As a dominant force in the aerospace industry, Boeing presents traders with a compelling opportunity to grow their portfolio and succeed with their investments. Explore why investing in Boeing can unlock the power of your trades in the dynamic world of finance. If you want to discover the trading prowess of Boeing Co (NYSE: BA), then stay with us on this article.

I. Boeing Co's Overview

Boeing is an American multinational corporation known for designing, manufacturing, and selling airplanes, satellites, rockets, and more. It is a major player in the aerospace industry, with a market capitalization of $126.9 billion as of June 8, 2023.

Founded in 1916 by William E. Boeing, the company has achieved significant milestones, including introducing the first all-metal airliner in 1933 and the first commercial jet airliner in 1947. Boeing is structured into divisions such as Commercial Airplanes, Defense, Space & Security, Global Services, and Capital. Dave Calhoun has served as CEO since January 2021, bringing his expertise as a former CEO of General Dynamics.

II. Boeing Co's Business Model and Products/Services

A. Business Model

Boeing, a prominent player in the aerospace industry, operates on a robust business model centered around the design, manufacture, and sale of commercial aircraft, defense products, and aerospace technology. Additionally, the company provides comprehensive after-sales support, training, and services for its wide range of offerings.

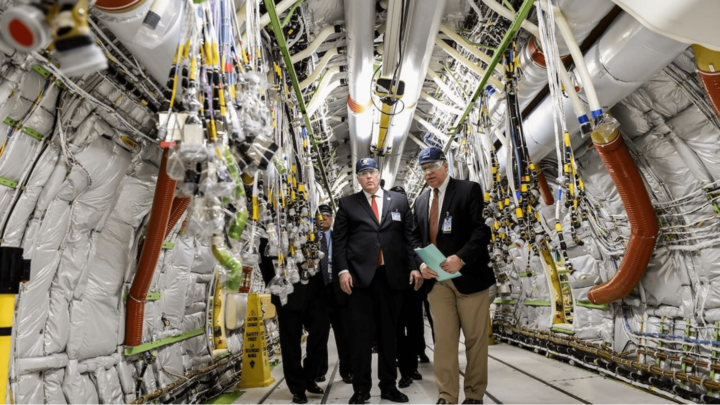

As the largest commercial aircraft division globally, Boeing boasts a commanding market share of over 50%. Their commercial aircraft portfolio includes highly sought-after models such as the 737 MAX, 787 Dreamliner, and 777. In the realm of defense products, Boeing also holds a significant presence, specializing in fighter jets, bombers, and missiles. Notable products in this domain include the F-15 Eagle, F-18 Hornet, and AH-64 Apache.

B. Main Products/Services

A number of essential items are included in the product and service offerings of the company. The Commercial Airplane Unit is responsible for the design, development, and manufacturing of commercial aircraft such as the 737 and the 787. The Defense, Space, and Services Units cater to clients in the government sector, providing them with a wide variety of products and services, some examples of which are fighter jets, weaponry, satellites, and space/technology services. In addition to this, Boeing Capital Corporation acts as a global provider of various financing options for commercial airplanes, defense equipment, and space systems.

Customers from over 150 different countries, including airlines, governments, and defense contractors, make use of the extensive product portfolio that Boeing has to offer. The unrelenting pursuit of innovation is one of the fundamental concepts that underpins the business model of the company. This helps to ensure that the company's products and services are always at the cutting edge of developments in their respective industries. In addition, Boeing places a significant focus on quality, making it a priority to provide products and services that meet or exceed the industry's most stringent criteria.

The business model of Boeing, which is driven by innovation, quality, safety, and sustainability, continues to consolidate the company's position as a leader in the aerospace industry by responding to the varied requirements of the company's international clientele.

III. Boeing Co's Financials, Growth, and valuation Metrics

A. Review of Boeing Co's financial statements

The financial accounts of Boeing Co. provide valuable insight into the operations of the firm as well as its future prospects. A consistent increase in the company's top line has been demonstrated by Boeing's experience of a revenue growth rate of 3.5% yearly over the course of the past five years. The corporation has been able to keep its profit margins quite steady, and they currently sit at about 8% for their net profit margin. This suggests that a stable amount of profit is being generated.

Cash flow from operations has shown positive growth for Boeing over the previous five years, increasing at a compound annual growth rate of 6% throughout that time period. This would imply that the company's operating cash flow has been consistently improving, which is an indication that the company is in good financial health and has the ability to generate cash.

B. Key financial ratios and metrics

One notable strength of Boeing is its strong balance sheet, evident from a debt-to-equity ratio of 0.5. This indicates that the company has more assets than liabilities, which provides a solid foundation and financial stability.

However, when compared to its peers like Airbus and Embraer, Boeing's revenue and earnings growth appear to be slower. Additionally, Boeing's forward price-to-earnings (P/E) ratio is higher than its peers, indicating that the market anticipates faster growth for the company in the future.

