- Constellation Brands achieves over 8% depletion growth, showcasing adaptability and market strength.

- Share gains in tracked channels highlight dominance in both mainstream and higher-end beer categories.

- Disciplined capital allocation, including $215 million in share repurchases, emphasizes shareholder value.

- Anticipation of 7-8% growth in beer business operating income underscores operational excellence and strategic focus.

The article analyzes Constellation Brands' Q3 fiscal 2024 performance, where triumphs and challenges intertwine in the shifting beverage industry. From robust beer portfolio growth to strategic investments and the nuanced dance with market dynamics, Constellation Brands holds a compelling edge of adaptability and resilience. Risks are also looming that should not be ignored.

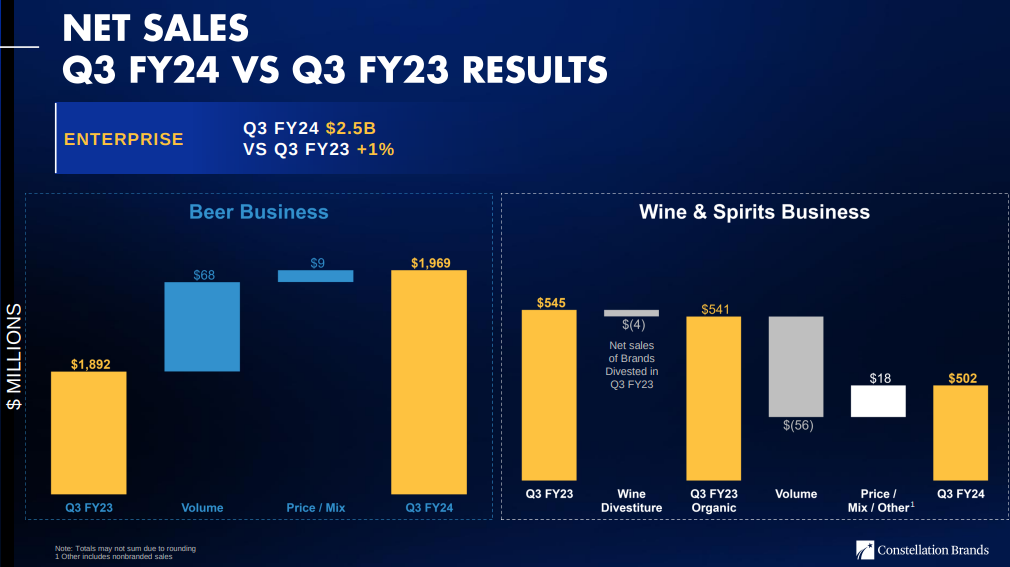

Source: Earnings Presentation

Depletion Growth in Beer Portfolio

Constellation Brands' achievement of depletion growth exceeding 8% for its beer portfolio represents the robust demand for its beer products. In the dynamic and competitive beer market, where consumer preferences continually evolve, sustaining such impressive depletion growth signifies Constellation Brands' ability to adapt and meet consumer expectations effectively.

This trend highlights the company's strength in understanding and responding to market dynamics. The growth in depletions indicates that consumers are not only choosing Constellation Brands' beers but are doing so consistently over the quarters. The company's portfolio seems to resonate well with consumer tastes, reflecting a combination of product quality, brand recognition, and effective marketing strategies.

The beer industry is characterized by shifting consumer preferences, and Constellation Brands' ability to achieve and maintain depletion growth demonstrates agility in product innovation and marketing. The company's understanding of consumer trends, whether related to flavors, packaging, or marketing messaging, is crucial in maintaining and expanding its market share.

Additionally, the consistent growth in depletions can be indicative of successful distribution strategies. The company's products are likely reaching consumers efficiently through various channels, ensuring a wide and accessible market presence. The data underscores the effectiveness of Constellation Brands' distribution network and supply chain management.

