Gold has long been a popular investment asset due to its label as a safe-haven asset and its ability to hedge against inflation. However, investors face a decision between investing in physical assets, such as gold bullion or coins, or financial derivatives, such as gold CFDs (contracts for difference) or futures contracts. Each option comes with its advantages and disadvantages. Regardless of the choice, investors should carefully evaluate the risks and potential rewards of each option and consider how it fits into their overall investment portfolio.

I. Introduction

A. A brief explanation of physical gold and gold CFD

Physical gold refers to gold in its physical form, such as gold bullion or coins. Investors can purchase physical gold and hold it as a tangible asset, either by storing it themselves or through a third-party storage facility. Physical gold can offer a sense of security and ownership, as investors have direct control over their investments.

On the other hand, gold CFDs are financial derivatives to speculate on the gold's price movements without owning the physical asset. CFDs are contracts between two parties where the seller agrees to pay the buyer the difference between the current price of gold and its price when the contract is closed. Gold CFDs are traded on margin, which means that investors only need to put up a fraction of the value of the contract to open a position. This can provide investors with greater leverage and potential returns, but it also increases the potential for losses.

B. Importance of understanding the difference between the two options

Understanding the difference between physical gold and gold CFDs is vital for investors to make informed decisions about their investments. For example, investors who prioritize owning a physical asset and are comfortable with the associated costs and risks may prefer to invest in physical gold. On the other hand, investors who prioritize liquidity and flexibility may choose gold CFDs.

It is also essential to consider the risks associated with each option. Physical gold is subject to risks such as theft and damage. Physical gold is subject to risks such as theft, damage, storage, and insurance costs. Gold CFDs, on the other hand, are subject to risks such as leverage, counterparty risk, and market volatility.

II. Physical Gold

A. Definition and Characteristics

Explanation of physical gold and its properties

Physical gold refers to real, solid gold that investors can purchase and own in its physical form, as opposed to paper gold, which represents ownership of gold through financial instruments such as ETFs, futures contracts, or options.

Gold has unique properties that make it desirable as a physical investment. It is a dense, malleable, and ductile metal that does not corrode or tarnish. Gold is also highly conductive to heat and electricity and is an excellent reflector of light. These properties make it a popular material for jewelry, electronics, and other industrial applications.

Types of physical gold (coins, bars, bullion)

There are different types of physical gold that investors can purchase, including gold coins, gold bars, and gold bullion. Gold coins are usually minted by governments and have a legal tender value in their country of origin. They may have a higher premium over the spot price of gold due to their collectible value or rarity. Gold bars are rectangular blocks of gold produced by private mints or refineries and come in different sizes and weights, ranging from a few grams to hundreds of ounces. Gold bullion refers to any form of investment-grade gold that is at least 99.5% pure, such as gold bars, coins, and rounds.

Cost and storage considerations

The cost of physical gold can vary depending on the type and the dealer's markup. Gold coins may have higher premiums over the spot price of gold due to their collectible value, while gold bars and bullion may have lower premiums but higher fabrication costs. In addition, investors need to consider storage and insurance costs when purchasing physical gold. Physical gold can be stored at home, in a bank-safe deposit box, or in a third-party storage facility, and each option comes with different costs and risks.

One example of a physical gold investment is the American Gold Eagle coin contains one troy ounce of gold produced by the US Mint. The coin has a face value of $50 but is worth much more due to its gold content and collectibility. Another example is the London Bullion Market Association (LBMA) Good Delivery Gold Bar, the international standard for gold traded in the wholesale market. The bar is 400 troy ounces and is at least 99.5% pure gold.

B. Advantages of Physical Gold

Physical gold has long been considered a valuable investment due to its numerous advantages.

Tangible physical asset

Physical gold is a tangible (real) asset that investors can hold in their hands, which is a significant advantage over other forms of investments that exist only on paper. The possession of physical gold offers a feeling of safety and authority since it is a tangible property that can be conveniently stored and moved.

Universally recognized store of value

Gold, with its timeless allure, has been deemed a reliable store of wealth for millennia, and its universal recognition and acceptance stand as a testament to its enduring value. It is not tied to any specific currency or government, making it a reliable hedge against economic instability and political uncertainty.