Considering these factors, it seems that Boeing may be undervalued at present. With a strong balance sheet and the potential for accelerated revenue and earnings growth, the company holds promise. However, it is important to bear in mind that the aerospace industry is cyclical, and Boeing's stock price may exhibit volatility in the short term.

In evaluating Boeing's valuation, it is essential to consider additional factors. Furthermore, the emergence of new technologies, such as electric and autonomous aircraft, poses a potential threat to Boeing's business model.

IV. BA Stock Performance

A. BA Stock Trading Information

Since the 15th of March in 1916, Boeing Company (BA) has been a publicly traded company on the New York Stock Exchange (NYSE), where it maintains a prominent position in the aerospace industry. Boeing's stock is traded in dollars under the ticker code BA on the New York Stock Exchange (NYSE), which acts as the company's primary exchange.

During the trading hours of the New York Stock Exchange (NYSE), which run from 9:30 AM to 4:00 PM Eastern Time (ET), investors can engage in transactions involving BA stock. The pre-market trading session begins at 4:00 AM Eastern Time (ET), while the after-market trading session extends until 8:00 PM ET, giving investors more opportunity to trade throughout the trading day.

The most recent stock split that Boeing has had was in 2019, when the company's shares were divided at a ratio of 2:1. In all, Boeing has undergone ten stock splits during the course of its history. Since 1934, Boeing has made it a practice to distribute dividends to its shareholders; the company's current dividend yield is 0.8%, which is an extra potential source of profit for owners.

B. Overview of BA Stock Performance

An in-depth investigation at the performance of Boeing's stock over the past few years finds that the stock has been subject to a significant amount of volatility. The share price has dropped by more than fifty percent ever since it reached its all-time high in 2018. As of June 12, 2023, Boeing stock is trading at $217.31 per share. This represents a decline of more than 50% from its all-time high of $446.01 per share.

There are a number of factors that have contributed to the volatility of Boeing's stock price over the past few years. These factors include:

Product recalls: Boeing has been forced to recall a number of its aircraft in recent years, including the 737 MAX and the 787 Dreamliner. These recalls have damaged Boeing's reputation and led to a decline in demand for its aircraft.

Trade wars: The ongoing trade war between the US and China has hurt Boeing's business, as it has made it more difficult for the company to sell its aircraft to Chinese airlines.

C. Key Drivers of BA Stock Price

Several key factors significantly influence the stock price and overall performance of Boeing Co (NYSE: BA). These factors include the company's financial performance, market demand for Boeing's products and services, competition within the aerospace industry, economic conditions, and geopolitical events impacting the industry.

To make informed decisions about Boeing's stock, it is crucial for investors and traders to closely monitor developments within the aerospace industry. This entails assessing Boeing's financial performance, tracking market demand for aircraft, analyzing the competitive landscape and strategic initiatives undertaken by Boeing, considering global economic conditions, and staying updated on geopolitical events that can impact the aerospace sector.

By staying vigilant and conducting thorough analysis, investors and traders can make well-informed decisions and potentially capitalize on opportunities presented by Boeing's stock. This approach allows for effective risk management and enables them to navigate the dynamic nature of the aerospace industry.

D. Analysis of Future Prospects for BA Stock

When the potential outcomes for BA's stock in the years to come are analyzed, there are a great deal of unanswered questions. In addition to the requirement that it must adjust to new technological developments, Boeing must also fight increased competition from Airbus, trade disputes that may continue to exist between the United States and China, and other challenges. In spite of this, Boeing's well-established status as a prominent participant in the aerospace sector, together with the company's long-standing dedication to innovation, shows the existence of possible opportunities for growth and resilience in the company. If these challenges are conquered in the most efficient manner feasible, there is a possibility that the stock's performance will increase over the long run.

V. Risks and Opportunities

A. Potential Risks Facing Boeing Co

Threats from Competitors: There are a number of rival aerospace companies, including Airbus, Bombardier, and Embraer, that pose a threat to Boeing's market share. As the largest commercial aircraft manufacturer in the world, Airbus in particular represents a serious threat to other businesses in the industry. Because of the constant competition between Boeing and Airbus, there have been shifts in market share, and as a result, Boeing is required to continually innovate in order to keep its edge over its competitors.

Reputational Risks: Recent occurrences, including the grounding of the 737 MAX aircraft and the impact of the COVID-19 epidemic, have taken a toll on Boeing's reputation, which has suffered as a result. Not only did the company suffer financial losses as a result of the grounding of the 737 MAX, but it also saw a decline in customer trust and confidence in the brand. The COVID-19 pandemic had a further negative effect on Boeing's business since it led to a considerable drop in air travel, which in turn affected the demand for aircraft and services associated with the aviation industry.

Risks to the Company's Financial Position: The financial performance of Boeing has been negatively impacted by direct circumstances like the decline in stock prices. In addition, the corporation is confronted with higher expenditures connected with technological investments and the effort required for regulatory compliance.

