Introduction

Cisco Systems Inc is a leading technology company that provides networking, security, collaboration, cloud, and other products and services. The company has recently announced its financial results for the fourth quarter and fiscal year 2023, which showed strong growth and profitability. The company also declared a quarterly dividend of $0.37 per share and authorized a $10 billion increase in its stock repurchase program. The company's stock price has been rising steadily in the past year, reaching a 52-week high of $55.84 on August 16, 2023.

The company has also been making headlines with its innovative products and solutions, such as its Internet for the Future strategy, its Optimized Application Experiences portfolio, and its strategic partnerships with Amazon Web Services, Google Cloud, IBM, Salesforce, and ServiceNow.

Cisco Systems Inc's Overview

Source: Britannica

What is Cisco

Cisco Systems Inc was founded in 1984 by Leonard Bosack and Sandra Lerner, who were computer scientists at Stanford University. They developed a device that could connect different types of computer networks, which they called a router. The name Cisco comes from the city of San Francisco, where the company was initially based.

Today, Cisco is the world's largest provider of networking equipment and software, headquartered in San Jose, California. The company has four main segments: Infrastructure Platforms, Applications, Security, and Services. The company is led by CEO Chuck Robbins, who joined Cisco in 1997 and became the chief executive in 2015. Some of the top shareholders of Cisco are Vanguard Group, BlackRock, State Street, and Berkshire Hathaway.

Cisco has achieved many milestones in its history, such as:

- Launching the first multi-protocol router in 1986

- Going public on Nasdaq in 1990

- Becoming the most valuable company in the world in 2000

- Acquiring more than 200 companies since 1993

- Pioneering technologies such as Voice over IP (VoIP), Internet of Things (IoT), and Software-Defined Networking (SDN)

Cisco Systems Inc's Business Model and Products/Services

Cisco makes money from two main sources: selling its products and providing its services. The company's revenue breakdown for fiscal year 2022 was as follows:

- Products: $36.8 billion (74% of total revenue)

- Services: $13.1 billion (26% of total revenue)

The products segment generates revenue from the sale of Cisco's hardware and software products for networking, communication, collaboration, security, and cloud computing. The average selling price (ASP) of Cisco's products varies depending on the type and complexity of the product. For example, the ASP of a router can range from a few hundred dollars to several million dollars.

Main products and services

The company's main products and services include:

- Routers

- Switches

- Wireless products and solutions

- Data Center: Products and solutions that enable cloud computing and storage

- Collaboration: Products and solutions that enable communication and teamwork

- Security: Products and solutions that protect networks and data from cyber threats

- Other Products and services: Products such as optical networking, video systems, cable modems, and IoT devices

Source: ET Telecom

Cisco Systems Inc's Financials, Growth, and Valuation Metrics

Cisco has a strong financial position with consistent revenue growth, high profitability, and solid cash flow generation. The fiscal year 2023 of Cisco ended on July 31, 2023. The company released its financial results for the fiscal year 2023 on August 16, 2023. Cisco market cap as of October 2023 is around $216 Billion.

Here are the financial highlights of Cisco for the fiscal year 2023:

- Revenue: $57.0 billion, an increase of 13% year-over-year

- Net income: $16.0 billion, an increase of 13% year-over-year

- Earnings per share (EPS): $3.89, an increase of 16% year-over-year

- Gross margin: 63.9%

- Operating margin: 36.0%

- Return on equity (ROE): 30.8%

Here is a summary of Cisco's balance sheet strength and cash flow situation for the fiscal year 2023:

- Cash and cash equivalents: $10.7 billion, up from $9.9 billion.

- Total assets: $101.8 billion, up from $98.8 billion.

- Total liabilities: $59.9 billion, up from $58.7 billion.

- Total equity: $41.9 billion, up from $40.1 billion.

- Operating cash flow: $16.7 billion, up from $15.6 billion.

- Free cash flow: $15.5 billion, up from $14.5 billion.

As you can see, Cisco's financial performance in fiscal year 2023 was strong, with revenue and earnings per share increasing by 13% and 16%, respectively. The company's outlook for the fiscal year 2024 is also positive, with revenue and earnings per share expected to grow in the mid-single digits.

