what's happening in the broader economy. Most people know them as a defensive haven during recessions.

Powerful Dividend Income

Accordingly, consumer staple stocks pay solid dividends over the long term. In reality, they represented very well among dividend aristocratic institutions that have enhanced dividends annually for 25 years.

Longevity And Stability

Many of the biggest consumer staples companies have existed for decades; some are over a century. It's because consumer staples always sell in-demand products. They even act to maintain brand value and translate into long-term stock value for investors.

Risks of Investing in Consumer Staple Stocks

Investing in consumer staples stocks has benefits as well as risk factors. Most noteworthy, they are generally stable and low-risk businesses. Over time, consistent revenue and earnings growth depend on the popularity of their brand portfolio and relationships with consumers. To maintain brand popularity and affinity, these staple businesses must be innovative. That's because they need to stay ahead of new competitors and understand consumer preferences.

Let's learn more about the risk of investing in consumer staples stocks below:

Slow-growth & Low-Margin Companies

Adequately, consumer staples profit margins are razor thin, leaving little room for growth for stocks in this sector. During periods when the economy is performing well, these stocks may not perform well than other more dynamic sectors.

Some Brands Are Risky

Part of the consumer defensive stocks sector, specifically retailers, are perfect targets for disruption by new e-commerce competitors. Furthermore, growing online sales erode the strength of popular consumer staple brands.

Top 4 Best Consumer Staples Stocks

From hundreds of consumer staple stocks, it can be challenging to choose the best one. But today, we have furnished the top 4 best consumer staple stocks. Certainly, these four staples remain steadfast in their niches with long-term staying strength. Also, with a history of delivering value to shareholders, they are the best choices for many consumers right now. Here's the kicker:

Walmart Inc (WMT)

- Market Cap: $403.28 Billion

- Last 12 Months (LTM) EPS: $6.05

- Dividend Yield: 1.5%

- Full Year Dividend Raise: 50

- EPS (most recent fiscal year): $5.48

- PEG Ratio (5-year expectation): 3.27

- P/E Ratio: 33.03

- Payout Ratio: 36.97% (based on this year's estimate)

- Net Income: $11.68 Billion

Financial Health and Stability Assessment

Walmart Inc. is based in Bentonville, Arkansas. It manages around 11,400 stores in the name of Walmart International and Sam's Club under 54 banners in 26 countries. This company sells household products, groceries, pharmacy services, sports products, etc, at competitive prices.

First, the market valuation shows a stable position at $450 billion, 1.7% higher than the previous year. Consumer behavior has normalized after the COVID-19 pandemic, and the stability in the market capitalization could extend in 2024 and 2025.

The long-term debt-to-equity ratio shows a debt injection during the pandemic era. Still, the company has enough room to generate finance via debts, keeping equity holders safe.