In conclusion, the trend of over 8% depletion growth signifies Constellation Brands' success in the beer market. The company's ability to consistently meet and exceed consumer expectations, adapt to industry changes, and effectively distribute its products positions it as a formidable player in the competitive beer sector.

Share Gains in Tracked Channels

Constellation Brands' achievement of leading share gains in tracked channels, with a more than 2-point expansion in the US beer category and nearly a 3-point gain in the higher-end segment, indicates the company's strong competitive position and its ability to outperform rivals in key market segments.

Share gains are a critical metric in the beverage industry, reflecting a company's ability to capture a larger portion of the market relative to its competitors. Constellation Brands' consistent expansion of market share showcases its effective strategies in brand management, marketing, and consumer engagement.

The data emphasizes the success of Constellation Brands in both mainstream and higher-end beer categories. Mainstream beers appeal to a broad consumer base, and gaining share in this segment indicates the brand's ability to connect with a wide range of consumers. Simultaneously, the higher-end segment represents a more discerning consumer base, and achieving nearly a 3-point gain in this category demonstrates the company's success in positioning itself as a premium and desirable choice.

Leading share gains also imply that Constellation Brands' products are preferred by consumers in the tracked channels, suggesting a competitive edge in terms of taste, quality, and brand perception. It is crucial to delve into the qualitative aspects that contribute to this success, such as effective marketing campaigns, product differentiation, and brand positioning strategies.

The expansion in share within the US beer category and the higher-end segment is a significant accomplishment. It showcases Constellation Brands' understanding of diverse consumer preferences and its ability to cater to both the mainstream and premium markets effectively. This nuanced approach to market segmentation contributes to the company's overall strength and resilience in a dynamic industry.

Additionally, gaining share in the higher-end segment implies that Constellation Brands is successfully capitalizing on the trend of premiumization in the beverage industry. Consumers are increasingly inclined towards premium and craft offerings, and the trend indicates that Constellation Brands is aligning itself well with this consumer shift.

In conclusion, the data on share gains underscores Constellation Brands' strong market position and its ability to outperform competitors in both mainstream and higher-end beer categories. The company's success in gaining market share is indicative of effective brand management, strategic marketing, and a keen understanding of consumer preferences.

Disciplined Capital Allocation

Constellation Brands' execution of $215 million in share repurchases during Q3 reflects the company's disciplined and balanced approach to capital allocation. This trend provides insights into the company's focus on enhancing shareholder value and optimizing its capital structure.

Share repurchases are a strategic financial move employed by companies to return value to shareholders, signaling confidence in the company's financial health and future prospects. Constellation Brands' allocation of capital towards share repurchases indicates a focus on maximizing shareholder returns and a belief in the intrinsic value of its shares.

The disciplined approach to capital allocation involves making strategic decisions that align with the company's long-term goals and financial stability. Constellation Brands' ability to execute share repurchases while maintaining a net leverage ratio of 3.2 times demonstrates a prudent and thoughtful approach to managing its capital structure.

Beyond the trend, it is essential to explore the qualitative aspects of Constellation Brands' capital allocation strategy. This involves assessing the company's overall financial health, its liquidity position, and the alignment of capital allocation decisions with its business strategy. Additionally, considering the macroeconomic environment and industry trends is crucial in ensuring that capital allocation decisions are in sync with the broader market conditions.

The execution of share repurchases is one aspect of Constellation Brands' broader capital allocation strategy. The company may also allocate capital towards investments in research and development, mergers and acquisitions, debt reduction, or dividends. Analyzing the rationale behind these decisions and their alignment with the company's growth strategy provides a comprehensive understanding of Constellation Brands' financial management.

The disciplined capital allocation strategy is particularly crucial in the beverage industry, which requires significant investments in branding, marketing, and production capabilities. Constellation Brands' ability to balance growth-oriented investments with returning value to shareholders through share repurchases reflects a nuanced understanding of financial management.