Protection against inflation and economic uncertainty

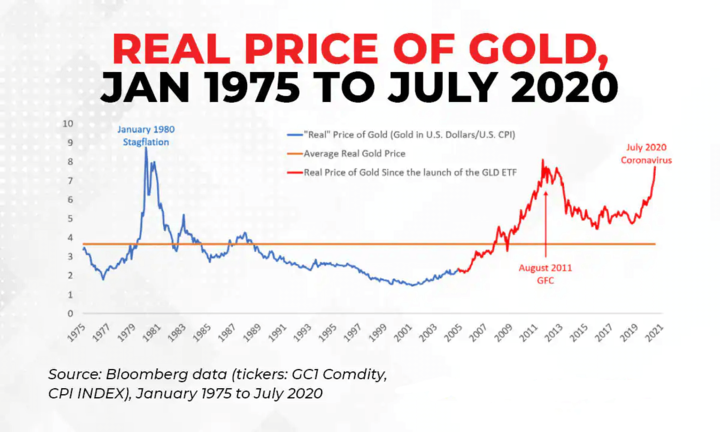

Physical gold can provide a hedge against inflation and economic uncertainty. As the value of paper currencies fluctuates, the value of gold typically remains stable, making it a valuable asset during economic turmoil.

As evidenced by the cases of Venezuela and Zimbabwe, physical gold has demonstrated its dependability as a safe haven during periods of hyperinflation or economic disintegration. In these situations, the paper currency loses value rapidly, while the value of physical gold remains relatively stable. Additionally, during times of global economic uncertainty, such as the 2008 financial crisis, physical gold prices increased significantly as investors sought out safe-haven assets.

C. Disadvantages of Physical Gold

Physical gold has been a popular investment choice for centuries due to its perceived value and stability. However, like any investment, physical gold also has several disadvantages that potential investors should consider before investing.

High upfront costs and transaction fees

One of the main disadvantages of physical gold is its high upfront costs and transaction fees. When purchasing physical gold, investors often pay a premium above the spot price of gold. For example, a one-ounce gold coin may cost $1,500 even if the current spot price of gold is $1,200. This premium, known as the "numismatic value," can vary based on factors such as rarity, age, and condition.

In addition to the premium, investors may also need to pay transaction fees. These fees can include shipping costs, insurance, and handling fees. For example, if an investor buys physical gold through an online dealer, they may have to pay shipping costs to have the gold delivered to them. These costs can add up and significantly impact the overall return on investment.

Storage and security concerns

Another disadvantage of physical gold is its storage and security concerns. Unlike other investments like stocks and bonds, physical gold must be stored safely. This means that investors may need to invest in a safe or pay for secure storage. Additionally, investors must ensure the security of their gold, as it is often a target for theft. This can be incredibly challenging for investors who want to keep their gold at home, as they may need to take extra precautions to protect it.

Limited liquidity and ability to sell quickly

Lastly, limited liquidity and the ability to sell quickly are significant disadvantages of physical gold. When investors need to sell their gold, they often face difficulties finding a buyer at a fair price. Furthermore, the process of selling physical gold can be time-consuming and costly. For example, an investor may need to transport their gold to a dealer or auction house, which can incur additional costs.

III. Gold CFD

A. Definition and Characteristics

Explanation of gold CFD and its properties

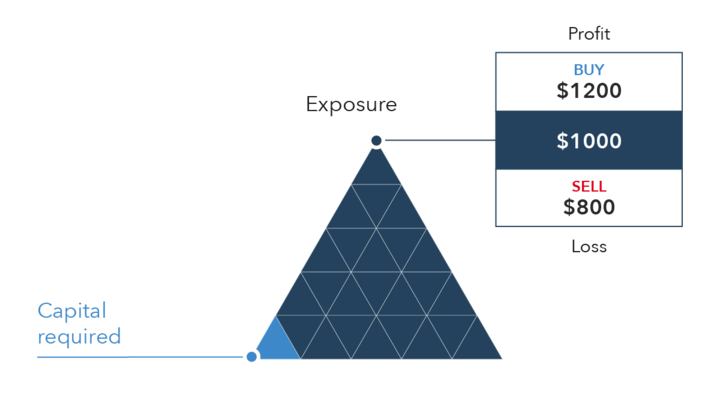

Gold CFDs (contracts for difference) are applied to speculate on the gold's price movements without physical ownership. In a gold CFD trade, a trader makes an agreement with a broker to exchange the variation in the gold price from the beginning to the end of the contract. Gold CFDs are traded on margin, which means that traders only need to deposit a percentage of the total value of the trade to open a position.