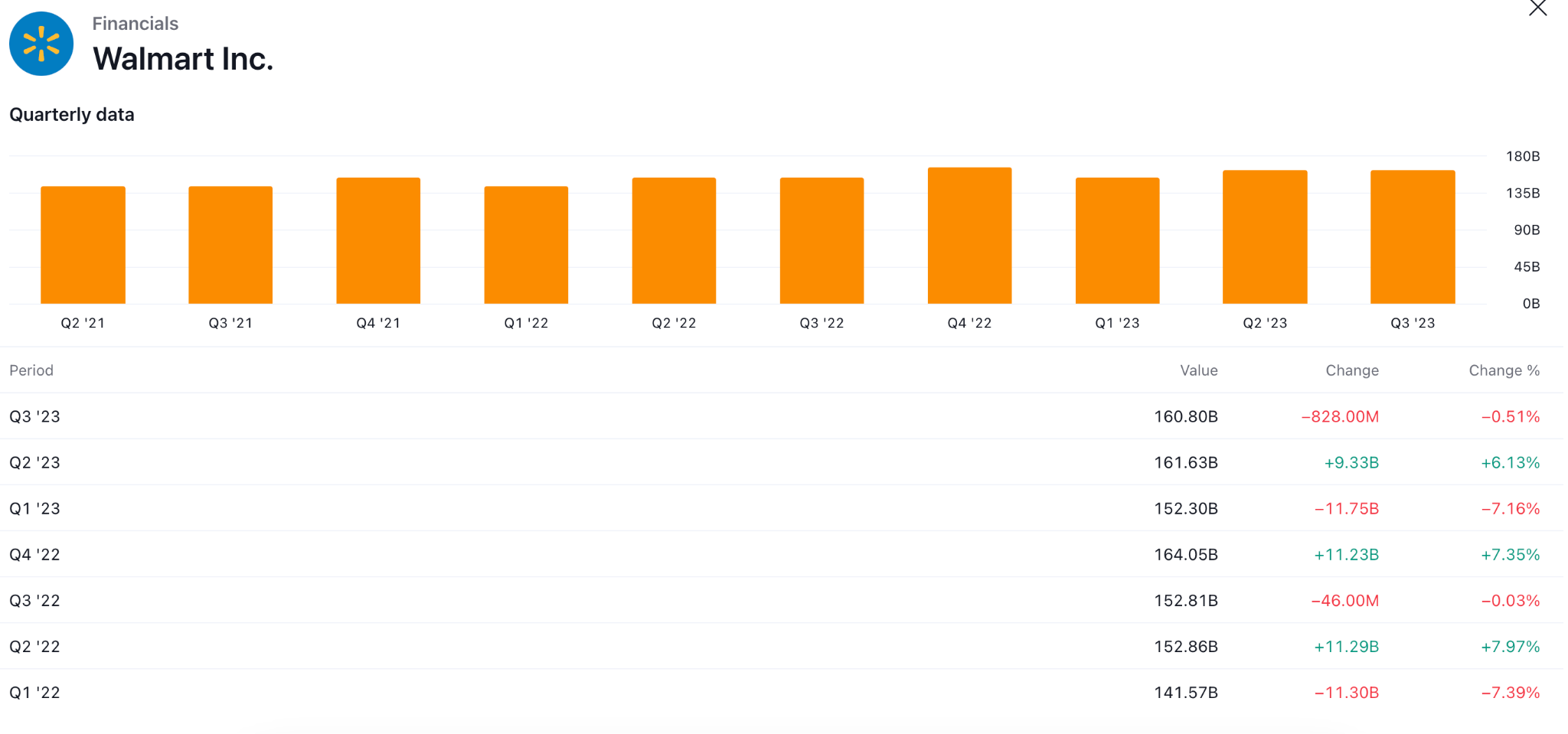

Earnings Report & Growth Potential

After Amazon, Walmarrt.com is the second largest online retailer, both domestically and internationally. In the third quarter of 2023, this company reported revenue growth of 4.3% year-over-year in constant currency. Consistanced EPS also increased by 2%.

Sincere size and global footprint are the main points of this Walmart. Besides this, this company has proven its capability to change consumer preferences. For instance, it includes the Walmart membership program, online and in-store shopping, and ongoing integration.

Most importantly, this company is examining the growth of in-store healthcare services. From CVS, it takes a page and pilots Minute Clinics. Soon, it will test the in-store mammogram screening. All of these innovations will help to strengthen the relationships with its customers. Even so, it will unlock the probable new growth channel. Mainly, Walmart pays a dividend of 1.5% and has repurchased 8.7 million shares (worth $1.3 billion) this year.