In conclusion, the trend of $215 million in share repurchases underscores Constellation Brands' disciplined approach to capital allocation. The company's focus on enhancing shareholder value, maintaining a balanced capital structure, and executing strategic financial decisions contributes to its overall financial health and long-term sustainability.

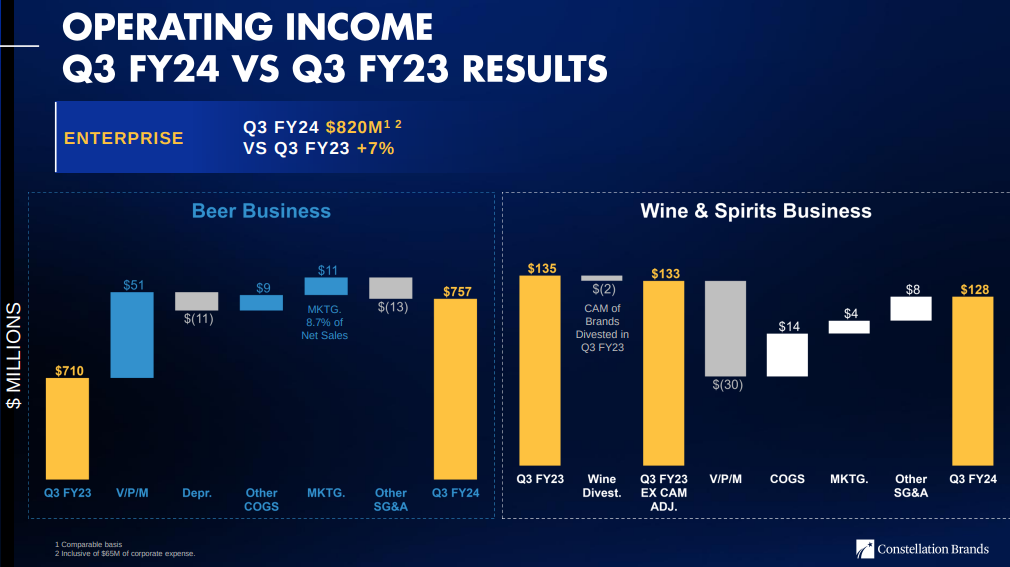

Operating Income Growth in Beer Business

Constellation Brands' expectation of 7% to 8% growth in operating income for its beer business in fiscal '24 highlights the robust financial performance and operational efficiency within this segment. This trend indicates that the beer business is a significant driver of operating income growth for the company.

Source: Earnings Presentation

Achieving growth in operating income is a key metric for assessing a company's profitability and operational effectiveness. Constellation Brands' focus on the beer business as a primary driver of operating income growth suggests a strategic emphasis on optimizing performance in this high-margin segment.

The trend is not only indicative of past success but also provides guidance for future expectations. Constellation Brands' projection of 7% to 8% growth in operating income implies a proactive approach to managing costs, driving efficiencies, and capitalizing on revenue opportunities within the beer business.

The beer industry is highly competitive, and achieving consistent growth in operating income requires strategic decision-making. Constellation Brands' ability to navigate market dynamics, adapt to changing consumer preferences, and innovate in product offerings contributes to its operational resilience and sustained profitability.

Furthermore, the emphasis on marketing effectiveness actions indicates a holistic approach to driving growth in the beer business. Successful marketing strategies not only contribute to revenue generation but also play a crucial role in brand building and consumer loyalty. The trend of operating income growth is, therefore, tied to the company's ability to create a strong brand presence and resonate with consumers.

In conclusion, the trend of 7% to 8% growth in operating income for the beer business underscores Constellation Brands' operational excellence and strategic focus on profitability. The company's ability to navigate the competitive beer industry, implement effective marketing strategies, and drive efficiencies positions it as a leader in the segment, contributing to sustained financial growth.

