BYD Company Limited is a leading electric vehicle (EV) manufacturer in China and the world. The company produces various products, including passenger cars, buses, trucks, batteries, and solar panels. BYD stock is listed on the Hong Kong Stock Exchange and the Shenzhen Stock Exchange and has attracted many investors and traders over the years.

But how can you make money from BYD's stock price history? What are the factors that drive the price of BYD stock today? And what are the best ways to trade BYD CFDs with VSTAR, a global regulated trading platform that offers low-cost access to over 1000 markets? In this article, we will answer these questions and more.

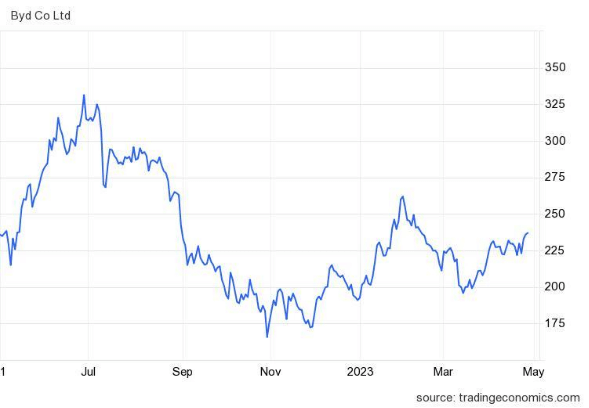

BYD stock price history

BYD stock trades under the ticker symbol 1211 on the Hong Kong Stock Exchange and 002594 on the Shenzhen Stock Exchange. As of April 27, 2023, BYD has a market capitalization of $200.56 billion.

BYD's stock price history shows that the company has experienced significant growth and volatility over the years. The company went public in Hong Kong in 2002 at HK$10.95 per share and in Shenzhen in 2011 at 18.00 CNY per share. Since then, BYD's stock price has reached several highs and lows, reflecting the company's performance and market conditions.

Some of the notable milestones in BYD stock price history are:

● In 2009, BYD's stock price surged by over 400% after Warren Buffett's Berkshire Hathaway invested US$230 million for a 10% stake in the company.

● In 2010, BYD's stock price reached an all-time high at the time of HK$85.50 per share, driven by strong sales of its plug-in hybrid car F3DM and its pure electric car E6.

● In 2012, BYD's stock price plummeted to HK$13.98 per share due to declining profits, quality issues, and competition from other EV makers.

● In 2016, BYD's stock price rebounded to over HK$60 per share. The company became the world's largest EV manufacturer by sales volume and benefited from China's subsidies and policies to promote green vehicles.

● In 2020, BYD stock price soared by over 400% again, as the company launched its new Blade Battery technology and its premium EV brand Han, and received positive ratings from analysts and investors.

● In 2021, BYD's stock price fluctuated between HK$150 and HK$250 per share as the company faced challenges from the global chip shortage, rising raw material costs, and regulatory uncertainties.

● In 2022, BYD's stock price climbed to over HK$300 per share. The company reported record-breaking sales and earnings, expanded its production capacity and global presence, and launched new models and technologies.

Major events and news affecting BYD stock price

BYD stock price history is influenced by various events and news that affect the company's performance and the industry's outlook. Some of the significant events and news that have impacted BYD stock price are:

● The launch of new products and technologies, such as the F3DM plug-in hybrid car in 2008, the E6 pure electric car in include Blade Battery technology in 2020, and the Han premium EV brand in 2020.

● The changes in China's policies and regulations regarding EVs include subsidies for EV purchases, quotas for EV production and sales, emission standards for vehicles, and the anti-monopoly rules for tech companies.

● The competition from other EV makers in China and abroad, such as Tesla, Nio, Xpeng, Li Auto, Geely, Volkswagen, Toyota, and Hyundai.

● The global events and trends affecting EV demand and supply include the COVID-19 pandemic, the chip shortage crisis, the environmental awareness movement, and the innovation wave.