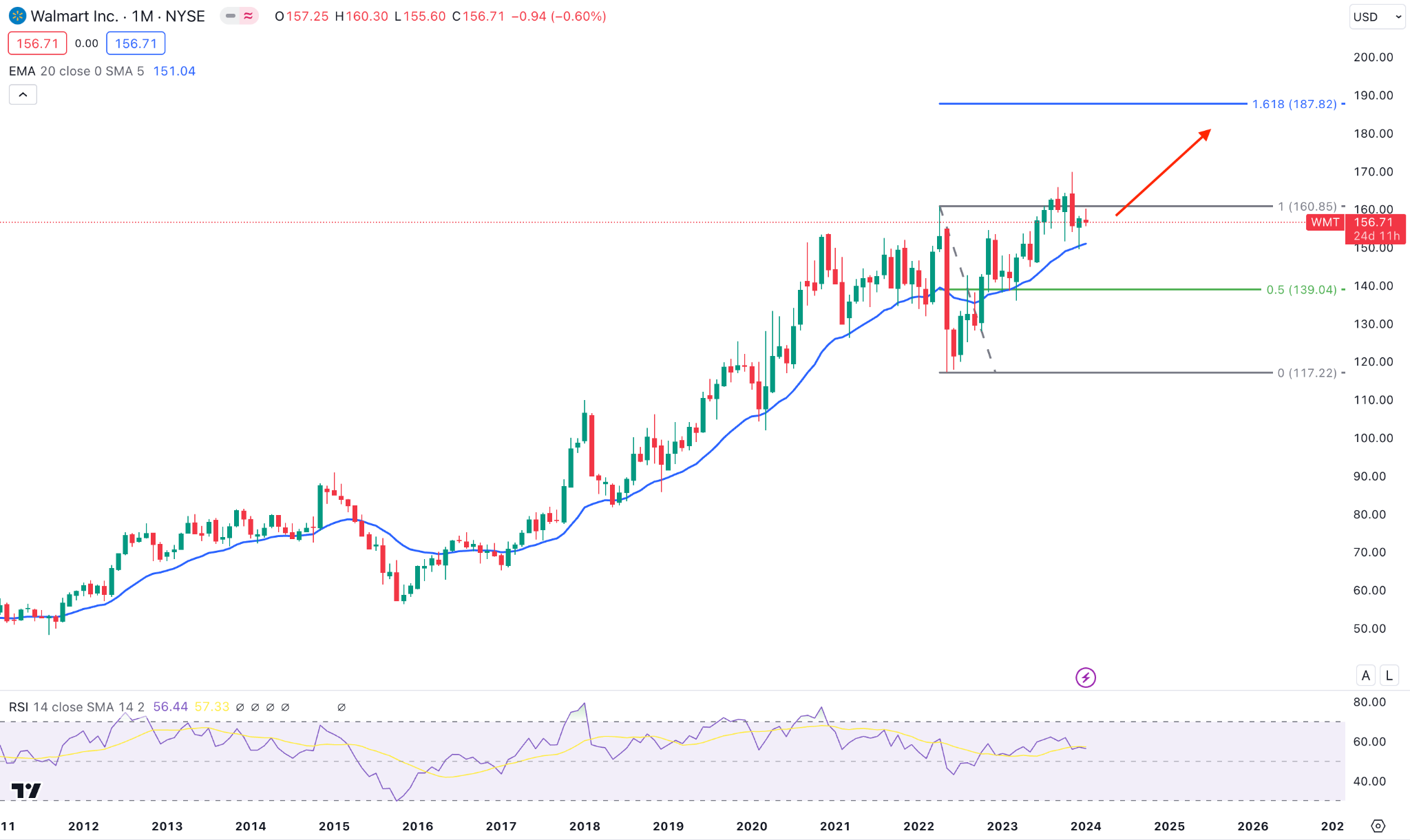

Walmart Stock Forecast

The long-term bullish trend is clear, where the current price trades at the all-time high area. A simple trend trading strategy could provide a decent gain in 2024-2030.

Let's see what other technical indicators say about this stock:

- Relative Strength Index (RSI): Monthly RSI suggests an upward continuation as a recent bullish slope is seen above the 50.00 area.

- MACD: The histogram retraces to the neutral level, suggesting a downward correction on the monthly chart. The MACD Signal line remains in the bullish zone.

- Moving Average: The 20-month EMA acts as an immediate support line, with the contraction to the 100-week SMA.

Based on this outlook, the 187.82 Fibonacci Extension level is achievable within 2025, and beyond this level, the next target area would be 300.00. However, the buying possibility depends on how the price trades in the Q1 of 2024. A downside correction towards the 130.00 to 120.00 area is possible, but breaking below the 100.00 level could be an alarming sign.

Costco Wholesale Corporation (COST)

- Market capitalization: $298.01 Billion

- LTM EPS: $14.18

- Dividend yield: 0.59%

- Total Yield: 0.82%

- Years of dividend raises: 20

- Dividend: 0.79%

- Net income: $6.517 Billion (2023)

Subscription Membership Warehouse Model

Costco currently operates 861 warehouses and e-commerce sites in the US, Canada, the UK, Mexico, Korea, Taiwan, Japan, and Australia. Still, it sells personal merchandise and manages pharmacies, stations, tire installations, and optical centers.

- There are two membership models in this company, such as:

Annual Memberships: Costco offers annual memberships to customers, providing them access to its warehouses. Memberships come in different tiers, with varying benefits and pricing structures. - Exclusive Access: Only members can shop at Costco warehouses, ensuring a recurring revenue stream and customer loyalty through the subscription model.

Costco Stock Performance

This model is crucial for stockholders as it might work as a crucial bullish factor for COST in different ways.

The membership fee might provide a stable revenue source with a highly predictable income. Also, the customers' loyalty could be another crucial factor as they have already paid for the subscription. The earnings from the yearly fee with the bulk purchase model provided a healthy financial performance of this stock.

In the last 5 years, the stock provided a 243% growth; in the last 1 year, the price showed a recent 50% gain.

Costco Dividend Yield

As the revenue model is strong, investors have enjoyed a decent dividend income, where the last 5-year dividend yield suggests business stability:

Financial Health And Stability Assessment

Costco has achieved impressive sales and profits over the past five years. Not surprisingly, its stock hit an all-time high last December.

In addition, Costco has more upside as it expands its store footprint domestically and internationally. The membership chain will start approximately 25 new stores in the next few years. That expansion will deliver multifaceted revenue growth.

The long-term debt to equity suggests a stable position for equity holders, and its business structure supports less need for debt finances.