Focused Investments in Brewing Capacity

Constellation Brands' plan to invest approximately $5 billion in growth and maintenance CapEx from fiscal '24 to fiscal '28, primarily focused on brewing capacity expansions for its beer business, signifies a proactive approach to meeting growing demand and capitalizing on market opportunities.

The trend of a significant investment in brewing capacity indicates Constellation Brands' confidence in the future prospects of its beer business. This strategic decision aligns with the company's focus on supporting the growth of its beer segment and ensuring that it can meet increasing consumer demand efficiently.

The brewing capacity expansion is a critical aspect of Constellation Brands' long-term growth strategy. As consumer preferences and market dynamics evolve, having the necessary production capabilities is essential for the company to stay competitive and capitalize on emerging trends in the beer industry.

The brewing industry requires substantial capital investments in infrastructure, technology, and equipment. Constellation Brands' focus on allocating a significant portion of its capital expenditure towards brewing capacity expansions reflects a forward-thinking approach to addressing both current and future market demands.

Additionally, the focus on brewing capacity expansions is closely tied to the company's ability to innovate in product offerings. As new beer products and variations are introduced, having the necessary brewing capacity ensures that Constellation Brands can bring these innovations to market effectively, maintaining its position as a leader in the beer industry.

In conclusion, the trend of a $5 billion investment in brewing capacity expansions underscores Constellation Brands' strategic approach to supporting the growth of its beer business. The company's focus on ensuring it has the necessary production capabilities aligns with its vision for sustained success and market leadership in the dynamic and competitive beer industry.

Wine & Spirits Transformation

Constellation Brands' expectation of accelerating net sales growth to 1% to 3% over the medium term for its Wine & Spirits business, despite near-term headwinds, underscores the company's strategic focus on the transformation and growth of this segment.

The guidance provides insights into Constellation Brands' confidence in the long-term prospects of its Wine & Spirits business. The acknowledgment of near-term challenges indicates a realistic assessment of current market conditions, but the expectation of accelerated net sales growth reflects the company's focus on overcoming these challenges and driving positive results.

The transformation of the Wine & Spirits business involves strategic initiatives aimed at aligning the product portfolio with consumer-led premiumization trends and expanding the business in targeted international markets. The guidance serves as a roadmap for investors and stakeholders, indicating the expected trajectory of this transformation over the medium term.

The Wine & Spirits industry is characterized by evolving consumer preferences, and Constellation Brands' focus on premiumization aligns with broader market trends. Premiumization involves the consumer shift towards higher-quality and more premium products, and the company's focus on this trend indicates a strategic understanding of changing consumer dynamics.

Additionally, the emphasis on international expansion reflects Constellation Brands' recognition of growth opportunities beyond its domestic market. The Wine & Spirits segment often benefits from global demand, and the company's efforts to expand its presence in targeted international markets can contribute significantly to overall sales growth and market share.

In short, the guidance of accelerating net sales growth in the Wine & Spirits business, coupled with the strategic emphasis on premiumization and international expansion, underscores Constellation Brands' focus on transforming and growing this segment. The company's ability to navigate near-term challenges and capitalize on long-term opportunities positions it as a key player in the dynamic and evolving Wine & Spirits industry.