Comparison with other stocks in the same industry or market

BYD stock price history can also be compared with other stocks in the same industry or market to evaluate its performance and potential. Some of the main competitors or peers of BYD are:

● Tesla (TSLA), the US-based EV leader, has a market capitalization of US$514.86 billion as of April 29, 2023. Tesla's stock price has increased by over 1000% since 2018, reaching an all-time high of US$409.97 per share in November 2021. Tesla's main advantages are its brand recognition, innovation capability, loyal customer base, and global expansion strategy.

● Nio (NIO) is a China-based EV maker focusing on premium smart EVs. Nio has a market capitalization of US$13.15 billion as of April 29, 2023. Nio's stock price has increased by over 3000% since 2019, reaching an all-time high of US$62.84 per share in February 2021. Nio's main advantages are its high-quality products, innovative features, user-centric services, and loyal community.

● Xpeng (XPEV) is a China-based EV maker focusing on smart EVs powered by advanced technologies. Xpeng has a market capitalization of US$8.20 billion as of April 29, 2023. Xpeng's stock price has increased by over 200% since its IPO in August 2020, reaching an all-time high of US$72.17 per share in November 2020. Xpeng's main advantages are its strong R&D capability, cutting-edge software and hardware, and fast growth potential.

● Li Auto (LI) is a China-based EV maker focusing on extended-range electric vehicles (EREVs). Li Auto has a market capitalization of US$24.28 billion as of April 29, 2023. Li Auto's stock price has increased by over 150% since its IPO in July 2020, reaching an all-time high of US$43.96 per share in November 2020. Li Auto's main advantage is its unique EREV technology that combines the benefits of EVs and hybrid vehicles.

BYD has a more diversified product portfolio, a more established market position, a more integrated supply chain, and a more profitable business model compared with these competitors or peers. However, BYD also faces challenges from rising competition, changing consumer preferences, evolving technologies, and uncertain regulations in the EV industry.

What are the characteristics of BYD stock price?

Carrying out a BYD stock analysis shows that the company’s stock has distinctive characteristics that traders should know before investing or trading. Some of these characteristics are:

Volatile

BYD stock price is prone to large fluctuations in a short period due to various factors such as news, events, rumors, sentiment, and speculation. This means BYD stock prices can experience rapid rises and falls, creating opportunities and risks for traders.

Active

BYD stock price is one of the most actively traded stocks in the Hong Kong and Shenzhen markets, with high trading volume and liquidity. This means BYD stock prices can be easily bought and sold, and there is always a buyer and a seller for every trade.

Influenced by multiple markets

The performance and trends of multiple markets, such as the EV market, the battery market, the solar market, the Chinese market, the US market, and the global market, influence BYD stock price. This means that BYD stock prices can be affected by various factors and events in different markets and regions.

Responsive to company news

BYD stock price is highly responsive to the company's news and announcements, such as product launches, earnings reports, partnerships, awards, lawsuits, etc. This means that BYD stock news can significantly impact the stock price, making it react quickly and strongly to any positive or negative news about the company.

What factors drive the price of BYD stock today?

Today's price of BYD stock is driven by a combination of factors related to the company and the wider industry. Economic conditions, such as GDP growth, consumer spending, and interest rates, shape demand for electric vehicles (EVs) and BYD's profitability. Industry trends, like competition, technological innovations, and consumer preferences, also affect the stock price as they impact BYD's growth potential and challenges. Additionally, government policies, including subsidies and regulations, can influence opportunities and risks for the company. Lastly, BYD's performance and news, such as financial results, product launches, and partnerships, can impact its reputation and credibility, further affecting the stock price.

What to learn from BYD stock history and how to get profit from BYD

BYD stock history can provide valuable insights and lessons for traders who want to profit from the ups and downs of BYD stock price. Some of these insights and lessons are:

Pros and cons of investing in BYD

Investing in BYD has advantages and disadvantages, depending on an investor's goals, risk appetite, and time horizon. Pros include the company's volatility, which creates opportunities for active traders, a diversified product portfolio covering various EV industry segments, an integrated supply chain offering cost advantages and quality control, and a profitable business model generating positive cash flow and earnings growth.

