- With a 40% projected surge to $50 billion in fiscal 2024, driven by the VMware integration and robust semiconductor growth, positive revenue indicators could potentially bolster investor confidence, impacting stock price positively.

- Despite a cyclical slowdown in some areas, the growth in generative AI revenue, representing 20% of semiconductor revenue in Q4 2023, and the anticipation of exceeding 25% in fiscal 2024 could signal potential market expansion, favorably impacting stock prices.

- The restructuring of VMware to emphasize cloud environments and the divestiture of non core assets might lead to potential market alignment, positively influencing stock price in line with renewed strategic direction.

As Broadcom announces its Q4 2023 results and outlines its ambitious fiscal 2024 projections, the company showcases a remarkable growth trajectory. With a solid rise in net revenue, strategic segment performances, and an impressive outlook for the future, Broadcom seems poised to capitalize on semiconductor advancements and VMware's integration.

Revenue Analysis

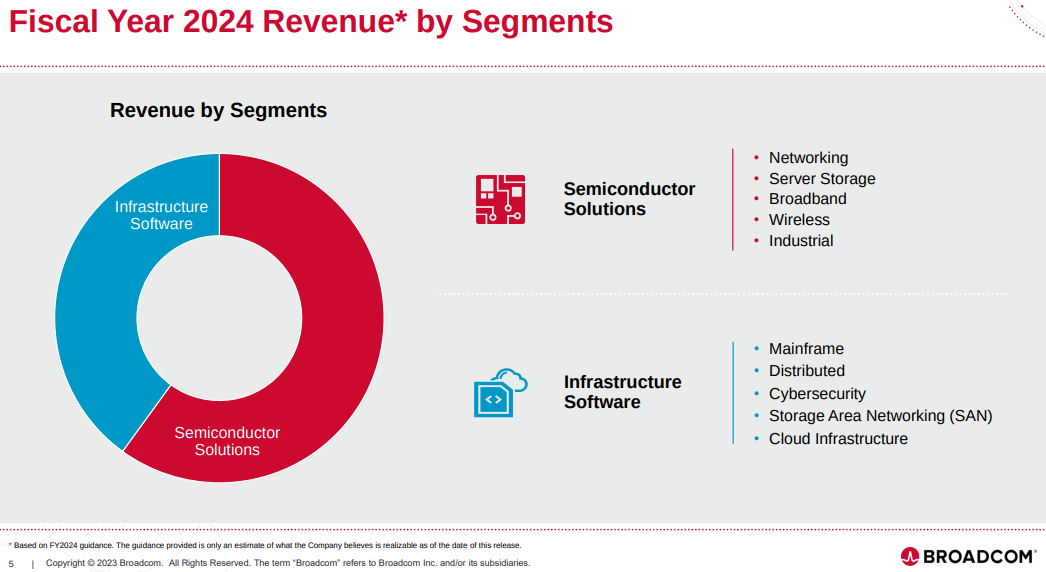

Broadcom's fiscal Q4 2023 consolidated net revenue stood at $9.3 billion, marking a 4% year-on-year increase, aligned with previous guidance. The semiconductor solutions revenue grew by 3% to $7.3 billion, while infrastructure software revenue rose by 7% to $2 billion.

Semiconductor Segment: The semiconductor segment witnessed a 3% year-on-year revenue increase, reaching $7.3 billion. A significant portion of this was attributed to generative AI revenue, notably driven by Ethernet solutions and custom AI accelerators, accounting for approximately $1.5 billion or 20% of semiconductor revenue.

Infrastructure Software Segment: The infrastructure software segment, encompassing CA, Symantec, and Brocade, experienced a 7% year-on-year revenue growth, totaling $2 billion in Q4. Notably, consolidated renewal rates averaged 119% over expiring contracts, emphasizing the recurring nature of over 90% of renewal value via subscription and maintenance.

Source: Company Overview

Fiscal Year 2023 Performance and Forecast for 2024

In fiscal 2023, Broadcom achieved a record revenue of $35.8 billion, indicating an 8% year-on-year growth. The operating profit grew by 9%, reaching $22.1 billion, while free cash flow expanded by 8%, amounting to $17.6 billion or 49% of fiscal 2023 revenue. Additionally, $13.5 billion was returned to shareholders through dividends and stock buybacks.

The acquisition of VMware was completed in November 2023, leading to a revised outlook for fiscal year 2024. The integration and restructuring of VMware are expected to contribute significantly. Broadcom foresees fiscal 2024 consolidated revenue of $50 billion, reflecting a substantial 40% year-on-year growth.

Infrastructure Software Segment (2024): With the integration of VMware, the infrastructure software segment is anticipated to generate $20 billion in revenue, consisting of $8 billion from CA, Symantec, and Brocade, and a significant $12 billion contribution from VMware.

