Beyond Meat Inc (NASDAQ: BYND) is a company that has changed the way people think about meat. It offers food products that provide protein from plants as an alternative to animal-based meat, which is increasingly seen as harmful to the environment, human health, and animal welfare. Beyond Meat's mission is to find "a better way to feed the planet" while addressing some of the most pressing global issues of our time. Whether you are a potential investor, a trader, or simply curious about this innovative company, this article will provide investors with valuable insights and information.

Beyond Meat Inc's Overview

Source: Alamy

What is Beyond Meat

Beyond Meat Inc is a company that produces plant-based meat alternatives that aim to replicate the taste, texture, and nutritional benefits of animal-based meat. The company got founded in 2009 by Ethan Brown, who is still the president and CEO of the company. The company is headquartered in El Segundo, California, USA.

The company operates in two segments: retail and food service. The retail segment sells products directly to consumers through grocery stores, club stores, mass merchandisers, and e-commerce platforms. The food service segment sells products to restaurants, hotels, schools, hospitals, and other customers. The company's products include burgers, sausages, nuggets, tenders, meatballs, crumbles, and strips made from plant-based ingredients such as pea protein, soy protein, rice protein, mung bean protein, canola oil, coconut oil, and beet juice.

Some of the top shareholders of Beyond Meat Inc are The Vanguard Group Inc, BlackRock Fund Advisors, SSgA Funds Management Inc, Geode Capital Management LLC, and JPMorgan Securities LLC (Investment Management). Some of the top investors of Beyond Meat Inc are Kleiner Perkins Caufield & Byers LLC, Obvious Ventures LLC, Tyson Foods Inc (Venture Capital), Bill Gates (Individual Investor), and Leonardo DiCaprio (Individual Investor).

The company has achieved several significant milestones throughout its history. In 2012, the company introduced its first product, Beyond Chicken Strips, which debuted at Whole Foods Market. Progressing, in 2014, the company extended its offerings to include Beyond Beef Crumbles, marking its entry into plant-based beef alternatives. A pivotal moment arrived in 2016 with the introduction of The Beyond Burger, a pioneering plant-based burger that notably secured placement in the meat section of grocery stores. Collaborative efforts emerged in 2017 when the company partnered with Dunkin' to provide a plant-based breakfast sandwich.

Further cementing its trajectory, the company went public on the Nasdaq as BYND in 2019, making history as the first plant-based meat analog company to undergo public listing. The year 2020 witnessed the company's expansion into the Chinese market via a partnership with Alibaba Group, simultaneously launching a dedicated e-commerce platform for direct consumer sales. In 2021, the company established an advanced R&D center in Shanghai and introduced vegan chicken tenders into retail markets. In 2023, the company announced its plans to enter new product categories, such as plant-based eggs and cheese, and to expand its distribution network globally.

Beyond Meat Inc's Business Model and Products/Services

Source: Alamy

Beyond Meat makes money by selling plant-based meat alternatives to consumers and businesses. The company generates revenue from two segments: retail and food service. The retail segment sells products directly to consumers through grocery stores, club stores, mass merchandisers, and e-commerce platforms. The food service segment sells products to restaurants, hotels, schools, hospitals, and other customers. The company also earns revenue from co-manufacturing agreements, licensing fees, and royalties.

Main Products and Services

Beyond Meat offers a range of products that provide protein from plants as an alternative to animal-based meat. The company's products include burgers, sausages, nuggets, tenders, meatballs, crumbles, and strips made from plant-based ingredients such as pea protein, soy protein, rice protein, mung bean protein, canola oil, coconut oil, and beet juice. The company's products aim to replicate the taste, texture, and nutritional benefits of animal-based meat while avoiding the negative impacts of animal agriculture on the environment, human health, and animal welfare. The company's products get sold under the Beyond Meat brand name and get certified as vegan, kosher, halal, gluten-free, and non-GMO. The company also offers customized products and services to its foodservice customers based on their needs and preferences.

Beyond Meat Inc's Financials, Growth, and Valuation Metrics

Source: Alamy

Beyond Meat Inc is a company that has a market capitalization of $0.8 billion as of August 22, 2023, based on its closing stock price of $11.55 per share and its outstanding shares of 63.8 million.

BYND Earnings

The company reported a net loss of $53.5 million, or $0.83 per diluted share, for the second quarter of 2023, compared to a net loss of $97.1 million, or $1.53 per diluted share, for the same period in 2022. The company also suffered a revenue decline of 30.5% year-over-year, reaching $102.1 million for the second quarter of 2023, due to the impact of the COVID-19 pandemic and increased competition and pricing pressure in the retail and foodservice segments. Also, the company deteriorated its profit margins, reporting a gross margin of 2.2% and an operating margin of -52.4% for the second quarter of 2023, mainly due to higher manufacturing costs and lower net revenue per pound. The company also decreased its return on equity to -32.9% for the second quarter of 2023, compared to -38.7% for the same period in 2022.