Cisco's valuation multiples are relatively low compared to its peers and the industry average. The company's current valuation ratios are:

- Price-to-Earnings (P/E): 17x, compared to the industry average of 24x

- Price-to-Sales (P/S): 4x, compared to the industry average of 5x

- Price-to-Book (P/B): 5x, compared to the industry average of 7x

- Enterprise Value-to-EBITDA (EV/EBITDA): 10x, compared to the industry average of 14x

The table below shows the valuation multiples of Cisco and its peers as of August 2023:

|

Company |

P/E |

P/S |

P/B |

EV/EBITDA |

|

Cisco |

18.7 |

4.5 |

6.1 |

12.7 |

|

HPE |

11.8 |

0.8 |

1.5 |

7.9 |

|

IBM |

23.3 |

1.8 |

5.7 |

10.9 |

|

Juniper |

29.4 |

2.3 |

2.6 |

13 |

|

Microsoft |

37.9 |

13 |

15.3 |

24 |

|

Oracle |

19 |

6 |

18.8 |

15 |

These ratios suggest that Cisco is undervalued based on its earnings, sales, book value, and cash flow generation.

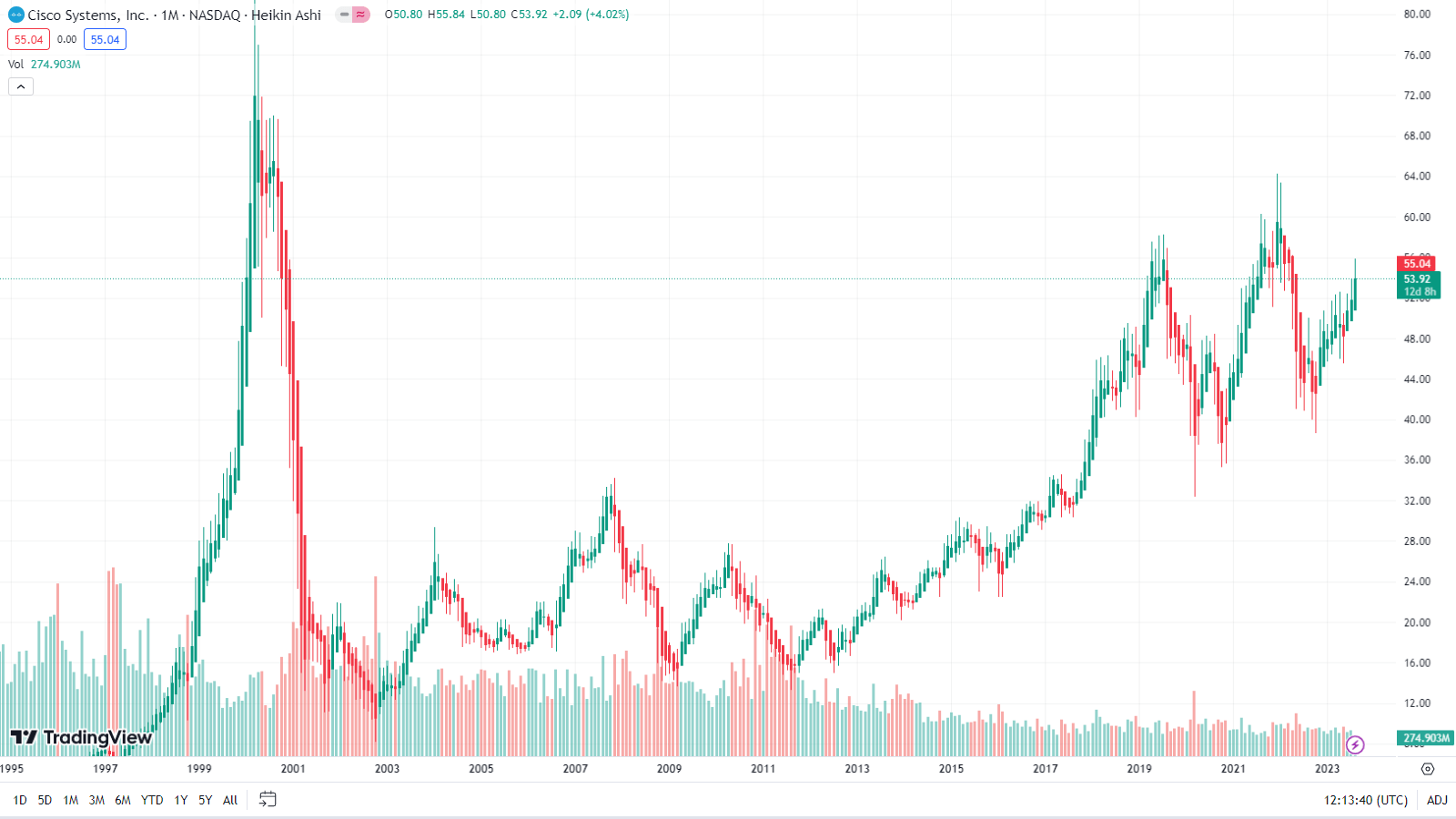

Cisco Stock Performance Analysis

Cisco stock trades on the Nasdaq under the ticker symbol CSCO. The company went public in February 1990 at an initial price of $0.06 per share (adjusted for stock splits). Since then, the stock has split nine times (2-for-1 in June 1992; June 1993; June 1994; June 1995; March 1997; March 1998; March 1999; March 2000; February 2003).

