Berkshire Hathaway is a multinational conglomerate led by Warren Buffett. It invests in a variety of industries, including insurance, utilities, railroads, and manufacturing. By 2024, Berkshire Hathaway is expected to reach a market value of $750 billion, making it one of the most valuable companies in the world. Berkshire Hathaway will release its earnings report before the market opens on February 22, which may have an impact on the following types of stocks:

Stocks of companies in the portfolio

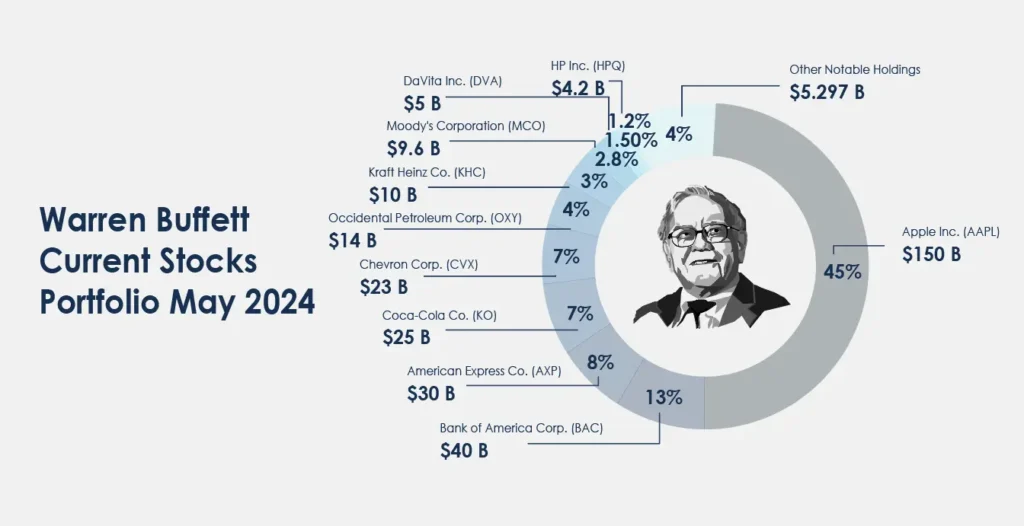

Berkshire Hathaway has a wide portfolio that includes stocks of many well-known companies. When the earnings report is released, the market will pay attention to changes in Berkshire's holdings in these companies, especially whether there are new purchases, sales, or increases or decreases in positions. The following are some of Berkshire Hathaway's major investment targets, and the earnings report may affect their stock prices:

Apple Inc. (AAPL): Berkshire Hathaway is one of Apple's largest single shareholders. Any changes in Apple's holdings or Buffett's comments on Apple's future prospects will have a significant impact on Apple's stock price.

American Express (AXP): Berkshire has long held American Express shares, and Buffett has always been very optimistic about its business model. Berkshire's earnings report may reveal whether it has increased or reduced its holdings in the stock, or provide insights into its future prospects.

Coca-Cola (KO): As one of Berkshire's earliest investments, any buying or selling actions regarding Coca-Cola, or Buffett's assessment of its position in the consumer goods industry, will be closely watched by investors.

Chevron (CVX) and other energy stocks: Berkshire has invested heavily in the energy sector in recent years, including Chevron and other energy companies. The description of these investments in the earnings report may affect the performance of energy stocks, especially when oil prices are volatile.

Wells Fargo (WFC): Although Berkshire has gradually reduced its holdings in Wells Fargo in recent years, the company still has a large weight in bank stocks. If the change in its holdings in Wells Fargo is revealed when the earnings report is released, it may have an impact on bank stocks.

Berkshire's other investments: Large-cap stocks such as JPMorgan Chase (JPM), Goldman Sachs (GS), and Disney (DIS) will all be paid attention to when the earnings report is released, especially in the context of whether Berkshire has increased or reduced its holdings in these stocks.

Insurance industry stocks

One of Berkshire Hathaway's core businesses is insurance. It owns several insurance companies, such as GEICO and General Re, and also indirectly invests in other insurance-related companies through its investment portfolio. Berkshire may mention the performance of its insurance business in its financial report, which may affect stocks in the entire insurance industry, especially:

UnitedHealth (UNH)

Cigna (CI)

Aflac (AFL)

Stocks in the consumer goods industry

Berkshire has many investments in the consumer goods sector, especially some well-known brands such as Duracell, See’s Candies, Fruit of the Loom, etc. Berkshire's financial reports may include discussions about the performance and future development expectations of these subsidiaries, which in turn affect other stocks in the consumer goods industry, especially:

Procter & Gamble (PG)

Johnson & Johnson (JNJ)

Technology stocks

Although Buffett is known for not investing in technology stocks, in recent years he has increased his investment in technology company stocks such as Apple through Berkshire. Therefore, any announcements about technology investments when earnings are released could affect other large technology stocks similar to Apple, such as:

Microsoft (MSFT)

Amazon (AMZN)

Google's parent company (Alphabet, GOOG)

Banks and financial stocks

Berkshire's investments in the financial sector are also very extensive, involving several large banks and financial institutions. Especially in the earnings report, Berkshire's views on the financial market and whether it increases or reduces its holdings in financial stocks will have an impact on the entire financial industry. For example:

Bank of America (BAC)

Energy and Utilities

Berkshire's investments also cover the energy and utilities sectors. Buffett's attitude towards the energy industry and whether Berkshire continues to increase or reduce its holdings in energy stocks will also affect these related stocks in the market. For example:

Exxon Mobil (XOM)

NextEra Energy (NEE)

Affecting a wide range of macroeconomic indicators and market sentiment

Because Berkshire's financial report not only involves the company's own financial performance, but also Buffett's interpretation of the macro economy, the comments on the market, economic policies or global situation in the financial report will also have an important impact on market sentiment. Especially in times of great economic uncertainty, Buffett's views on the economy and the market may trigger investors to re-evaluate other industries or even the entire stock market.

Summary

Berkshire Hathaway's financial report release will not only directly affect the individual stocks it invests in, but may also affect multiple industries in the entire market through Buffett's remarks or portfolio changes. In particular, the stock price fluctuations of core holdings such as Apple, Coca-Cola, and American Express may trigger changes in sentiment in related industries and markets. Therefore, investors will pay close attention to Berkshire's financial reports and Buffett's comments to capture possible investment opportunities or risks.

*Disclaimer: The content of this article is for learning only, does not represent the official position of VSTAR, and cannot be used as investment advice.