Earnings Reports And Growth Potential

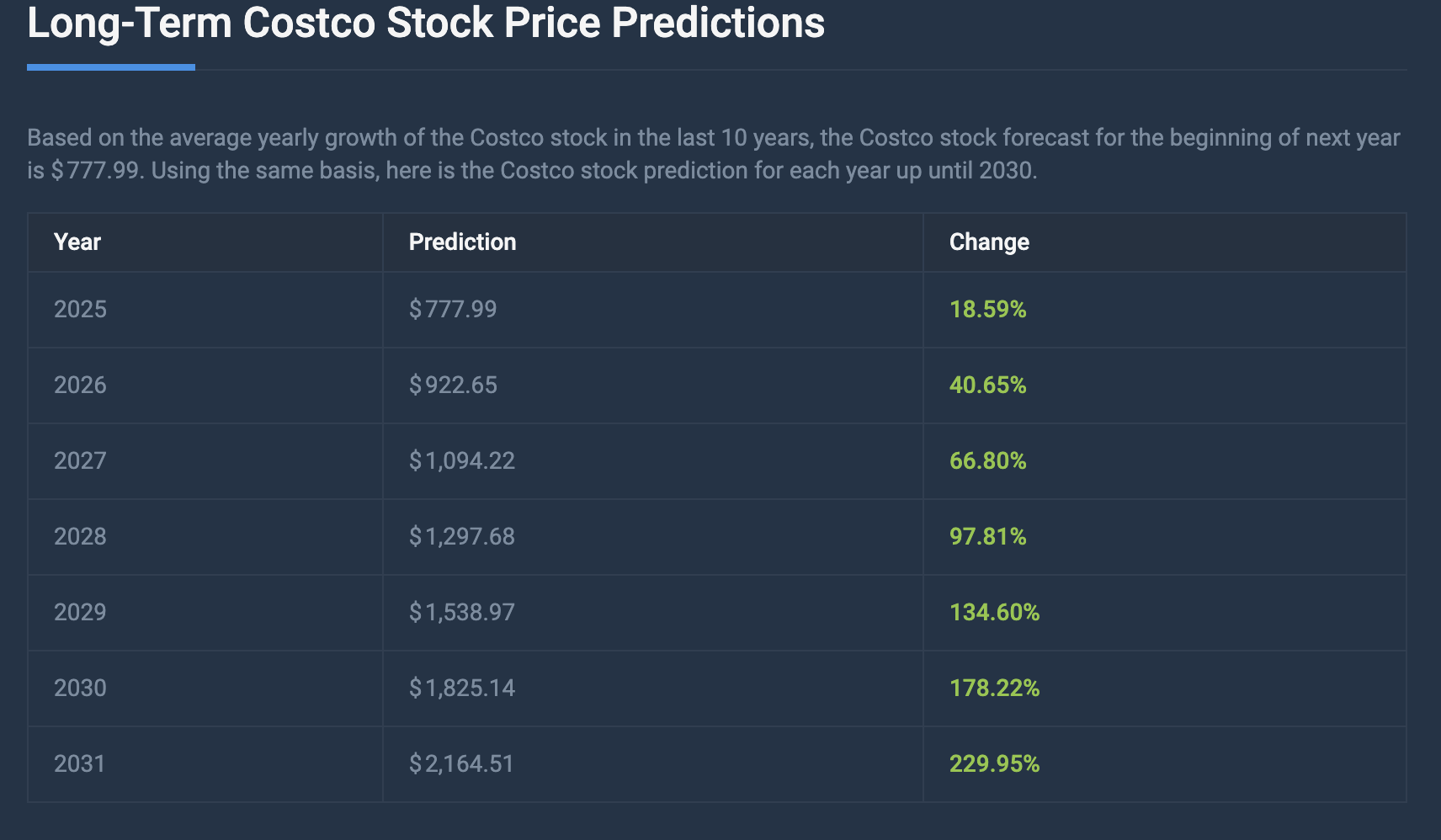

The earnings per share for this stock remained at the highest level in 2023 with upward traction as per the last 5 years' data:

Also, the company has strong growth potential according to many analysts. For example, coincodex anticipates a 178% yearly growth in stock to $ 1,825.14 in 2030.

Costco Stock Price Forecast

Costco stock (COST) trades in a clear bullish trend, where the latest monthly candle suggests an all-time high price area. Although a massive downward correction is pending, investors might expect the $800 level within 2030.

Let's see what other technical indicators say about this stock:

- Relative Strength Index (RSI): Monthly RSI suggests an upward continuation after moving above the 70.00 overbought level.

- MACD: The histogram moves above the neutral level with a steady momentum, with a bullish crossover in the Signal line.

- Moving Average: The 20-month EMA suggests a downside correction as a mean reversion, while the 100-week SMA shows upward traction.

Based on this outlook, a decent bearish correction might come in 2024 to 2025, but a rebound from the 2022 low could be the lower limit of the bullish possibility.

PepsiCo Inc. (PEP)

- Market Capitalization: $230.54 Billion

- Revenue: $23.45 Billion

- Diluted EPS: 2.24

- Net Profit Margin: 13.18%

- Dividend Yield: 3.02%

- Dividend: $1.26

- P/E Ratio: 27.95

- Earning Yield: 3.58%

- 1-year Performance: -8.00%

- Net Income: $3.09 Billion (2023)

Main Products/ Brands

PepsiCo, Inc. is an American multinational food, beverage, and snack corporation headquartered in Harrison, New York. PepsiCo's business includes all aspects of the food and beverage market. Thus, it manages the first marketing, manufacturing, and distribution of its products.

Not only is it the owner of Quaker and Frito-Lay, but also the owner of Gatorade and Mountain Dew. Nevertheless, its Frito-Lay snack business generates nearly all the revenue in North America. With its global brand and distribution, Pepsi enjoys the same advantages as industry giants P&G and Coca-Cola (KO 0.57%).

Pepsico Stock Performance

Since the 2008 market crash, Pepsico stock has traded higher and managed to provide a 346% gain until 2023.

In the last 5 years, the average yearly gain was 45%, with an all-time high formation in 2023. Moreover, the last yearly gain was nearly 3%, which suggests a correction.

PEP Stock Dividend Yield

In the last 5 years, the dividend payout has been stable, with an average of 4.0%. Moreover, the latest dividend yield was 2.5%, unchanged from the previous year. As the products of this company are directly linked to consumer usage, it could be an attractive investment opportunity in 2024-2030.

