To strengthen its November completion $69 billion acquisition of VMware, Broadcom has implemented new invoicing models and streamlined product bundles. Although these measures are consistent with the approaches taken by Broadcom in prior acquisitions, not every customer of VMware is amenable to these modifications.

Is VMWare Acquisition Worthy?

Broadcom, well-known for acquiring mundane yet crucial microchip components and instituting cost-cutting measures, is now implementing similar strategies with VMware, its largest acquisition in the enterprise software sector.

The VMware Cloud Foundation division of Broadcom has drastically reduced its product catalog from nearly a thousand to two bundles in recent months. Furthermore, perpetual license sales have been substituted with a payment model that requires a full subscription. Working Documents Retraining Notifications and Worker Adjustment Notifications indicate that the organization has implemented reductions; however, Broadcom has not commented.

Modifying the division's bundles results from partner and customer feedback, indicating that more excellent value can be achieved by streamlining the portfolio. It is purported that adopting a subscription model facilitates ongoing innovation, expedites time to value, and ensures investments are predictable.

Analysts Forecast On Broadcom Stock

At its core of 600 customers, Broadcom's business philosophy is predicated on cross-selling and upselling, which distinguish it from conventional strategies employed in the software industry. This strategy has caused some CIOs concern, particularly in light of Broadcom's evident emphasis on its most valuable clients.

According to a forecast by Forrester, 20% of VMware customers may initiate the search for alternatives by 2024. On the contrary, certain industry specialists, such as Stephen Elliot from International Data Corp, perceive the simplification of the product portfolio as a chance for clients to enhance the value they derive from their VMware investments and foster a more proactive interaction with the organization.

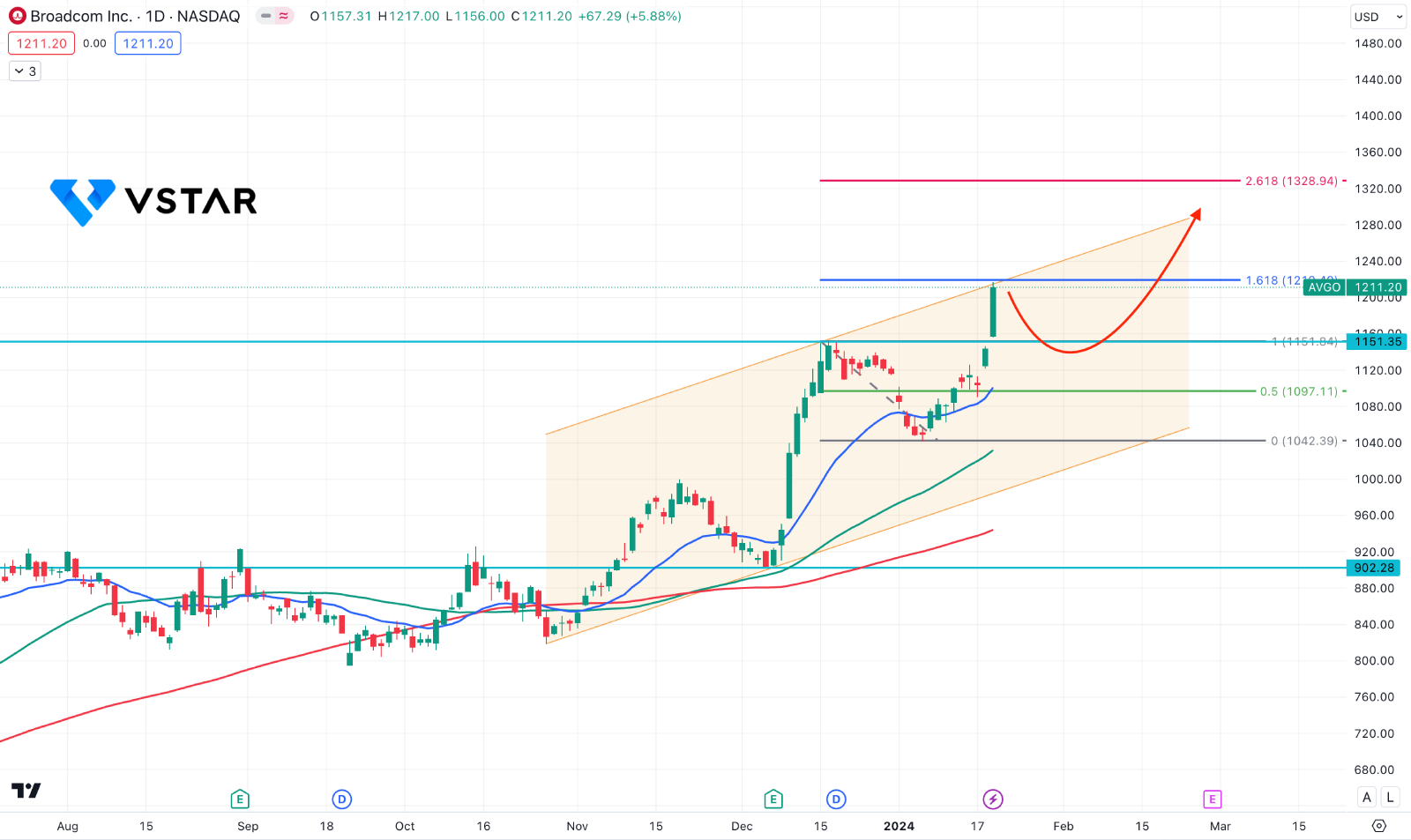

AVGO Stock Technical Analysis

In the daily chart of AVGO stock price, the ongoing buying pressure is solid, with strong fundamental support. As a result, the most recent price made a new high and tapped into the ascending channel resistance.

The ongoing bullish momentum is supported by all Moving Averages, which suggests an impulsive pressure. Moreover, the daily RSI rebounded above the 70.00 level, indicating a confluence support for bulls.

Based on this outlook, the ongoing bullish pressure could extend towards the 1328.94 level, which is a crucial Fibonacci Extension level. However, a downside correction is potent, where a bullish rebound from the 1120.00 to the 1042.00 area could offer another long opportunity.