Beyond Meat Inc has a weak balance sheet with $0.4 billion in cash and cash equivalents, $0.9 billion in total assets, and $0.5 billion in total liabilities as of June 26, 2023. The company has a low current ratio of 1.8, indicating its difficulty to meet its short-term obligations. The company also has a high debt-to-equity ratio of 0.6, meaning high leverage and financial risk. The company generated a negative operating cash flow of $17.6 million and a negative investing cash flow of $21.9 million for the second quarter of 2023, mainly due to operating losses and capital expenditures for capacity expansion and innovation.

Key Financial Ratios and Metrics

As of August 22, 2023, Beyond Meat Inc had a P/S ratio of 2.09, a P/B ratio of -2.79, and an EV/EBITDA ratio of -7.84. These ratios are much higher or lower than the industry average of 0.67, 1.92, and 10.32, respectively. This implies that Beyond Meat Inc's stock is trading at a premium or a discount to the industry, depending on the valuation metric used. However, some of its competitors, such as Impossible Foods and Oatly, also have high or negative valuation multiples, indicating that they are in the early stages of development and have high growth potential.

BYND Stock Performance Analysis

Source: TradingView

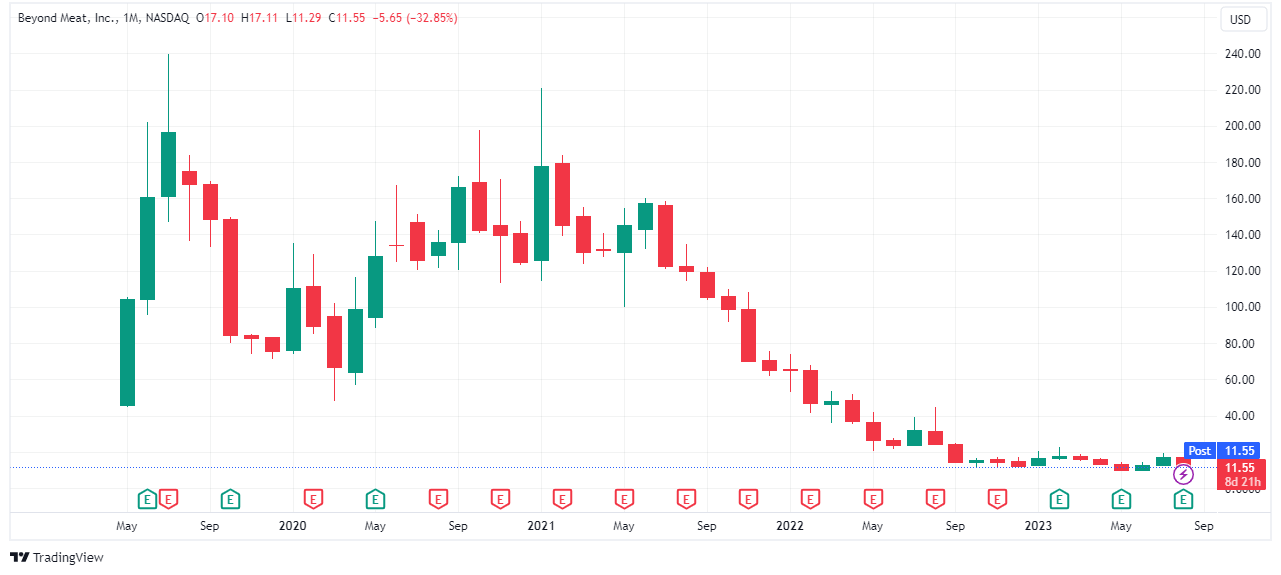

Beyond Meat, Inc. (BYND) has made its mark in the plant-based meat sector with a noteworthy stock performance. Founded in 2009, the company successfully entered the public market on May 2, 2019, debuting at an IPO price of $25 per share. BYND's listing on the Nasdaq Global Select Market, identified by the ticker symbol BYND, is denominated in U.S. dollars. The stock follows Eastern Time (ET) trading hours, from 9:30 a.m. to 4:00 p.m., supplemented by pre-market sessions from 4:00 a.m. to 9:30 a.m. and after-market sessions from 4:00 p.m. to 8:00 p.m. The company's IPO witnessed remarkable success, as its stock surged by over 160% on its first day of trading. Since its IPO, BYND has not undergone any stock splits or paid any dividends to its shareholders. The company has stated that it intends to retain all future earnings to fund its growth and does not anticipate paying any cash dividends in the foreseeable future.

