Bitcoin is primed to conclude the halving week with a marginal decline of around 1%, recovering strongly from its intra-week lows. Bitcoin (BTC) could resume the ongoing trend to make a new all-time high if this momentum continues.

Bitcoin Holds The Buying Pressure After Halving

According to data from a prominent firm, spot Bitcoin exchange-traded funds witnessed an inflow of $30.4 million the day before the halving, marking the end of five-day outflows.

The Grayscale Bitcoin Trust (GBTC) has experienced a preponderance of outflows, unlike BlackRock's iShares Bitcoin Trust (IBIT), which has witnessed consistent streaming investments.

A crucial prediction from Bloomberg indicates that Bitcoin ETF inflows will persistently increase throughout 2024. According to Bitwise CEO Hunter Horsley, by the end of the year, numerous wealth management firms will have positions in Bitcoin ETFs.

Despite Bitcoin Halving, Miners Are Winning

The Bitcoin blockchain is undergoing a substantial transformation, propelled by the implementation of the Runes token standard. This innovation revolutionizes the Bitcoin network's economic dynamics by facilitating the generation of fungible tokens, which significantly raise transaction fees and miner revenue.

Moreover, the average Bitcoin transaction fee has skyrocketed to $128, a significant increase from its apex of $30. The increase in fees has proven to be highly advantageous for miners. Despite a 50% decrease in inflationary rewards resulting from the halving.

Nevertheless, the advent of Runes was accompanied by a substantial decrease in newly created Bitcoin addresses, which plummeted to their lowest level in two years.