Semiconductor Segment (2024): The semiconductor solutions revenue is projected to experience mid-to-high-single-digit percentage year-on-year growth in fiscal 2024. The generative AI revenue is anticipated to surpass 25% of semiconductor revenue, compensating for the expected lack of growth from non-AI semiconductor revenue.

Segment-wise Analysis

Semiconductor Segment

Networking: Q4 networking revenue surged by 23% year-on-year, driven by hyperscalers' demand for custom AI accelerators and networking products, totaling $3.1 billion. The networking revenue in fiscal 2023 reached $10.8 billion, demonstrating a robust 21% year-on-year growth. A significant portion, approximately $8 billion, represented pure silicon-based networking connectivity. For fiscal 2024, a 30% year-on-year growth in networking revenue is anticipated, propelled by accelerated deployment of networking connectivity and AI accelerators in hyperscalers.

Wireless: Q4 wireless revenue witnessed a sequential increase of 23% but declined by 3% year-on-year, totaling $2 billion. In fiscal 2023, wireless revenue remained relatively flat at $7.3 billion. The engagement with North American customers remains strategic, anticipating stable revenue for fiscal 2024, aligning with the previous year's figures.

Server Storage Connectivity: Q4 revenue for server storage connectivity decreased by 17% year-on-year, amounting to $1 billion. Fiscal 2023 witnessed an 11% year-on-year growth in this segment, reaching $4.5 billion. For fiscal 2024, an anticipated decline in revenue by mid-to-high-teens percentages is expected due to cyclical weaknesses that emerged late in 2023.

Broadband: Q4 broadband revenue declined by 9% year-on-year to $950 million. However, fiscal 2023 exhibited an 8% year-on-year growth, reaching $4.5 billion. For fiscal 2024, a further decrease by low-to-mid-teens percentage year-on-year is predicted, reflecting continued cyclical weakness in service providers.

Infrastructure Software Segment

Revenue Growth: In Q4, the infrastructure software business expanded by 7% year-on-year to $2 billion. The strategic accounts exhibited robust performance, averaging 130% in renewals. For fiscal 2023, revenue reached $7.6 billion, with a 3% year-on-year growth. A projected revenue of $8 billion is anticipated for fiscal 2024, representing a 4% year-on-year increase.

VMware Integration: VMware's integration aims to refocus on core business activities like creating private and hybrid cloud environments for large enterprises globally. With VMware contributing $12 billion to the 2024 revenue, the company anticipates a trajectory of accelerated growth over the next three years by converting perpetual licenses to subscription-based models and enhancing its software stack to attract and retain workloads.

Financial Performance

Q4 Financials: Consolidated revenue for Q4 was $9.3 billion, with gross margins at 74.3% of revenue. Operating income was $5.7 billion, reflecting a 4% year-on-year increase. Adjusted EBITDA stood at $6 billion, accounting for 65% of revenue, excluding $124 million of depreciation.

Full Year Financials: Fiscal 2023 revenue hit a record $35.8 billion, with an operating income of $22.1 billion. Adjusted EBITDA reached $23.2 billion, representing 65% of net revenue, excluding $502 million of depreciation. Free cash flow grew by 8% year-on-year to $17.6 billion.