Cisco stock trading hours are:

- Trading hours: 9:30 AM to 4:00 PM ET

- Pre-market hours: 4:00 AM to 9:30 AM ET

- After-market hours: 4:00 PM to 8:00 PM ET

CSCO Dividend

The ex-dividend date for the next Cisco dividend is on September 29, 2023. This means that if you buy CSCO stock on or after September 29, 2023, you will not be eligible to receive the next dividend. The dividend will be paid on October 13, 2023.

Source: TradingView

Cisco stock price has reached several historical highs and lows over the years. The highest closing price was $80.06 on March 27, 2000, during the dot-com bubble. The lowest closing price was $8.12 on October 8, 2002, during the dot-com bust. The current stock price as of August 18, 2023, is $53.20, which is near its 52-week high of $55.84 and far above its 52-week low of $24.60.

Cisco share price has been volatile and has trended upward in the past year, driven by several factors, such as:

- Strong Cisco earnings results and guidance, Cisco news

- Accelerating revenue growth and order growth

- Improving supply chain and component availability

- Increasing demand for networking and cloud solutions amid the pandemic

- Expanding product portfolio and innovation capabilities

- Returning capital to shareholders through dividends and buybacks

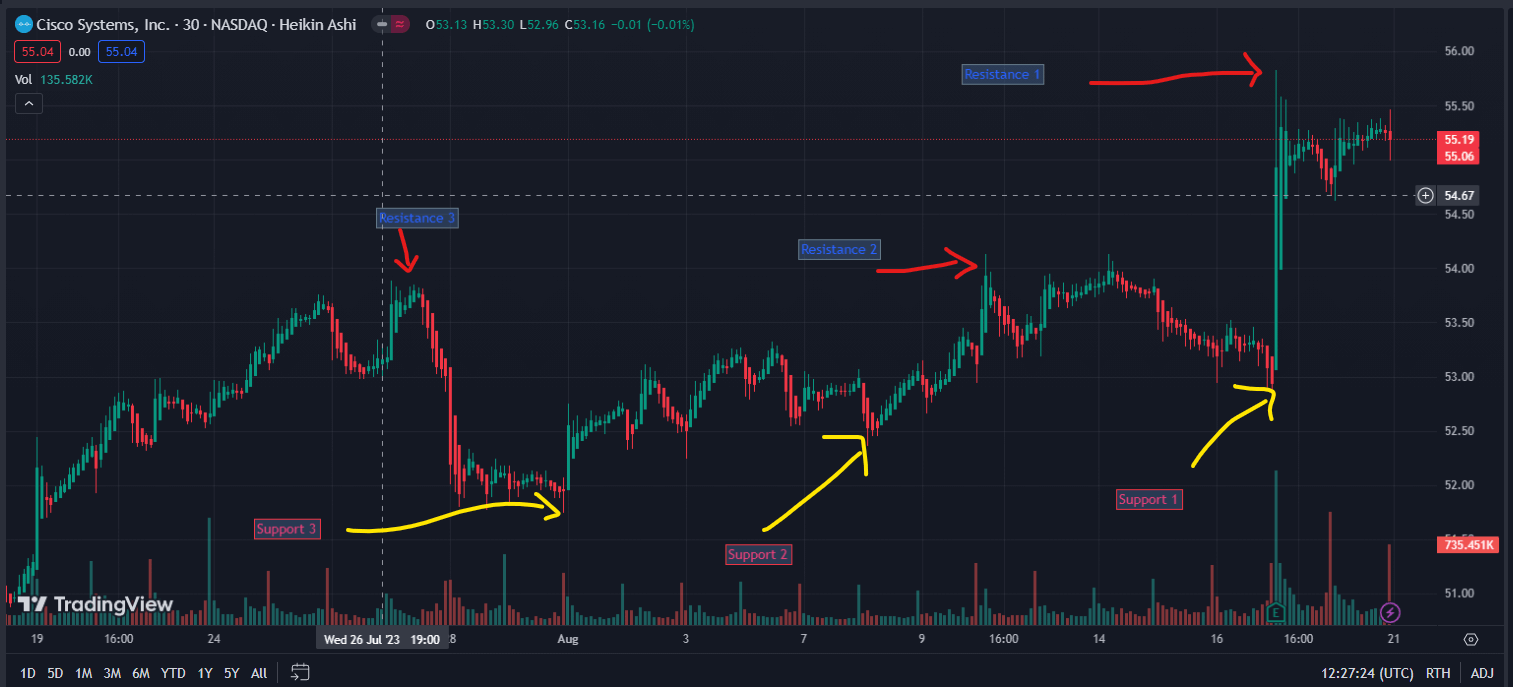

Cisco Stock Forecast

Cisco Systems stock price faces some key resistance and support levels in the near term. Based on the technical analysis of TradingView, the current resistance levels are $55.50, $54.00, and $53.80, while the current support levels are $52.50, $51.50, and $52.00.