BYND Stock Price Performance since its IPO

BYND's stock performance since its IPO has been disappointing and turbulent. The company went public on May 2, 2019, at an IPO price of $25 per share. The stock soared to an all-time high of $239.71 on July 26, 2019, but then plummeted to an all-time low of $54 on March 18, 2020, due to the impact of the COVID-19 pandemic on its foodservice channel. As of August 22, 2023, the stock closed at $11.55 per share, down 95% from its peak.

BYND stock is highly volatile, with a beta coefficient of 2.13, meaning it moves 2.13 times more than the market. This volatility is higher than some of its competitors, such as Impossible Foods (IMPF), with a beta of 1.51 and Oatly Group (OTLY), with a beta of 0.98.

Key Drivers of BYND Stock Price

- Demand for plant-based meat: BYND's revenue source lies in plant-based meat products catering to consumers seeking alternatives for various reasons. Positive news, such as new product launches and partnerships, can drive stock gains, while negative developments like recalls or controversies may lead to declines.

- Competition: In a competitive landscape, Beyond Meat faces challenges from rivals. Stock reactions get influenced by changes in market share or competitive positioning against competitors like Impossible Foods, Oatly Group, and others.

- Growth opportunities: BYND's strategy involves expanding into new markets and segments. Stock prices may rise with indications of successful growth ventures, while challenges may trigger declines.

- Beyond Meat news, financial performance and outlook: BYND's financial reports and guidance strongly impact its stock movement. Beating analysts' estimates or improving guidance can drive prices up while missing estimates or lowering guidance can result in declines.

BYND Stock Forecast

Source: TradingView

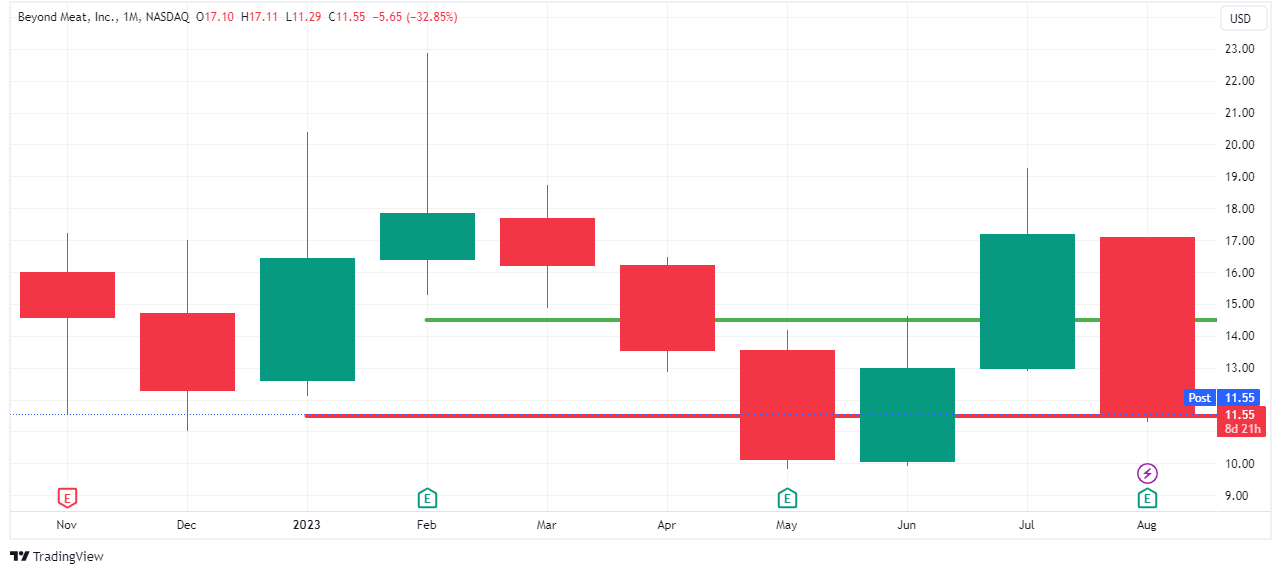

Resilient technical indicators, resistance, and support levels offer insights into potential price ranges where Beyond Meat stock price might encounter resistance or support. Utilizing TradingView charts, BYND's performance since July 2019 illustrates a persistent downtrend channel characterized by lower highs and lower lows. Notably, these channels' upper and lower boundaries serve as dynamic resistance and support levels, respectively. Presently, as of August 22, 2023, these levels stand at approximately $14.50 and $11.50. These critical benchmarks delineate BYND's short-term potential, signaling possible shifts in trajectory.