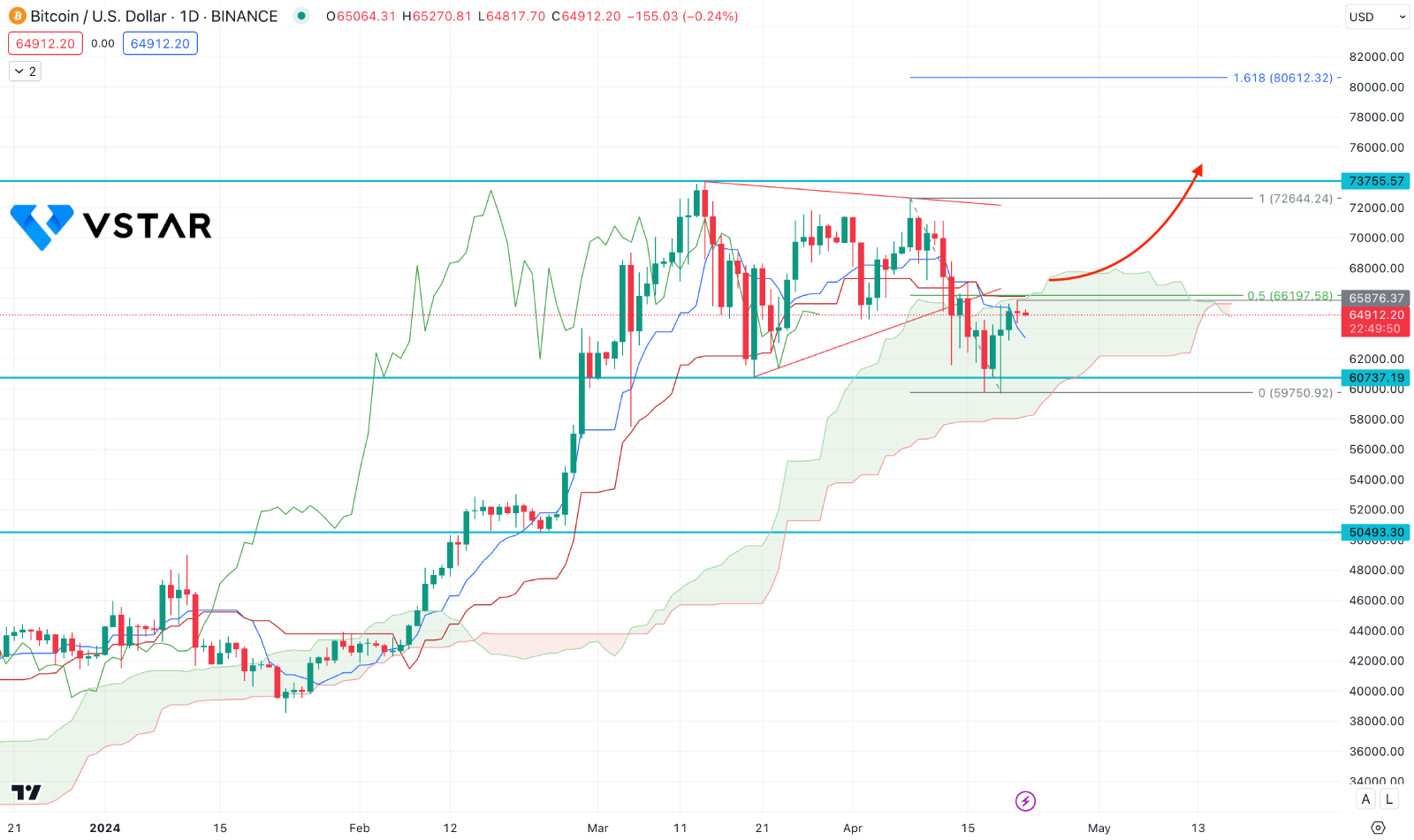

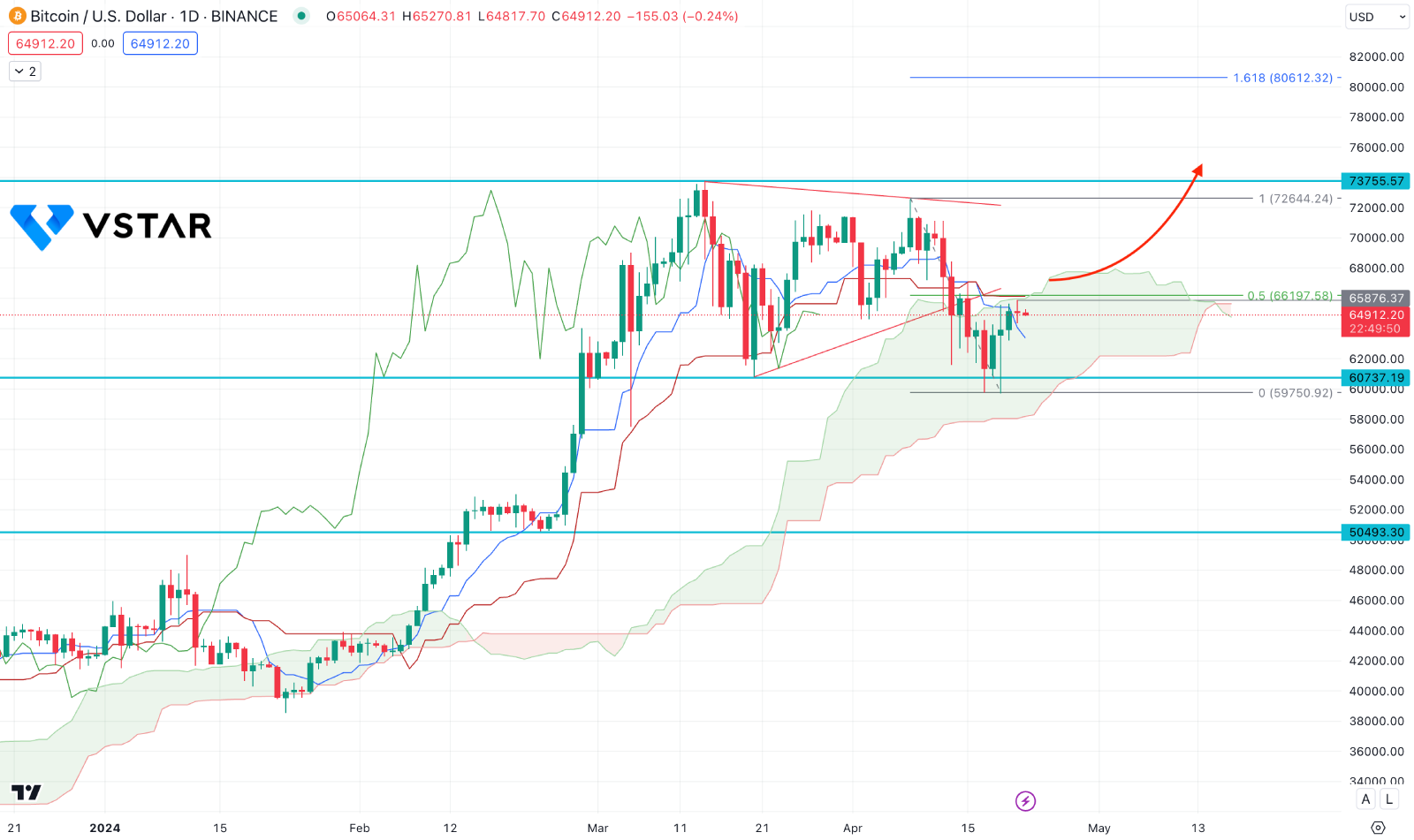

Bitcoin Price Technical Analysis

In the daily chart of BTCUSD, the ongoing buying pressure is valid, even if the price formed bearish pressure from the symmetrical triangle formation. Although the price made a new low below the 60737.19 level, an immediate bullish reversal is seen with a sell-side liquidity sweep.

In the Ichimoku Indicator, the price found support at the dynamic Kumo Cloud, where the dynamic Kijun Sen is the immediate support.

Based on this outlook, a bullish continuation, with a daily candle above the 66000.00 level, could increase the possibility of reaching the 80612.32 level, which is the 161.8% Fibonacci Extension level from the current swing. Moreover, a stable market above the 73500.00 level could signal more upward possibility, targeting the 100K level.

On the bearish side, an extended selling pressure with a daily candle below the 59750.92 level could lower the price toward the 50493.30 support level.