Capital Allocation and Shareholder Returns

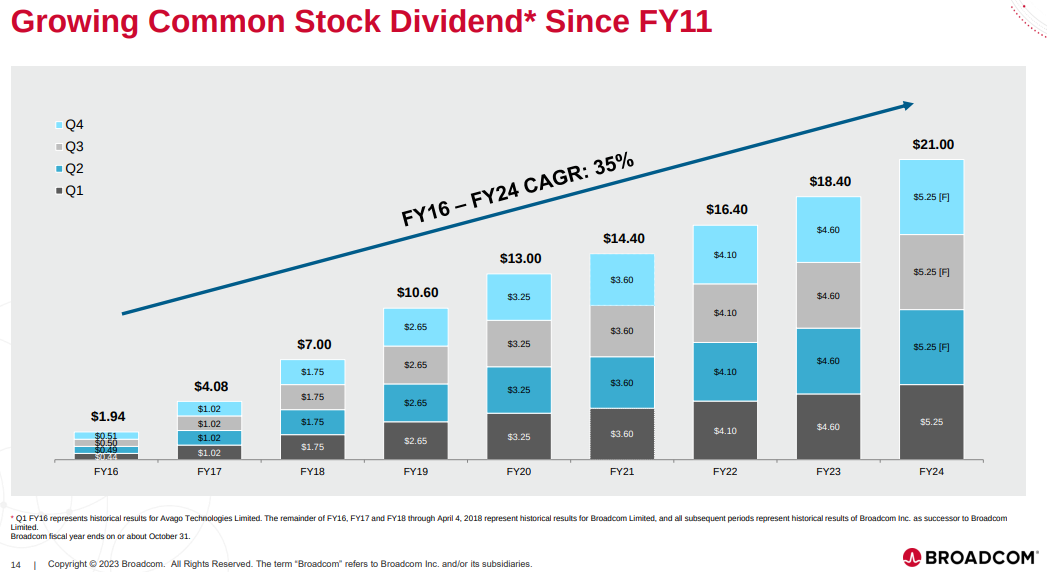

Capital Allocation: In fiscal 2023, Broadcom allocated $15.3 billion, including $7.6 billion in cash dividends and $7.7 billion in share repurchases. The company ended the year with $7.2 billion of authorized share repurchase programs remaining.

Shareholder Returns: Post VMware acquisition, Broadcom resumed share repurchases under the existing program. The non-GAAP diluted share count for fiscal 2024 is anticipated to be around 494 million. Broadcom increased the quarterly common stock cash dividend in Q1 fiscal 2024 to $5.25 per share, marking a 5% year-on-year increase.

Source: Company Overview

Implications on Broadcom Stock Price

Strategic Shift and Focus on Core Business

Broadcom's focus on core business areas like generative AI, networking, and VMware's cloud foundation could significantly impact the stock price positively. Successful execution of these strategies could instill market confidence and potentially lead to stock price appreciation.

Revenue Diversification and Growth Trajectory

Broadcom's plans for revenue diversification and growth, particularly in the semiconductor and infrastructure software segments, could attract investor interest and contribute to long-term stock price appreciation. The company's emphasis on subscription-based models in infrastructure software may enhance recurring revenue and stabilize earnings.

Cyclical Challenges in Certain Segments

Challenges faced in segments like server storage connectivity and broadband might concern investors and impact stock price growth due to uncertainties regarding recovery timelines and market conditions. The cyclical weaknesses in these segments could lead to revenue declines and affect investor sentiment negatively.

Financial Performance and Guidance

Broadcom's strong financial performance and optimistic guidance for fiscal 2024, with expected revenue growth and EBITDA margins, may enhance investor confidence. This confidence could translate into increased investor interest, potentially influencing AVGO stock price growth.

Share Repurchases and Dividends

Resumed share repurchases and increased dividends demonstrate management's confidence in future cash flows. These shareholder-friendly initiatives might attract income-focused investors, contributing to stock price stability or growth.