One of the main characteristics of gold CFDs is their leverage. Leverage enables traders to control a larger position than the amount of capital they have deposited. For example, if a trader has $1000 and a broker provides a leverage ratio of 1:100, the trader can control a position size of $100,000. This means that a small price movement in the underlying asset can result in a significant profit or loss.

Another characteristic of gold CFDs is that they are derivative instruments. This means that the value of the CFD is derived from the price of gold rather than representing actual ownership of the commodity. This makes trading gold CFDs more accessible to traders who may not want to own physical gold or who may not have the resources to store and secure the commodity.

Benefits of trading gold CFDs

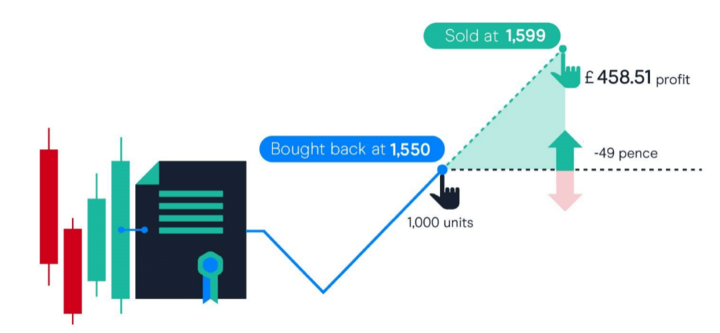

There are several benefits to trading gold CFDs. Firstly, gold CFDs offer flexibility in terms of trading strategies. Traders can go long (buy) or short (sell) gold CFDs depending on their market outlook. Traders have the opportunity to earn profits from price increases as well as decreases.

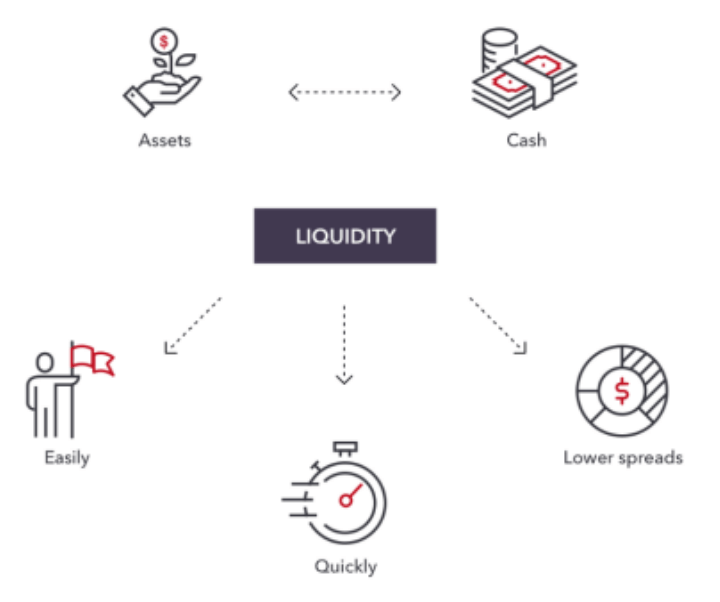

Secondly, gold CFDs offer high liquidity. Traders can transact CFDs quickly and easily, which makes it easier to take advantage of short-term price movements.

Lastly, gold CFDs offer low transaction costs compared to physical gold trading. Traders only need to pay the spread (the difference between the bid and ask price) and any overnight financing fees. The cost-effectiveness of trading gold CFDs makes it a more attractive option for traders than buying physical gold, which can be a costly affair owing to high transaction fees and storage charges.

B. Advantages of Gold CFD

Some of the main advantages of gold CFD trading are as follows:

No ownership of physical assets is required

No ownership of a physical asset is required. Gold CFD trading allows traders to benefit from the gold's price movements without having to purchase or store the physical asset. This means that traders can easily access the gold market without the hassle of storing and securing the metal. Additionally, CFDs offer a higher level of flexibility, allowing traders to trade on rising and falling gold prices.