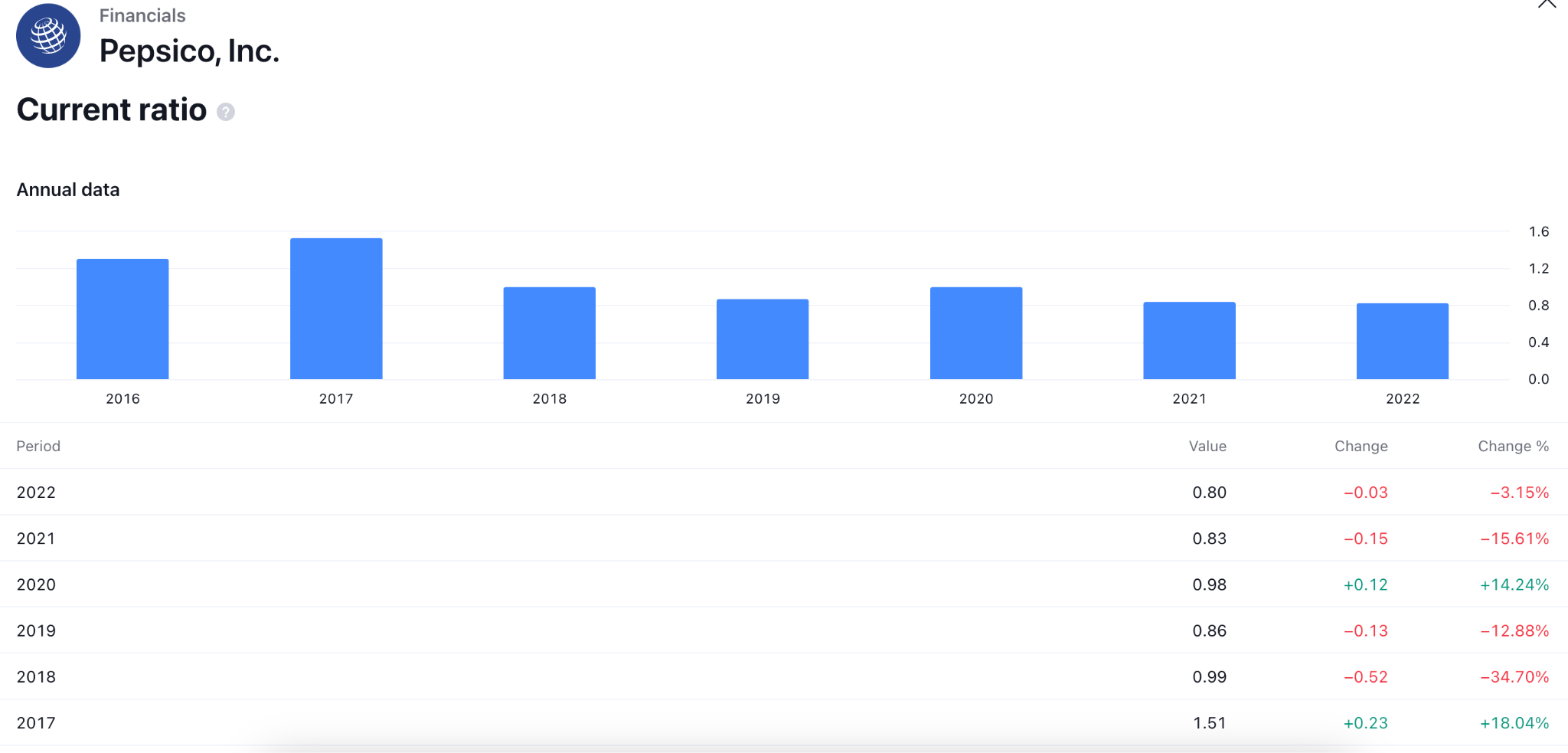

Financial Health And Stability Assessment

The long-term business stability of a company could be visible from the debt structure. The higher debt increased the possibility of insolvency, but the open space to generate finance through debts indicates easy finance.

Pepsico has a stable position in long-term debts as the debt to equity in the latest year was at 1:2.1. Within the last 5 years, the company offloaded some debt finances, which could be a positive sign for equity holders.

In day-to-day business operations, Pepsico has a strong position as the current ratio has remained in a positive zone for a long time.