On the other hand, cons encompass high competition from other EV makers like Tesla, Nio, and Volkswagen, regulatory uncertainty due to changing policies and regulations from the Chinese government and other governments, and quality issues such as recalls and accidents that can damage BYD's reputation and incur legal liabilities and costs.

Investment strategies for traders

Traders looking to profit from BYD's stock price history should consider these investment strategies.

Long-term holding: Buy and hold BYD shares for an extended period, benefiting from compound returns and dividends while withstanding short-term volatility.

Short-term CFD trading: Take advantage of short-term price movements with VSTAR by trading CFDs, profiting from rising and falling trends but involving higher risk and leverage.

Analyzing stock price history: Utilize technical, fundamental, and sentiment analysis to make informed decisions based on historical data, trends, and market mood.

Diversifying the investment portfolio: Reduce risk and exposure to BYD by investing in uncorrelated assets across different industries, markets, regions, or asset classes, and use VSTAR to access over 1000 markets and various trading instruments.

How to trade BYD CFD with VSTAR?

One of the most effective ways to trade BYD stock price history is by trading BYD CFDs on VSTAR, a globally regulated platform offering affordable access to over 1000 markets. Vstar is regulated by the Cyprus Securities and Exchange Commission (CySEC), VSTAR features a user-friendly app that enables trading in various instruments such as FX, CFD indices, US shares, HK stocks, crypto and commodities. Here’s how to trade BYD CFD with VSTAR:

1. Understand the difference between investing and trading

Investing in BYD stock means buying and holding the shares for an extended period, hoping that they will increase in value over time. Trading BYD CFDs means speculating on the price movements of BYD stock without owning the shares, allowing traders to profit from rising and falling prices. For example, a trader can go long on BYD CFDs by buying 100 CFDs at $50 with 10:1 leverage and make $500 if the price rises to $55 or go short on BYD CFDs by selling 100 CFDs at $50 with 10:1 leverage and make $500 if the price drops to $45. Trading BYD CFDs on VSTAR also offers advantages such as lower fees, higher leverage, and access to global markets.

2. Practice using a VSTAR demo account

A demo account allows you to trade with virtual money and simulate real market conditions without risking any real money. You can use the demo account to practice long and short positions on BYD CFDs and other instruments available on VSTAR.

3. Develop a trading strategy by defining trading goals

Choose a time frame, identify entry and exit signals for going long or short, and set risk and reward parameters. A trading strategy helps traders plan and execute their trades consistently and objectively.

4. Manage risk by using leverage wisely

Leverage allows traders to trade with more money than they have in their account, but it also magnifies the potential losses. Traders should use leverage cautiously and adjust it according to their risk appetite and market conditions. Stop loss and take profit orders help traders to lock in profits and limit losses automatically when the price reaches a predetermined level. Traders should also follow risk management best practices such as diversifying their portfolio, limiting their exposure per trade, and reviewing their performance regularly.

Why trade BYD CFD with VSTAR?

Trading BYD CFD with VSTAR offers several advantages, including low-cost trading through zero commission fees, tight spreads, and low minimum deposit and trade sizes. VSTAR's high leverage of up to 1: 200 allows traders to trade with more money than in their account, magnifying profits and losses. The Cyprus Securities and Exchange Commission (CySEC) regulates the platform and operates under the European MiFID II framework, ensuring security and protection for traders' funds and data. Additionally, VSTAR's user-friendly app enables trading on the go with real-time market information, charts, indicators, tools, and a $100,000 risk-free demo account to practice and develop trading strategies.

Conclusion

BYD's stock price history offers valuable insights into the company's growth and the EV industry, reflecting its position as a leading and innovative company. To capitalize on this, traders can use VSTAR, a globally regulated trading platform offering low-cost access to over 1000 markets and various advantages, including low-cost trading, high leverage, global regulation and security, and a user-friendly app.

To trade BYD CFDs with VSTAR, traders need a clear strategy aligned with their objectives, risk tolerance, time frame, effective risk management using leverage, stop loss and take profit orders, and portfolio diversification. Trading BYD CFDs on VSTAR can be a rewarding experience for those interested in the EV industry. The VSTAR app is available on Google Play and the App Store for easy access to start trading.