Analyst Recommendations and Price Targets

According to the ratings of 8 analysts in the last year, BYND's consensus rating is Reduce, with 4 sell ratings and 4 hold ratings, as per MarketBeat data. Price targets indicate mixed opinions: the average, $12.78 with a range of $8.00 to $18.00, suggests a -3% decline from the August 31, 2023 valuation of $12.19. Notable analysts' estimates include Piper Sandler's $18.00 (hold), Credit Suisse's $15.00 (sell), JPMorgan's $14.00 (sell), Barclays' $14.00 (sell), and UBS's $8.00 (sell). These varied perspectives reflect analysts' views, from neutral to bearish, highlighting the complex factors that influence Beyond Meat stock forecast.

Challenges and Opportunities

Source: Alamy

Beyond Meat Inc is a company that faces both challenges and opportunities in the plant-based meat industry.

Competitive Risks

Beyond Meat Inc has to compete with other companies that offer plant-based meat alternatives, such as Impossible Foods Inc, Oatly Group AB, Tattooed Chef Inc, and The Very Good Food Company Inc. These competitors may have different product offerings, pricing strategies, distribution channels, marketing campaigns, and customer bases. Beyond Meat Inc also has to compete with traditional meat producers and processors, such as Tyson Foods Inc, Hormel Foods Corp, and JBS SA. These competitors may have lower costs, higher margins, larger scale, and more loyal customers. Beyond Meat Inc's competitive advantages include its brand recognition, product quality, innovation capability, retail presence, foodservice partnerships, and social impact.

Other Risks

Beyond Meat Inc also faces other risks that may affect its business performance and growth prospects, such as regulatory uncertainties, legal disputes, supply chain disruptions, product recalls, consumer preferences, environmental issues, health concerns, and market volatility. Beyond Meat Inc has to comply with various laws and regulations in different countries and regions regarding food safety, labeling, packaging, advertising, and intellectual property. Beyond Meat Inc may also get involved in lawsuits or claims from its competitors, customers, suppliers, or regulators. Beyond Meat Inc relies on a network of suppliers and co-manufacturers to source its ingredients and produce its products.

Any disruption or shortage in the supply chain may result in higher costs, lower quality, or delayed delivery of its products. Beyond Meat Inc may also have to recall its products due to quality issues or contamination. Beyond Meat Inc's products may not appeal to all consumers due to their taste, texture, appearance, or price. Beyond Meat Inc's products may also negatively impact the environment or human health due to their production process or consumption effects. Beyond Meat Inc's stock price may also fluctuate due to market conditions, investor sentiment, analyst ratings, news events, and industry trends.

Growth Opportunities

Beyond Meat Inc has many opportunities to grow its business and expand its market share in the plant-based meat industry. Some of the main options are:

- Product Innovation: The company can continue innovating, introducing products with diverse flavors, textures, shapes, sizes, and nutritional profiles. Enhancing the taste, quality, consistency, and shelf life of existing products is also an avenue for improvement.

- Market Penetration: Strengthening relations with retail and foodservice customers can boost sales. Tactics include expanding shelf space, product availability, promotions, and loyalty programs in different outlets. Additionally, increasing offerings, visibility, marketing support, and customer satisfaction in restaurants, hotels, schools, and hospitals can drive growth.

- Market Expansion: Leveraging brand awareness, differentiation, innovation, and social impact can aid in entering new markets. Expanding geographically, especially in regions like Asia-Pacific, Europe, Latin America, and Africa, where demand for plant-based alternatives is growing due to environmental, health, ethical, or religious reasons. Diversifying into categories like seafood, dairy, eggs, or snacks also presents growth opportunities.

Future Outlook and Expansion

Beyond Meat is facing negative performance in the plant-based meat sector. The company lowered its 2023 revenue guidance to $375 million to $415 million, representing a decrease of approximately 10% to 1% compared to 2022. The gross margin is expected to deteriorate, reaching 2.2% in the second quarter of 2023, down from 6.7% in the first quarter. The company attributes the decline in revenue and margin to the impact of the COVID-19 pandemic, increased competition and pricing pressure, and unfavorable product sales mix. The company plans to use capacity expansion and innovation investments, but it may not be able to achieve its growth targets. Strategic partnerships and acquisitions are also uncertain, as the company faces challenges in entering new markets and categories.