Earnings Report And Growth Potential

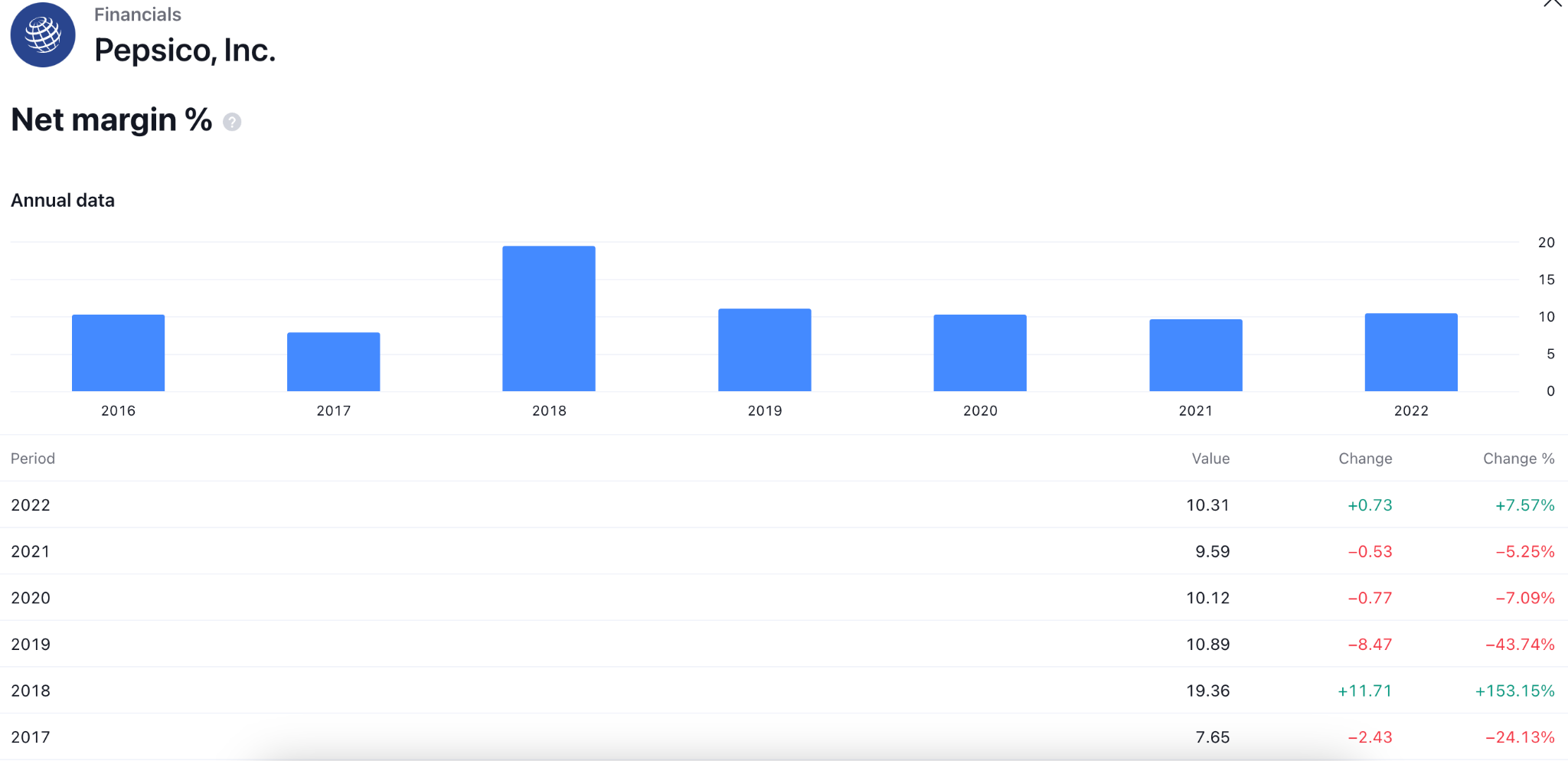

Since 2016, the highest profit margin was in 2016 - 19% net profit, 115% higher than the previous year. After this year, the growth was stable at 10% with no sign of a downward possibility.

After PepsiCo's exposure to the restaurant industry, it was more affected by the pandemic. However, the company recovered its preparation fast and posted organic revenue growth of 9.5% in 2021.

In 2018, it obtained SodaStream, leading the company in the countertop soda maker position. Even more, it purchased energy drink manufacturer Rockstar Energy in 2020. Recently, it became a dividend king, making its quarterly payouts for 50 years, showing it's an attractive stock for investors.

PEP Stock Forecast

Pepsico stock (PEP) monthly price trades in a clear bullish trend, where the recent downside pressure in 2023 came with a possible Head and Shoulders formation. Although the neckline is protected, a bullish rebound is possible.

Let's see what other technical indicators say about this stock:

- Relative Strength Index (RSI): Monthly RSI is neutral at the 50.00 line after a downward pressure, which suggests a possible downside continuation in 2024-2-26.

- MACD: The MACD Histogram is stable below the neutral line, supported by the bearish crossover in Signal lines.

- Moving Average: The 20-month EMA is an immediate resistance, which could be a minor barrier to continuing the bull run.

Based on this outlook, a bearish break with a consolidation below 150.00 could extend the downside pressure. A rebound is possible from this line, but a stable price above the 20-day EMA could make a new high in this structure.

The Coca-Cola Company (KO)

- Market Capitalization: $252.142 Billion

- LTM EPS: $2.49

- Dividend: 1.84

- Dividend Yield: 3.16

- Years of Dividend Increases: 61

- P/E Ratio: 23.42

- Average Volume: 13.48 Billion

- Shares Out: $4.32

- Net Income: $3.09 Billion (2023)

Main Products/Brands

Headquartered in Atlanta, Coca-Cola Co. is one of the most valuable brands in the world. Typically, Coca-Cola manufactures and sells a portfolio of non-alcoholic drinks worldwide. Brand names are Fanta, Bodimore, Coke, Fudge Tea, Powerade, Dasani, and Minute Maid.

However, the biggest revenue section of this company is Coke, which is a flagship product.

Coca Cola Stock Performance

Since the COVID-19 market crash, Coca-Cola Stock (KO) rebounded with counter-impulsive pressure and eliminated all losses. Moreover, the price consolidated after making a new all-time high, which is a sign of a continuation.

KO Stock Dividend Yield

The dividend payout ratio has been down since 2017, but a curve has formed in the latest year, where the number was at 80.23%. Also, the dividend yield was at 2.77, which indicates a stable position.