Source: TradingView

The above chart shows that if the Cisco stock price rises to these levels, it is likely to encounter selling pressure and may reverse its upward movement. The current support levels are $52.50, $51.50, and $52.00. This means that if the CSCO stock price falls to these levels, it is likely to encounter buying pressure and may reverse its downward movement.

Analyst Recommendations

The table below shows some of the analyst recommendations and price targets for CSCO stock as of August 2023:

|

Analyst |

Rating |

Price Target |

Implied Upside/Downside |

|

Morgan Stanley |

Overweight |

$68 |

23.60% |

|

UBS |

Neutral |

$55 |

-0.10% |

|

Morningstar |

Hold |

$56 |

1.70% |

|

Melius Research |

Buy |

$68 |

23.60% |

|

Average |

Buy |

$61.75 |

12.20% |

Based on these forecasts, it seems that Cisco stock has a modest potential for growth in the future, but also faces some downside risks from competition and market uncertainty. Traders should be cautious and monitor the market trends and news closely before making any investment decisions.

Source: Cisco

Challenges and Opportunities

Cisco faces some competitive and operational risks that could affect its business performance and stock price. However, the company also has some growth opportunities and a positive future outlook that could enhance its competitive edge and market position.

Competitive Risks

Cisco operates in a highly competitive and dynamic industry that is constantly evolving with new technologies, standards, customer preferences, and regulations. The company competes with various players in different segments and markets, such as:

- Huawei, Juniper Networks, Arista Networks, Dell Technologies, Hewlett Packard Enterprise, Nokia, Ericsson, and ZTE in the networking hardware market

- Microsoft, Zoom, Slack, RingCentral, LogMeIn, Adobe, and Salesforce in the collaboration software market

- Palo Alto Networks, Fortinet, Check Point Software, FireEye, Zscaler, CrowdStrike, Okta, and Splunk in the security software market

Some of these competitors have lower cost structures, larger customer bases, stronger brand recognition, or more diversified product offerings than Cisco. They may also offer more innovative or disruptive solutions that could challenge Cisco's market leadership or reduce its profitability.

Despite all the above competitive risks, Cisco has some very strong competitive advantages. Sure, here are some of Cisco's competitive advantages:

- Brand recognition: Cisco is a well-known and respected brand in the networking industry. This gives the company a strong advantage over its competitors, as customers are more likely to choose Cisco products and services.

- Global reach: Cisco has a global reach, with operations in over 170 countries. This allows the company to serve customers all over the world and to better understand their needs.

- Customer base: Cisco has a large and loyal customer base. This gives the company a steady stream of revenue and allows it to invest in research and development.

- Product portfolio: Cisco has a broad product portfolio, which covers a wide range of networking products and services. This gives the company the ability to meet the needs of a variety of customers.

Other Risks

Cisco also faces some other risks that could adversely affect its business operations or financial results, such as:

- Supply chain disruptions or component shortages that could limit its production capacity or increase its costs

- Cybersecurity breaches or data privacy violations that could compromise its network infrastructure or customer data

- Legal disputes or regulatory actions that could result in fines, penalties, injunctions, or reputational damage

- Macroeconomic uncertainties or geopolitical tensions that could affect its global sales or operations

Source: Cisco

Growth Opportunities

Despite these risks, Cisco has some growth opportunities that could enable it to expand its market share, revenue streams, customer base, and competitive advantages. Some of these opportunities are:

- Leveraging its Internet for the Future strategy to build a new Internet architecture that can support the growing demand for bandwidth, speed, security, and intelligence

- Capitalizing on its Optimized Application Experiences portfolio to deliver better performance and user experience for applications across hybrid cloud environments

- Growing its recurring revenue from software subscriptions and services that provide higher margins and customer retention

- Investing in research and development and acquisitions to enhance its product innovation and differentiation capabilities

Future Outlook and Expansion

Cisco has a positive future outlook and plans to expand its business in various ways. Some of these plans are:

- Increasing its focus on software, cloud, security, and collaboration segments that have higher growth potential than hardware segments

- Pursuing strategic partnerships and alliances with other technology leaders such as Amazon Web Services, Google Cloud, IBM, Salesforce, and ServiceNow to offer integrated solutions to customers

- Expanding its presence in high-growth regions such as Asia-Pacific, Latin America, and Africa where there is a rising demand for digital transformation

- Enhancing its social responsibility and environmental sustainability initiatives to support its purpose of powering an inclusive future for all.