Why Traders Should Consider BYND Stock

Source: Alamy

Traders should be cautious about BYND stock due to several conflicting factors. Beyond Meat Inc. is a pioneer in the plant-based meat sector, but it faces increasing competition and challenges from environmental, health, ethical, and regulatory perspectives. The company's brand recognition, product quality, innovation capability, retail presence, and foodservice partnerships may not be enough to sustain its competitive edge. In Q2 2023, Beyond Meat reported disappointing financial results, recording a 30.5% YoY revenue decline and a net loss of $53.5 million. Lower profit margins and return on equity reflect the company's deteriorating performance.

With a negative outlook, Beyond Meat lowered its revenue guidance for 2023 to $580 million to $600 million, citing the impact of the COVID-19 pandemic and increased competition and pricing pressure. The company plans to invest in capacity expansion and innovation initiatives, but it may not be able to achieve its growth targets. The company also faces uncertainties in entering new markets and categories, such as plant-based eggs and cheese. Technical indicators and analyst consensus suggest a sell signal for BYND stock, with a reduced rating and an average price target of $11.22, indicating a potential -3% decrease from the current price.

Trading Strategies for BYND Stock

When considering trading meat stock like BYND stock, traders have several strategies, each tailored to their goals, risk appetite, and time horizon.

1. CFD Trading

Contracts for Difference (CFD) trading offers a versatile approach, allowing traders to speculate on BYND stock price's value without owning the underlying asset. With the ability to go long and short, CFDs facilitate leveraging through margin, amplifying exposure and potential returns. CFDs enable traders to capitalize on rising and falling markets, diversify portfolios, and hedge against other positions. To engage in BYND stock CFD trading, traders must select a reputable and regulated CFD broker like VSTAR offering BYND stock as an instrument. A funded trading account is necessary, focusing on market analysis, entry, exit, and risk management strategies.

2. Trend Following

The trend following strategy involves tracking and riding dominant market trends. By utilizing technical analysis tools such as moving averages, trend lines, and indicators, traders identify and capitalize on trend direction and strength. Price action analysis, encompassing support and resistance levels, breakouts, and candlestick patterns, helps determine optimal entry and exit points. This strategy excels in capturing substantial profits over extended periods while adapting to shifting market conditions and maintaining discipline.

3. Swing Trading

Swing trading targets short-term price movements within larger trends. Using a mix of technical and fundamental analysis, traders employ tools such as moving averages, oscillators and pivot points. This strategy thrives on exploiting price fluctuations and volatility, balancing risk and reward with stop-loss orders and trailing stops. Swing traders use both technical and fundamental insights to refine their trading decisions.

In either approach, careful analysis of the prevailing trends and price dynamics of the BYND stock price is crucial. For CFD trading, identifying suitable brokers and maintaining well-funded accounts is essential. Trend followers rely on technical signals to confirm trend direction and strength. Swing traders focus on identifying price swings within trends for timely entries and exits. In all cases, adherence to risk management principles is pivotal. By understanding these strategies, traders can navigate the complexities of BYND stock trading effectively, aligning their actions with individual preferences and objectives.

Trade BYND Stock CFD with VSTAR

If you have an interest in trading BYND stock CFDs, you may want to consider VSTAR as your preferred CFD broker. VSTAR is a globally regulated platform offering CFD trading on various markets, including BYND stock, with advantages like super low trading costs, deep liquidity, lightning-fast execution, full regulation under CySEC and MiFiD II, a user-friendly platform, and 24/7 live support. Benefit from competitive spreads, zero commissions, top-tier liquidity, rapid order execution, and a platform compatible with desktop, web, and mobile devices. VSTAR's regulatory compliance and comprehensive support ensure a secure and seamless trading experience.

Conclusion

BYND stock is a popular and volatile instrument that offers many trading opportunities for traders interested in the plant-based meat industry. Investors can trade BYND stock using different strategies, such as CFD trading, trend following, and swing trading, depending on the trader's goals, risk appetite, and time horizon. Traders who want to trade BYND stock CFDs can choose VSTAR as their preferred CFD broker, as VSTAR offers many benefits and advantages. Traders should always do their research and analysis before entering any trade and use proper risk management techniques to protect their capital and profits.

FAQs

1. What is BYND stock forecast for 2025?

Given the growth projections for the plant-based meat market, analysts estimate that BYND stock could reach $15-$20 per share by 2025.

2. What is the all-time high for Beyond Meat stock?

The highest closing price of BYND stock to date is $239.71, which occurred on July 26, 2019, shortly after its 2019 IPO debut.

3. How can I invest in Beyond Meat stock?

Buy and hold BYND shares directly, trade BYND options contracts, trade CFDs to go long or short on BYND stock price.