Financial Health And Stability Assessment

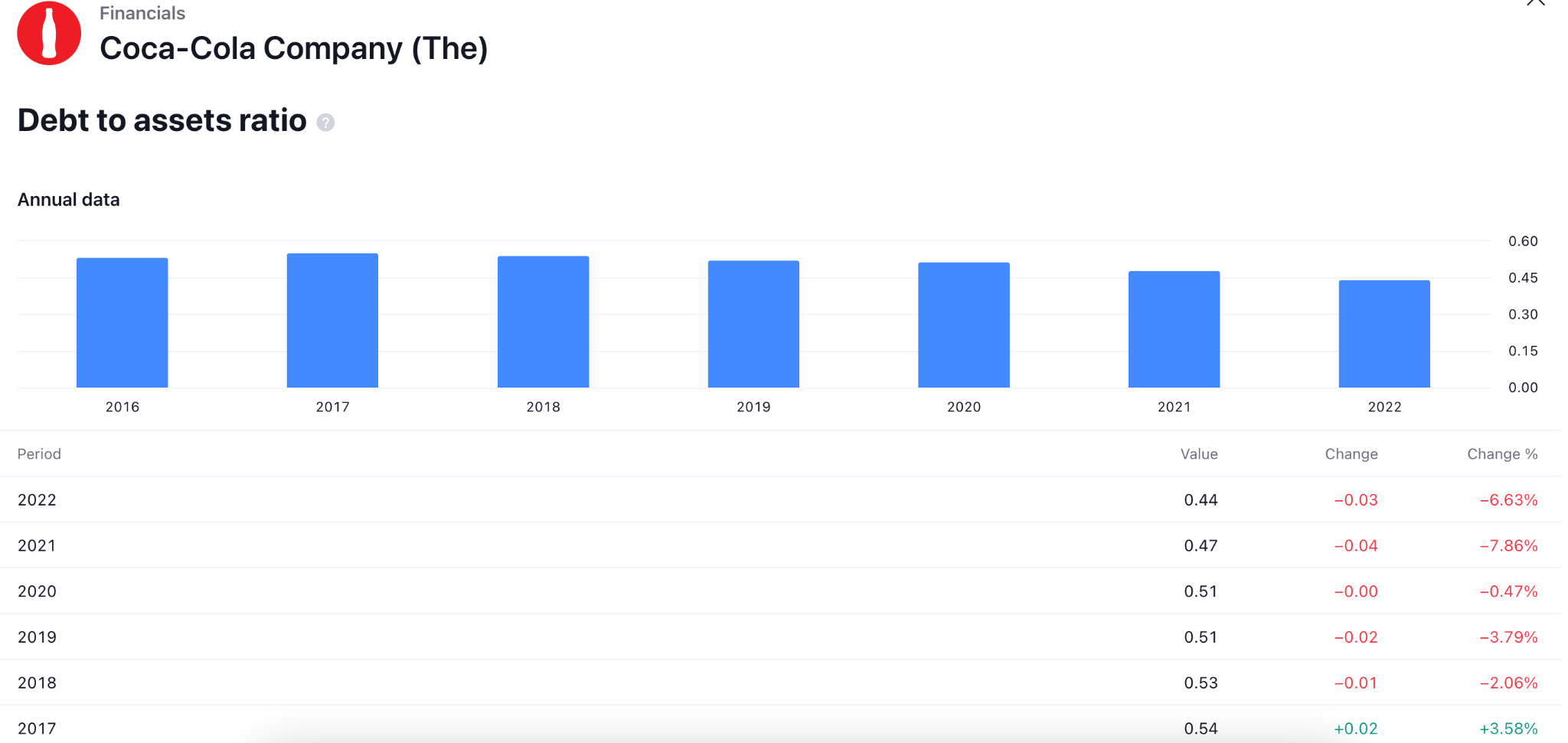

The debt to asset ratio for Coca-Cola Company suggests a stable position as no fluctuation is seen in the last 5 years:

The long-term debt-to-equity ratio suggests no significant fluctuation to consider a volatility in the business structure:

Earnings Reports And Growth Potential

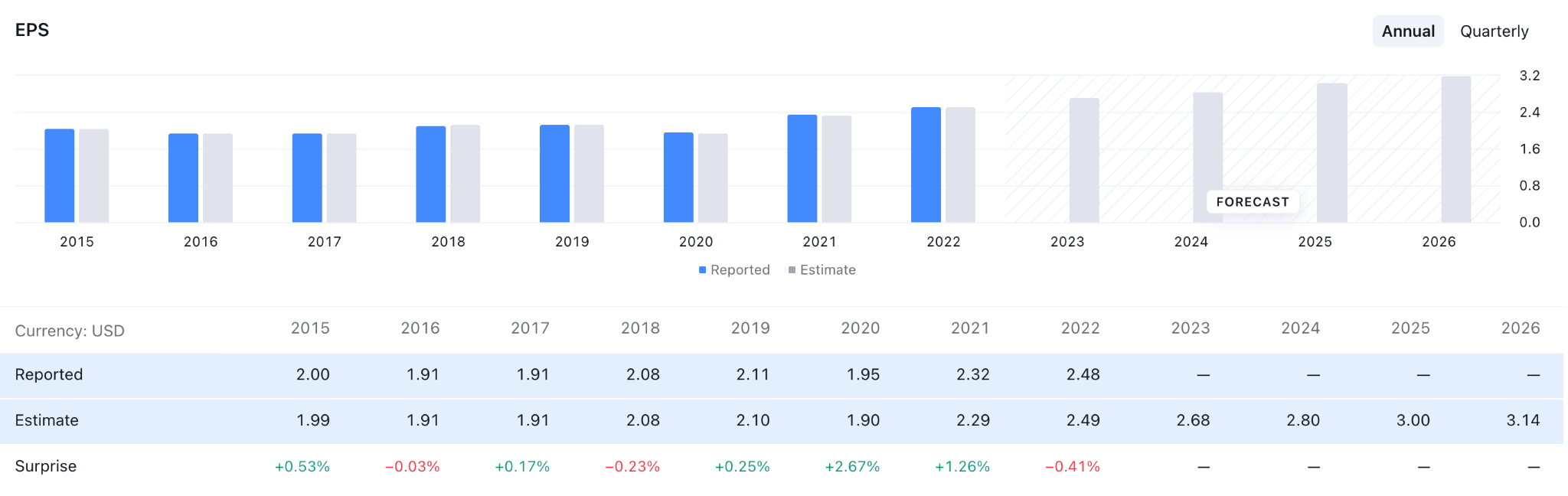

For the quarter ending September 29, 2023, Coca-Cola reported an 8% increase in net income to $12 billion. EPS increased 9% to $0.71. Coca-Cola has continuously shown solid earnings and has consistently raised its dividend for the past 61 years.

Also, the Earnings projection is solid, where the company's Earnings per share could reach the 3.14 level within 2026.

Even without it, this company has proven Performance on geographic expansion, product innovations, and strategic acquisitions. Investors also like this company's 3.1% dividend yield, which produces $1.84 in annual earnings per share. Consequently, Coca-Cola uses share repurchases to offset employee stock-based reparation award reductions.

KO Stock Forecast

Coca-Cola stock (KO) monthly price trades in a clear bullish trend, where the recent downside correction and immediate rebound suggest a bullish rebound.

Let's see what other technical indicators say about this stock:

- Relative Strength Index (RSI): Monthly RSI is neutral at the 50.00 line after a downward pressure, suggesting a need for a bullish rebound at the 60.00 level before anticipating the bull run.

- MACD: The MACD Histogram starts losing momentum while the Signal line is above the neutral level. A rebound above the neutral level would suggest a long opportunity.

- Moving Average: The 20-month EMA is closer to the price, acting as a resistance. A bullish break above this line could resume the market trend.

Based on this outlook, a bullish continuation is potent from the previous swing low, but a downside correction could come towards the 55.00 area to offer a long opportunity. However, a massive selling pressure below the 48.00 psychological level could be an alarming sign to bulls.

Tips for Investing in Consumer Staples Stocks

Indeed, There is no guarantee of investment. We pick the best staple sticks at the wrong time and see significant losses in an account. Unfortunately, those experiences are part of the process. To avoid financially devastating issues, we can take some effective steps. Here are the following:

- Reinvest dividends from these mature companies to increase returns

- Dollar-cost averaging can benefit from reversals during earnings season.

- Use stop losses to contain downside risk when trading these defensive stocks

- Keep a long-term focus. Longer holdings insulate us from market volatility.

- If you can afford the losses, you can invest.

- Research and purchase companies that are best. We can manage our portfolio more appropriately if we invest in attractive companies.

- Try to invest across different asset classes, geographies, economic sectors, and company sizes. All these niches respond to market trends differently.

Trade Consumer Staples Stocks CFD with VSTAR

Trading CFD on VSTAR is simple, so we can trade with the mobile-enhanced trading experience app everywhere. VSTAR provides the ultimate trading experience with an easy-to-access outlook with the highest availability.

VSTAR is a dynamic platform that opens doors to trade consumer staples stocks in 2024 and offers a fast and simple approach that may potentially boost your investment portfolio. VSTAR is not just a trading platform, it's a comprehensive solution designed to empower traders of all levels, from beginners to seasoned professionals.

The platform provides a step-by-step guide to help you easily navigate the best consumer staples stocks to buy in 2024, ensuring that you make informed decisions.

Here are some key features of VSTAR:

- Real-Time Data: Stay ahead of market trends with VSTAR's up-to-the-minute data, ensuring that you have the latest information at your fingertips.

- Zero Commission: You can buy stocks with no tension of commission or additional charges.

- User-Friendly Interface: VSTAR's intuitive design makes it easy for both novices and experienced users. Also its mobile portability could be an additional factor to join this platform.

- Analytical Tools: Benefit from VSTAR's advanced analytical tools, technical analysis, and market outlook, enabling you to perform in-depth stock analysis and make well-informed decisions.

- Risk Management: Mitigate risks effectively with VSTAR's robust risk management features, allowing you to set limits and safeguard your investments.

If you want to try buying the Top 4 Best Consumer Staples Stocks In 2024, VSTAR can be your reliable companion, offering a comprehensive toolkit to explore, analyze, and trade, potentially unlocking the gains from affordable stocks.

Final Word

Consumer staples stocks always carry a defensive reputation and have the potential for good growth. Many also provide dividend income, which will only spot your portfolio in a downturn. Remember to choose the best consumer staples stocks with healthy balance sheets and a proven leadership team. All of these stock qualities can make you permanently rich.

What's the bottom line? Use risk management techniques regardless. Because the protection of your trading capital will be paramount when engaging. Remember, the CFD market will help us during price fluctuations as both long and short positions are available here. Ultimately, using a regulated broker like VSTAR has to be the first step before choosing the best consumer staples stocks in 2024.