The analysis explores various factors influencing Bitcoin's price during the week . These factors encompass technical analysis, macroeconomic trends, regulatory developments, and global events that have the potential to sway Bitcoin's trajectory.

Technical Analysis

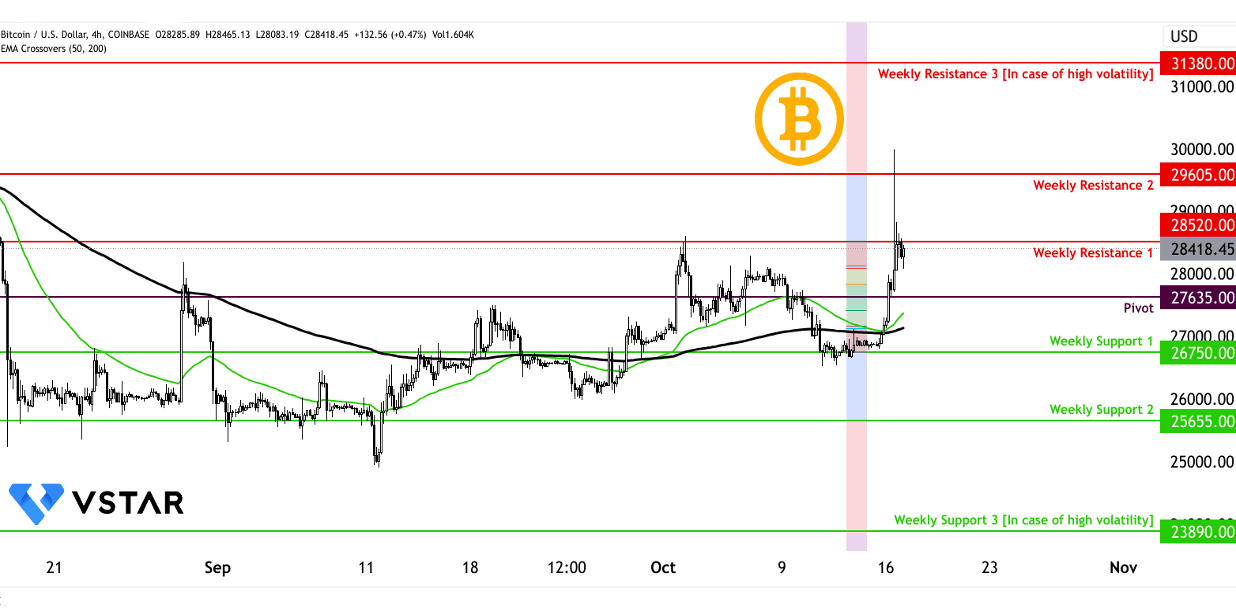

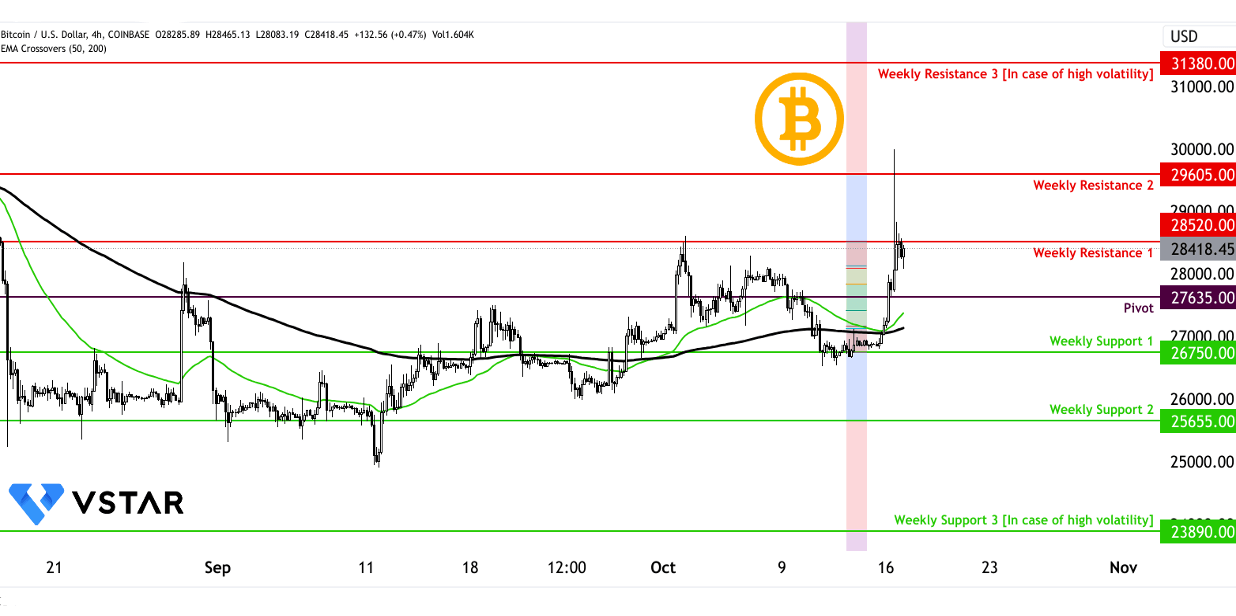

To set the stage for our analysis, let's begin with a technical perspective by examining key support and resistance levels for Bitcoin. These levels are instrumental in understanding the potential price movements and assessing market sentiment:

Weekly Resistance (in case of extreme volatility): $31,380

Weekly Resistance (in case of high volatility): $29,605

Weekly Resistance (in case of low volatility): $28,520

Weekly Support (in case of low volatility): $26,750

Weekly Support (in case of high volatility): $25,655

Weekly Support (in case of extreme volatility): $23,890

The above critical technical levels can be considered while initializing the long positions (near support level) and short positions (near resistance level). The continuous weekly technical developments can be observed on vstar.com.

Now, let's delve into the factors that have the potential to influence Bitcoin prices.

Fundamental Analysis

Ferrari's recent decision to accept cryptocurrency as a payment method for its luxury sports cars in the United States

It is a notable development in the crypto landscape. This move reflects the evolving dynamics of digital currencies and their growing acceptance in mainstream commerce. However, this announcement also brings into focus various aspects, including the implications for the crypto market, the luxury automobile industry, and the broader economic context.

Ferrari's decision to embrace cryptocurrencies is a noteworthy indicator of the shifting sands in the financial world. While many blue-chip companies have been cautious about accepting cryptocurrencies due to their inherent volatility and regulatory uncertainties, Ferrari is stepping into this arena to cater to its clientele. The company's Chief Marketing and Commercial Officer, Enrico Galliera, highlighted that this move is in response to growing customer demand, indicating that there is a segment of the wealthy elite who are keen to use their cryptocurrency holdings for high-end purchases. This clientele includes both early adopters who have amassed significant wealth through cryptocurrencies and traditional investors seeking portfolio diversification.

It's important to recognize that while Bitcoin, the flagship cryptocurrency, is the primary focus of the announcement, Ferrari will also accept payments in other digital assets like ether and USDC (a stablecoin). This decision underscores the maturation of the cryptocurrency market, where multiple tokens are gaining acceptance as mediums of exchange.

One of the most prominent factors that has held back widespread adoption of cryptocurrencies in commerce is their environmental impact, particularly Bitcoin's energy-intensive mining process. However, Ferrari's move also acknowledges the efforts within the crypto industry to address these concerns. Cryptocurrencies, including Bitcoin, have been actively working on reducing their carbon footprint. This reflects a broader shift towards more sustainable practices within the crypto space, including the adoption of renewable energy sources and the development of energy-efficient technologies. Ferrari's commitment to carbon neutrality by 2030 aligns with these sustainability goals.

The decision to engage with cryptocurrencies may have far-reaching consequences for both Ferrari and the crypto market. On one hand, it can expand Ferrari's customer base to individuals who might not have considered purchasing a luxury sports car before. This strategy enables the company to reach a broader market and diversify its customer portfolio. Furthermore, the company can harness the international appeal of cryptocurrencies and potentially expand its crypto payment scheme to other regions.

For the cryptocurrency market, Ferrari's adoption provides further evidence of mainstream recognition and acceptance. It showcases that cryptocurrencies are evolving from speculative assets into practical means of conducting high-value transactions. As established luxury brands like Ferrari embrace cryptocurrencies, it can instill more confidence in these digital assets and encourage broader adoption.

Additionally, this move has economic implications. It highlights the transformation of traditional financial systems and payment methods. Cryptocurrencies offer a borderless, efficient, and secure way of conducting transactions. Their integration into high-end markets, such as luxury automobiles, challenges traditional financial intermediaries, including banks and payment processors. Consequently, this shift may inspire other industries to explore crypto payment options.

Nonetheless, several factors warrant consideration. Firstly, the cryptocurrency market remains highly volatile. While Ferrari and BitPay have mechanisms in place to shield themselves from price fluctuations, there is an inherent risk associated with accepting cryptocurrencies due to their price unpredictability. This risk could potentially affect not only Ferrari but also other businesses considering similar moves.

Furthermore, regulatory factors pose a challenge. Cryptocurrency regulations vary widely across different regions, and businesses must navigate a complex legal landscape. In some countries, such as China, cryptocurrencies are restricted, creating obstacles for international companies like Ferrari to expand their crypto payment services globally.

Source: tradingview.com