For instance, suppose that the current market price of gold is $1,800 per ounce, and a trader expects the price to rise. They can enter into a CFD contract with a broker, and if the price of gold increases to $1,850, the trader will earn a profit of $50 per ounce without owning the physical asset.

Access to instant trading with low transaction costs

Access to instant trading with low transaction costs: Gold CFD trading offers traders instant access to the market with low transaction costs. As there is no physical ownership of the asset, there are no associated storage, insurance, or delivery costs. Traders can initiate and terminate positions rapidly and proficiently without bearing substantial trading charges.

A wide range of trading platforms are available

Gold CFD trading is available on a wide range of trading platforms, including mobile applications, desktop trading platforms, and web-based trading platforms. Traders have the flexibility to choose a trading platform that suits their individual trading styles and preferences.

For instance, a trader can use a mobile application to quickly enter and exit trades while on the go. On the other hand, a desktop trading platform may offer more advanced charting tools and features, allowing traders to conduct in-depth technical analysis.

C. Disadvantages of Gold CFD

There are some disadvantages associated with gold CFDs that should be considered before investing.

Does not offer the same tangible asset as physical gold

The primary drawback of gold CFDs lies in their inability to offer the same level of physical possession and control as that of physical gold. CFDs enable traders to capitalize on the price fluctuations of an underlying asset without owning it physically. While this can prove to be a convenient mode of investing in gold sans the hassles of possessing a tangible asset, it also implies that traders cannot possess the gold or utilize it for any other purpose.

For instance, if a trader invests in a gold CFD and the gold price surges, they can benefit from the price differential. However, they cannot swap the CFD for physical gold bars or coins, which can be a significant limitation for some traders.

A higher degree of market risk

Gold CFDs are subject to market risk, just like any other financial instrument. Gold prices can fluctuate due to a multitude of factors, such as shifts in economic conditions, political tensions or instability, and investor confidence or fear. The price of gold is subject to sudden and large fluctuations. Such volatility can expose traders who invest in gold CFDs to higher risks.

For example, if a significant economic crisis occurs, such as a recession or a global pandemic, the price of gold can increase rapidly as investors seek safe-haven assets. However, if the crisis is resolved quickly or does not significantly impact the global economy, the price of gold can fall just as quickly.

Limited protection against global economic uncertainty

While gold is often considered a safe-haven asset during economic uncertainty, gold CFDs may not offer the same level of protection as physical gold. In some cases, CFDs may be more vulnerable to economic fluctuations and market volatility than physical gold.

For example, during hyperinflation, physical gold can retain its value and provide a hedge against inflation. However, a gold CFD may not offer the same level of protection, as its value is tied to the price of gold and can be influenced by several other factors.

IV. Comparison between Physical Gold and Gold CFD

Let's take a closer look at how these two investment options compare in terms of price, liquidity, ownership, and storage.

A. Price

Physical gold and gold CFDs have different prices and price fluctuations. The price of physical gold is based on the gold's spot price, which is the price at which gold is traded on the global market. The price of gold CFDs, on the other hand, is based on the price of physical gold but can fluctuate more rapidly due to market conditions and leverage.

For instance, if the gold's spot price is $1,500 per ounce, the price of a physical gold bar will also be $1,500 per ounce. However, the price of a gold CFD may fluctuate more rapidly due to market conditions and can be affected by a variety of other factors, such as geopolitical events or economic indicators.

B. Liquidity

The concept of liquidity refers to the degree of ease with which an asset can be traded without causing a significant impact on its market value. Physical gold is generally less liquid than gold CFDs because buying and selling physical gold requires the physical transfer of the asset, which can be more cumbersome and costly than trading gold CFDs online.

In contrast, gold CFDs can be bought and sold more quickly and easily through online trading platforms, which makes them a more liquid investment option than physical gold. However, it's worth noting that the liquidity of gold CFDs can vary depending on the platform and market conditions.

C. Ownership

One of the main advantages of physical gold is that it represents ownership of a tangible asset that can be physically held, stored, and transported. In contrast, gold CFDs represent ownership of a financial derivative that tracks the price of gold but does not provide ownership of the actual gold asset.

For example, if you buy a physical gold bar, you own it and can physically store it in a safe or a vault. If you buy a gold CFD, you do not own any physical gold, but you have a financial contract that tracks the price of gold.