Why Traders Should Consider Cisco Stock

Cisco stock is a solid investment option for traders who are looking for a stable, reliable, and dividend-paying technology stock. Cisco has a strong market position, a loyal customer base, a diversified product portfolio, and robust financial performance. Cisco also has potential for growth, as it leverages its innovation capabilities and strategic partnerships to capture the opportunities in the fast-growing segments of cloud, security, collaboration, and IoT. Cisco also rewards its shareholders with generous dividends and buybacks, which enhance its shareholder value and returns.

Trading Strategies for Cisco Stock

Traders can use different trading strategies to profit from Cisco stock's price movements. Some of these strategies are:

CFD Trading: CFD trading is a form of derivative trading that allows traders to speculate on the price changes of an underlying asset without owning it. Cisco stock CFD trading has several advantages, such as:

- Lower capital requirements

- Higher flexibility: Traders can trade in both rising and falling markets, as they can go long (buy) or short (sell) on CFDs.

- Wider access: Traders can trade on a variety of markets and instruments, such as stocks, indices, commodities, currencies, and cryptocurrencies.

Swing Trading: Swing trading is a form of medium-term trading that involves holding positions for several days or weeks. Cisco stock swing traders aim to capture the price swings that occur due to market trends, cycles, or events. Swing trading has some benefits, such as:

- Lower risk.

- Higher reward.

- More time: Swing traders do not need to monitor the market constantly and can balance their trading with their other commitments.

Day Trading: Day trading is a form of short-term trading that involves opening and closing positions within the same trading day. Cisco stock day traders aim to exploit the price fluctuations that occur due to market news, sentiment, or momentum. Day trading has some advantages, such as:

- Higher profit potential

- No overnight risk: Day traders do not hold any positions overnight, which means they do not face any gap risk or interest charges.

- More opportunities: Day traders can trade on multiple markets and time frames and take advantage of market volatility and liquidity.

Source: Cisco

Trade Cisco Stock CFD with VSTAR

VSTAR is an online broker that offers CFD trading on various markets and instruments, including Cisco stock. VSTAR has some features and benefits that make it a great choice for traders who want to trade Cisco stock CFDs, such as:

- Low spreads and commissions: VSTAR offers competitive spreads and commissions on Cisco stock CFDs, which means lower trading costs for traders.

- High leverage and margin: VSTAR allows traders to trade with up to 1:200 leverage on Cisco stock CFDs, which means higher exposure and profit potential for traders.

- Fast execution and order types: VSTAR provides fast execution and various order types on Cisco stock CFDs, which means more control and flexibility for traders.

- Advanced trading platform and tools: VSTAR offers an intuitive and user-friendly trading platform that supports web, desktop, and mobile devices. The platform also provides various tools such as charts, indicators, news, and signals that help traders analyze the market and make informed decisions.

- Secure and regulated: VSTAR is regulated by the Cyprus Securities and Exchange Commission (CySEC) and follows strict security measures to protect its clients' funds and data.

- Customer support: VSTAR has improved their customer support, in fact, they are currently offering podcasts for mentoring traders.

Conclusion

Cisco Systems Inc is a leading technology company that provides networking, security, collaboration, cloud, and other products and services. The company has a strong financial position, consistent revenue growth, high profitability, and solid cash flow generation. The company also has growth potential, as it leverages its innovation capabilities and strategic partnerships to capture the opportunities in the fast-growing segments of cloud, security, collaboration, and IoT. The company also rewards its shareholders with generous dividends and buybacks.

Traders can use different trading strategies to profit from Cisco stock's price movements. Some of these strategies are CFD trading, swing trading, and day trading. Traders can also trade Cisco stock CFDs with VSTAR, an online broker that offers low spreads and commissions, high leverage and margin, fast execution and order types, an advanced trading platform and tools, and secure and regulated services.

Cisco Systems Inc is a well-established and reputable technology company that offers a range of products and services that are essential for the digital transformation of businesses and societies. Cisco stock is a solid investment option for traders who are looking for a stable, reliable, and dividend-paying technology stock with modest growth potential. However, traders should also be aware of the competitive and operational risks that Cisco faces and monitor the market trends and news closely before making any investment decisions.