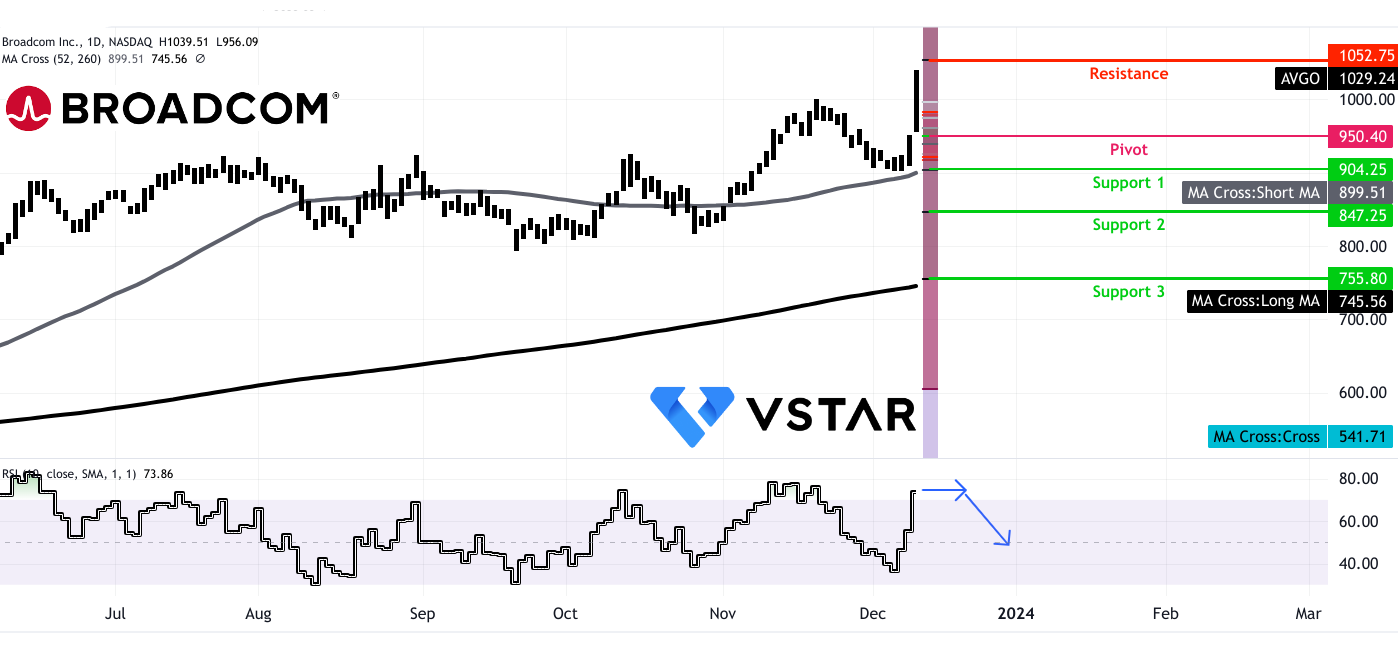

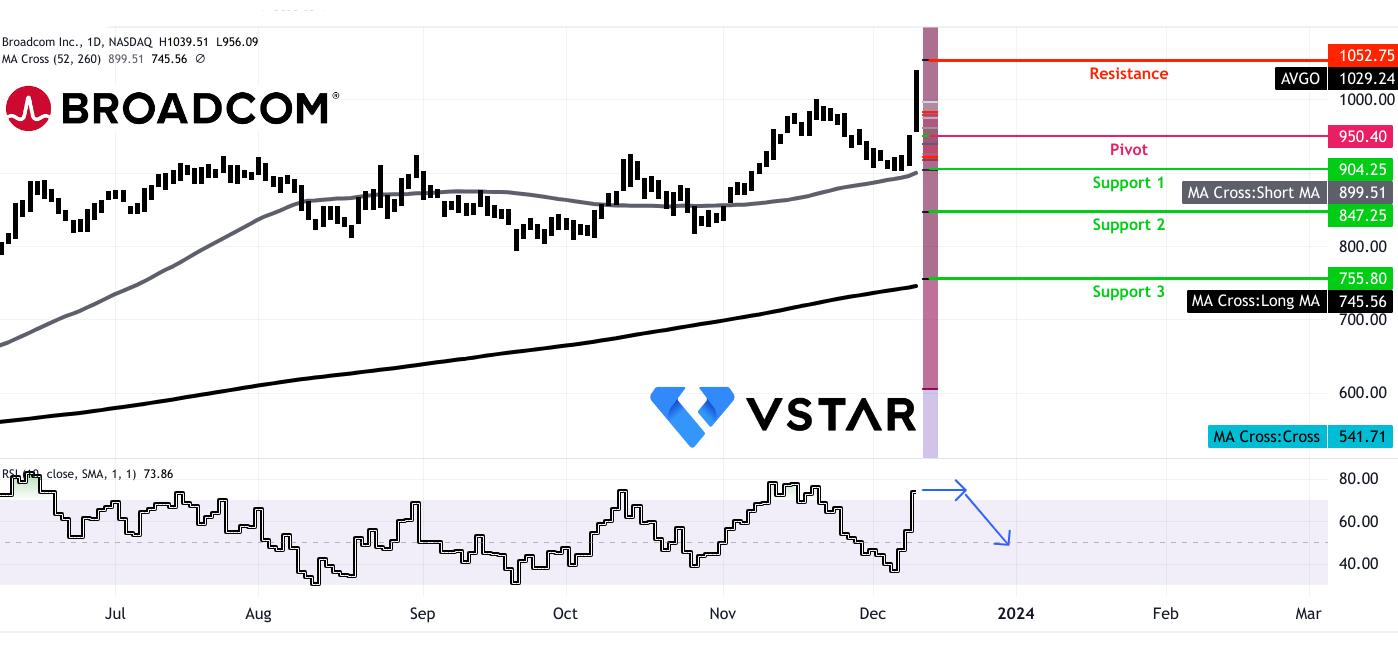

AVGO Stock Technical Take

The price of AVGO is boosted to new highs after earning. However, considering the Relative Strength Index (RSI), the price may revert towards the mean as it is currently hovering in an overbought trajectory. Based on the Fibonacci retracement, the price may hit $1052.75, which is a vital resistance for 2023. During correction, long positions can be established and the dollar averaged at the support levels of $904.25, $847.25, and $755.80, which mimic the dynamic support levels formulated by 52-day and 260-day moving averages. There are possibilities for RSI to reach a level of 50 that serve as a rationale behind potential correction.

In conclusion, Broadcom's strategic decisions, revenue diversification, financial performance, and future guidance are critical drivers that could significantly impact its stock price. While growth opportunities in core areas might lead to positive market sentiment, challenges in specific segments or execution risks may influence investor perception and impact stock price movements. The successful integration of VMware and sustained growth in revenue, particularly in networking and AI-related solutions, are pivotal factors that could drive Broadcom's stock price trajectory in fiscal 2024 and beyond.