D. Storage

Storage is necessary for physical gold, as it is a physical asset that needs to be stored in a secure location to protect it from theft, damage, or loss. Physical gold can be stored in a home safe, a bank vault, or a specialized storage facility, but it may come with additional costs and security risks.

Gold CFDs, on the other hand, do not require any physical storage because they are traded online through a broker. Investors who wish to avoid the risks and storage costs associated with physical gold can benefit from this.

V. Which investment option is best: Buy Physical Gold or Trade Gold CFD?

When considering whether physical gold or gold CFDs are the best investment option, several factors should be taken into account. These include the individual investor's investment goals, risk tolerance, market conditions, and the economic outlook.

A. Factors that impact the choice

Individual investment goals: An investor's goals can significantly impact their choice of investment. For instance, if an investor intends to find a reliable long-term asset for value preservation and portfolio diversification, physical gold might be a more appropriate choice. On the other hand, if an investor is looking for short-term trading opportunities, gold CFDs may be a more attractive option due to their liquidity.

Risk tolerance: Risk tolerance is another essential factor to consider. Physical gold is generally considered a lower-risk investment due to its long-term store of value and historical stability. Gold CFDs, on the other hand, carry a higher degree of risk due to their leverage and rapid price fluctuations.

Market conditions and the economic outlook can also play a role in determining the best investment option. During periods of economic uncertainty or inflationary pressures, physical gold may be a more attractive option due to its historical ability to maintain value during turbulent times. Conversely, during stable or growing markets, gold CFDs may offer more attractive trading opportunities.

B. Conclusion

Ultimately, Just like a customized suit that fits perfectly, the best investment option between physical gold and gold CFDs depends on the individual investor's unique investment goals, risk appetite, and market conditions. Thorough research and analysis are essential before making any investment decisions. Seeking advice from a financial advisor or investment professional can also provide valuable insights and guidance. Ultimately, choosing the right investment option requires careful consideration, and investors should select the one that aligns with their specific needs and goals for optimal success in the long term.

VI. How to trade gold CFDs on VSTAR

If you're interested in trading gold CFDs, VSTAR offers a user-friendly platform that allows you to trade on global markets with low costs and deep liquidity. Here's how to get started:

Open an account with VSTAR: To start trading gold CFDs on VSTAR, you'll need to open an account. The process is quick and easy, and you can sign up on their website or mobile app.

Fund your account: After creating an account, the next step is to fund it. VSTAR has a low minimum deposit requirement of only $50, which makes it a feasible option for both novice and seasoned traders.

Choose the gold CFD you want to trade: After funding your account, you can begin trading gold CFDs. VSTAR provides various gold CFDs, including futures, spot gold, and ETFs. Select the gold CFD that aligns with your investment objectives and trading approach.

Analyze the market: Before making any trades, it's crucial to analyze the market and identify potential entry and exit points. VSTAR provides a range of tools and resources to help you analyze the market, including real-time charts and technical indicators.

Place your trade: Once you've identified a trading opportunity, it's time to place your trade. VSTAR provides traders with tight spreads and rapid execution, enabling them to open and close positions quickly and efficiently.

Monitor your trade: It is crucial to closely monitor your trade once it has been opened. VSTAR offers real-time updates on your trades, so you can see how they're performing and adjust your strategy accordingly.

VII. Key Takeaways

The investment world offers two unique options, buy physical gold, and trade gold CFDs, each presenting its own pros and cons. Physical gold is a real asset, which can be owned and kept, and has proven to be a reliable store of value for centuries. In contrast, gold CFDs allow investors to trade the price of gold without possessing the underlying asset and offer more nimbleness and fluidity in trading, along with the possibility of enhanced liquidity.

As investors ponder over the fork in the road, they ought to introspect on their investment aspirations and appetite for risk. For instance, if an investor seeks a steadfast sanctuary for their wealth over the long haul, they might lean towards the preciousness of physical gold endowed with an enduring legacy of stability. Conversely, if they are enticed by the potential for swift gains in the fleeting present, the malleability and marketability of gold CFDs could prove more alluring.

Investors need to understand the risks associated with physical gold and gold CFDs. Physical gold requires storage and carries the risk of theft or loss, while gold CFDs have market risk and may be subject to rapid price fluctuations.

By doing so, investors can choose the option that best aligns with their specific needs and goals.