B. Opportunities for Growth and Expansion

Despite the difficulties, Boeing is still in a position to take advantage of its enormous growth prospects. Boeing is expected to make huge profits from the anticipated expansion of the global air travel sector in the years to come because of its strong market position. Boeing is also able to satisfy the ever-changing requirements of its customers and secure a higher market share by maintaining a varied portfolio of commercial aircraft options. These offers include the future 777X as well as the highly successful 787 Dreamliner.

Opportunities in Technology: Boeing is cognizant of the fact that developing technologies, such as electric and autonomous aircraft, have the potential to radically alter the aerospace sector. Boeing hopes to foster innovation, improve efficiency, and expand its product offerings by investing in research and development and leveraging the technological advancements that result from these investments. Because of the company's emphasis on technological progress, it is currently in a leading position in the evolution of its industry.

Opportunities in military: Boeing is a big player in the military market in addition to being a leader in the commercial aviation sector. The company has considerable prospects for expansion in this sector thanks to the vast range of defense equipment it offers, which includes both combat aircraft and helicopters used by the military. The anticipated expansion of the global military industry presents Boeing with an additional opportunity to expand its defense-related operations and gain contracts from governments all over the world.

In general, Boeing has significant risks and problems, but the company also has chances for growth and expansion that it may take advantage of. For the company's future success, it is absolutely necessary for them to successfully navigate the competitive landscape, recover their reputation, and efficiently manage the financial risks that they face. By capitalizing on growth opportunities in the global air travel market, embracing emerging technologies, and leveraging its position in the defense industry, Boeing can position itself for long-term growth and profitability.

VI. How to invest in BA Stock

A. Three Ways to Invest in BA Stock

Holding the Share:Investors can become partial owners of the company by purchasing shares of BA stock and holding on to those shares. Investors are able to participate in the company's assets and profits if they hold shares in the company. If Boeing has a good performance, this might lead to an increase in the value of the shares, but if they have a terrible performance, this could lead to a decrease in share value.

Optionsare contracts that provide the right, but not the responsibility, to purchase or sell a set number of BA stock shares at a predetermined price on or before a specific date. Options are a type of derivative financial instrument. Options are assets that are more difficult to understand than ordinary shares, and as a result, they may not be appropriate for all investors.

Contracts for Difference (CFDs):CFDs are a type of financial derivative that gives investors the ability to speculate on the price swings of BA stock without actually owning the stock itself. CFDs provide leverage, which enables investors to hold greater positions with the same amount of capital that they initially invested. Although contracts for difference (CFDs) have the potential to generate profits, they also entail significant risk and demand careful evaluation.

B. Why Trade BA Stock CFD with VSTAR

VSTAR, a leading CFD provider, offers several advantages for trading BA stock:

Competitive Pricing:VSTAR provides competitive pricing on BA Stock CFDs, enabling investors to maximize potential profits.

Wide Range of Assets:VSTAR offers a diverse selection of assets for trading, including stocks, indices, commodities, and currencies, providing investors with a comprehensive trading portfolio.

Advanced Trading Platform:VSTAR offers a sophisticated trading platform equipped with a variety of tools and features that enhance the trading experience and enable informed decision-making.

Excellent Customer Support: VSTAR ensures excellent customer support, available 24/7, to address any queries or concerns traders may have during their trading journey.

C. How to Trade BA Stock CFD with VSTAR - Quick Guide

1. Open an Account: Begin by opening an account with VSTAR and deposit funds into your trading account.

2. Log in and Select CFDs: After logging into your VSTAR account, navigate to the "CFD" tab.

3. Search for BA Stock CFD: Use the search bar to find BA Stock CFD and select it from the search results.

4. Enter Trade Details: Determine the desired amount of BA Stock CFD to trade and choose between "Buy" or "Sell."

5. Execute the Trade: VSTAR will execute the trade, and you can monitor the performance of your trade in the "My Trades" section of your account.

Note: CFD trading involves risks, and it is crucial to understand the associated risks before engaging in CFD trading. Carefully evaluate your risk tolerance and consider seeking professional advice if needed.

VII. Conclusion

Boeing, a prominent player in the aerospace industry, holds a promising position in the market. With the global air travel market expected to expand in the upcoming years, Boeing is well-positioned to capitalize on this growth. The company's development of new aircraft, such as the 777X and the 787 Dreamliner, further enhances its potential for success.

However, Boeing is not immune to challenges. Increased competition from Airbus, a longstanding rival, poses a significant threat. Airbus has been steadily gaining market share and currently holds the title of the world's largest commercial aircraft manufacturer. The ongoing trade war between the United States and China also presents a hurdle, potentially impacting Boeing's sales to Chinese airlines and affecting revenue streams.

Investors considering Boeing as an investment option should exercise caution and conduct thorough research. It is important to acknowledge the risks associated with the company's competitive landscape, trade tensions, and technological advancements. Consulting with a financial advisor is always recommended to gain a comprehensive understanding of the investment landscape and make informed decisions aligned with individual financial goals.