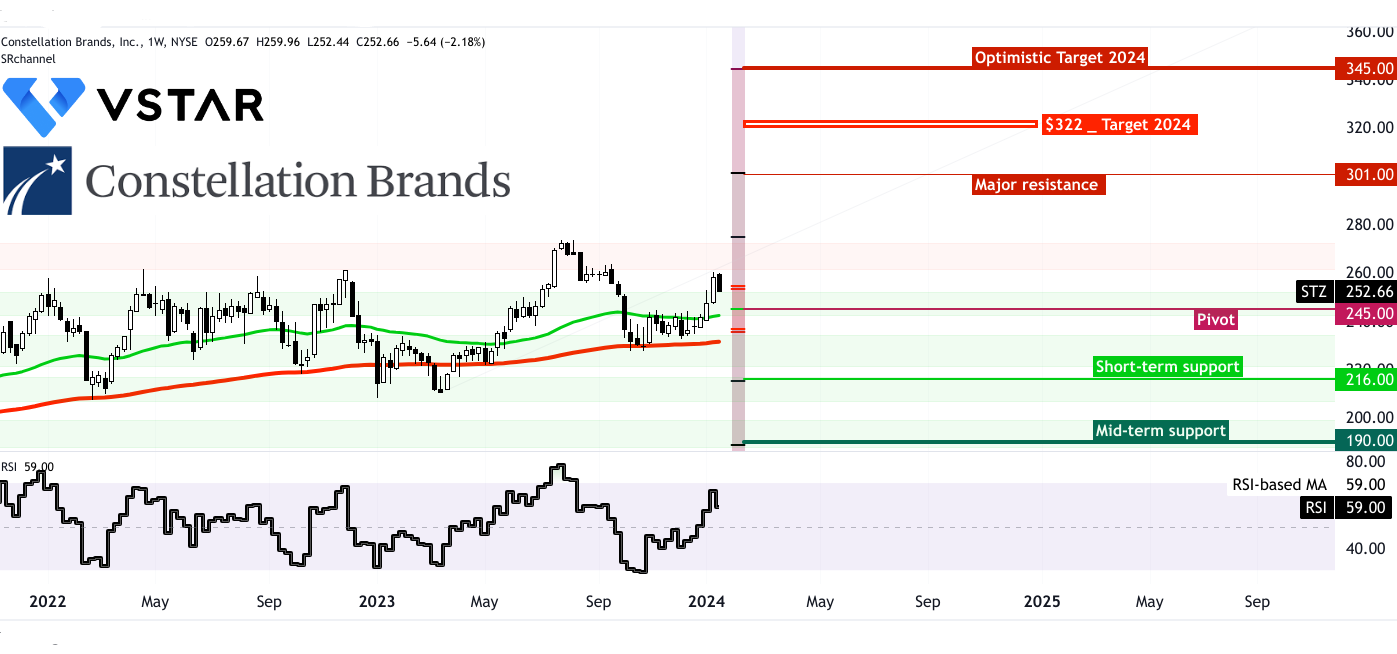

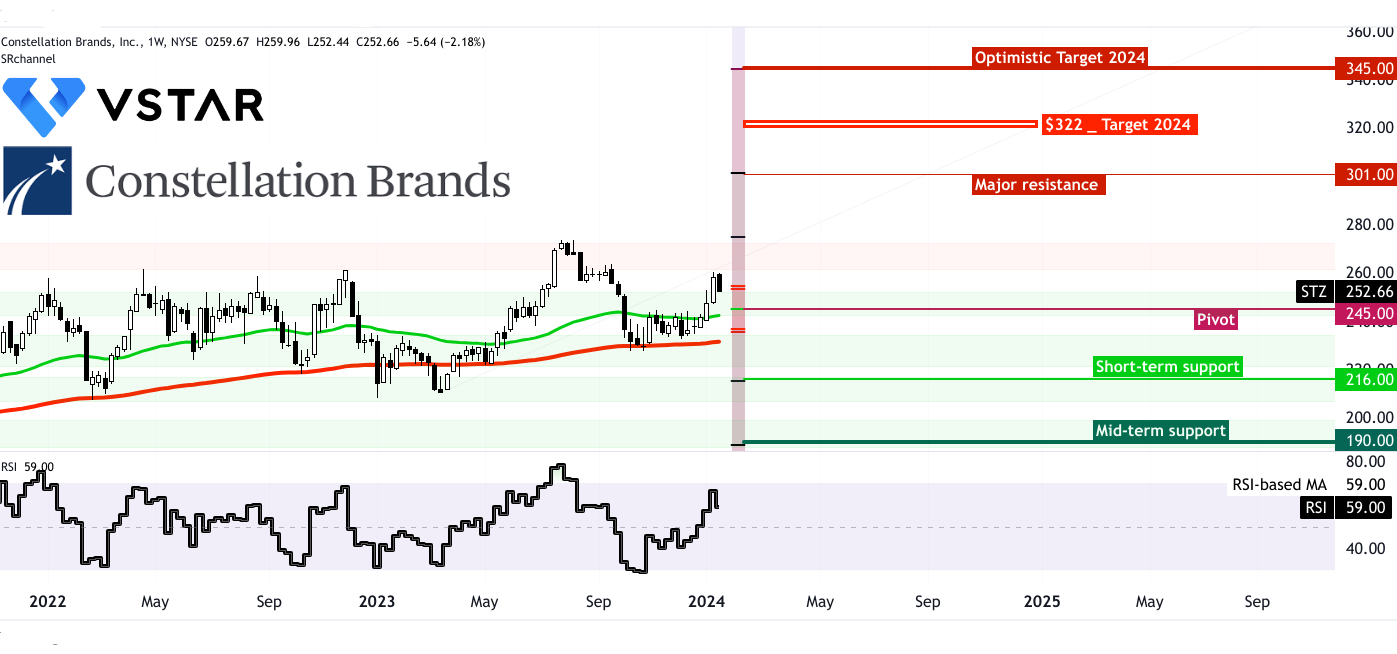

STZ Stock Technical Take

The Constellation Brands stock price may reach $322 by the end of 2024. Although, the stock price is in consolidation; however, the Constellation Brands stock has taken support at the 156-week exponential moving average (EMA). Over the long term the stock price is on an upward trajectory as observed in the crossover of the 52-week EMA and the 156-week EMA emerged at the end of 2020.

Towards upside, the STZ stock price required a proper close over $275, breaching the current range-bound momentum. After $275, the price may experience a major resistance near $300 before reaching its target of $322 by the end of 2024. However, in an optimistic scenario, considering the Fibonacci retracement and the high momentum of the stock price, the price may reach $345 during the same period.

In the prevalence of macroeconomic adversities, especially high inflation, competition, and Fed's higher for longer stands, the price is also attached to downside risk. On the downside, the price may test the pivot near $245. However, $216 and $190 can be considered as short-term and mid-term support for the stock. RSI (relative strength index) is still hovering at 59, suggesting more upside potential.

Source: tradingview.com

Specific Risk and Downsides

Decelerating Growth:

The Wine & Spirits segment, a historically significant part of Constellation Brands' portfolio, is currently grappling with a deceleration in growth. The provided text highlights a broader marketplace slowdown in the last few months, impacting the segment's performance. This is evident from the downward revision of fiscal '24 organic net sales guidance, indicating an anticipated decline of 7% to 9%. Similarly, the operating income guidance for the Wine & Spirits business is adjusted to a range of down 6% to 8%, reflecting the challenging environment.

The term "decelerating growth" suggests a departure from the historical upward trajectory, hinting at unfavorable shifts in consumer preferences, competitive pressures, or broader economic trends. Constellation Brands' Wine & Spirits segment, facing headwinds, is now reassessing its fiscal expectations, prompting a careful examination of both short-term challenges and long-term strategic initiatives.

External Headwinds:

Constellation Brands attributes the revision in guidance to near-term headwinds affecting the Wine & Spirits segment. These external factors include challenges faced by two of its largest volume brands, Woodbridge and SVEDKA. The mainstream headwinds may be influenced by shifting consumer preferences, competitive dynamics, or other industry-specific factors.In conclusion, Constellation Brands stands at a crucial juncture. Despite its fundamental strengths—beer portfolio growth, disciplined capital allocation, and strategic investments—price direction teeters. Poised for potential growth to $322, caution prevails as external headwinds could lead to a retreat, testing the $245 support level.